Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

The Federal Reserve has slashed interest rates again, but this time, it’s not just about safety—it’s about finding new winners in the market.

In this post, I'll look at which industries have typically thrived in rate cut cycles, using historical data, and show what it means for you.

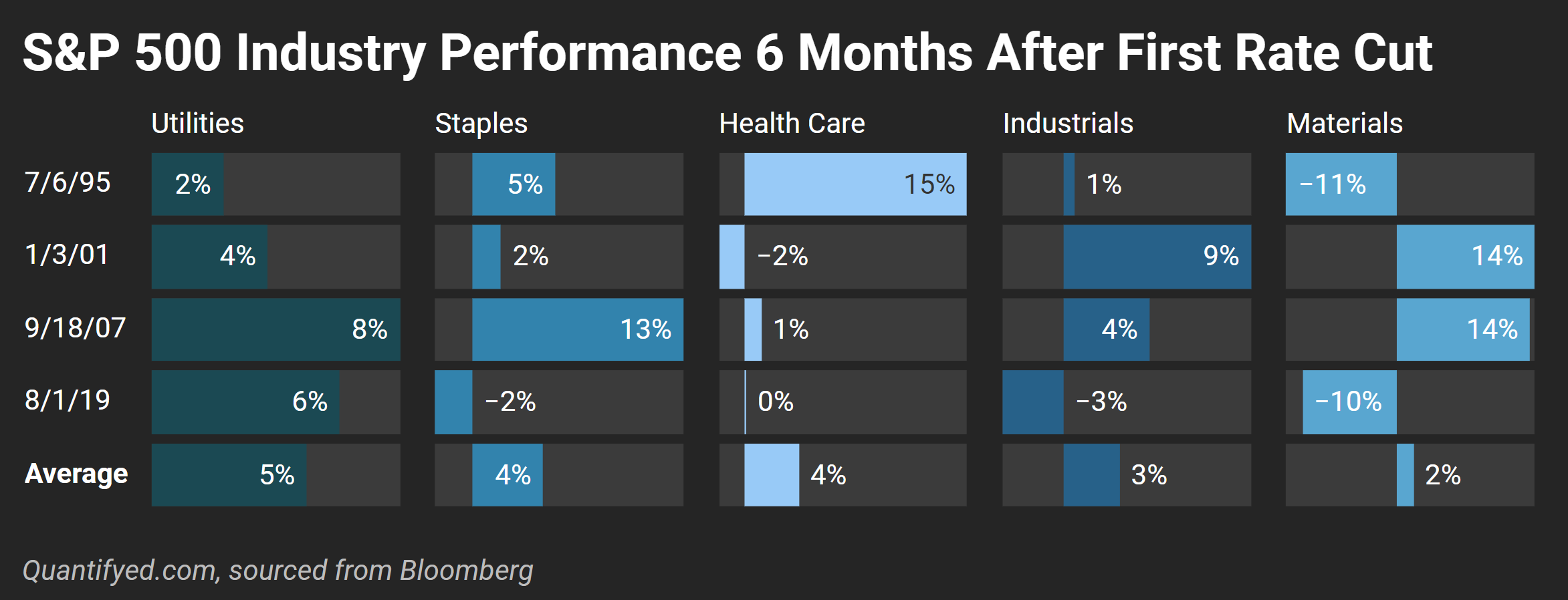

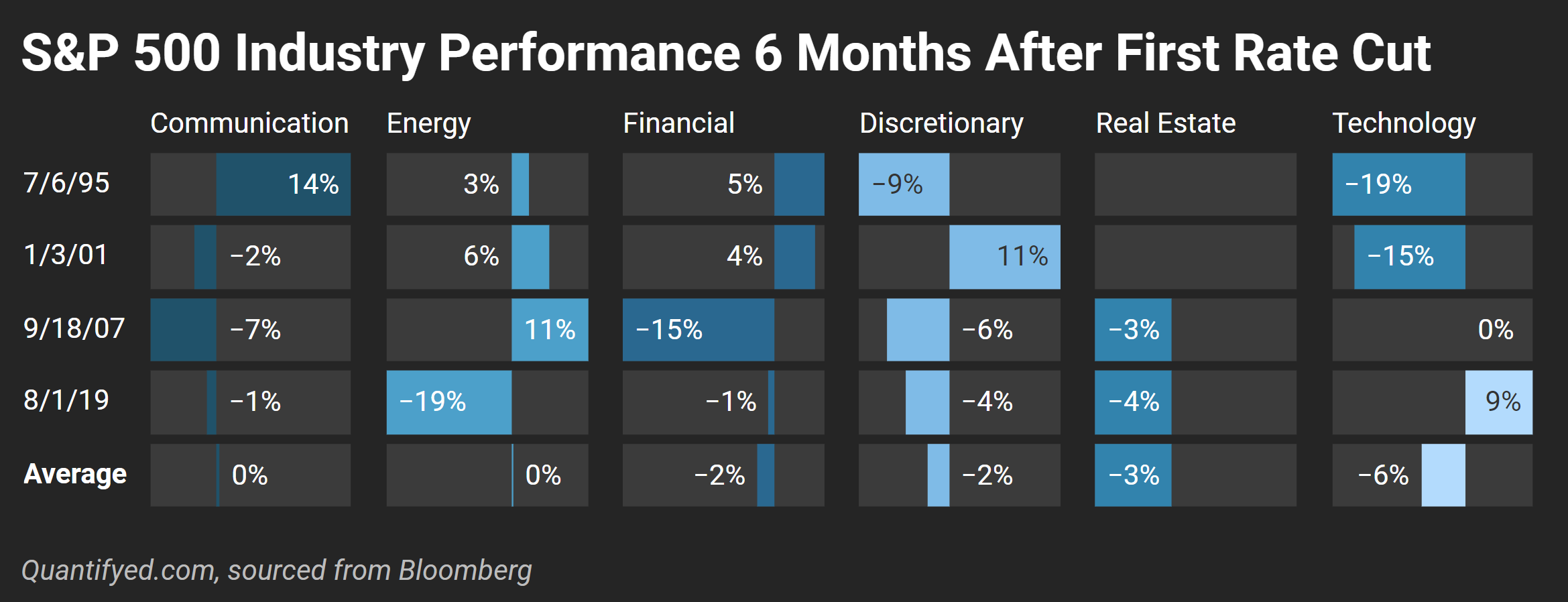

Historical Sector Performance After Rate Cuts

Historically, when the Fed cuts rates, certain sectors have consistently outperformed while others lag behind.

In past rate cut cycles, defensive sectors like utilities and consumer staples have typically been the winners. Utilities, for example, saw an average gain of 5.2% in the six months following a rate cut. Technology, on the other hand, often struggled, declining by 6.2%

What's different? Financials and industrials are looking much more attractive this time around. The economy is still expanding, corporate earnings are growing, and with borrowing costs falling, the sectors that are more sensitive to interest rates—like financials and industrials—could lead the way.

Financials and Industrials Lead the Way

Unlike past cycles, when financials tended to struggle during rate cuts, this environment could shape up to be different.

Financials: Banks such as JPMorgan Chase and Bank of America are expected to see a boost from lower borrowing costs. When rates drop, banks borrow more cheaply, improving their net interest margins. While they’re paying less on deposits, they can still charge favorable rates on loans, leading to higher profits.

Industrials: For capital-intensive companies in infrastructure, construction, and manufacturing, lower rates mean cheaper financing and the ability to invest more in growth. This is especially true for companies that rely on debt to fund growth (also called zombie companies)

