Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

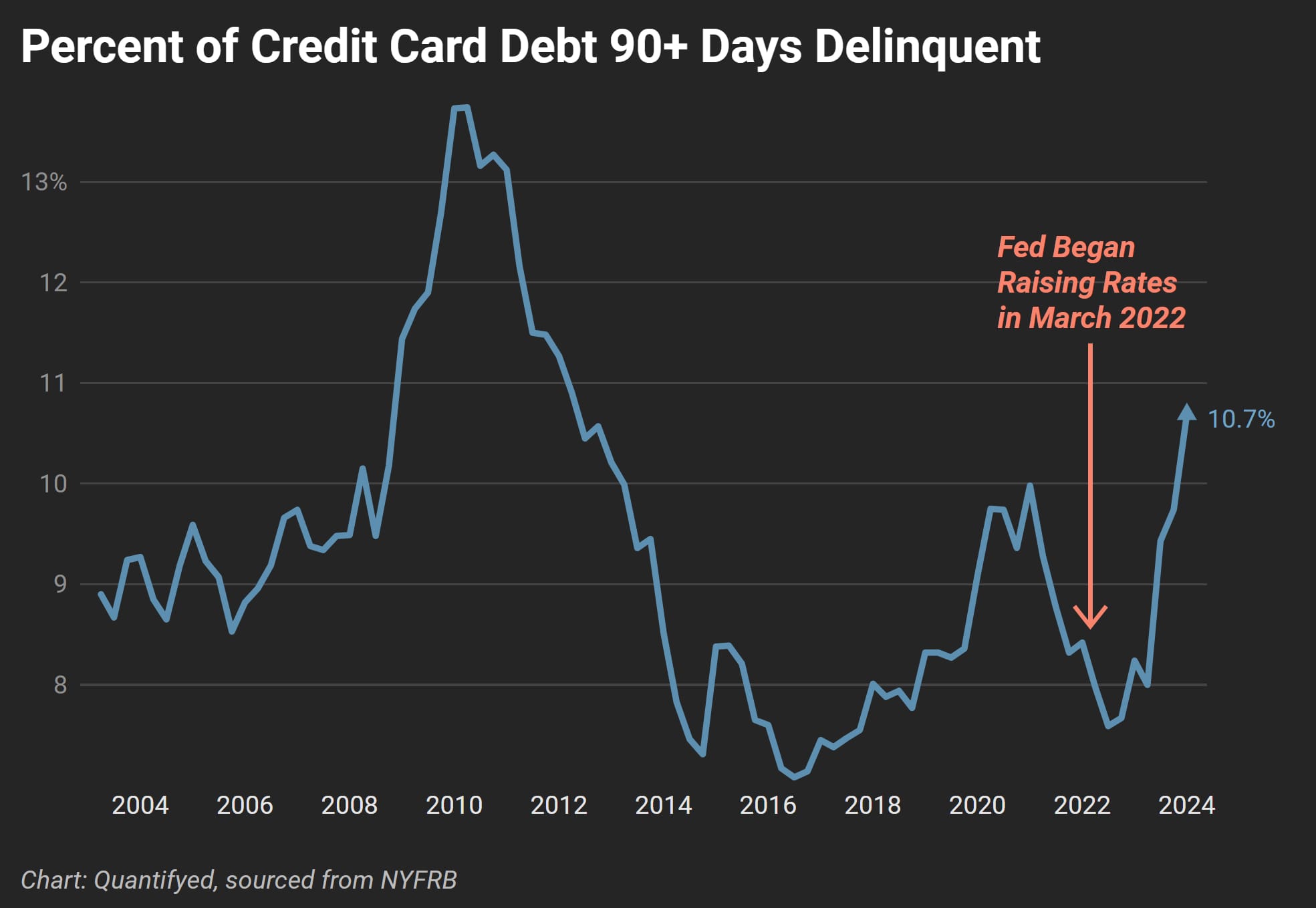

Brace yourself—U.S. credit card delinquencies are skyrocketing like never before. Looks like my credit card debt isn’t the only thing out of control. There’s an alarming rise in credit card delinquencies, backed by a 25-year data analysis from the Federal Reserve Bank of New York. We’ll explore why this is happening, who’s most affected, and what it means for the future.

Growing Share of Credit Card Delinquencies

The percentage of people in credit card delinquency is a crucial metric that indicates how many individuals are struggling to repay their debts. Our latest data shows a large increase in delinquency rates, especially among the poorest ZIP codes.

From 2021 to 2024, delinquency in the poorest ZIP codes grew from 11% to 17.4%—a staggering 58% increase. This trend is not isolated; the US and poorest 10% of ZIP codes are all hovering near all-time peaks.

This chart I generated shows you the percentage of credit card debt that is 90+ days delinquent from 2004 to 2024. There's a noticeable uptick starting around the time the Federal Reserve began raising rates in March 2022.

While the share of people delinquent on their credit cards is higher, the percentage of debt in delinquency is another critical indicator. This metric highlights the impact on lenders’ balance sheets and the broader financial system.

Over the past year, delinquency rates have risen across all regions. The richest 10% of ZIP codes experienced a 54% increase in delinquency rates, climbing from 4.8% in Q2 2022 to 7.4% in Q1 2024. In contrast, the poorest 10% saw their delinquency rate jump from 14.9% to 21% during the same period, a 41% increase.

The rise in credit card delinquencies aren't the same across all regions or income levels. The richest ZIP codes saw a 54% increase in delinquency rates, while the poorest ZIP codes experienced a 41% rise. This suggests that while higher income areas are not immune, the financial pressure is much more acute in lower income regions.

The effects of rising credit card delinquency rates are undeniable. Higher delinquency rates can strain household finances, limit spending, and slow our growth. Also, the combination of higher interest rates and tighter monetary policy appears to be accelerating this trend, pushing more people into financial distress.

When will the Federal Reserve cut interest rates? I answer that question here.

Overall, the rise in credit card delinquencies is a pressing issue with significant implications for individuals and the economy. Our latest data shows that this trend is particularly severe in the poorest ZIP codes, where financial pressures are already difficult.