Featured Posts

Every time the market rallies to new highs, people start asking the same question: Are we in a bubble? And every time, the answer is basically the same: maybe, but we won’t know until it pops. That’s how bubbles work. They never feel obvious in real-time. The 1999

Markets are trying to recover after last week’s selloff, but the gains are small. As of this morning, the S&P 500 and Russell 2000 are both up just 0.03%, the Dow is up 0.11%, and crude oil is climbing 0.2%. Meanwhile, the Nasdaq 100

The market’s winning streak just hit a roadblock. Trump’s latest tariff threats, floating a 25% tax on auto, semiconductor, and pharmaceutical imports are shaking stocks today. With growing inflation concerns, market's are guessing whether this could push back Fed rate cuts in 2025. Here’s what’

I used to think I could outsmart the market by buying at rock-bottom and selling at the peak. I’d try to pinpoint those perfect days when stocks were at their lowest, and then cash out before the next downturn. But over time I learned that chasing those 'magic&

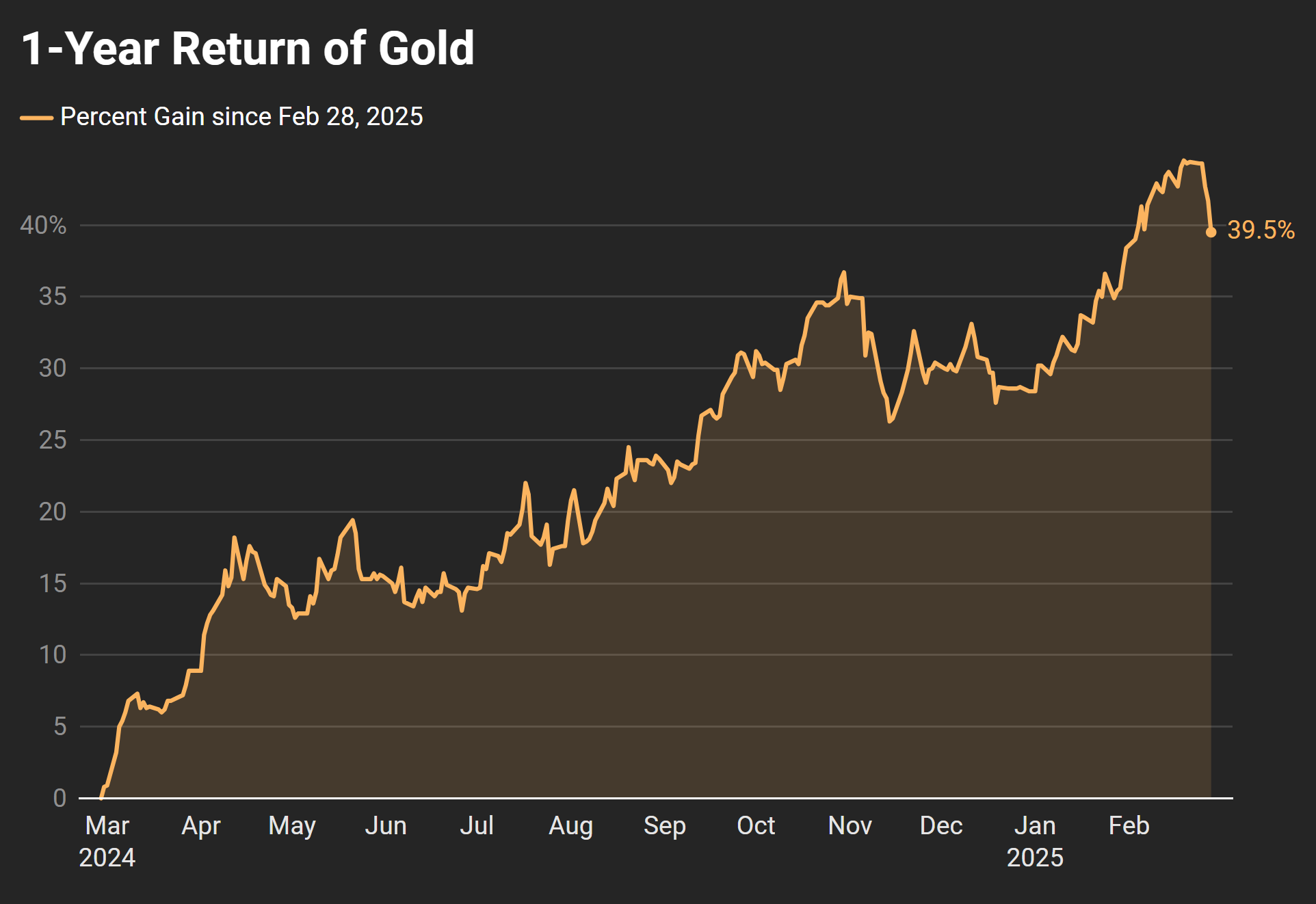

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades.

But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries the reputation of a “doomsday” asset—only useful to own during recessions.

Gold’s Breakout Is Already Here

The consensus is that gold only moves when there’s a crisis. A market crash, hyperinflation, or some major financial collapse. Those are the moments where gold is supposed to shine.