Real Estate as a Key Opportunity

The real estate sector is another big winner in any rate cut cycle. Both residential and commercial real estate benefit from falling borrowing costs, which spurs more activity in refinancing and purchases.

Residential Real Estate: With mortgage rates dropping, potential homebuyers who were previously priced out of the market are now re-entering. Lower rates mean cheaper monthly payments, which increases the affordability of homes. However, as demand rises, prices are likely to follow suit, so this window of opportunity might not stay open for long.

Commercial and Industrial Real Estate: On the commercial side, companies are taking advantage of lower rates to refinance existing debt, freeing up cash flow for expansion or higher dividends. REITs are especially well-positioned to capitalize on lower borrowing costs.

In previous rate cut cycles, a decline in mortgage rates has historically led to a 10% increase in refinancing activity, and REITs have posted average gains of 8%. This cycle is no different, as we see both residential and commercial real estate sectors gaining traction.

Time to Rethink Defensive & Tech Plays?

While defensive sectors like utilities and consumer staples have generally been safe bets during rate cuts, this time around, their potential for growth could be limited.

Utilities, in particular, have already seen a significant run-up in 2024, with gains of 26% year-to-date. But with valuations becoming stretched, further upside could be limited. Same logic applies to tech stocks, since technology & communication have made up over 24% of earnings in the S&P 500 this year.