Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

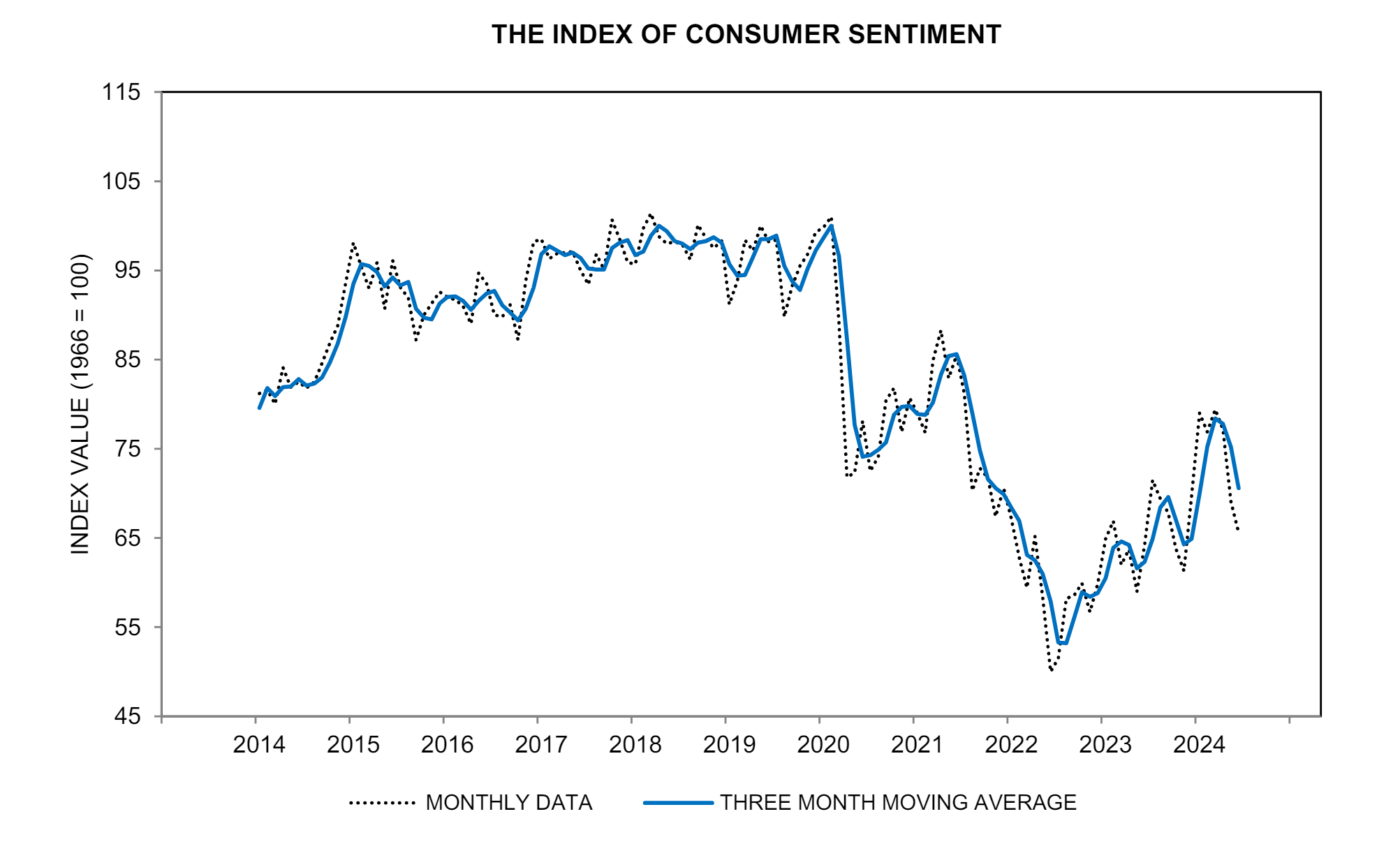

You ever had that one friend that thinks the world is gonna end? That’s what consumer sentiment is like right now— it’s a snapshot of how optimistic or pessimistic we all feel about the economy. Let me break down what’s going on and why it matters to you

In June, the University of Michigan's Index of Consumer Sentiment took a nosedive to 65.6 from 69.1 in May. Their Index of Current Economic Conditions also dropped to 62.5 from 69.6.

