Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Government surveys that track the economy are failing. Budgets are shrinking, people are skipping surveys, and economic data we rely on is becoming less trustworthy.

This is a big deal—because when the numbers are wrong, decisions that affect markets, businesses, and everyday life go wrong, too. Here’s what’s happening.

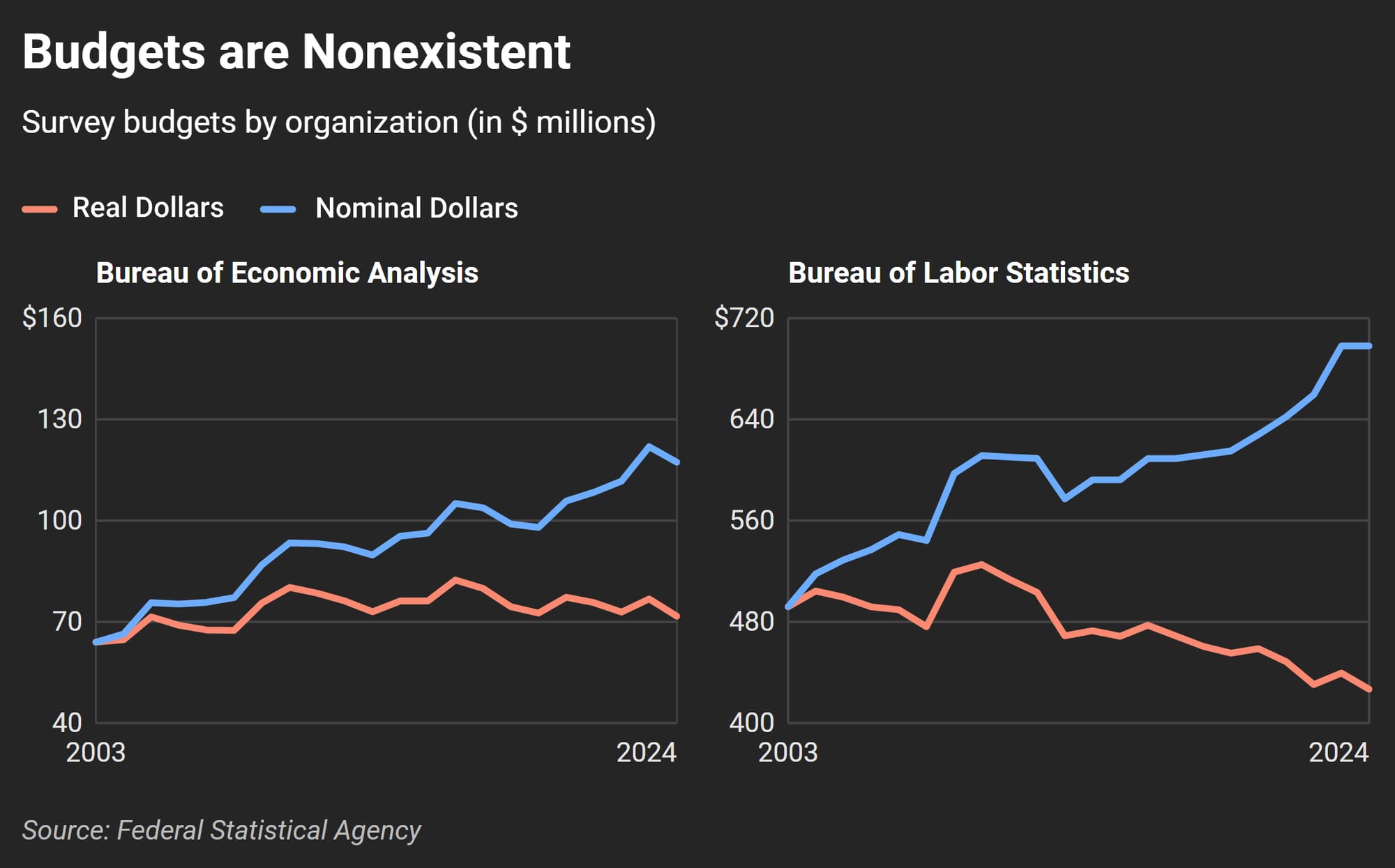

Budgets Are Too Tight

Agencies behind economic surveys—like the Bureau of Labor Statistics (BLS) and the Bureau of Economic Analysis (BEA)—have had their funding squeezed for years.

- In real terms, budgets are down by 20% since 2010.

