Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

The markets are going through some serious drama right now, and everyone’s asking the same question: What’s behind this mess?

Let’s start with the big one—recession fears. Last Friday, the US jobs report came out, and it was a lot weaker than anyone expected. We’re talking about a noticeable slowdown in hiring and a jump in unemployment. That’s got investors worried, thinking the US economy might be heading into some rough waters.

The concern is that the Federal Reserve might’ve kept interest rates too high for too long, and now the economy’s feeling the pinch. And when the biggest economy in the world starts showing signs of trouble, it’s no surprise that markets start to wobble.

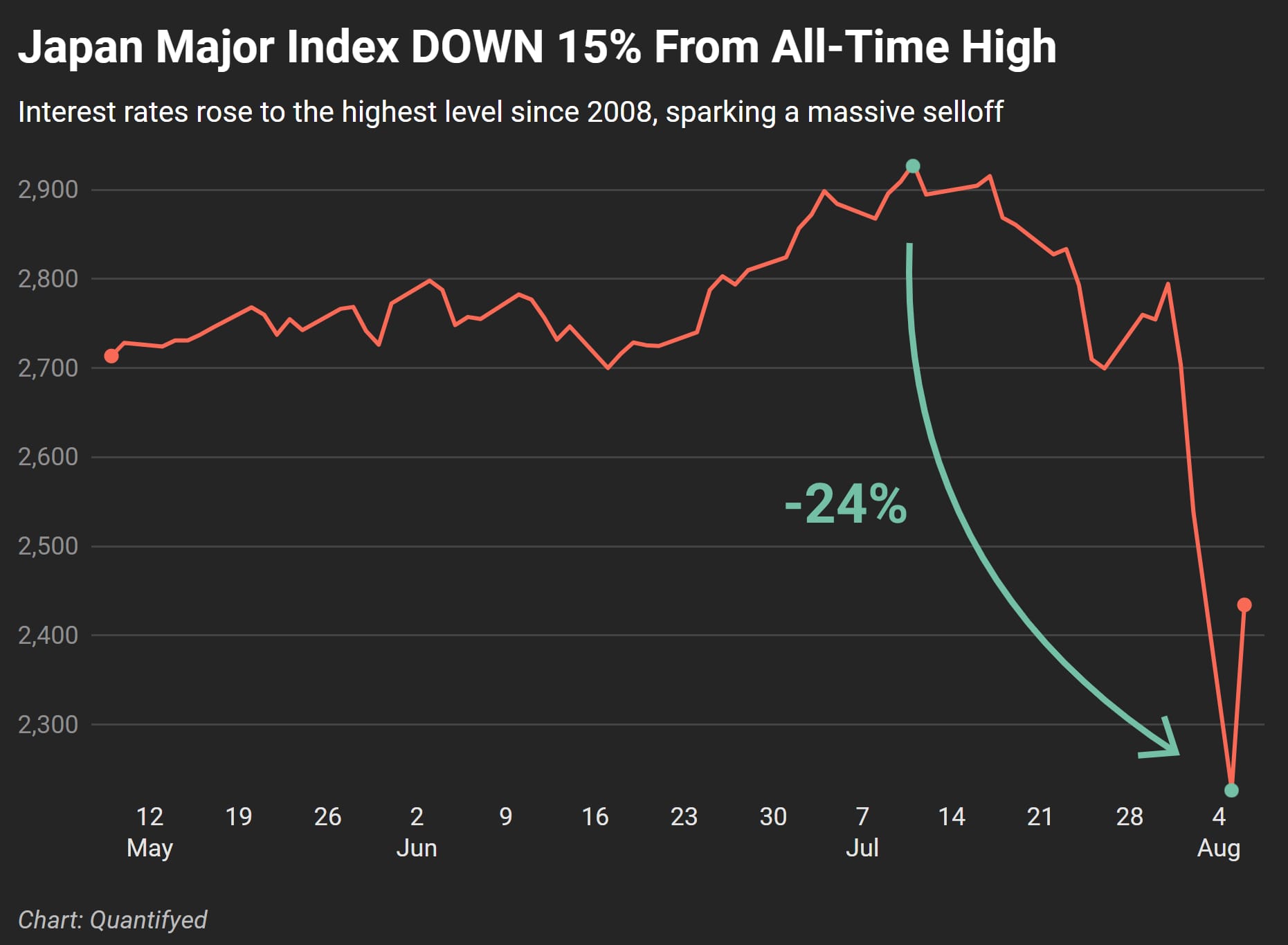

Japan’s market took a big hit, too. Their index dropped more than 12%—the worst since the 1987 “Black Monday” crash. What’s causing this? Well, the Bank of Japan recently hiked its main interest rate to 0.25%, which is the highest it’s been since 2008. This move made the yen skyrocket, and that’s bad news for Japan’s export-heavy economy.

With the yen surging, a lot of investors had to unwind their bets on borrowing in Japan to invest elsewhere—a move known as the carry trade. This unwind only added to the chaos, making Japan’s market selloff even worse.

This selloff isn’t just Japan’s problem—it’s spilling over into the US and European markets too. The S&P 500, which had been riding high a few weeks ago, has now dropped over 8% since July. Investors are starting to question the soft landing they were hoping for. Instead, it’s looking like things might get much worse.

Everyone’s keeping a close eye on the Federal Reserve. They’ve held interest rates at a 23-year high, but with the recent weak jobs report, there’s growing concern that they might’ve missed the window to start cutting rates.

Markets are now pricing in multiple rate cuts before the year is out, and some traders are even betting on an emergency cut before the Fed’s next meeting in September.