Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

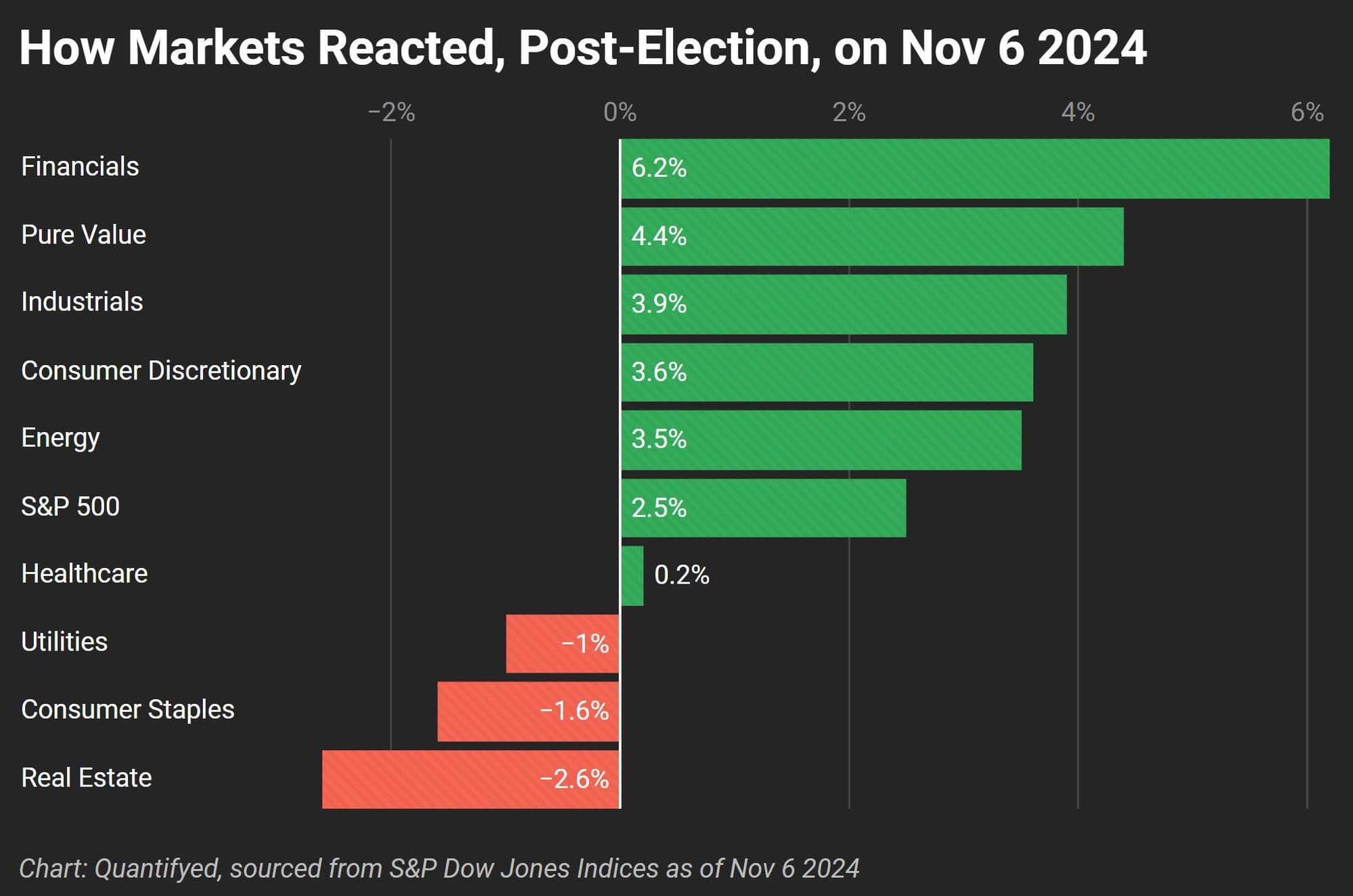

Trump’s 2024 win didn’t just make headlines—it moved markets in a big way. Some sectors surged, big time.

Record Day for the S&P 500

The S&P 500 rose 2.5% on November 6th, marking its biggest post-election day gain ever. in history. That's pretty wild. It's clear that investors expect Trump’s policies to drive growth through deregulation and economic stimulus. It’s a vote of confidence, but let’s not forget that excitement can go out of hand.

