Featured Posts

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Every time the market rallies to new highs, people start asking the same question: Are we in a bubble? And every time, the answer is basically the same: maybe, but we won’t know until it pops. That’s how bubbles work. They never feel obvious in real-time. The 1999

Markets are trying to recover after last week’s selloff, but the gains are small. As of this morning, the S&P 500 and Russell 2000 are both up just 0.03%, the Dow is up 0.11%, and crude oil is climbing 0.2%. Meanwhile, the Nasdaq 100

The market’s winning streak just hit a roadblock. Trump’s latest tariff threats, floating a 25% tax on auto, semiconductor, and pharmaceutical imports are shaking stocks today. With growing inflation concerns, market's are guessing whether this could push back Fed rate cuts in 2025. Here’s what’

The S&P 500 surged 1.72% this week, marking its best opening week under any president since 1985.

A $500 billion AI initiative and a key crypto executive order also fueled the tech and riskier asset sectors.

Let’s break it down.

Market’s Winning Week

Here’s how the major U.S. indexes performed:

- S&P 500: +1.72%

- Dow Jones: +2.04%

- Nasdaq 100: +0.98%

- Russell 2000: +0.93%

Tech stocks also stole the spotlight. Oracle jumped 14%, Nvidia rose 3.6%, and Arm gained 8.9%. Much of this was driven by the newly announced Stargate AI project, a $500 billion initiative aimed at boosting AI infrastructure.

Why Everyone Feels Bullish

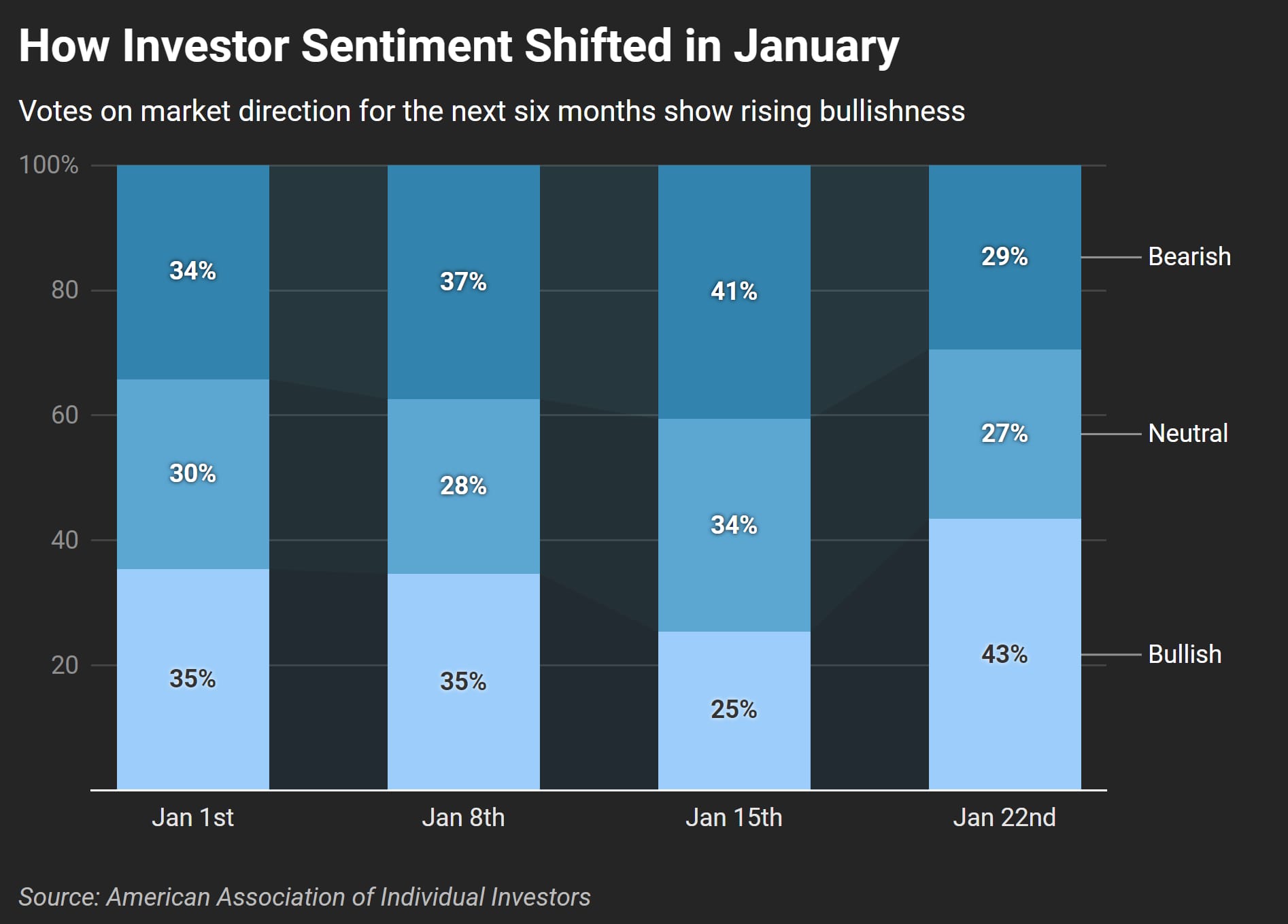

Investor sentiment shifted sharply this week, with bullish sentiment jumping to 43.4% (from 25.4% last week) while bearish sentiment fell to 29.4%.

