Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

The Federal Reserve is walking on a tightrope, and the stakes couldn’t be higher. If you were the Fed, how would you avoid a recession, while balancing the labor market and taming inflation? I'll break down in this post if the Fed can manage the cooling labor market without triggering a recession, analyzing recent trends and key economic data.

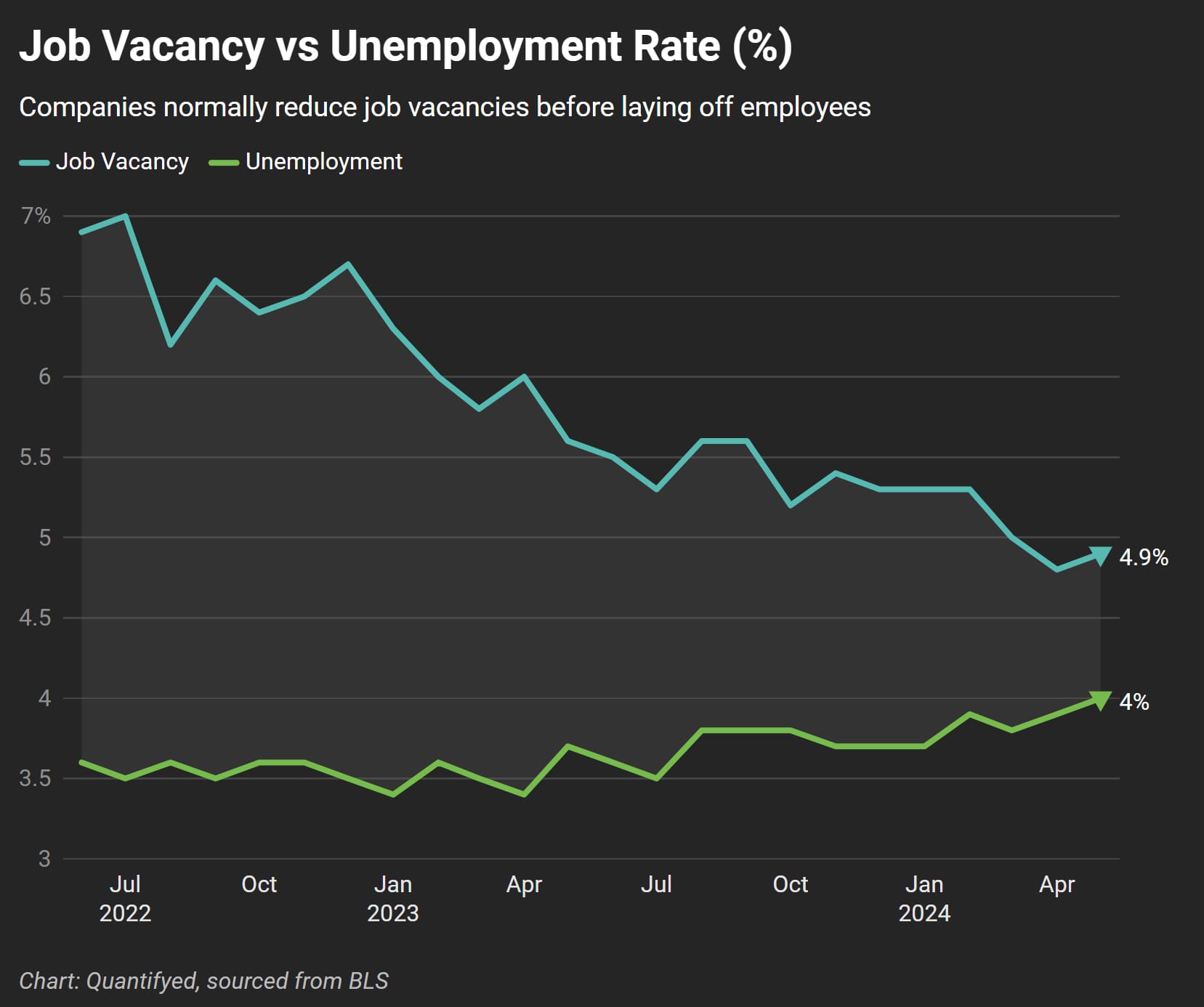

The U.S. labor market is a key indicator for the health of our economy. In recent months, jobs have been slowing down—with the unemployment rate rising to 4.1% in June 2024, up from 3.6% a year ago. Not only that, job vacancies have also dropped a lot, from a high of 7.4% in March 2022 to 4.8% in April 2024. It basically tells us that companies are still hiring, just at a slower pace.

The Federal Reserve's primary goal is to control inflation without causing a significant rise in unemployment. Inflation has decreased from 4% a year ago to 3% in May 2024, approaching the Fed's target of 2%. However, the Fed's challenge lies in maintaining this balance as the labor market cools.

Several Fed officials have noted that companies are more likely to reduce vacancies rather than lay off employees in response to higher interest rates. This trend has been evident as job vacancies have decreased without a corresponding rise in unemployment.

