Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

In today’s housing market, one segment stands out: affordable homes. With prices soaring and demand outpacing supply, lower-priced houses have become the new gold rush

In today’s housing market, one segment stands out as the hottest commodity: affordable homes. With prices soaring and demand outpacing supply, these lower-priced houses have become the new gold rush.

In this post, we explore where buyers are spending their money, the inventory dynamics across different price ranges, and how specific homebuilders are benefiting from these trends.

Where Buyers Are Spending Their Money:

If you're wondering where most buyers are throwing their cash, look no further than homes under $250k. These homes are flying off the market faster than concert tickets for a Taylor Swift show.

According to our research, this trend is driven by a mix of economic factors and sheer necessity.

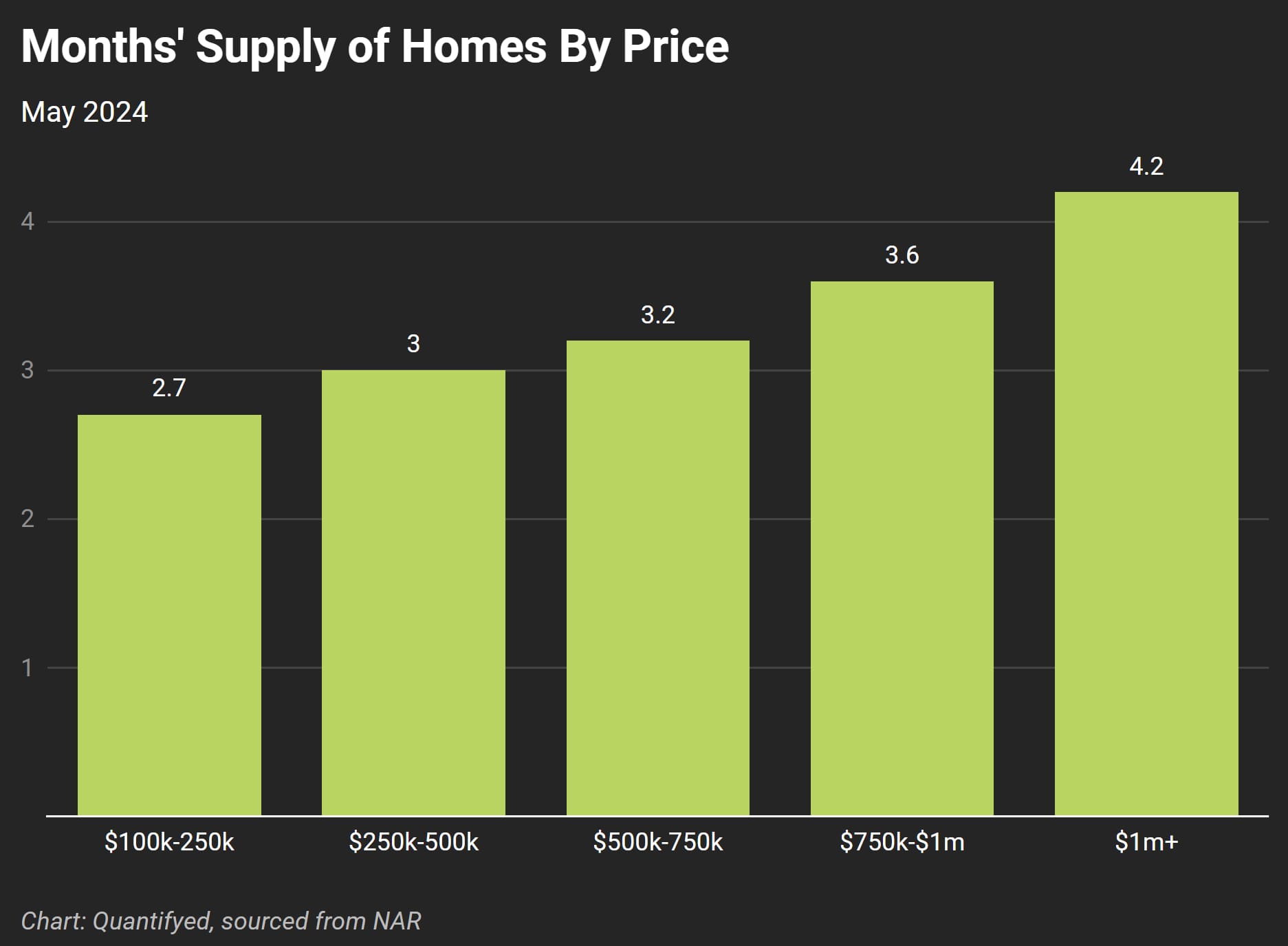

To get a clearer picture of the housing supply crunch, check out the chart below:

To our point, homes under <$250k are having the lowest months supply at 2.7 months. What does this mean? Simply put, there’s a fierce competition for these homes, driving up prices and leaving many buyers scrambling.