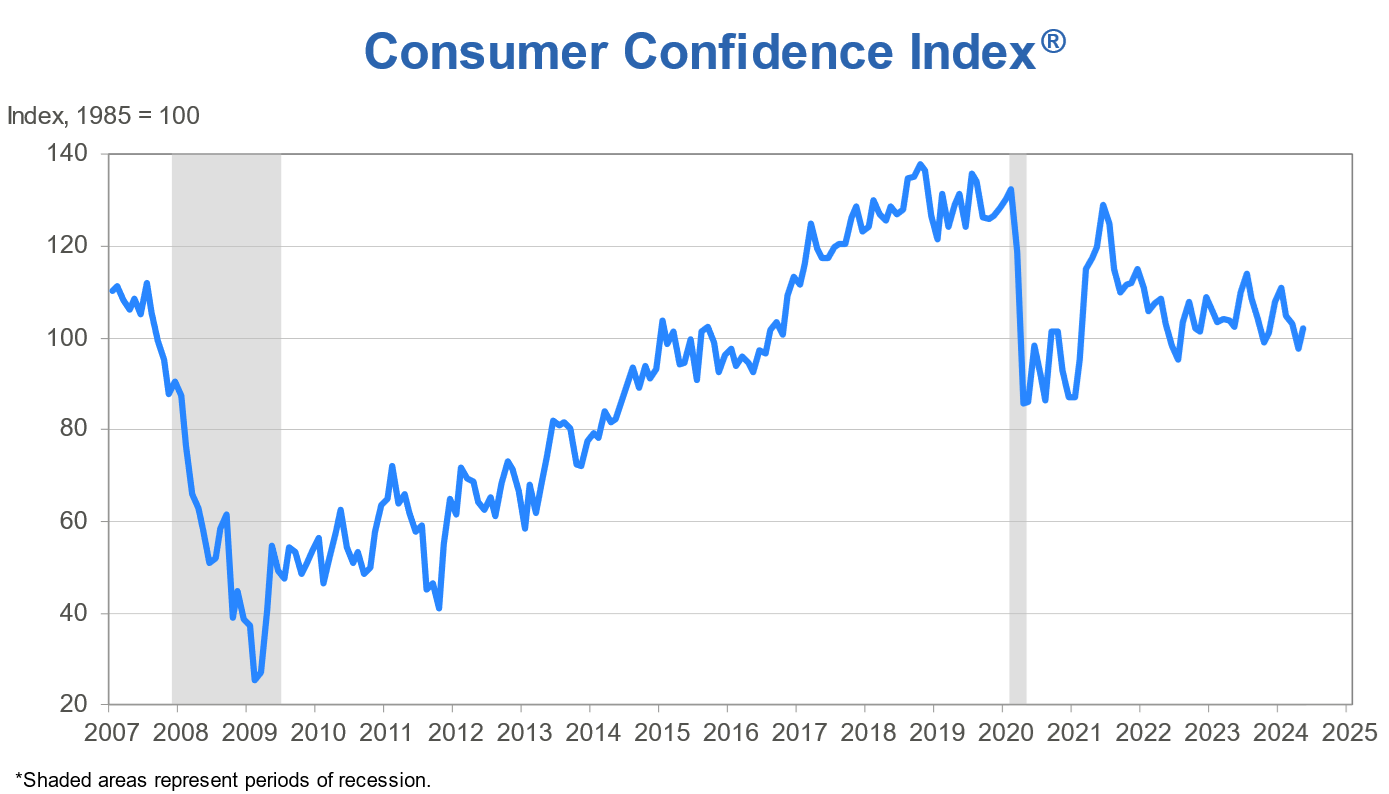

Meanwhile, the Conference Board’s Consumer Confidence Index rose to 102.0 in May, up from 97.5 in April. Talk about mixed signals.

Consumer sentiment, or consumer confidence, measures how optimistic or pessimistic consumers are about the economy, jobs, and personal finances. It's like checking the mood of the nation—when we're feeling good, we spend more; when we're not, we tighten our belts.

Why Does It Matter?

Consumer spending makes up a whopping 67.9% of the U.S. GDP. So, if people aren’t confident, they spend less, making it a useful indicator for predicting slowdowns in the economy.

How You Can Stay Informed

There are two surveys I follow, that I also recommend:

- University of Michigan’s Surveys of Consumers: Started in 1946 and now monthly, it surveys about 600 people on their finances, business conditions, and buying conditions.

- The Conference Board’s Consumer Confidence Survey: Started in 1967 and now monthly, it surveys around 3,000 people on business conditions, employment, and income expectations.

What Today's Data Tells Us

The latest data from June shows a dip in the Michigan's Consumer Sentiment, signaling reduced confidence.

On the flip side, the Conference Board’s index rose in May, suggesting some optimism.

It’s a bit like trying to decide if you need an umbrella or sunglasses—mixed signals everywhere.