Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Bitcoin’s breaking records again, shooting past $82,000 right after the U.S. presidential election. While we're debating politics, Bitcoin was busy throwing itself a victory party

Here’s what’s going on: let’s get into why Bitcoin’s on this massive run after the election, what it means for investors, and how it’s affecting the whole crypto market.

Crypto in Command

Trump’s back in office, and Bitcoin’s taking off. Bitcoin just hit $82,000 for the first time, and people aren’t holding back.

Almost immediately after the election results, Bitcoin jumped 7%. It looks like investors are betting big on the new administration’s stance on crypto, hoping it’ll mean more freedom or better regulations for the market. And it’s not just Bitcoin. The entire crypto market is feeling the effects.

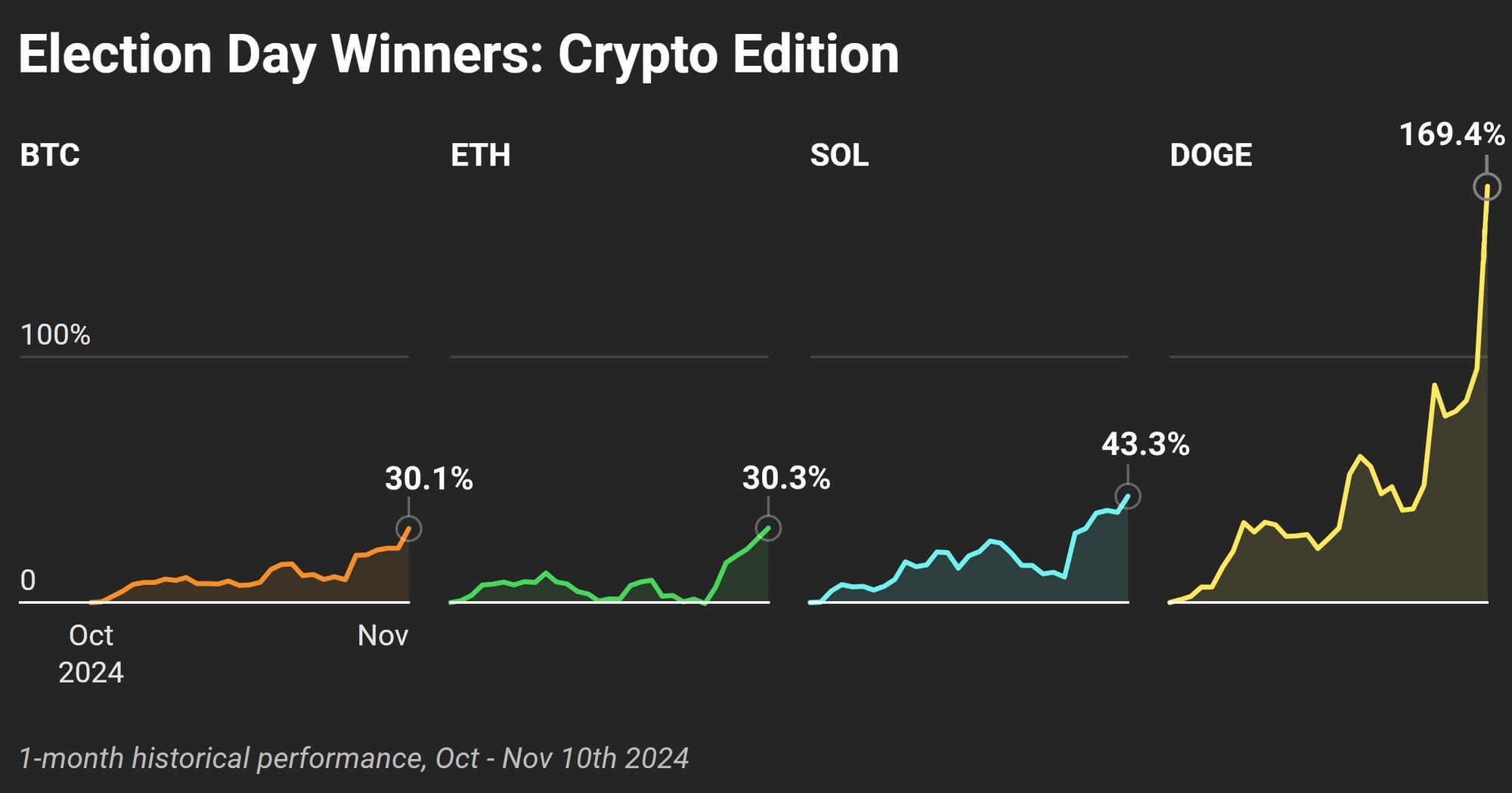

Here’s the last month performance of the major cryptos (Bitcoin, Ethereum, Solana, and Dogecoin):