On the flip side, luxury homes ($1m+) have a higher inventory, with a months supply of 4.2 months. The quick turnover of affordable homes compared to the slower sales of higher-priced homes underscores the high demand for cheaper options.

"The months-supply of new homes for sale is now almost three times of that of existing homes" -CNBC

Growth in Supply Despite Low Inventory:

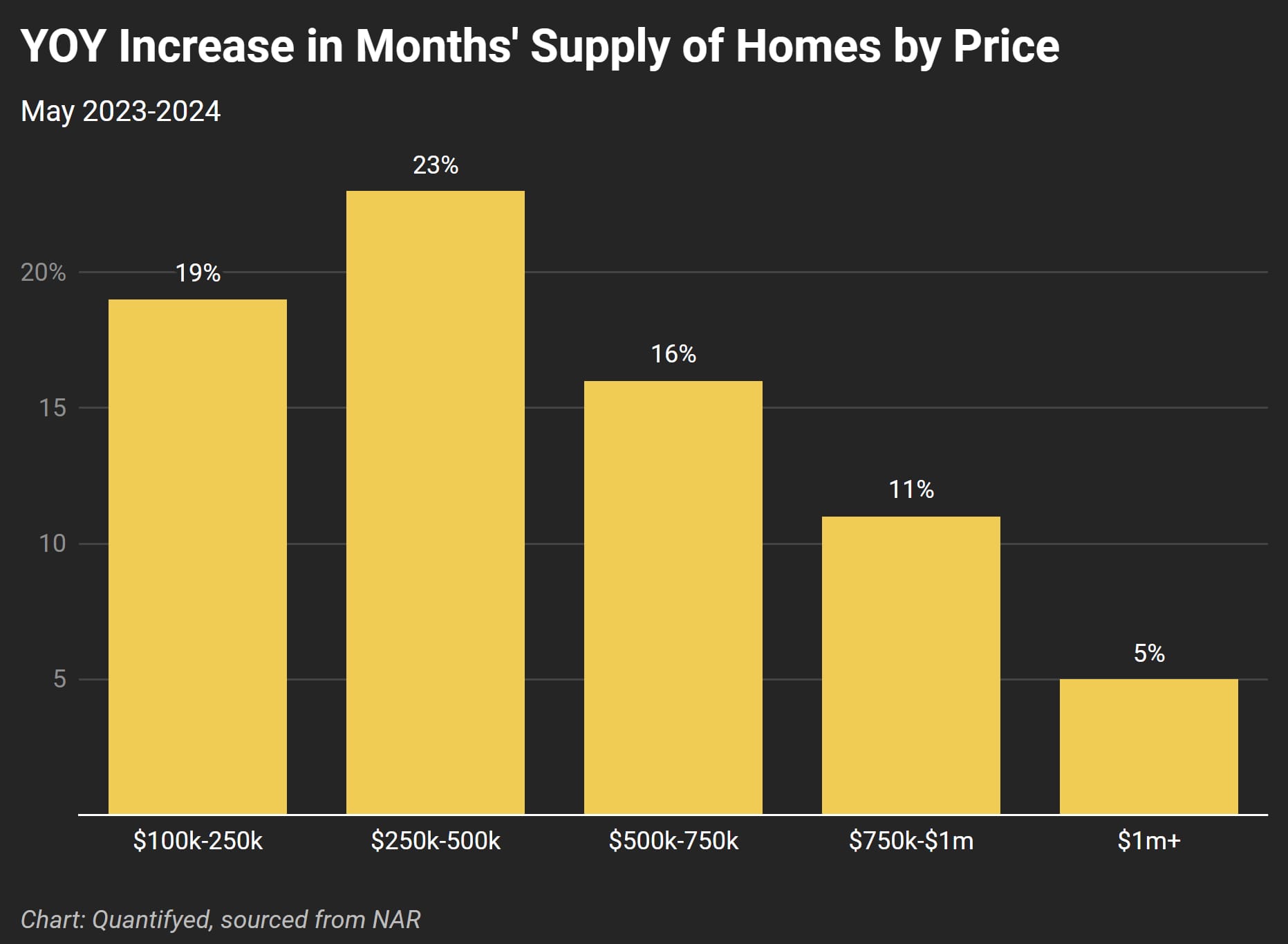

Here's another twist: even though the supply of homes under $250k is low, it’s actually growing the fastest. Take a look at the year-over-year increase in months supply:

Despite the lowest supply, homes under $250k have seen some of the highest year-over-year growth in months supply at 19%.

This tells us that while builders are ramping up production of affordable homes, the demand is so high that these homes are being snapped up almost immediately.

Homebuilders Benefiting from the Demand:

Not all homebuilders are created equal. Those focusing on entry-level homes are seeing the most sales. Builders like DR Horton, which offer more affordable options, are making a f*** ton of money.

