Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

For the first time since COVID hit, homes are selling below asking price. Yep, no more insane bidding wars. Let's break down what this means for the market.

Homes are selling for less than asking price. Last year, homes sold at list price; two years ago, they sold for 2% over. This shift is a big deal, and buyers are gaining leverage.

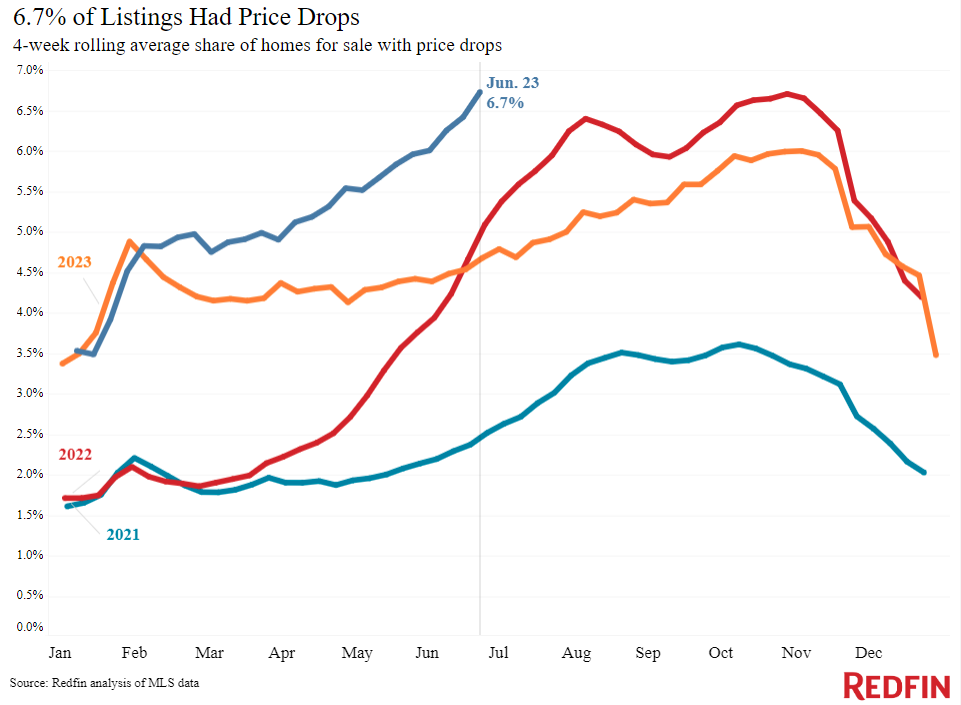

New listings are up 8.2% and pending sales are down 4.3%. This suggests more options for buyers and less competition. With 32.3% of homes selling below asking and almost 7% of sellers dropping prices, it's clear buyers have some power back.