Déjà Vu

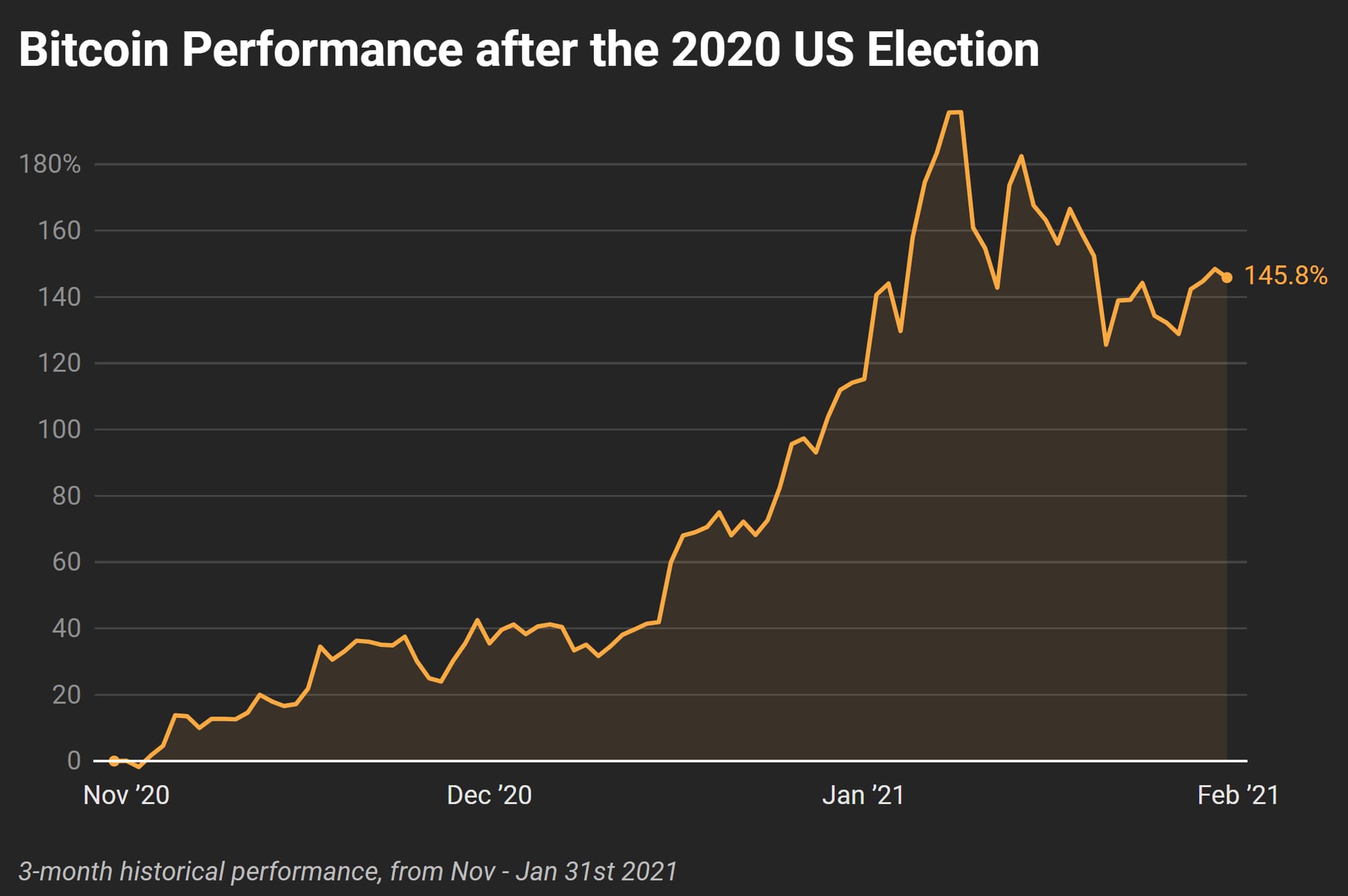

This isn’t Bitcoin’s first time rallying after a U.S. election. If we look back at 2020, you’ll see a similar story. Bitcoin took off after the election too, rising over 145% in just three months! Back then, it wasn’t just politics—there were a bunch of factors, like institutions starting to get into crypto, and the general hype around it.

After the 2020 election, Bitcoin rallied 145%. Elections seemed to give Bitcoin a boost, but there was likely more to the story than just who's in office.