For fun, here are the 5-year returns of DR Horton and S&P 500:

DR Horton ($DHI): 199%

S&P 500 ($SPY): 98%

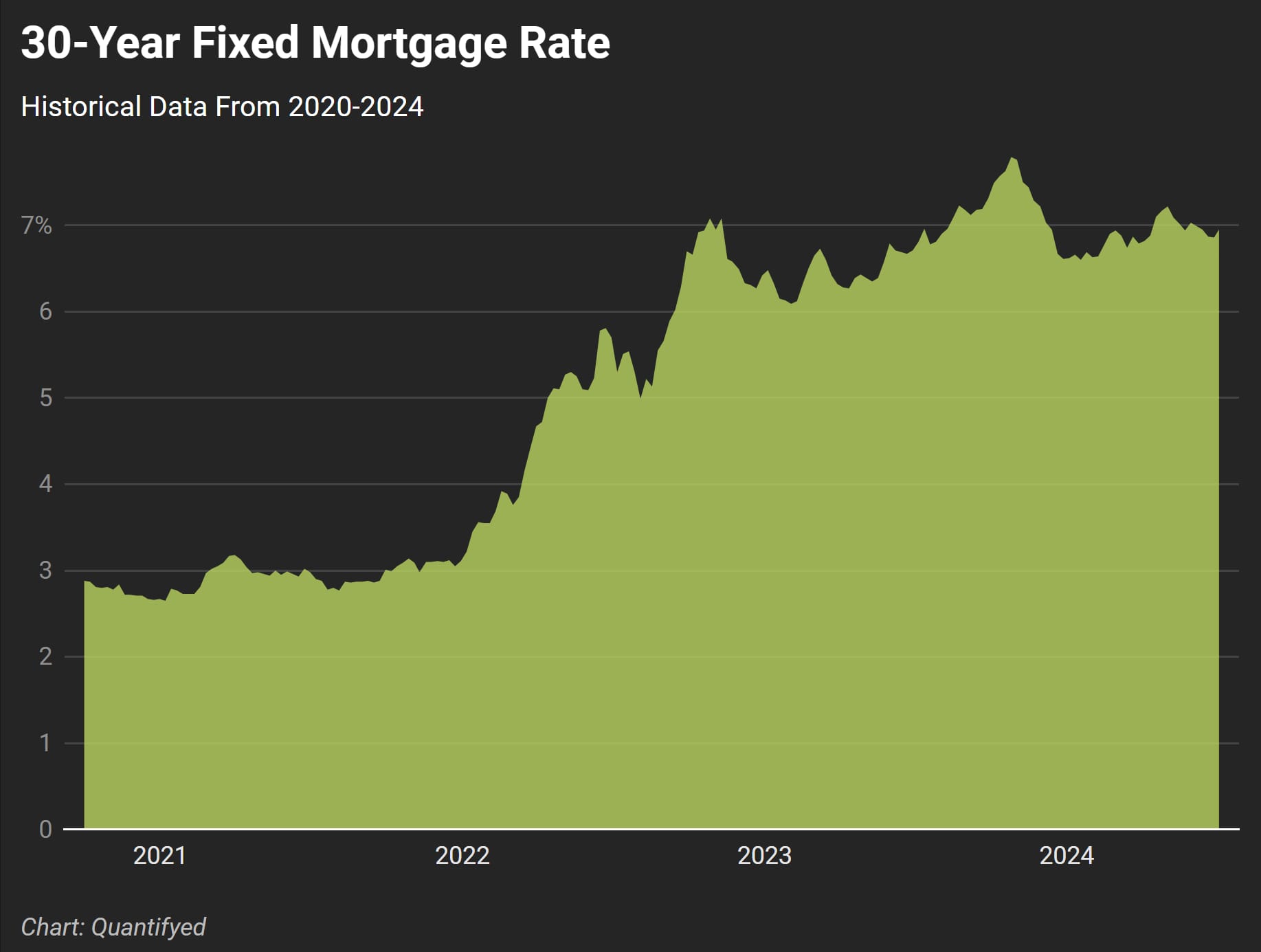

ALSO, One major factor shaping the housing market is mortgage rates. Here’s a look at how mortgage rates have trended over the past four years:

As you can see, mortgage rates hit historic lows at the start of the pandemic, which fueled a surge in homebuying. However, rates began to climb, reaching 20-year highs by 2022.

This spike cooled off some of the buying frenzy, particularly for existing homeowners who didn’t want to trade their low-rate mortgages for higher ones.

These fluctuations have a huge impact on buyers and sellers. When rates are low, more people can afford to buy homes, which drives up demand. Conversely, higher rates can dampen activity, especially for people looking to upgrade their current homes.

Looking forward, if mortgage rates decrease to more manageable levels, we could see a resurgence in homebuying activity. This shift could open demand, particularly for aging baby boomers looking to downsize into retirement.