Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

The tech titans have spoken! Apple and Amazon just dropped their earnings reports last night, and, spoiler alert, there’s a lot more at stake than you might think.

Amazon’s stock took a hit, dropping about 7% after hours following their report. They missed revenue estimates but surprised us with a 23% beat on EPS. So, it’s not all bad news, but there’s definitely some unpacking to do.

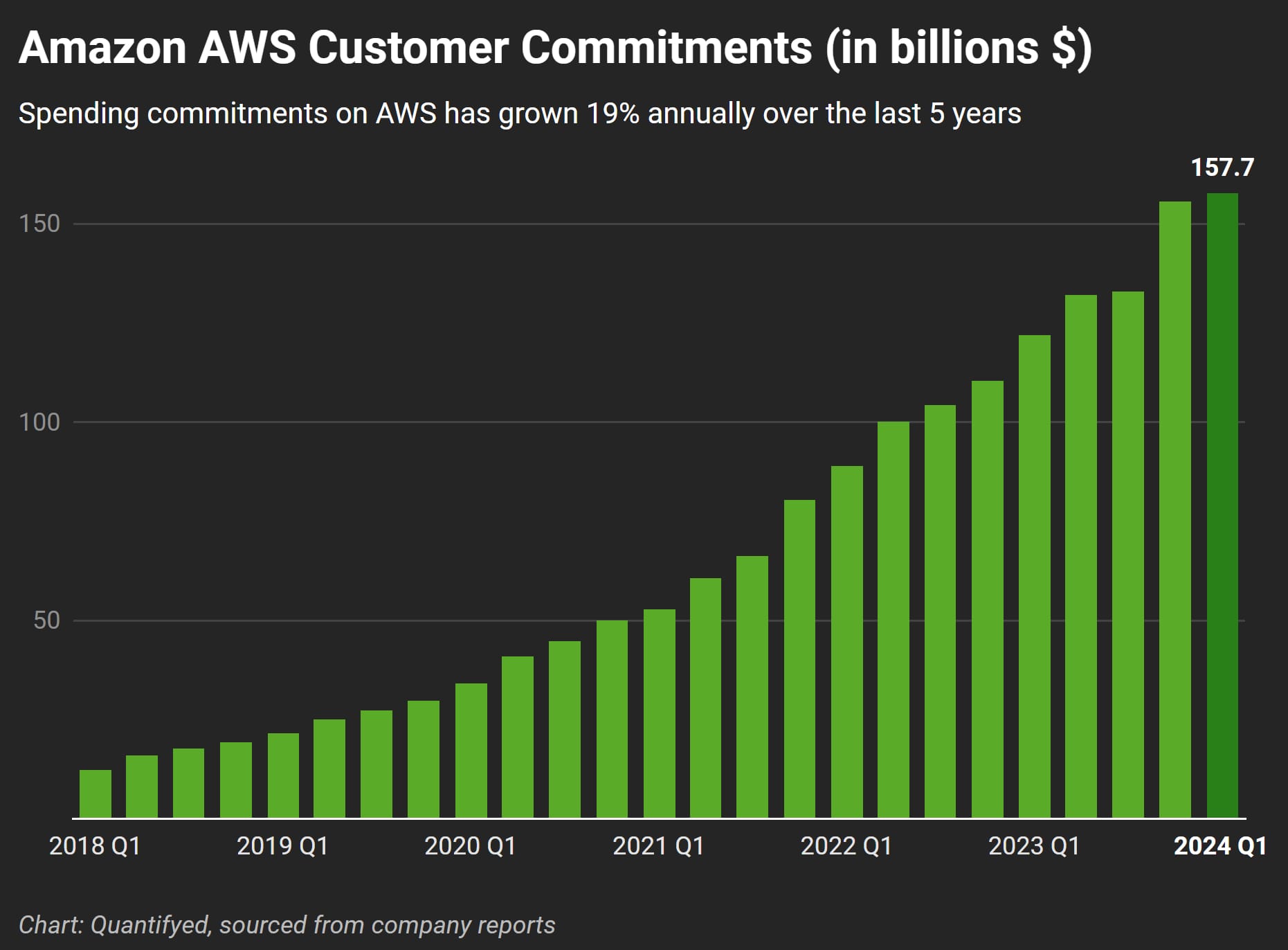

Amazon’s biggest highlight was their explosive cloud growth, where Amazon Web Services (AWS) posted a 19% increase in revenue. One key reason for this, in my view, is their new CEO Matt Garman.

Matt Garman has a long history in product management, both at Amazon and elsewhere, making him the perfect fit to lead AWS, especially as they adopt artificial intelligence onto their platform.

Amazon’s earnings tell the story of a company pushing hard to stay on top. With AWS’s 19% revenue growth under Matt Garman’s leadership, they’re showing they can still innovate in a fierce, competitive market. But with the stock taking a hit, investors seem more concerned with Amazon’s retail business and consumer spending habits.