Bitcoin's Ripple Effect

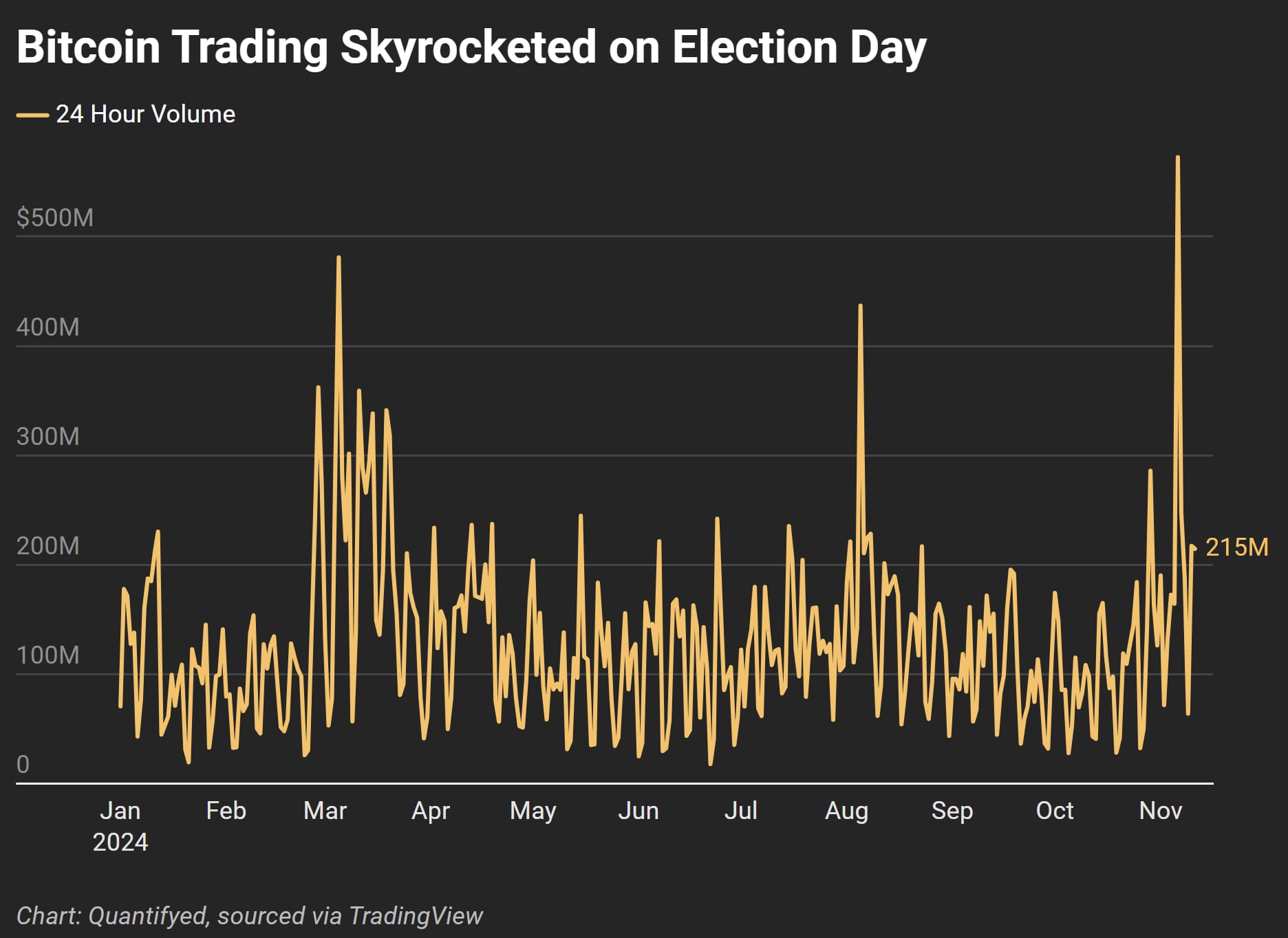

Bitcoin’s rally isn’t happening in a bubble. Suprisingly, Bitcoin’s trading volume on Election Day hit a record high for 2024. People aren’t just watching; they’re putting their money in.

On Election Day, Bitcoin’s trading volume reached $572 million, the highest volume all year. Everyone seems to be getting in, big time.

Key Takeaways

- Election boosted Bitcoin past $82,000, showing strong market reaction

- Historical trend: Bitcoin rallied 145% after the 2020 election

- Ripple effect: Major altcoins saw gains alongside Bitcoin

- Record trading volume hit on Election Day 2024