Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

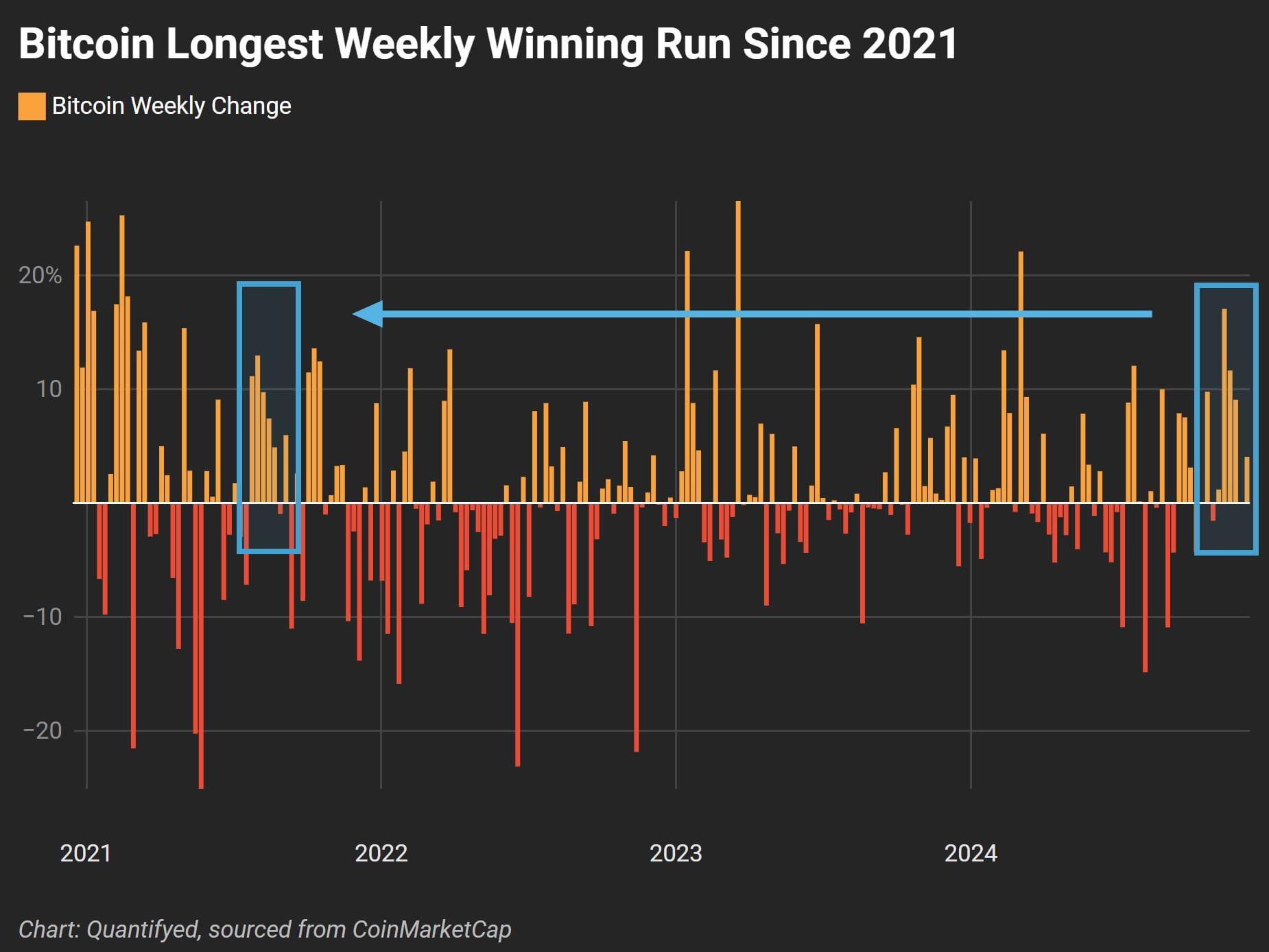

Almost $10 billion has poured into Bitcoin ETFs since the US election, pushing Bitcoin past the $100,000 mark for the first time. The momentum is crazy, with Bitcoin posting its best winning streak since 2021.

With investors pouring in, knowing the risks are more important than ever.

