Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

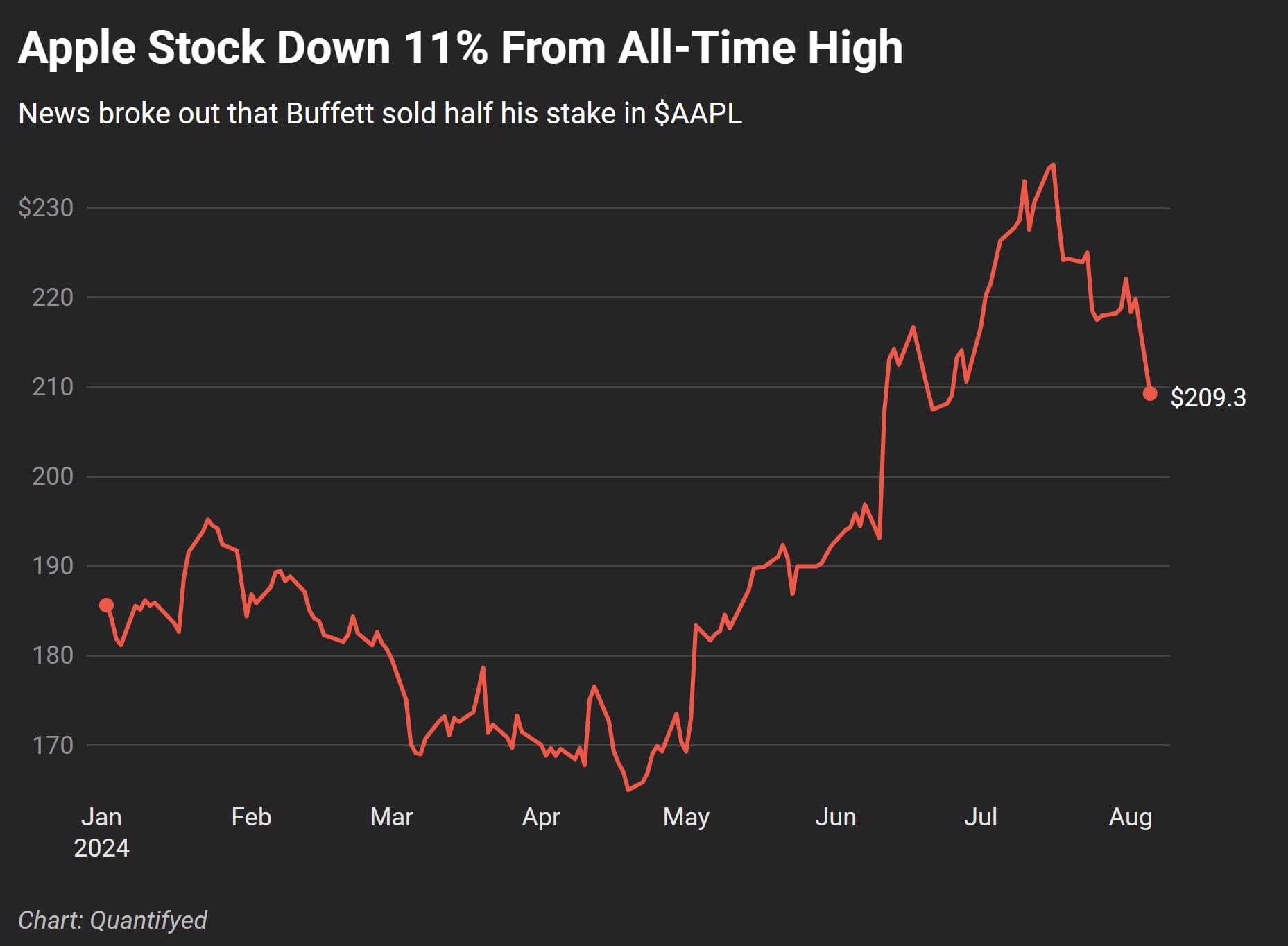

Warren Buffett just did something that’s turning heads in the stock market—he sold half of his Apple stake! Yep, you heard that right. The guy who once called Apple the best company in the world just trimmed his position by 50%. And when Buffett makes a move like this, it’s worth paying attention.

Now, before you start thinking he’s lost faith in the iPhone maker, let’s break it down. Apple was already a massive 50% chunk of Berkshire Hathaway’s public portfolio, valued at over $150 billion.

After selling, Apple’s share in Buffett's portfolio dropped from 40.8% to 20%. But even after all that trimming, Apple still remains Berkshire’s largest holding.

Buffett didn’t just sell a few shares here and there—he slashed his Apple position in half. This sale bumped Berkshire’s cash reserves up to a staggering $277 billion, the highest it’s ever been. So, why did the Oracle of Omaha decide to take such a big bite out of Apple?

