Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

Despite a record number of flights this summer, airline stocks are nosediving. I'll break down to you why investing in airlines are risky.

Airline stocks are crashing, kind of like my motivation on a Monday morning.

Over the past five years, airline stocks have plummeted by an average of 30%. The International Air Transport Association (IATA) forecasts a record 4.7 billion passengers flying in 2024, surpassing pre-pandemic levels. But, this passenger boom hasn’t translated into profits.

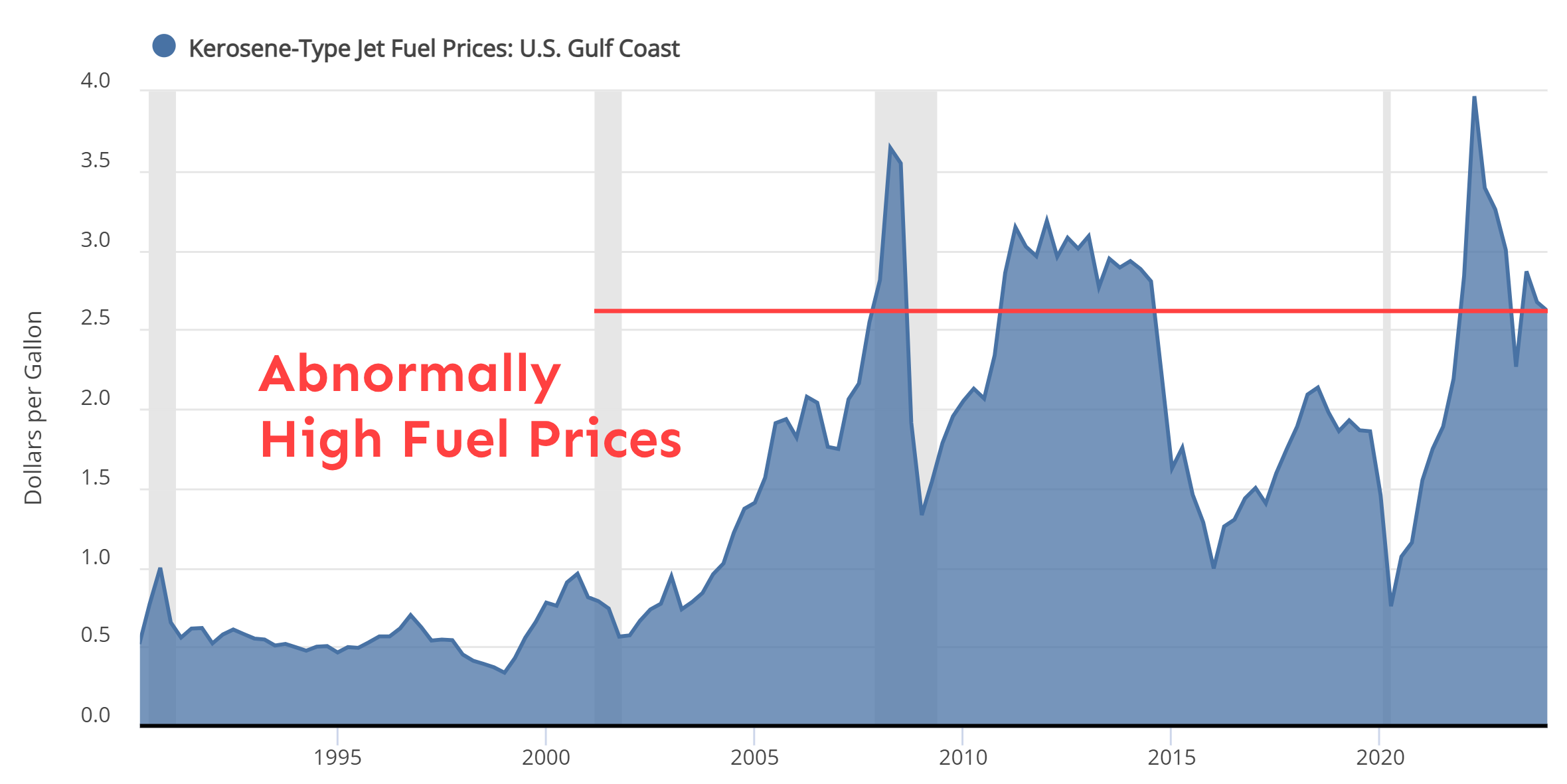

Higher Operational Costs: One major factor dragging down airline profitability is increased operational costs. There's a growing workforce demand, increasing labor costs, cutting into airlines' profit margins. Also, jet fuel prices are set to rise 7% to $114 per barrel in 2024, making up 31% of operating expenses.