Apple, on the other hand, reported quarterly revenue of $85.78 billion, beating the $84 billion expected. Their EPS came in at $1.40 versus the $1.35 estimate—solid beats, though not by a huge margin.

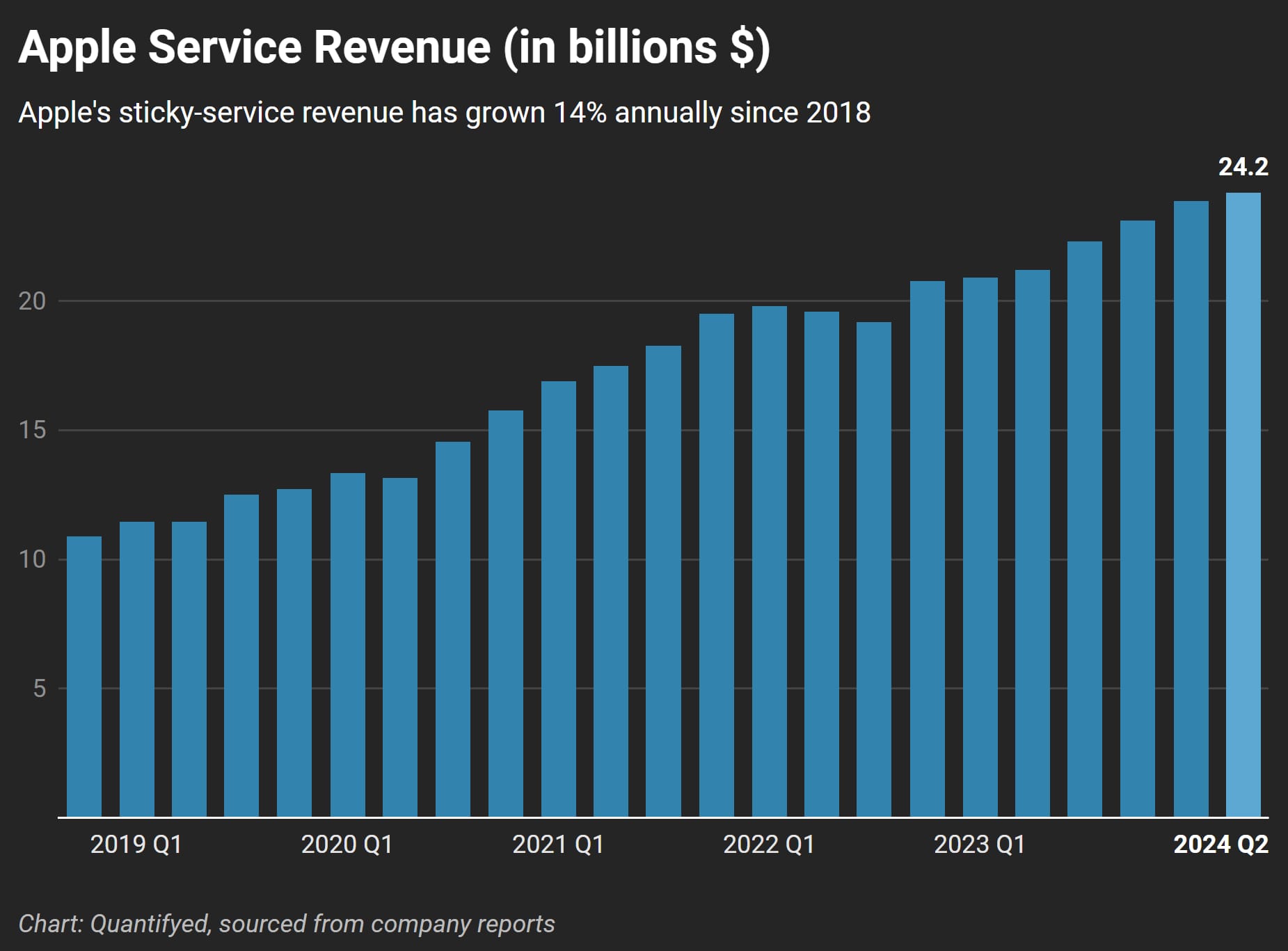

What really stood out in Apple’s report was their services revenue, which hit $24 billion for the quarter, in line with estimates. Apple expects this high-margin, sticky revenue stream to continue growing at around 14%, consistent with the last three quarters.

While iPhone sales beat estimates, Apple is inherently cyclical and dependent on hardware sales. Luckily they’re banking on their new feature, Apple Intelligence, to drive future revenue. Apple’s already teamed up with heavyweights like Google’s Gemini and OpenAI’s ChatGPT to enhance their products.

During the earnings call, CEO Tim Cook pointed out that nearly half of iPad buyers and two-thirds of Apple Watch buyers are new to the Apple ecosystem—proof that the hardware market isn’t saturated. As Cook put it, “I don’t know how every chapter of the book reads, but we’re very confident in the long term,” and it’s hard to disagree.