Featured Posts

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Every time the market rallies to new highs, people start asking the same question: Are we in a bubble? And every time, the answer is basically the same: maybe, but we won’t know until it pops. That’s how bubbles work. They never feel obvious in real-time. The 1999

Markets are trying to recover after last week’s selloff, but the gains are small. As of this morning, the S&P 500 and Russell 2000 are both up just 0.03%, the Dow is up 0.11%, and crude oil is climbing 0.2%. Meanwhile, the Nasdaq 100

The market’s winning streak just hit a roadblock. Trump’s latest tariff threats, floating a 25% tax on auto, semiconductor, and pharmaceutical imports are shaking stocks today. With growing inflation concerns, market's are guessing whether this could push back Fed rate cuts in 2025. Here’s what’

The S&P 500 has surged more than 150% since its pandemic low in March 2020, but there’s a catch: the market is now the most expensive in history.

With the S&P 500 trading at a price-to-earnings (P/E) ratio of 37x—far above its historical median of 25x—what does this mean for your portfolio over the next 10 years?

History gives a simple, sobering answer: when valuations are this high, future returns tend to be much lower.

Why Valuations Matter

Valuations might not matter much in the short term, but over 10 years or more, they become a major factor. Historically, markets with elevated P/E ratios have delivered much lower returns over the long run.

What Today’s Valuations Tell Us

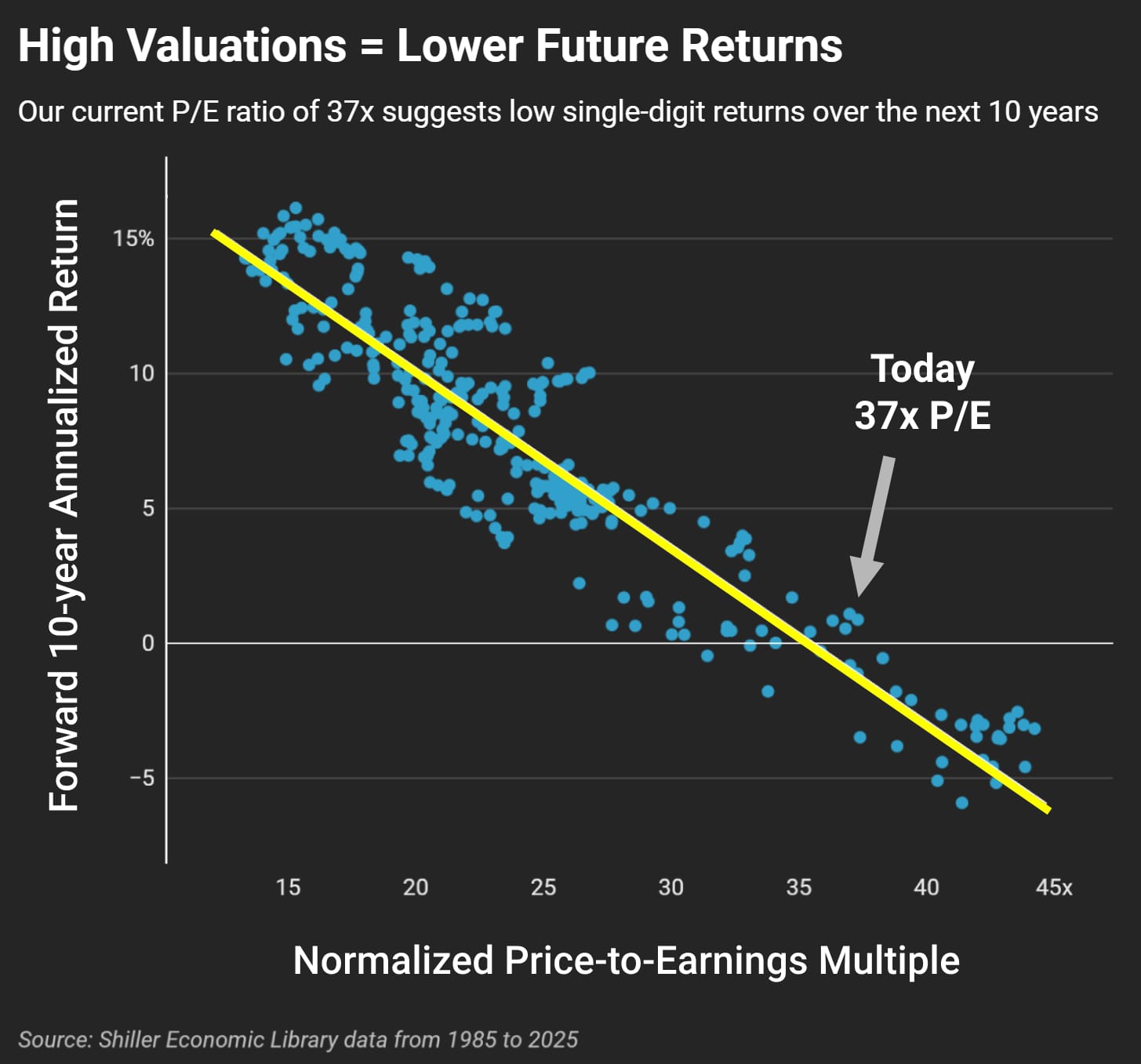

The chart below visualizes this relationship, plotting historical P/E ratios against the S&P 500’s forward 10-year annualized returns. As you can see, the higher the starting valuation, the lower the future returns.

Today’s P/E of 37x is far above the historical median of 25x. Based on historical trends, this suggests that investors could see low single-digit annualized returns from the S&P 500 over the next decade.

Why This Matters for Your Portfolio

It’s easy to get caught up in excitement of this year's rally, but assuming the past will repeat itself can be a dangerous mistake.

High starting valuations rarely result in strong long-term performance.

What can you do? Set realistic expectations, build a balanced stock portfolio, and perhaps diversify. Think long term.