Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Today's job report just dropped, smashing expectations. Markets are reacting, rate expectations are shifting, and now the big question is: will this job surge lead to more inflation?

Futures, Volatility, and the Aftermath

As of 8:45am CST, markets were clearly pleased with the news. The S&P 500 jumped 0.72%, the Dow Jones gained 0.62%, the NASDAQ climbed 1.15%, and the Russell 2000 took the lead with a 1.47% spike. Small caps especially loved this report—probably because they're the first to take a hit in a recession, and the job numbers hint that a recession might not be soon.

The Volatility Index (VIX) also dropped, falling 6% as traders seemed to relax—at least a little. It's worth noting, though, that the VIX is still higher compared to past months, partly due to other recent events, like the ongoing conflict between Iran and Israel. But for now, investors turned their attention back to economic data, with everyone more interested in the strong labor market than in geopolitics.

Shift in Fed Funds Rate Expectations

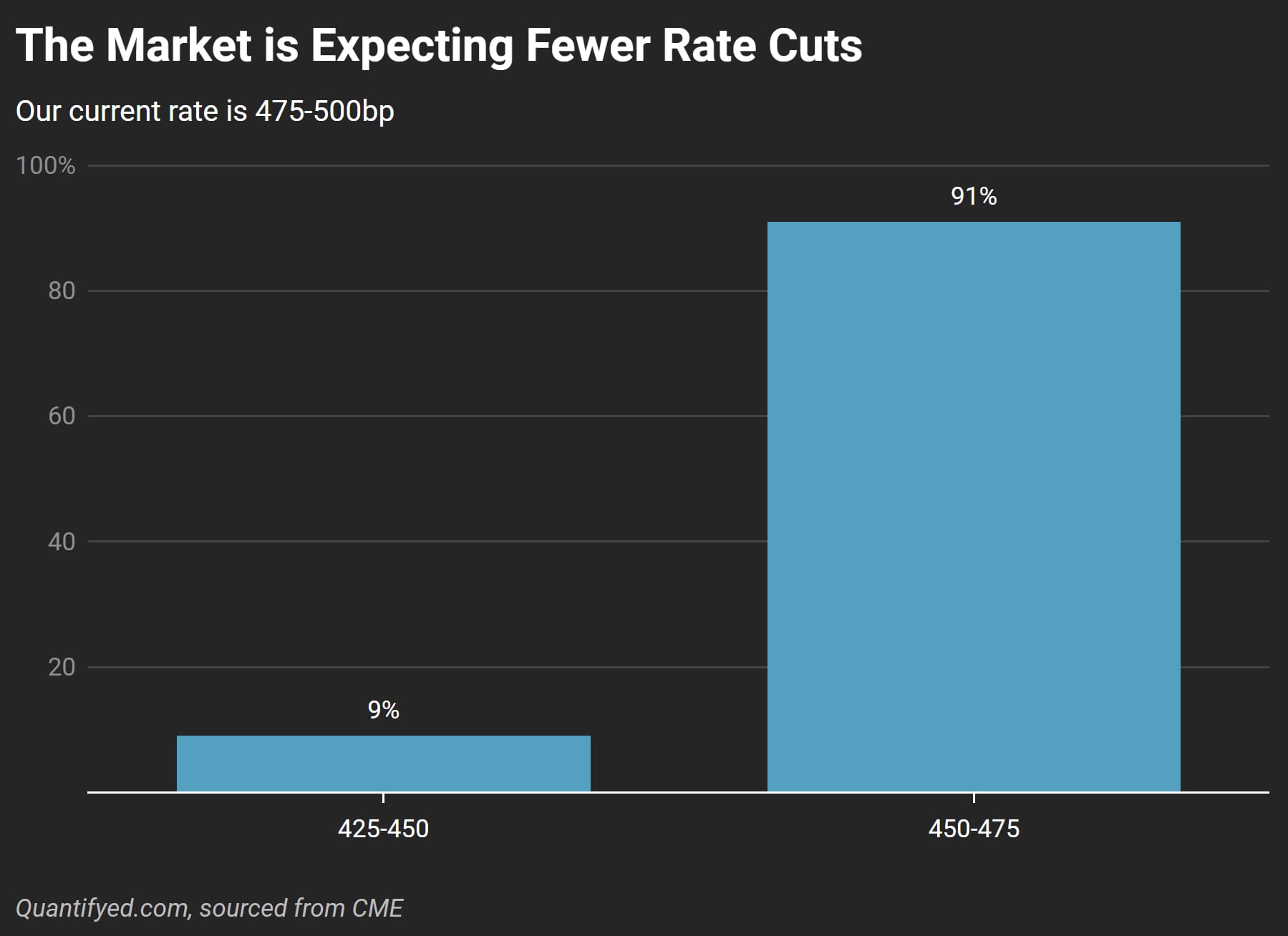

The strong jobs report caused a major shake-up in Fed Funds Futures. Before these payroll numbers came out, everyone was excited for a 50 basis point rate cut at the upcoming meeting. But after today's data hit, expectations swung sharply towards a smaller 25 basis point cut, with a huge 91% chance of that smaller move now priced in.

This isn't just about interest rates—it affects everything. A smaller cut is less aggressive, which implies that the Fed thinks the economy is doing fine but still wants to tread carefully. This shift has big impacts on bond yields, mortgage rates, and especially stock valuations, with rate-sensitive sectors like tech feeling the most impact.

Will This Job Growth Create Inflation?

The strong job market is great news for workers—more jobs, higher wages, more spending. But that can also mean rising prices, which is exactly what the Fed wants to keep under control.

More people working and spending could add upward pressure on prices. The market seems comfortable with a smaller rate cut for now, but if this job growth keeps pushing wages and spending higher, the Fed might have to rethink things sooner than expected.

So, the real question is: will this job growth be too much of a good thing and make inflation a problem again? For now, we’re in wait-and-see mode. Traders are betting that the Fed can keep things calm, but if inflation creeps back up, that might change fast.