Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

Low inventory, rising geopolitical tension, air conditioner season, and hurricane Beryl are stirring up fear in crude oil prices this week. I'll give you a rundown of what to expect and how you should react.

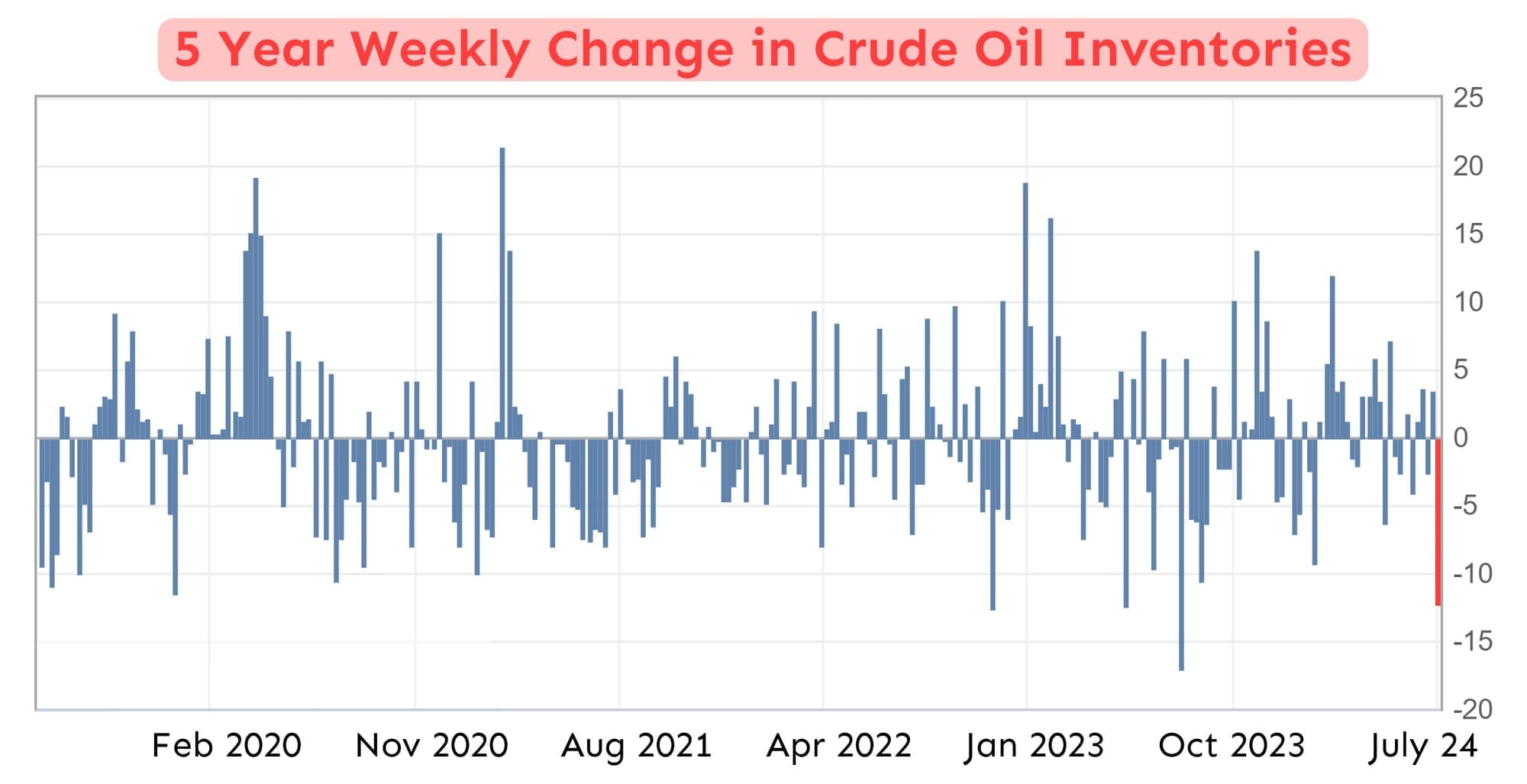

Oil prices jumped last week on Wednesday, July 3rd, after the US Energy Information Administration (EIA) reported a weekly crude oil inventory change of -12.2 million vs -0.4 million expected for the week ending June 28, 2024.

At 448.5m barrels currently, US crude oil inventories are 4% below our five-year average for this time of the year. Gasoline inventories also shed 2.2m barrels that week, compared to a build of 2.7m from the prior week.

What's driving oil prices? One reason is geopolitical tension. Further escalation of violence in the Middle East would come at a cost. Since Iran is the 7th largest oil exporter in the world, their conflict with Israel could impact oil production and infrastructure. In April, Iran fired 300 missles into Israel.