Historically, a rise in unemployment by more than half a percentage point often leads to a recession. This pattern is concerning given our latest increase from 3.6% to 4.1% in June.

There's still mixed signals. Hiring and quitting rates are back to levels seen 10 and 7 years ago, hinting at a turn to stability instead of a downturn. Layoff rates remain low, but that could change if vacancies continue to fall.

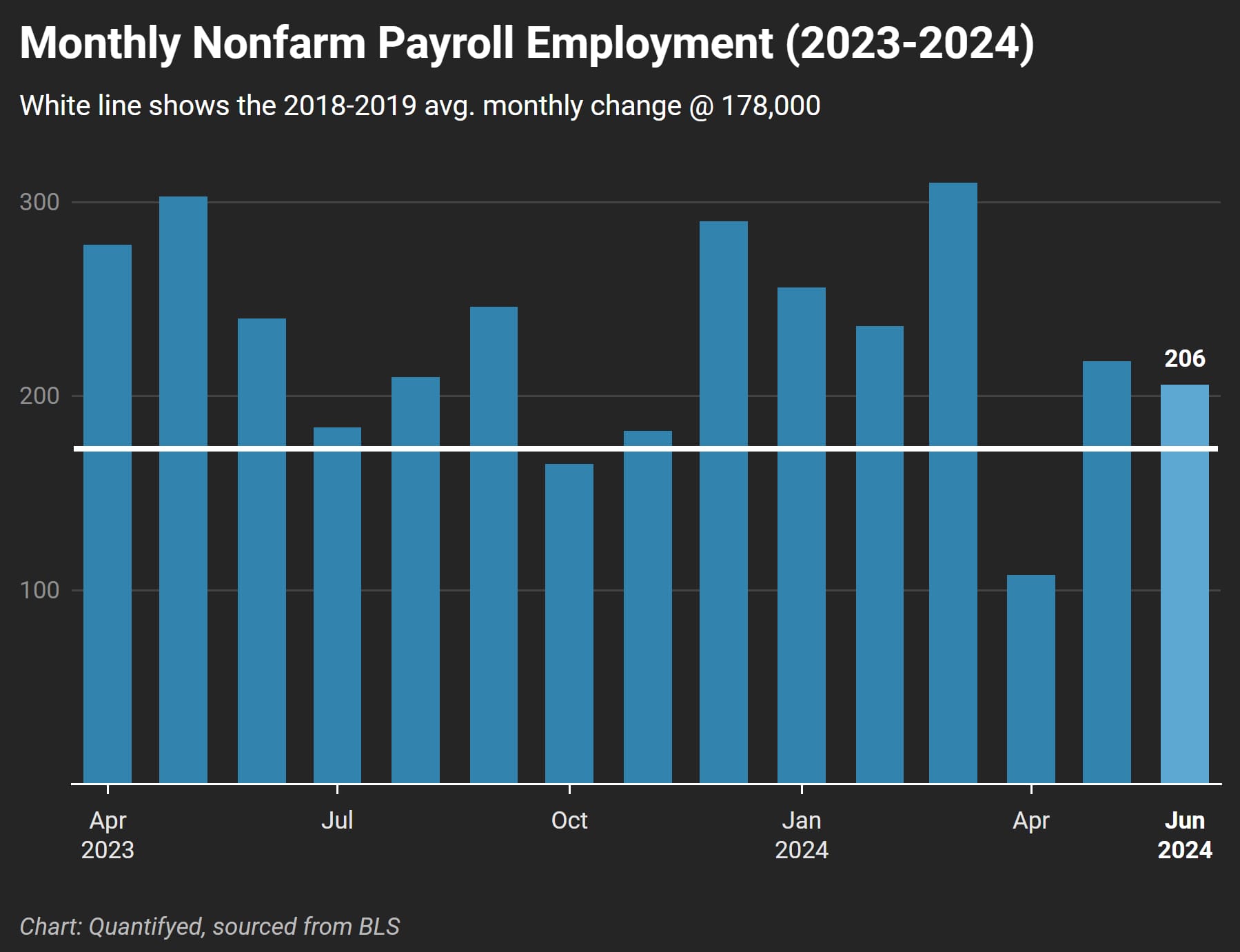

Other data I found could signal whether the labor market is stabilizing or heading towards a recession. Job growth data showed an increase of 206,000 jobs in June 2024—matching the average monthly gains in the past year. Although a bit concerning, initial unemployment claims have ticked up, which is an early warning sign of a downturn if the trend continues.

So... the big question.. If I were at the helm of the Federal Reserve, my approach to taming inflation while stabilizing the job market would involve a ton monitoring, and looking at incoming data while adjusting policies minimally.

That said, I'm definitely not fit for the job– after all, I'm just an observer trying to make sense of this rollercoaster. But with the data we have, it seems our economy is handling the Fed's policies relatively well so far. Let's hope it stays that way!