Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Goldman Sachs changed its mind (again) on the likelihood of a U.S. recession. After initially raising the odds to 25% earlier this month, they’ve now lowered it back down to 20%. What's going on?

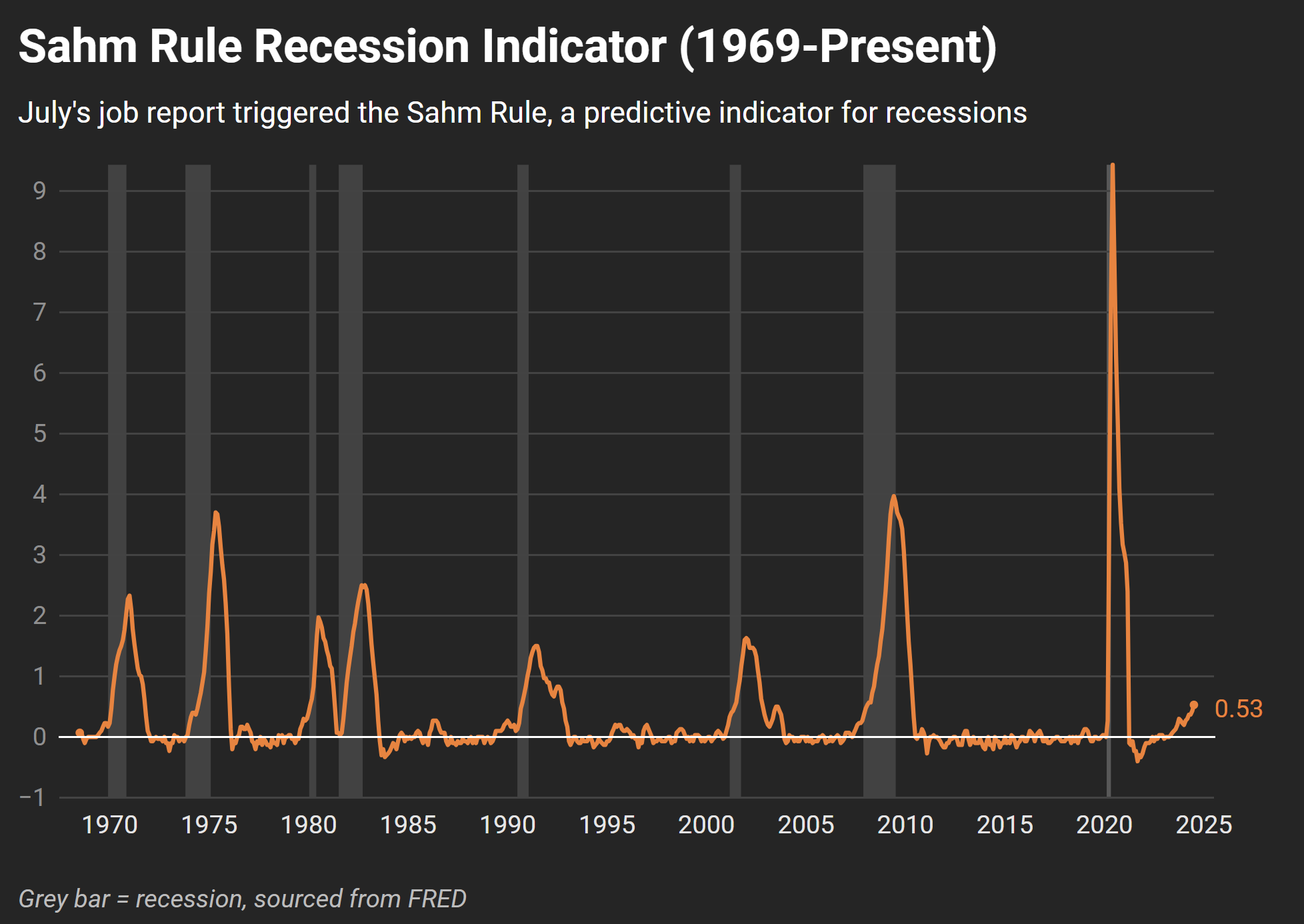

It all started with our July jobs report. Nonfarm payrolls only increased by 114,000 vs 185,000 expected. This weak number sparked a massive global selloff and led Goldman to hike their recession odds from 15% to 25%.

The 'Sahm Rule'—a recession indicator triggered when the three-month average of the U.S. unemployment rate rises by 0.5%—was a key factor behind this shift in sentiment.

Immediately after, some other new data brought relief. Retail sales for July were up by 1% (beating expectations) and weekly jobless claims were lower than expected.

This strength in the data made Goldman to dial back our recession odds to 20%.

What should we expect next? If the next jobs report on September 6th shows stronger numbers, Goldman might lower the recession odds even further, possibly back to 15%. Right now, they’re betting on a modest 25 basis point rate cut from the Federal Reserve in September, rather than the more aggressive 50bp cut some expected.

The markets seem to agree, with the chances of a larger cut dwindling to just 28.5%, according to the CME FedWatch tool.

Goldman’s shifting predictions goes to show how uncertain we are in today’s environment. Data can change quickly, and so can the outlook.