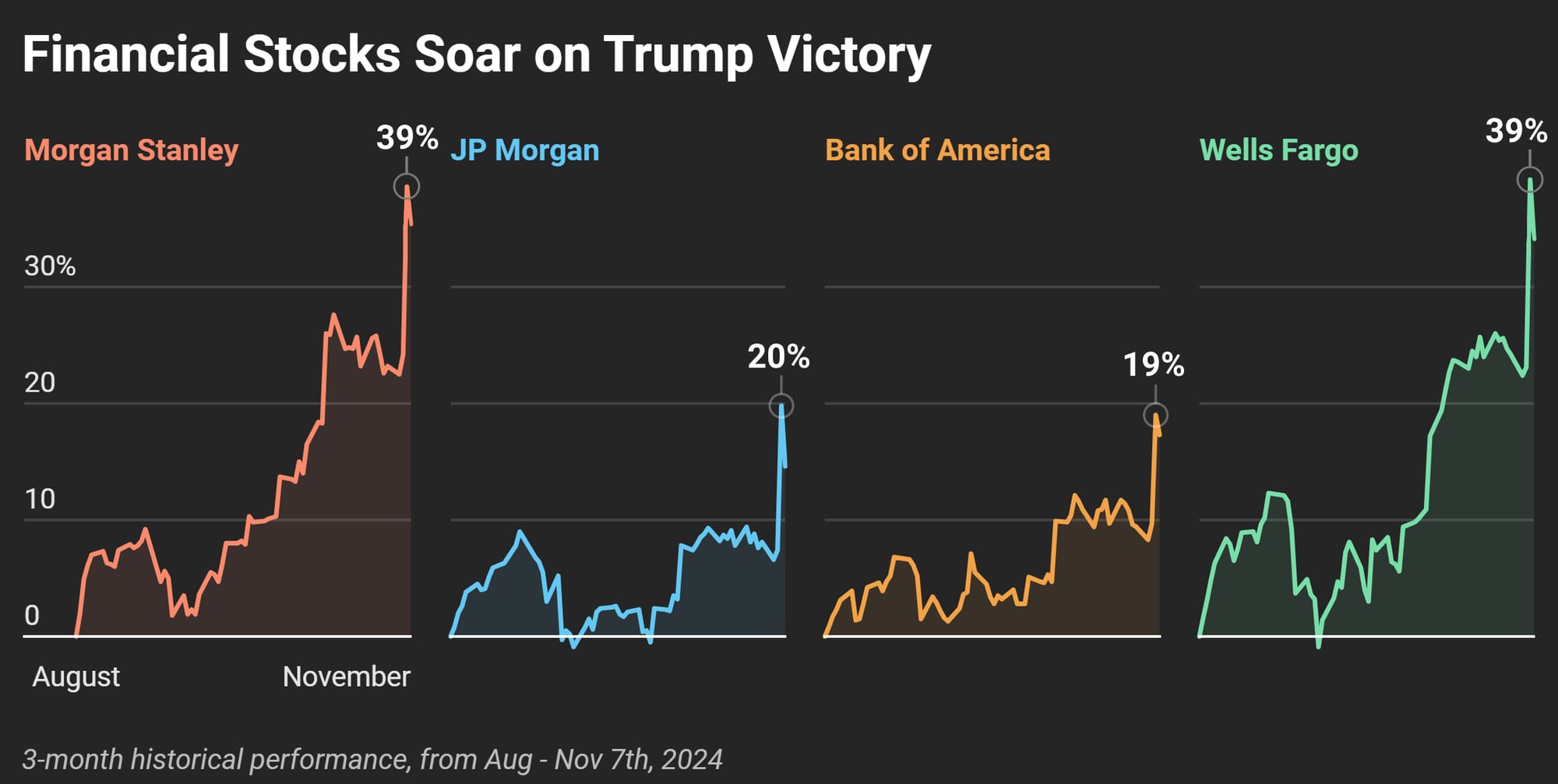

Financials Led the Way

The financial sector stole the show. Stocks like Morgan Stanley and Wells Fargo are up 39% in the last 3 months, with JP Morgan and Bank of America not far behind. Investors are confident that Trump’s return means lighter regulations and a friendlier conditions for banks.

Energy's Mixed Story

Although energy stocks had a 3.5% gain on November 6th (after the election), new information tells us a different story. Oil prices are falling on concerns about oversupply, while renewable energy stocks fell as investors braced for possible policy shifts away from green energy initiatives during the biden economy.

Real Estate and Defensive Sectors Slip

Real estate also had a rough day, dropping 2.6%. Consumer staples and utilities weren’t far behind, both seeing losses. The likely reason? Expectations for higher interest rates and a shift toward riskier investments as investors hope for growth-friendly policies.