Bitcoin’s Surge

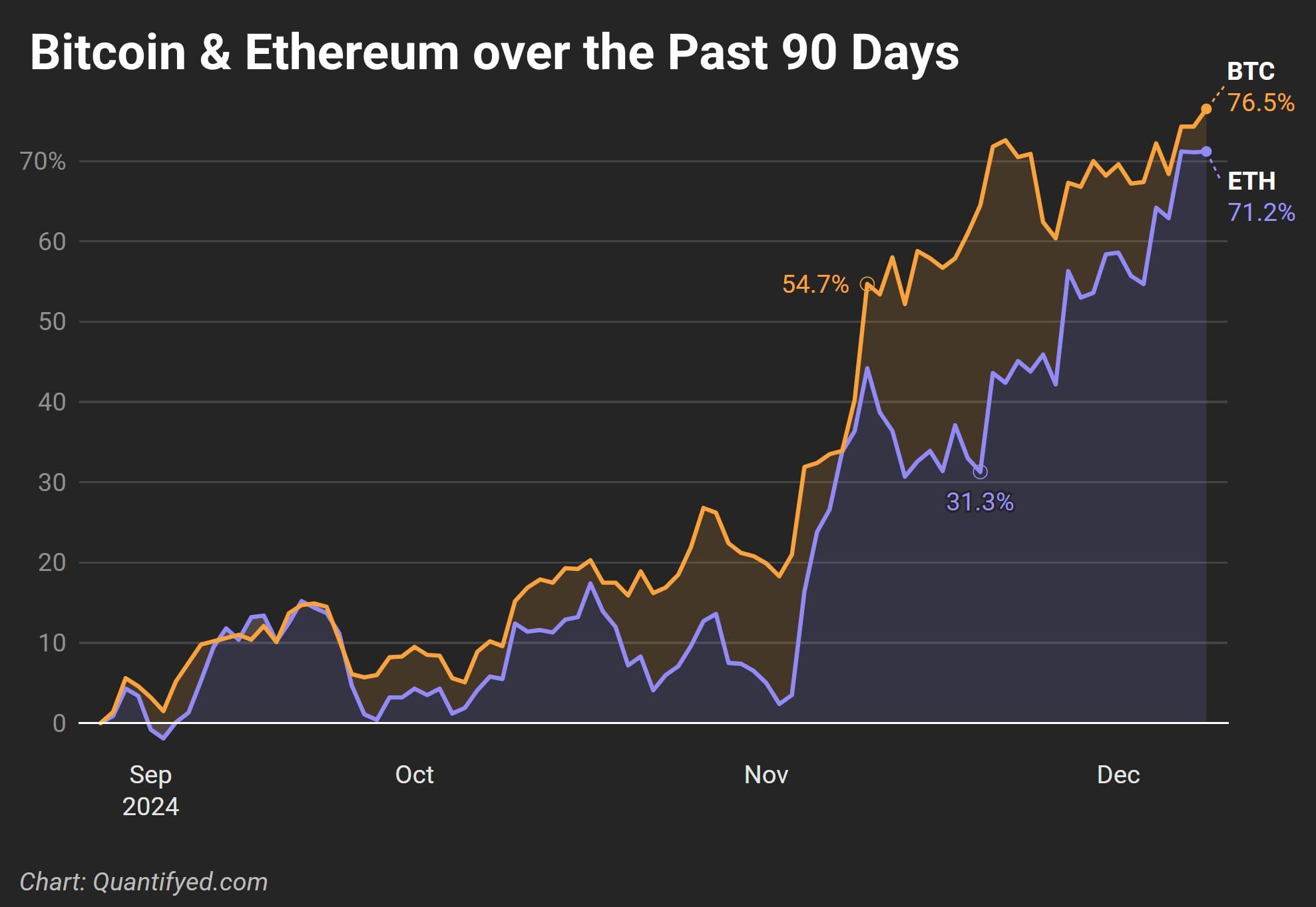

The crypto market has been on a wild ride. In just a month, $9.9 billion in net inflows have flooded into U.S. Bitcoin ETFs, bringing total assets to $113 billion, according to Bloomberg.

How FOMO Drives Investing

Bitcoin’s six-week streak of gains, its longest since 2021, is a classic example of how FOMO (fear of missing out) drives market behavior.

Historically, we’ve seen similar patterns during major milestones. In 2021, Bitcoin hit $69,000 during a frenzy that later led to significant corrections. Could history be repeating itself?

Risks to Watch as Bitcoin Hits $100K

Despite the excitement, there's some big risks:

- Volatility: Bitcoin briefly dipped to $92,000 after crossing $100K. Volatility is through the roof!

- Regulatory Uncertainty: Future U.S. and global regulations are still unknown. Any shift could impact the confidence driving these inflows.

- Overinvestment Risk: Chasing Bitcoin at all-time highs could overexpose investors to potential losses. Some investors found a secret to mitigate this risk.

Crypto’s Role in Traditional Finance

More investments into Bitcoin ETFs show how businesses are changing their view of cryptocurrencies. Alongside Bitcoin, Ethereum ETFs also saw $2 billion in inflows during this period.

Key Takeaways

- Bitcoin ETFs have attracted nearly $10 billion in inflows since Nov. 5, pushing total assets to $113 billion.

- Bitcoin’s $100K milestone shows FOMO in Full Swing

- With regulatory uncertainty and price swings, crypto is still unpredictable.

Did you like this post? For $1/month—less than a WSJ subscription—you'll get even more content like this. If you're interested, click the button below.