Featured Posts

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Every time the market rallies to new highs, people start asking the same question: Are we in a bubble? And every time, the answer is basically the same: maybe, but we won’t know until it pops. That’s how bubbles work. They never feel obvious in real-time. The 1999

Markets are trying to recover after last week’s selloff, but the gains are small. As of this morning, the S&P 500 and Russell 2000 are both up just 0.03%, the Dow is up 0.11%, and crude oil is climbing 0.2%. Meanwhile, the Nasdaq 100

The market’s winning streak just hit a roadblock. Trump’s latest tariff threats, floating a 25% tax on auto, semiconductor, and pharmaceutical imports are shaking stocks today. With growing inflation concerns, market's are guessing whether this could push back Fed rate cuts in 2025. Here’s what’

The US just slapped 25% tariffs on Canada and Mexico, and both countries are hitting back with their own.

Stocks are down, oil is up, and volatility is shaking markets.

This isn’t just about trade. The White House is framing tariffs as part of a bigger fight over immigration, drug trafficking, and even national security.

If you’re trying to make sense of what this actually means and how it’s already playing out in the markets, let’s break it down:

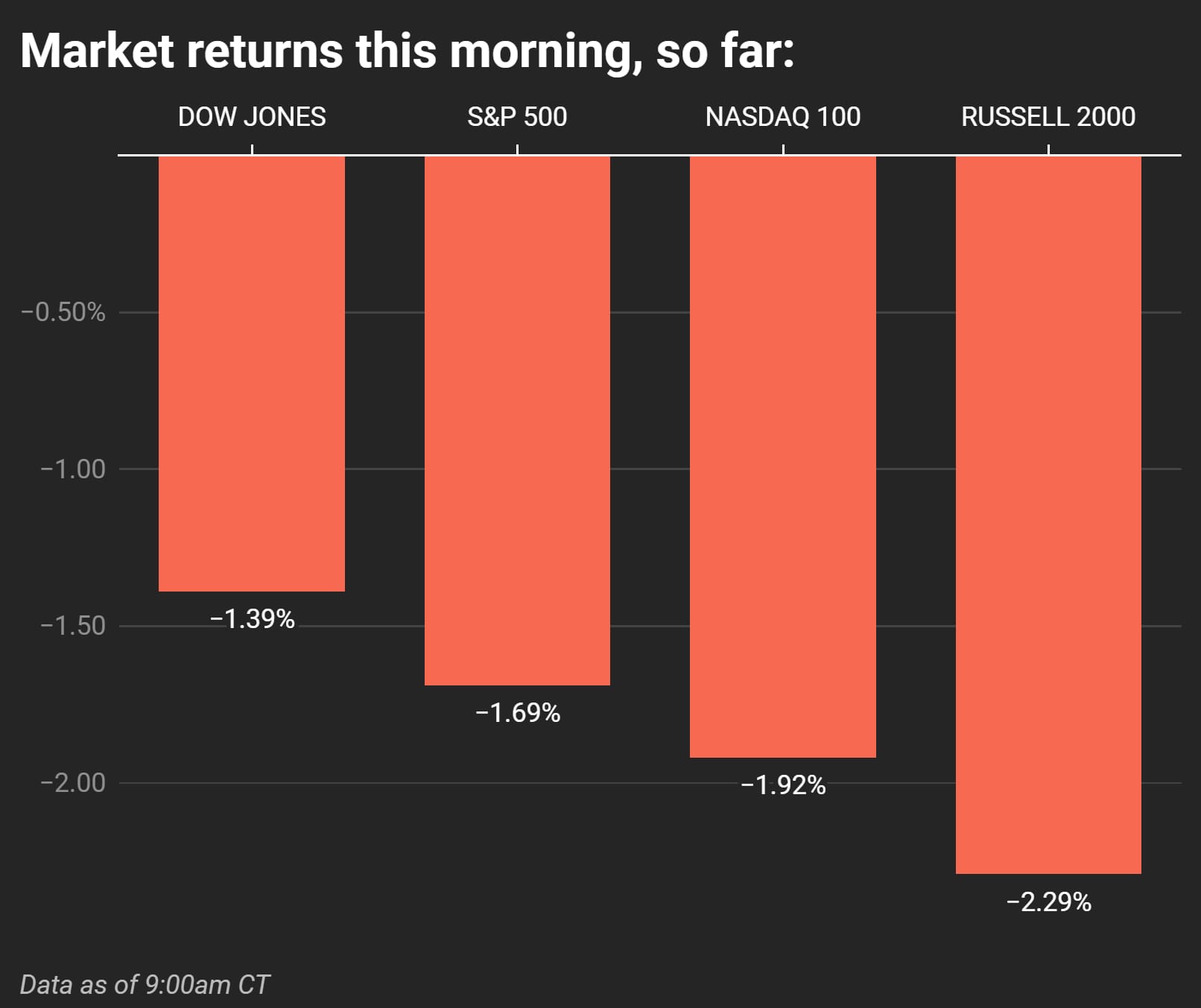

Stocks Are Falling

Wall Street didn’t expect these tariffs to actually happen. Now that they’re real, investors are freaking out. The Dow is down 1.39%, the S&P 500 fell 1.69%, the Nasdaq is down 1.92%, and the Russell 2000—made up of small-cap companies—is taking the biggest hit, down 2.29%.