It’s not just about sentiment, though. Trump’s executive order on digital assets sent Bitcoin soaring to $105,000.

Yields are Moving

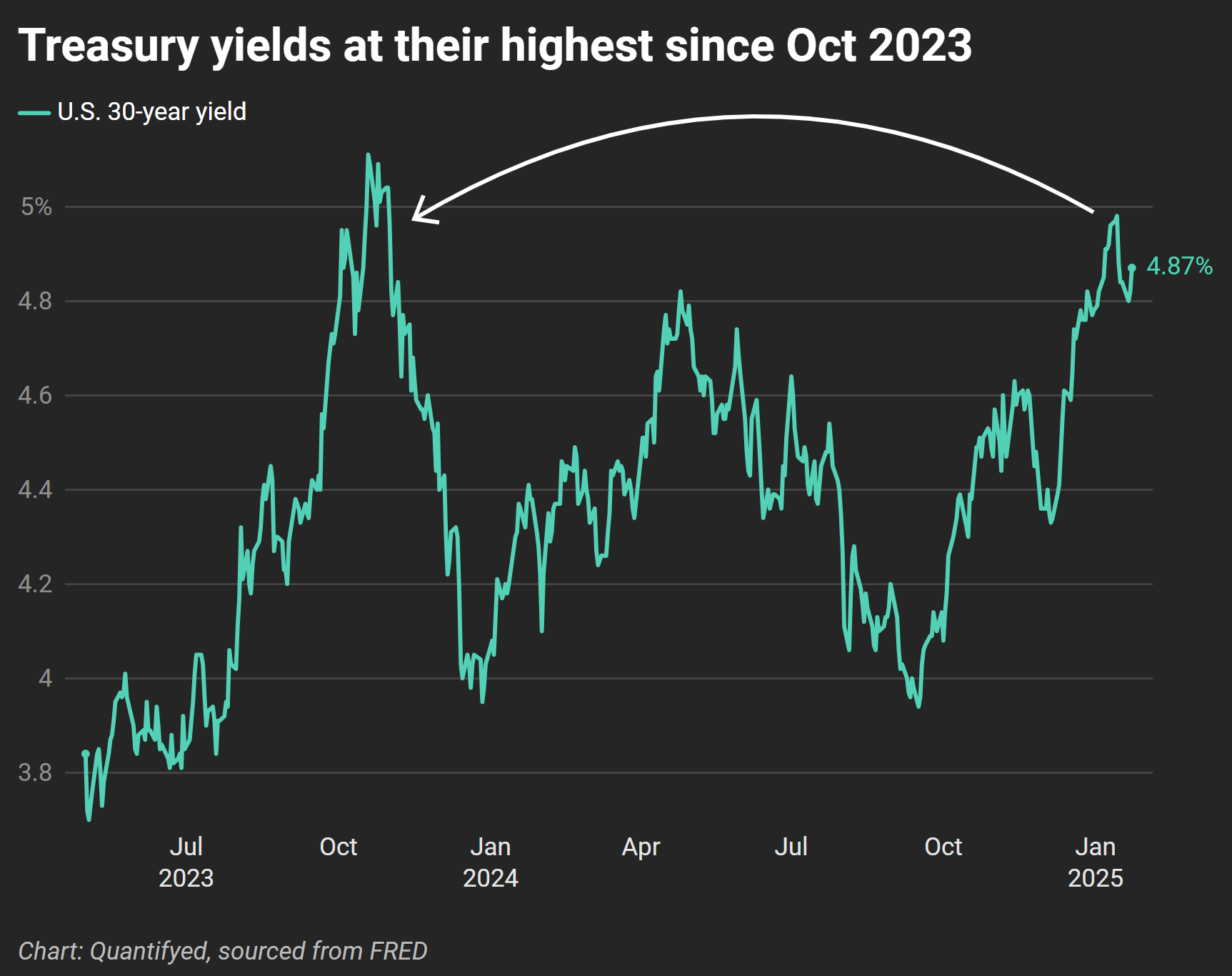

Despite optimism growing, rising Treasury yields are getting intimidating. The yield on the 30-year Treasury hit 4.87% this week, its highest level since October 2023:

Higher yields can increase borrowing costs for businesses and consumers, creating headwinds for market performance. Yet, the broader economy remains strong, with unemployment at a record low of 4.1%.

What You Need to Know:

- Indexes Climbed: S&P 500 is up 1.7%, Dow Jones rose 2%, and Nasdaq is up 0.9%

- Tech Jumped: Oracle soared 14% this week, helped by AI investments

- Yields Rose: The 30-year Treasury yield climbed to 4.87%, the highest since Oct 2023