Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

The American consumer, a pillar of economic growth, is starting to fatigue. With affordability at record lows, it's clear that spending patterns are shifting, and these changes could be symptoms of a slowdown. Let’s break down what’s happening and why it matters.

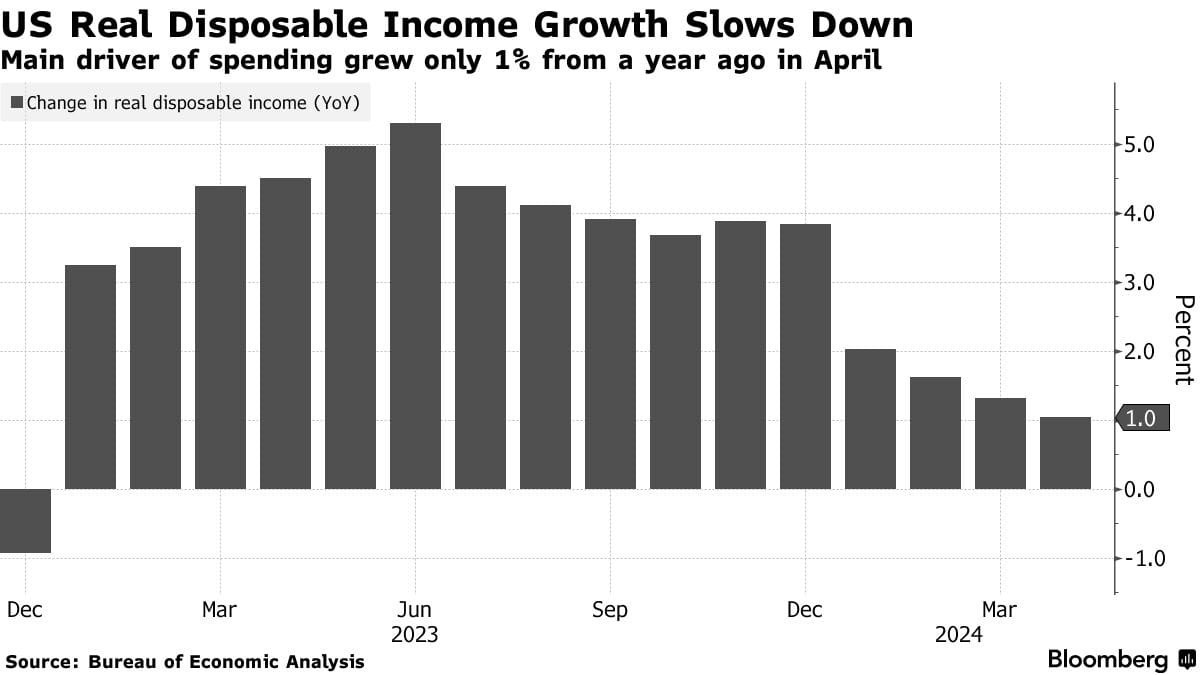

Decline in Disposable Income

One of the main indicators of consumer health is disposable income. Over the past year, real disposable incomes have seen only modest increases, growing by just 2%. It's like getting a small bonus at work— it helps, but it doesn’t change your life.

With the job market cooling off, wage growth has also slowed. April saw the smallest gain in wages and salaries in five months, which isn’t exactly the news we want to hear when we’re trying to grow the economy!

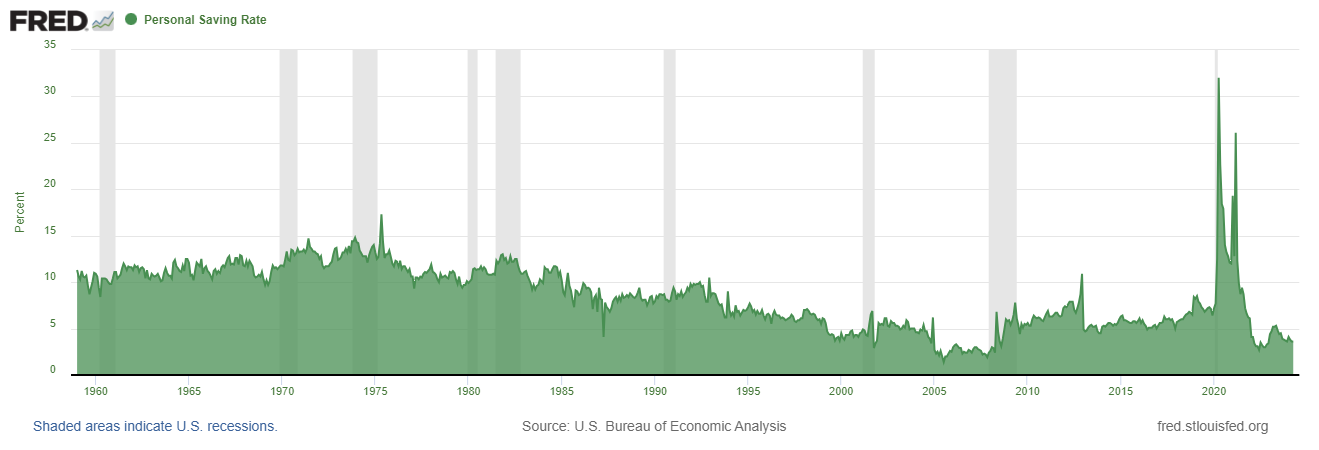

Depletion of Savings

Remember the extra cash we all stashed away during the pandemic? Well, it’s disappearing fast. The current savings rate is at a 16-month low, dropping to 3.6%.

This shows that households have largely spent their pandemic savings. This could mean more people are relying on credit cards and other forms of financing to support spending, increasing debt burdens. It’s like running out of fresh food and having to dig into that can of mystery meat from the back of the cupboard... yuck

Shifts in Spending Patterns

April’s consumer spending data revealed a decline in real spending, especially on non-essential items like cars (-2%), dining out (-1.2%), and recreational activities (-1.5%).

This shift means consumers are becoming cautious with their wallets. Retailers are feeling it too. Five Below, for instance, mentioned in a CNBC interview, "Consumers are more discerning with their dollars, increasingly buying to need".

Also, the US economy has been showing signs of cooling off. The government’s recent downward revision of the GDP estimate for the first quarter, combined with the decline in consumer spending, provides clear evidence of this trend.

It's good that the Federal Reserve is closely watching these trends. With our fed funds rate at its highest level in over 20 years, there’s an ongoing debate about whether it’s restraining the economy as intended. It’s a delicate dance of trying to tame inflation without breaking the economy.

The slowdown in consumer spending isn’t just a blip—it’s a sypmtom of a broader downturn. With disposable incomes stagnating, savings depleting, and consumers becoming more cautious, these signs are becoming more noticeable.