This isn’t just about the tariffs themselves. Investors are pricing in what comes next: higher costs, supply chain disruptions, and weaker profits.

If this drags on, businesses will have to absorb rising costs or pass them on to consumers.

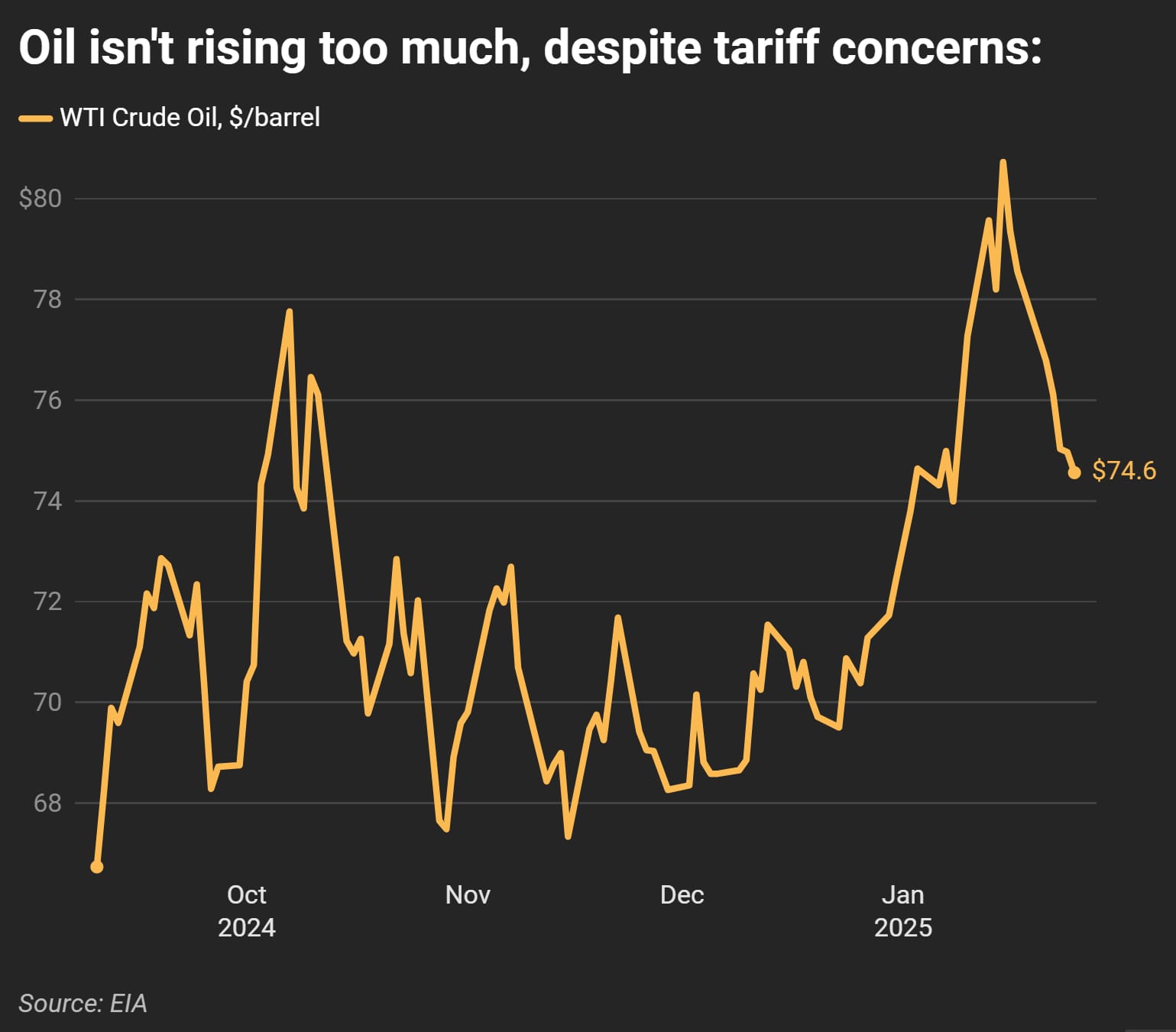

Oil Prices Holding Steady

Oil prices jumped after the tariff news, but it’s not an extreme reaction—at least not yet.

WTI crude hit $74.56 per barrel, up about 2% since the announcement. Canada supplies about 25% of US oil imports and those shipments now face a 10% tariff, which will rise costs for refineries, especially in the Midwest!

Canadian Dollar is Falling

The Canadian dollar is taking a hit as markets react to tariffs and trade uncertainty. In the past five days, it’s dropped nearly 2%.