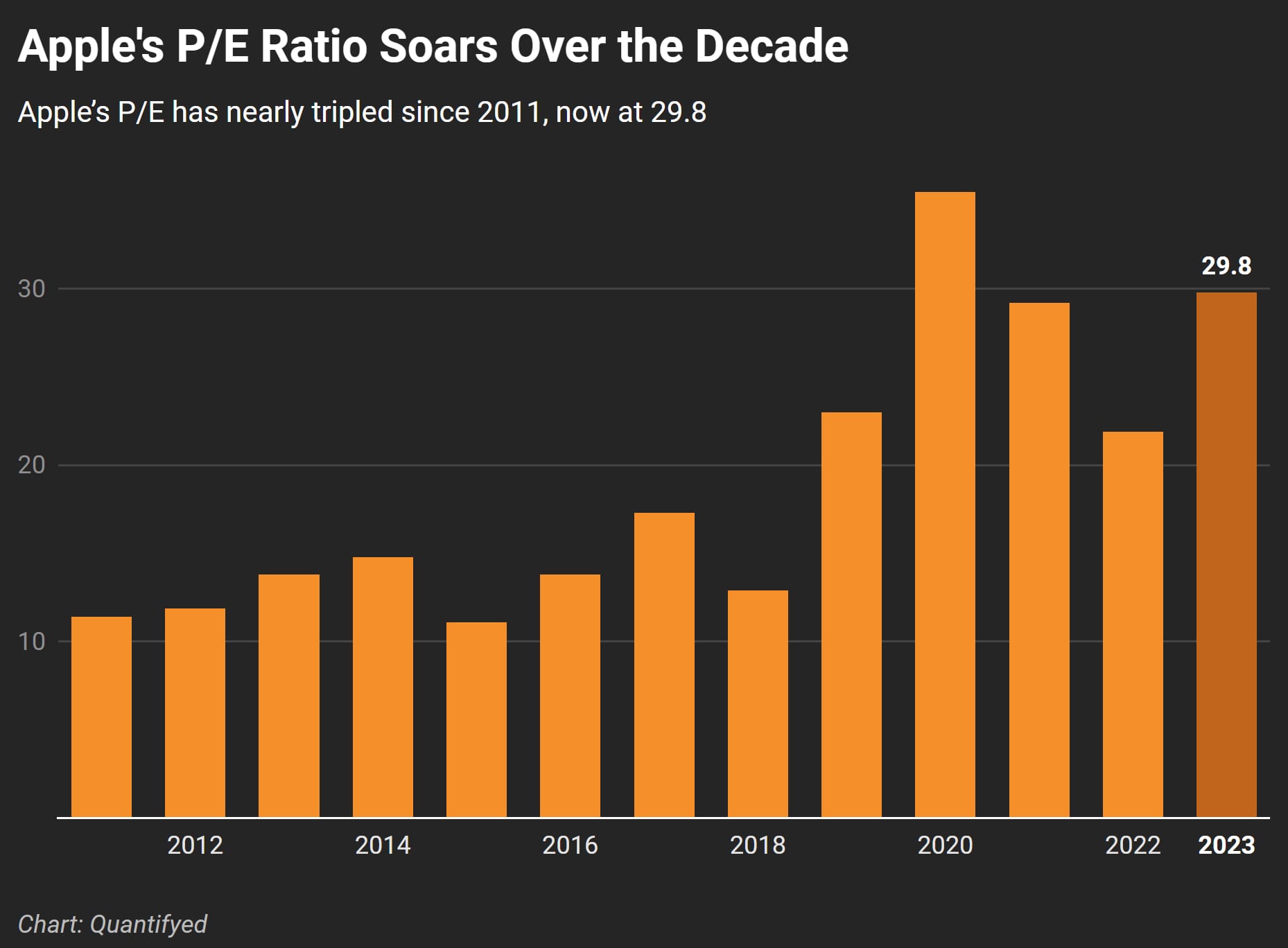

Let’s talk valuation. Apple’s been trading at a pretty steep price-to-earnings (PE) ratio of 30. For a company that’s been growing slower than it used to, that’s a high bar to clear.

But that’s not the only thing on Buffett’s radar. Apple’s facing more and more pressure from regulators, especially in the EU. A $2 billion fine here, new rules forcing Apple to open up its App Store there—it’s all chipping away at Apple’s moat, that competitive edge that’s kept it at the top for so long.

And let’s not forget about the Google factor. The DOJ’s recent lawsuit against Google is more than just a headache for Alphabet—it’s a potential problem for Apple, too. Google pays Apple a ton of money to be the default search engine on its devices. If that relationship gets cut off, it could hit Apple’s bottom line hard.

Buffett’s move is a classic reminder that no matter how much you love a stock, it’s crucial to understand the business. Apple might still be a great company, but at these valuations and recent lawsuits, it’s not as much of a bargain as it once was.