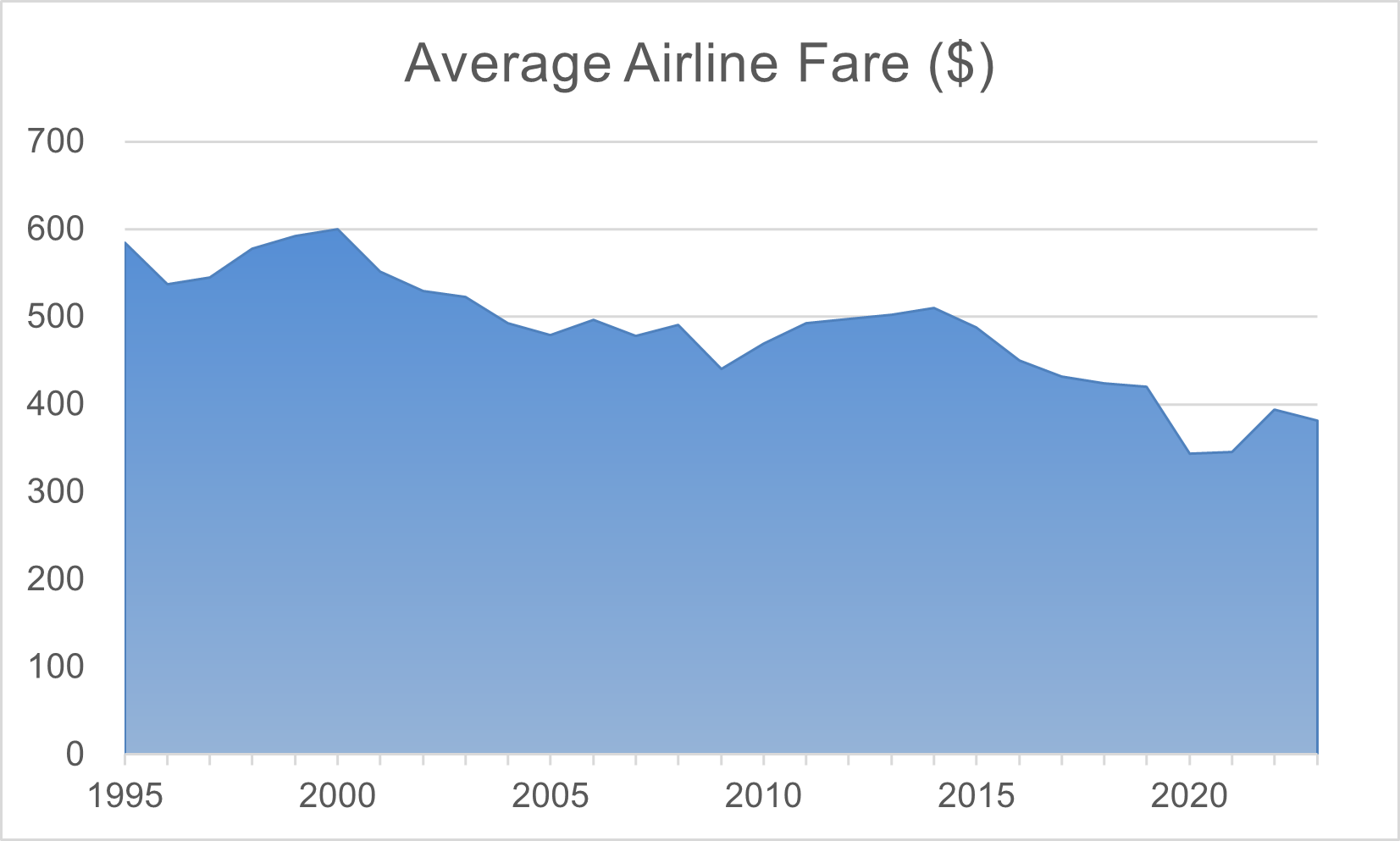

More Flights, Lower Profits: To meet the travel demand, airlines ramped up the number of flights. While this seems like a good strategy to capitalize on the increased number of travelers, it has also led to a significant drop in ticket prices. More seats mean more competition and lower fares, which in turn means lower profits. It’s a vicious cycle of supply outstripping demand in a race to the bottom on prices.

Too Competitive: When the U.S. airline industry was deregulated in 1978, it allowed businesses to set their own ticket prices. Since then, the average round-trip U.S. airfare has dropped by 85% from 1980 to today. This price war leaves no room for profit margins.

Too Commoditized. Domestic airlines have tried hard, but can't differentiate themselves from each other. All that matters in this industry is ticket prices and timetable, so nobody can charge a premium.

Too Capital Intensive. Airlines are capital-intensive businesses. They require hefty spending on aircrafts, causing high debt levels. At the end of 2021, Delta Air Lines had a staggering $19 in debt for every $1 of equity. Debt-to-equity ratios average 5-6x for airlines versus 1x for the S&P 500.

Safety Concerns. Recent incidents, like the door plug flying off an Alaskan airline flight, spark concerns for customers and investors. These fears are being priced into today’s valuations, adding to the stock slump.

Although, IATA projects that the airline industry’s revenues will reach $964 billion in 2024, a 7.6% YOY increase.

Still, profit margins are also expected to stay slim at around 2.7%— not exactly what you're looking for to get rich quick!

In the end, while more people are flying, airline stocks are still struggling to take off. So, before you buy that airline stock, consider the headwinds I addressed