A weaker Canadian dollar makes exports from Canada cheaper, which might help offset some of the damage for their businesses.

For the US, this means companies that rely on selling goods to Canada could see demand drop, simply because Canadian buyers now have to pay more for American products.

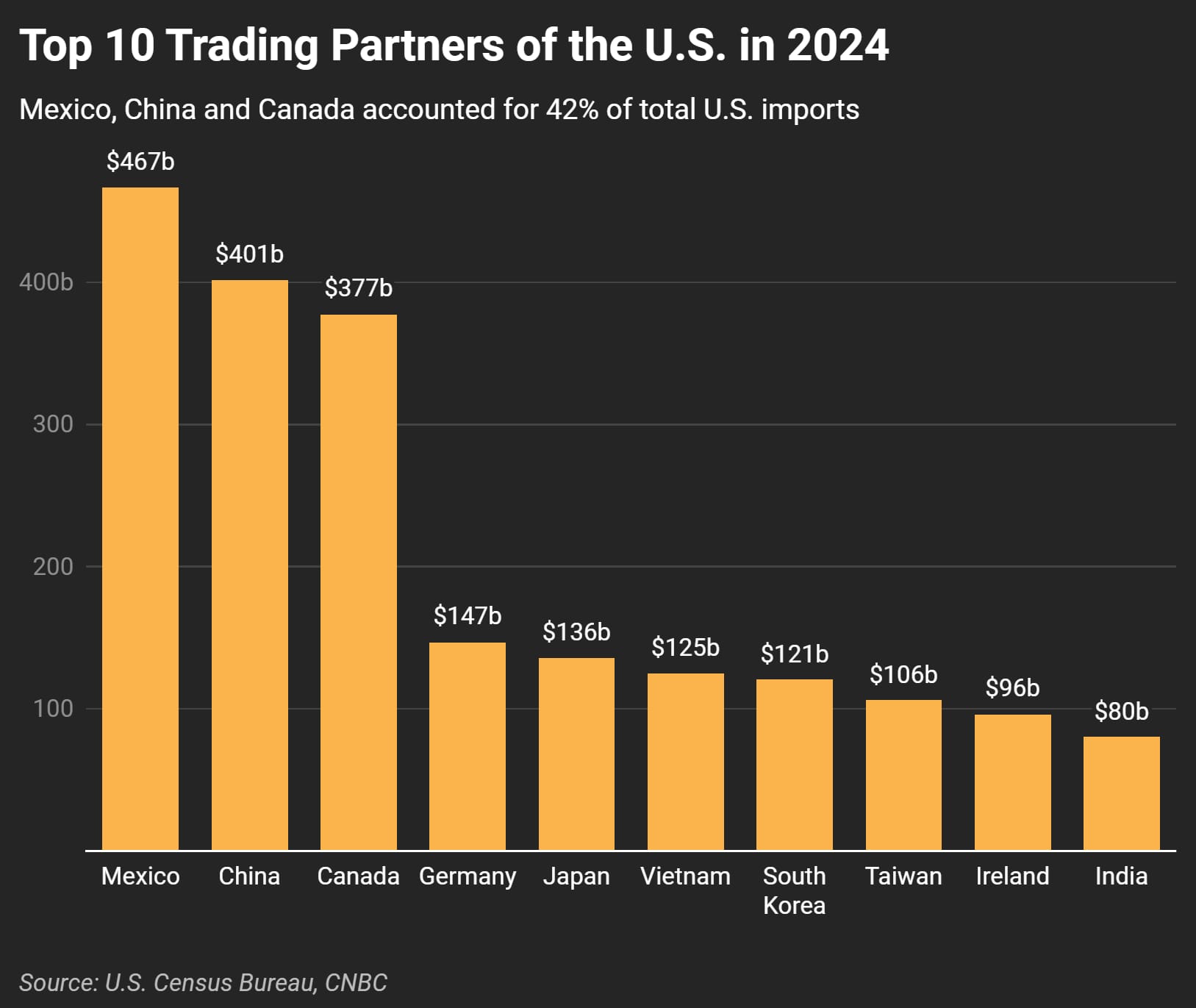

Why This Trade War Matters

If this was just about a few products, the market reaction wouldn’t be this bad. But Canada and Mexico are two of the biggest trade partners the US has.

Mexico is the #1 trading partner, with $466.6 billion in imports, and Canada is #3, with $377.2 billion.

These tariffs don’t just hit a few companies—they disrupt supply chains across major industries like auto, energy, food, and manufacturing.

Companies that rely on predictable trade between the three countries now have to adjust.

Businesses Are Feeling It

This isn’t just theoretical anymore. Some of the biggest industries are already taking the hit:

Automakers are bracing for higher costs across the board. About 42% of US auto parts come from Mexico, and another 13% from Canada, and every single one of those now faces a 25% tariff, per Reuters.

That means higher costs for Ford, GM, Honda, and every major automaker that operates in North America.

And this probably isn’t over. More tariffs could be coming, possibly against Europe and China next.