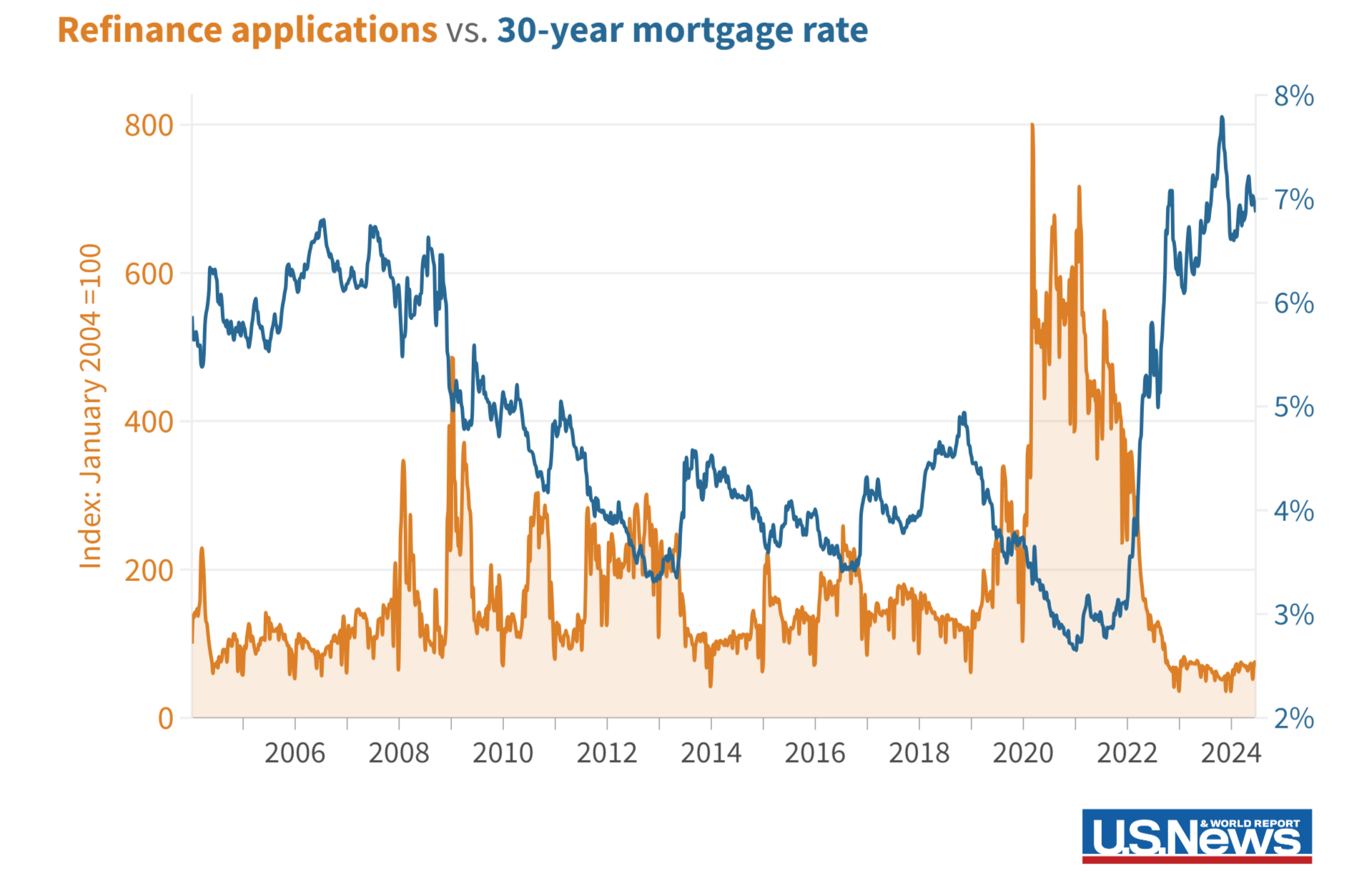

The Market Freeze. The median days on market increased by 4 days to 31 days, showing that the housing market is in a bit of a freeze due to higher mortgage rates.

'Higher for Longer' Mortgage Rates. Mortgage rates near 7% are pushing monthly payments to $2,785. High rates mean higher monthly costs, which makes buyers think twice before pulling the trigger. Sellers are feeling the heat as high rates lock them into their current homes, making the market less fluid

Higher Home Prices. Median home prices have risen 4.9% year-over-year to $397,250, making affordability a major issue. Buyers are becoming more selective, waiting for better deals, which adds pressure on sellers to drop prices.

Buyers Are Interested but Hesitant. The Redfin Homebuyer Demand Index is up 5% from last month but down 14% year-over-year. Home touring is also up 27% since January, showing people are curious but not necessarily ready to buy. It’s like window shopping – lots of looking, not much buying.

Buyers and sellers are both feeling the pressure. More homes selling below list price and more price drops mean the market’s cooling off, finally giving buyers a break.