Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

The Fed is about to start cutting rates, but what does that actually mean for different companies? Will some do better while others might struggle? Let’s break down what history and current trends might tell us.

Looking at Past Fed Rate Cycles

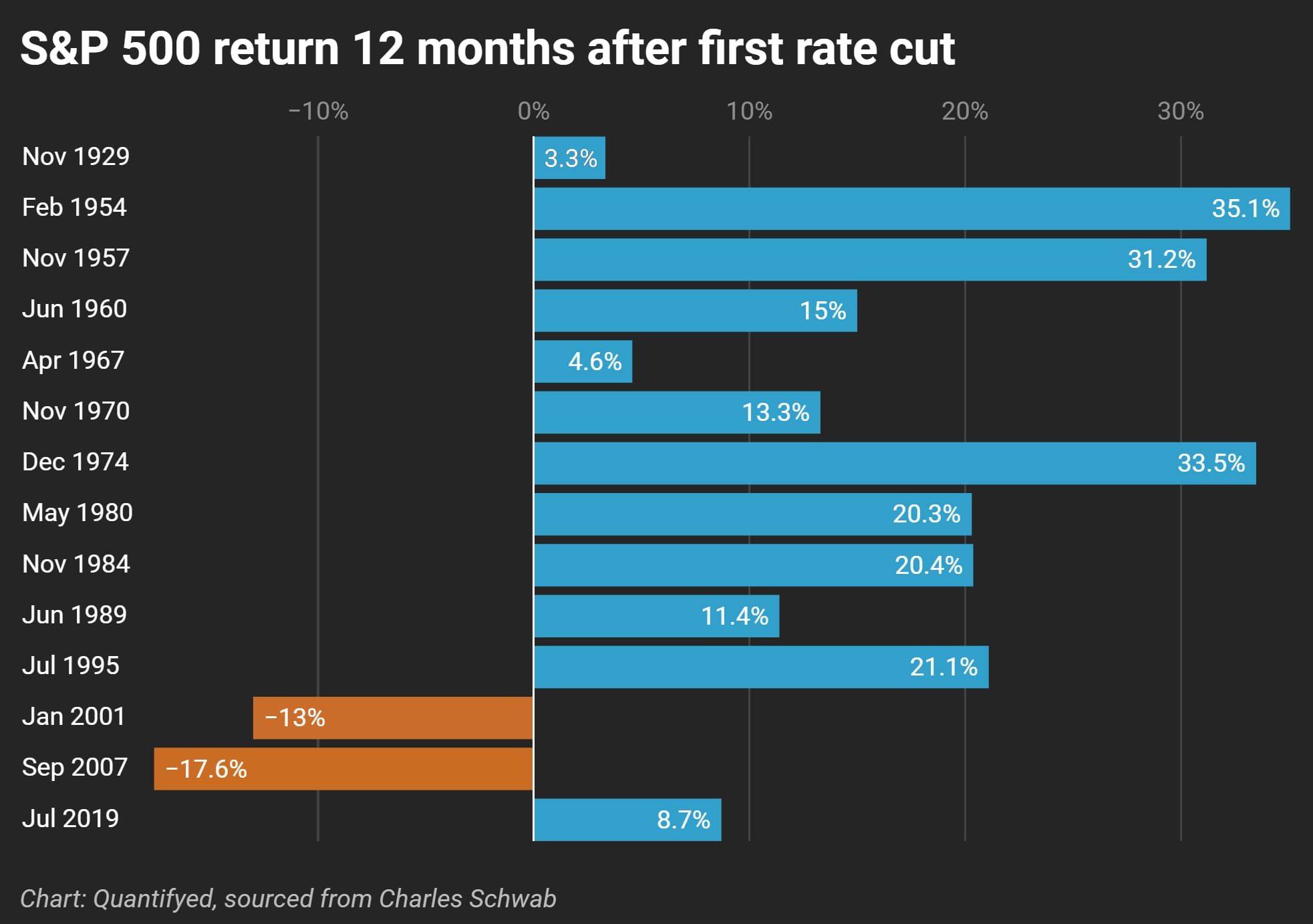

The Fed has gone through 14 rate cut cycles since 1929. While we can’t predict the future based on the past, there’s still some useful information here. In most of these cycles, the S&P 500 ended up with positive returns 12 months after the first rate cut.

For example, after rate cuts in 1954, 1957, and 1974, the market saw solid gains over 30%. But not every rate cut is the same. The downturns in 2001 and 2007 also prove that what’s happening in the economy also matters.

As I say, history doesn’t repeat itself, but it often rhymes. And as Jerome Powell joked in his recent speech at Jackson Hole, “The time has come" for rate cuts.

The Current Cycle—Fast Up, Slow Down

There’s a saying that the Fed takes the stairs up and the elevator down when it comes to interest rates. Usually, they raise rates slowly and then cut them quickly when something goes wrong. But this time, things are different.

From March 2022 to July 2023, the Fed raised rates really fast to deal with stubborn inflation—like taking the elevator up. Now, as they start cutting rates, it looks like they’ll be taking the stairs down, making smaller cuts over time to keep inflation in check while trying not to hurt the economy too much.

Who Wins and Who Loses When Rates Drop?

So, which companies might do well, and which might not, as the Fed starts cutting rates?

Cyclical sectors (like consumer goods and industrials): These types of companies usually do well when rates drop and the economy picks up speed.

Defensive sectors (like healthcare and utilities): These companies tend to do better when rates are going up because they provide stability. They might not do as well when the economy starts to grow faster.

Tech companies: Normally, tech is considered a cyclical sector, but lately, big tech companies have acted more like defensive ones. Their large cash reserves have protected them from the impact of higher borrowing costs.

What you should watch for

While the Fed’s rate cuts are important, they’re not the only thing that matters. A strong economy is good for the market, and the Fed’s focus on fighting inflation suggests they think our economy's in decent shape. But high investor confidence can be tricky. It’s great when everyone’s optimistic, but if the economy starts to wobble, that optimism can quickly flop into panic.

Valuations are also something to keep an eye on. Some are pretty high, but if earnings continue to grow, those high valuations might make sense. In these uncertain times, make sure you stay flexible and watch how things unfold.