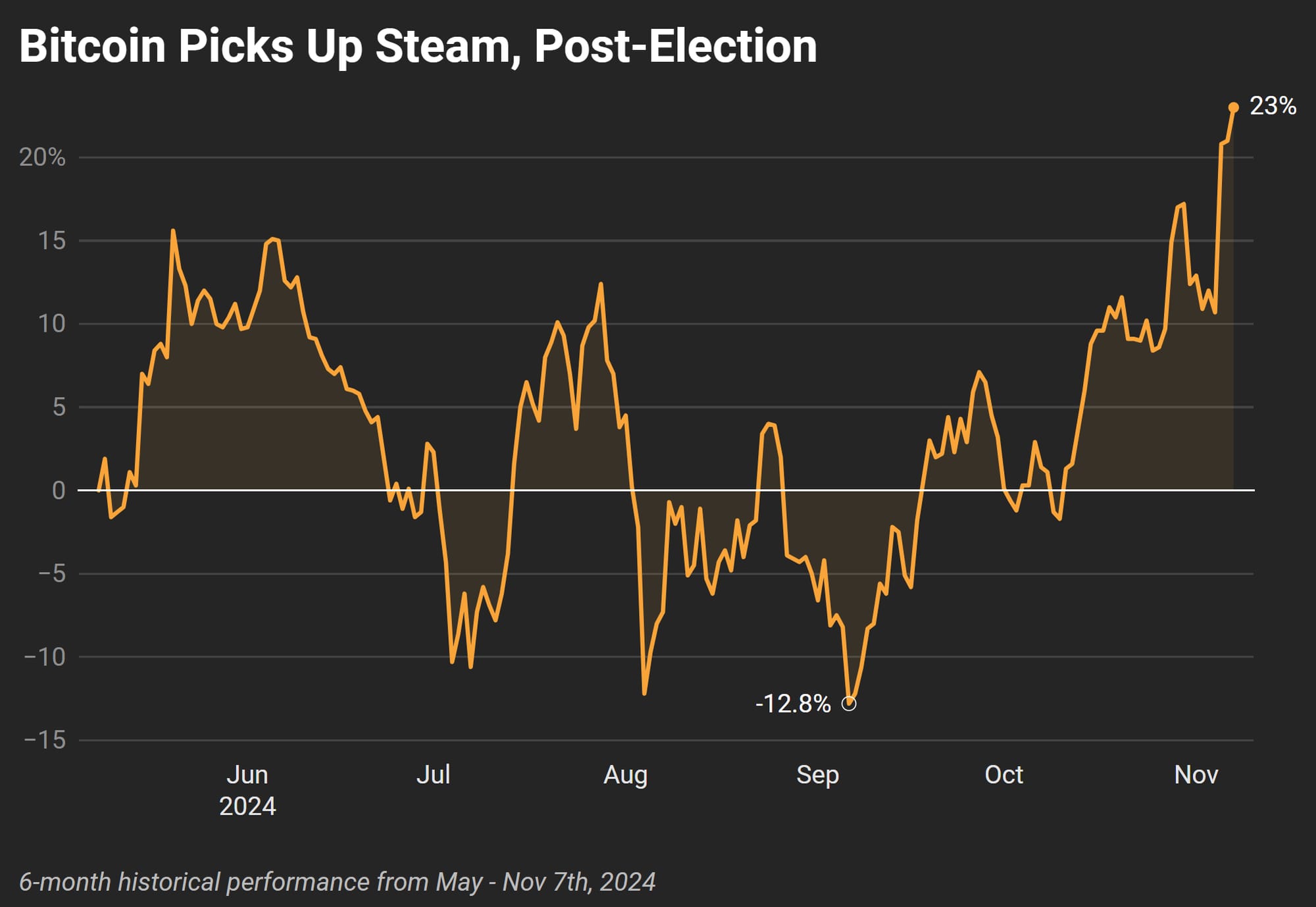

Bitcoin’s Big Leap

Bitcoin also took advantage of the election buzz, and it's up 23% in the last month. After being down 12.8% in September, there's more confidence in crypto’s future.

With Trump’s focus on less regulation, crypto investors see an opportunity.

Key Takeaways:

- Financials Soar: Morgan Stanley and Wells Fargo led with 39% gains, showing investor optimism.

- S&P 500 Hits a Record: A 2.5% post-election boost signals big expectations.

- Sector Divergence: While financials and Bitcoin surged, real estate and defensive stocks dropped.

The market is clearly recalibrating with Trump back in office. It's important to know stocks are at all-time highs. How long will the momentum last? I'm not sure.