But what if that’s the wrong way to think about it?

Gold has already been in a bull market for years. Since 2018, prices have nearly doubled, outpacing most assets outside of the tech sector.

It has held up through aggressive Fed rate hikes, a tightening monetary cycle, and one of the strongest stock market rallies in history.

This isn’t just price action. There’s a shift happening. Historically, gold has been a staple to own when the financial system weakens. Today, U.S. government debt is at record highs, yet gold reserves have remained stagnant for decades.

Notice how our gold reserves have changed as a percentage of US government debt over the years, per Crescat Capital:

- In 1941—before World War II—gold reserves accounted for 40% of government debt.

- By 1981, during the era of stagflation, that figure had dropped to 17%.

- Today, gold reserves make up just 2% of government debt.

Our system keeps growing while the gold supply goes stagnant. If demand suddenly surges, there might not be enough gold to go around.

Gold isn’t waiting for a crisis, it’s prices are already on the move.

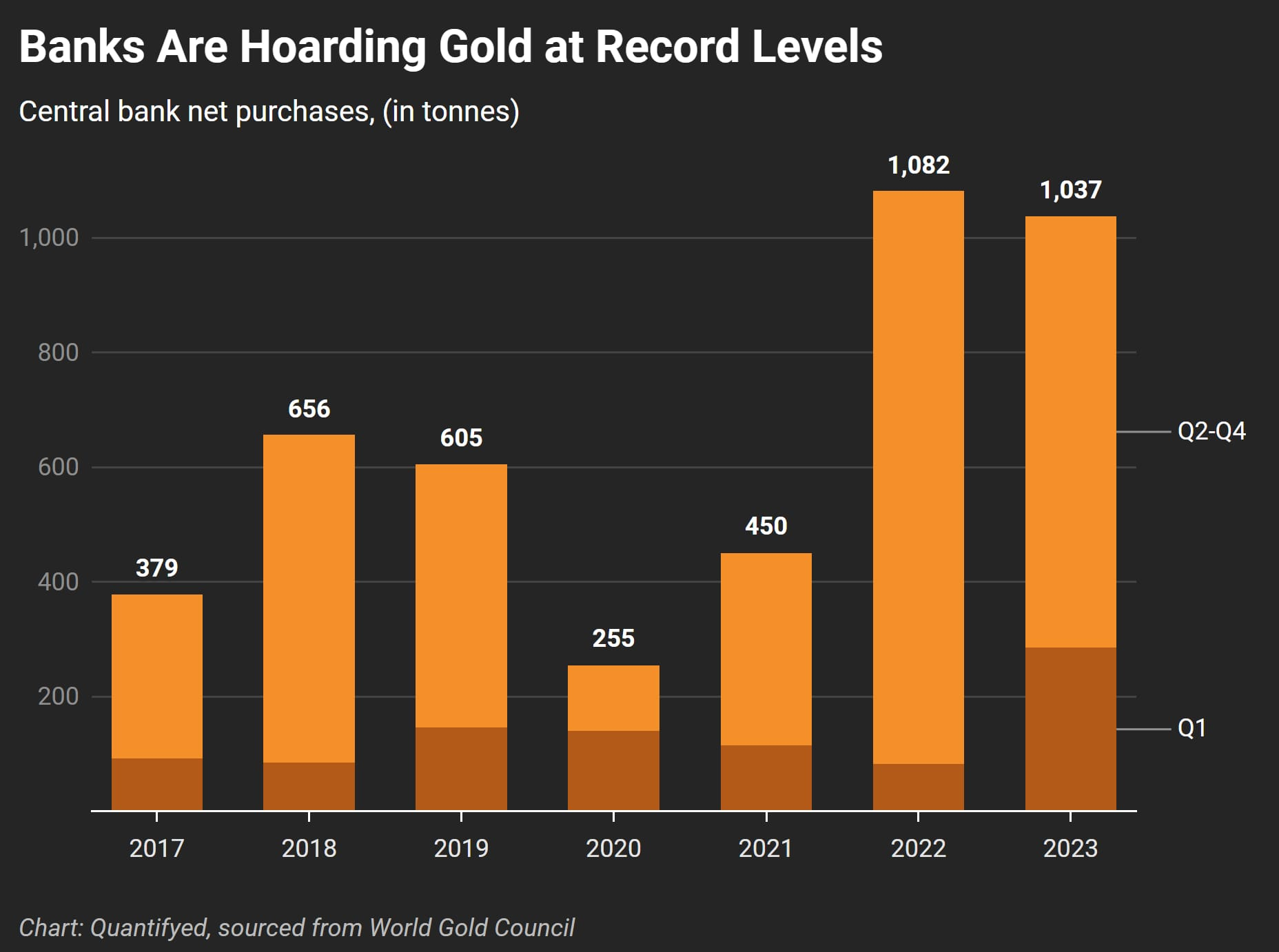

Central Banks Are Buying

The biggest institutions in the world are buying in big. Central banks—the ones responsible for managing entire economies—have nearly tripled their gold purchases since 2017, buying up more than 1,000 tonnes in 2023 alone.