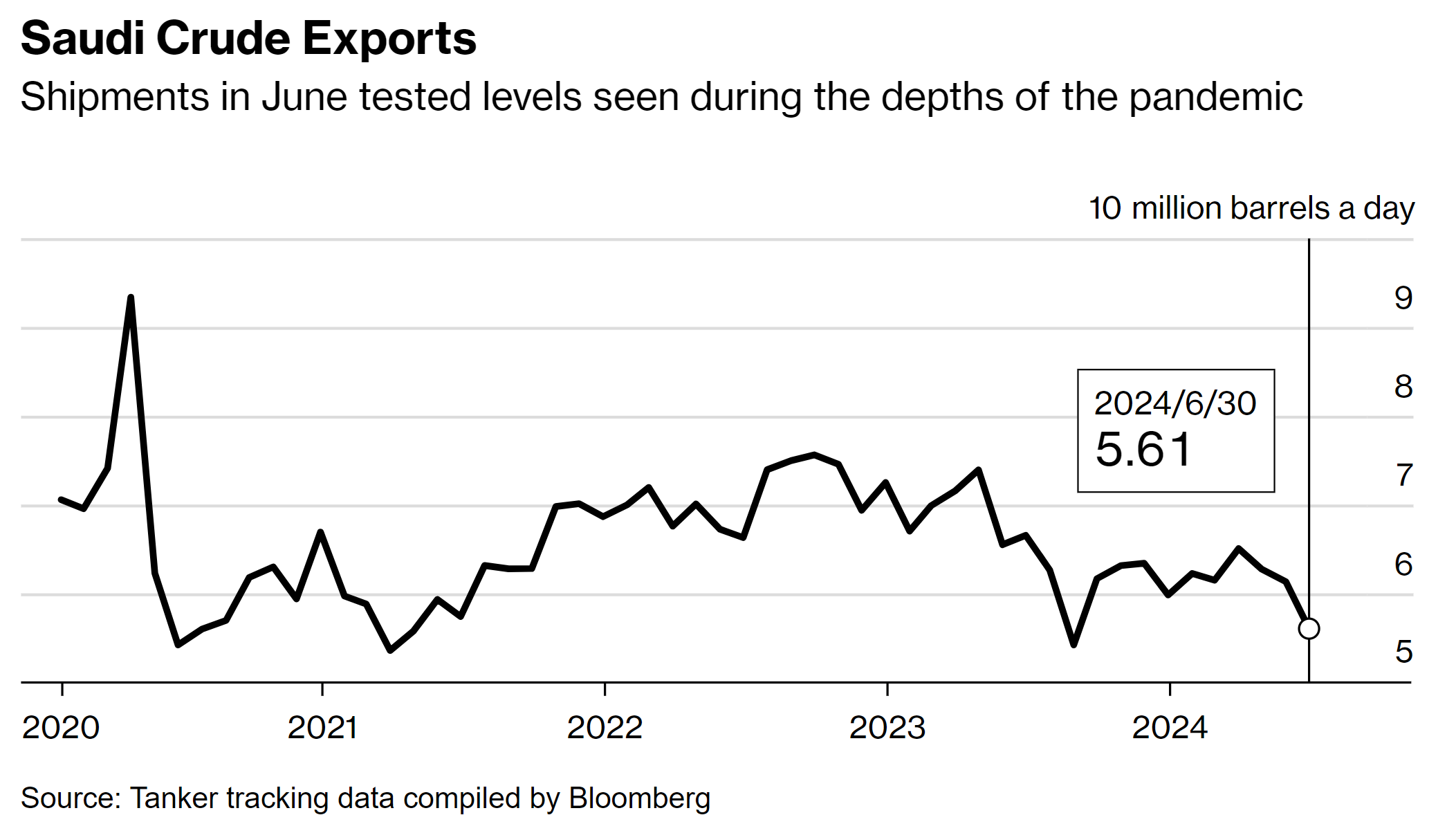

Also, signs are emerging of a slowdown in the oil exports from Saudi Arabia, which accounted for half of a global oil export decline that was -1.08 million barrels per day (bdp) in June.

The decline of 1.08m bdp was the biggest monthly drop in crude supply so far this year. We're speculating that because Saudi Arabia has soaring demand for air conditioning in the hottest months of the year, they burn more oil domestically.

Saudi Arabia happens to be the 10th hottest place on earth, where 125.6° F (52 C) was recorded in June 2010.

A major impact happening today, Monday the 8th, that could impact prices is hurricane Beryl; a category 2 storm crossing through Corpus Christi, a city about 200 miles south of Austin, TX.

Corpus Christi is a major oil export hub located along the east coast of Texas. A temporary halt to crude exports and oil shipments could have a huge impact on oil production.

Despite this hurricane, some producers aren't concerned. Cheniere Energy, a nearby natural gas producer said in a press release,

"Our Gulf Coast assets, including Corpus Christi, have robust and proven severe-weather preparedness plans and procedures in place"

Hurricane Beryl is expected to pass through Texas by the end of Tuesday, this week.