Agencies (like the BEA and BLS) are cutting back on sample sizes and surveys, making data less reliable.

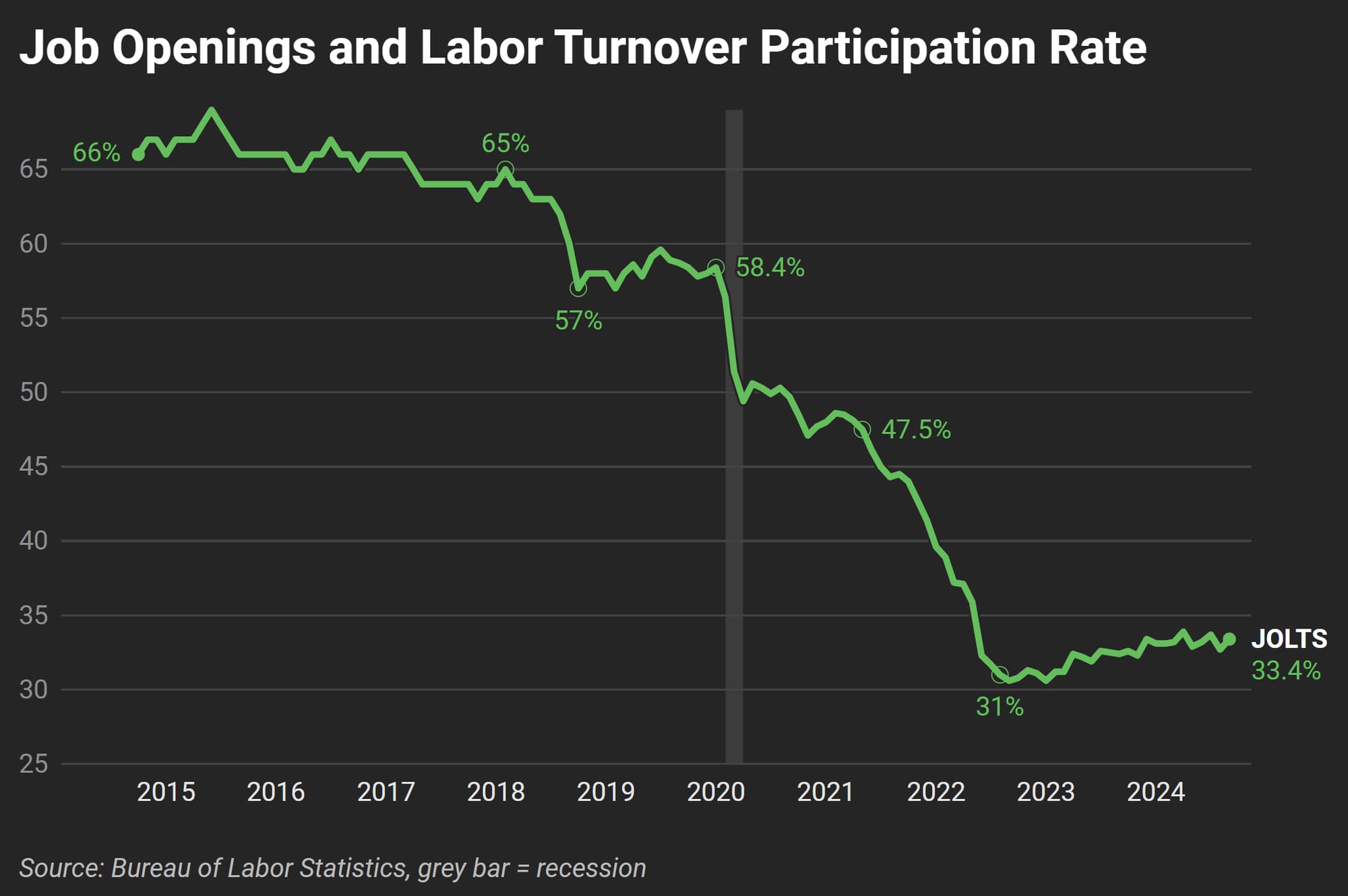

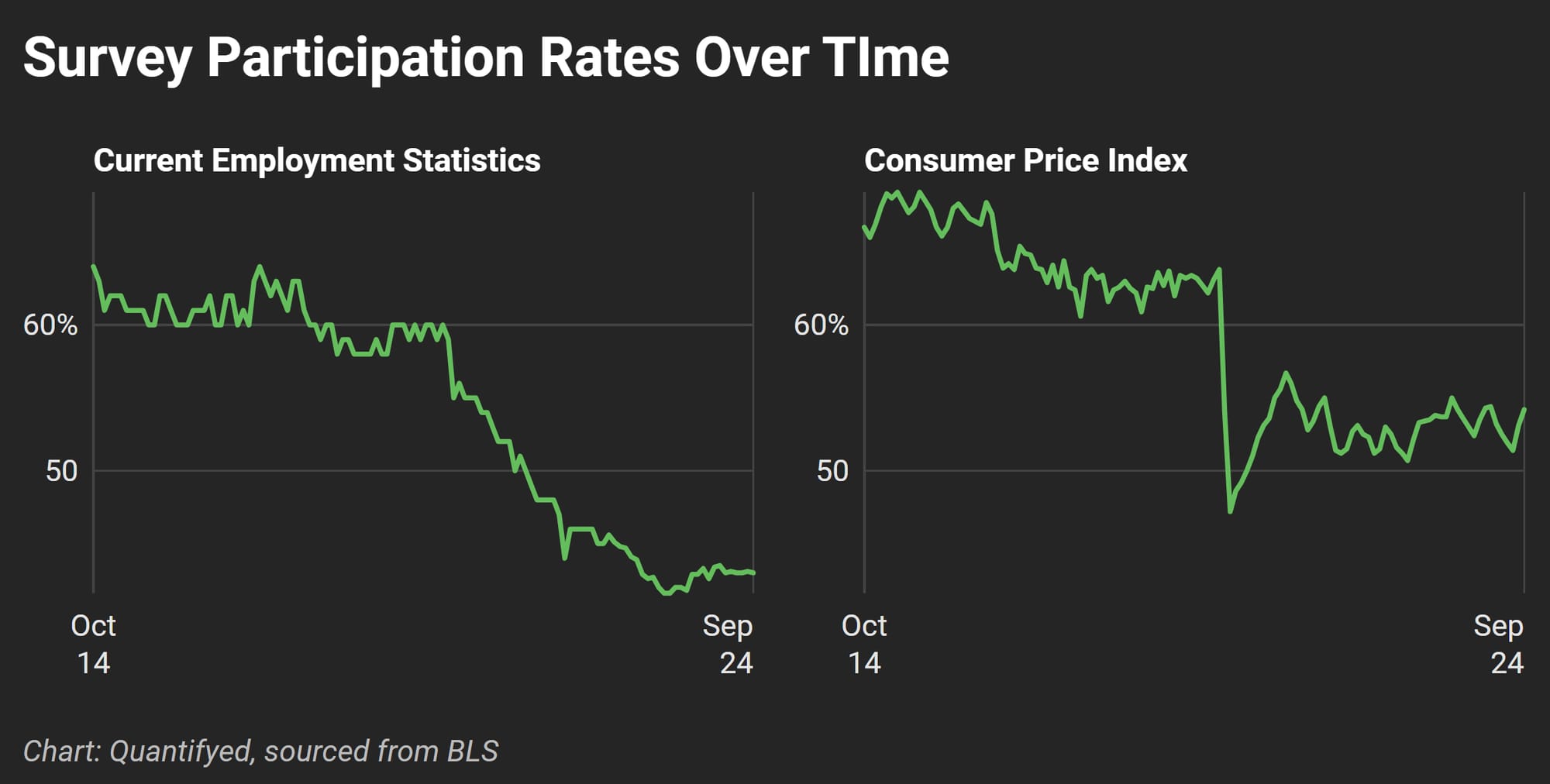

Participation Rates Suck

Even when surveys are funded, fewer people answering them.

- The Job Openings and Labor Turnover Survey (JOLTS) participation rate has dropped from 66% in 2015 to just 33% in 2024

Why? My guess is this: people are more concerned about privacy, trust the government less, and frankly, don’t want to bother with long surveys.

When fewer people respond, the data becomes biased, not telling us what's really going on.

Bad Data = Bad Decisions

If the numbers are wrong, decisions go wrong, too.

- In August, a weak jobs report caused $6.4 trillion to be wiped from global stock markets in just a few days, according to Bloomberg.

Policymakers rely on economic stats to make huge decisions about interest rates, spending, and investments. Without accurate data, we'll go blind.

Here's what you should know:

- Budgets are broken. Real funding for critical surveys are down 20% since 2010

- Participation is falling. JOLTS response rates have dropped by over 50%, affecting data quality

- The risk is real. Inaccurate numbers mean bad decisions for markets, businesses, and policies that affect us all