This wasn’t always the case. The U.S. once held more gold than the rest of the world combined. It was the foundation of monetary stability. Over time, that changed.

Today, the U.S. holds only 20% of the world’s total gold reserves—down from 53% in 1957—and this is the lowest share in nearly a century.

That raises an important question: if gold were truly outdated, why are more players in the global economy hoarding it?

The answer might be simple: they know something most investors don’t.

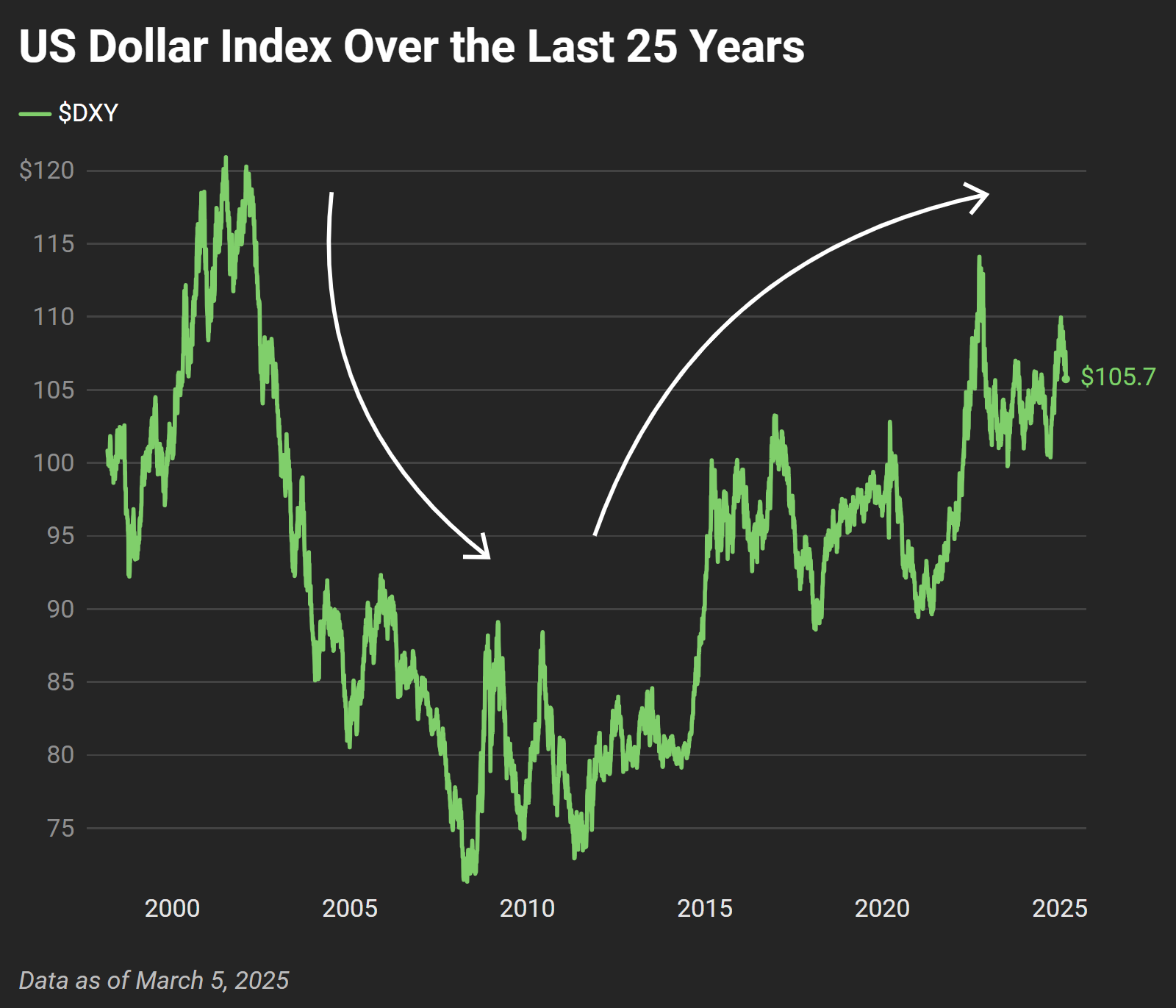

Gold & Dollar Can’t Rise Together

Gold and the U.S. dollar have always been connected. When the dollar is strong, gold tends to struggle. When the dollar weakens, gold moves higher.

Right now, the dollar is coming off one of its strongest periods in history. Years of low interest rates and global reliance on the U.S. financial system have made it the dominant asset in global trade. But cracks are forming.

The government’s debt burden is large. Fiscal deficits are wide. And more countries are shifting away from the dollar as the default global currency, slowly reallocating reserves into alternative assets, like gold.

This process doesn’t happen overnight, but history suggests that when confidence in a currency starts to erode, the reversal can be fast.

The last time the dollar faced this kind of pressure, in the early 2000s, gold entered a decade-long bull market.

Could it happen again? It’s too early to say. But if the dollar weakens or our economy takes a downturn, gold will be one of the first places investors look for safety.