Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

Double the AWS credits, double the fun. Amazon wants your startup to use their cloud platform, and they’re putting their money where their mouth is.

Let’s be real for a second: if your startup ideas have crashed and burned more times than you’d like to admit, you’re in good company.

Here's some good news: Amazon’s AWS is doubling down on support for startups with a significant boost in credits. This isn’t just a generous gesture; it’s a covert plan to capture the rising number of new businesses formed post-pandemic and strengthen their hold in the cloud industry.

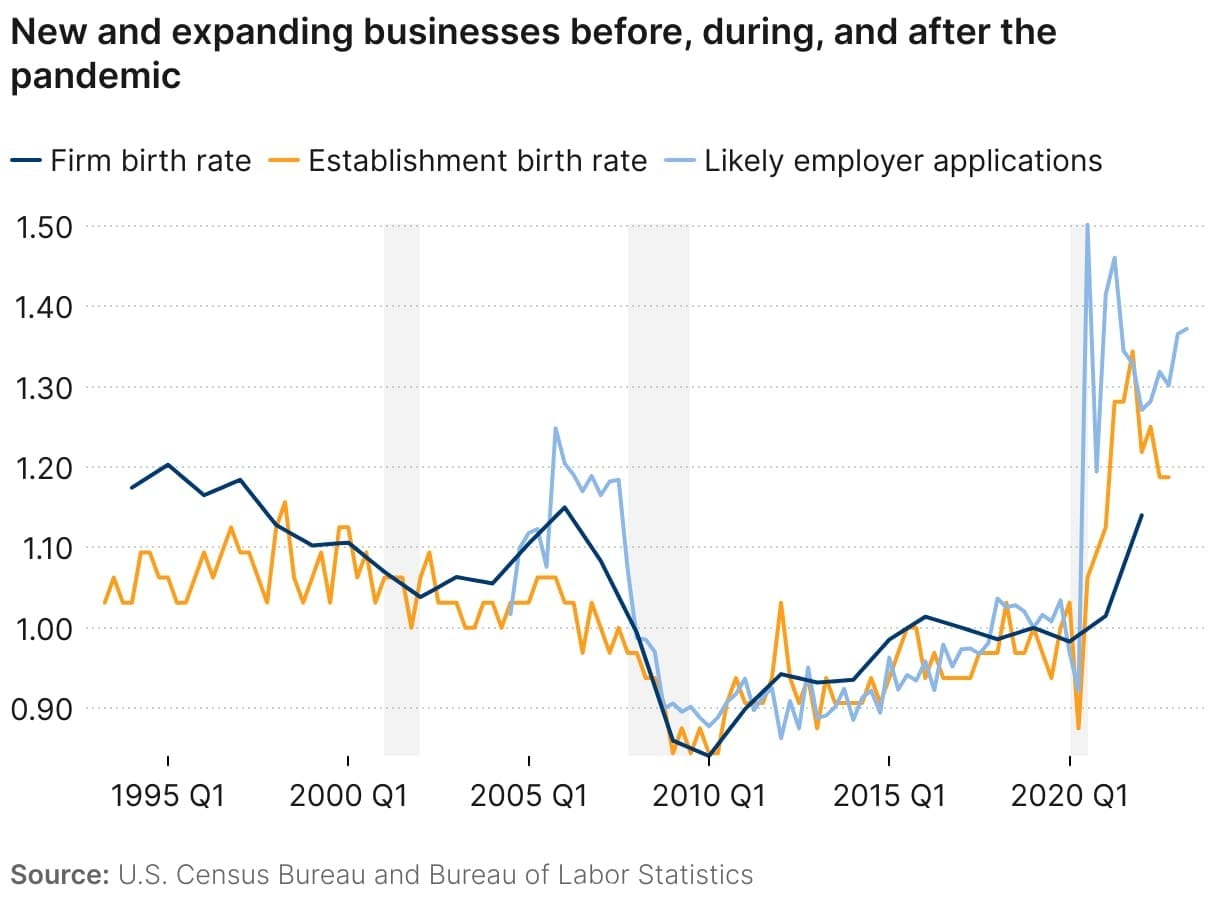

Since the pandemic in 2021, there's been a noticeable rise in new business formations. According to data from the U.S. Census Bureau and Bureau of Labor Statistics, new business applications have grown a LOT. This surge is a prime opportunity for cloud service providers to build their customer base

The biggest question to ask is: will this surge drive a renewed and durable increase in startups? AWS works with 280,000 startups within it's total customer base of 1.5 million— so startups make up a huge portion of their revenue.

It's possible that because of this trend, AWS doubled credits available for startups to $200k, up from $100k.

Running out of money is the top reason why startups fail and that’s largely due to the fact that many startups are funded by their owner’s personal finances. It turns out most new-business owners, 81%, are willing to take on debt.

AWS isn't the only cloud business out there. The cloud service market is intensely competitive, with heavyweights like Microsoft Azure, Google Cloud, and now Nvidia's DGX Cloud all wanting a piece of the pie.

These players are not just sitting on the sidelines watching AWS take the lead. Microsoft Azure, for instance, offers credits and resources through its Founders Hub program, which doesn’t even require previous venture funding.

Amazon’s AWS is doubling credits for startups in response to the surge in new business formations and the ongoing competitive cloud idustry. Amazon's move is going to attract and support startups, helping them build their customer base, and revenue.