Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

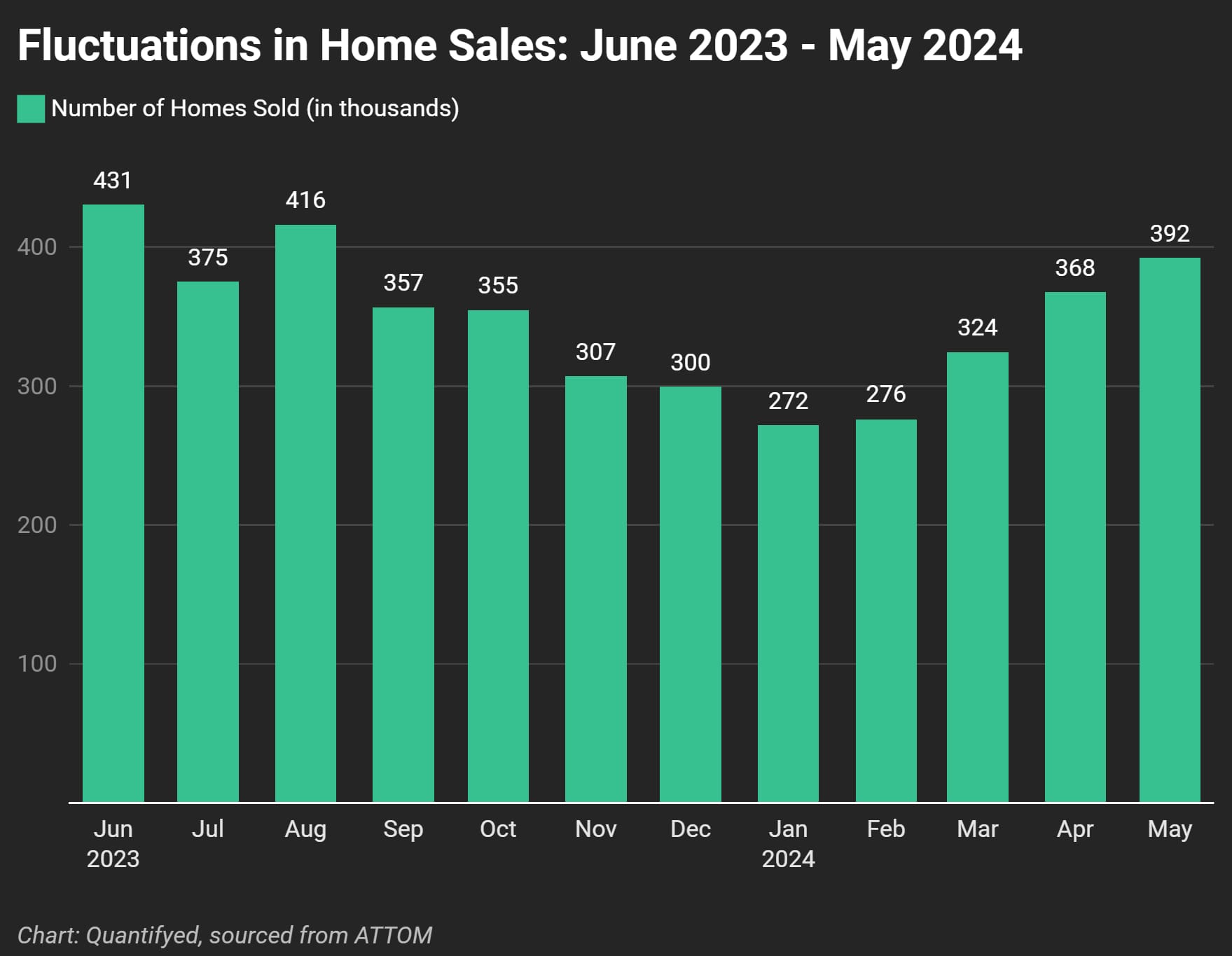

June's home sales took a big hit, dropping 5.4%. What does this mean for the housing market? As a college student, the only home I’m buying is in Monopoly, but these trends are worth watching.

Data released from the National Association of Realtors (NAR) found that home sales fell by 5.4% in June compared to May. This is the slowest sales pace since December. Inventory levels rose to 1.32 million units, a 23.4% increase from last year, representing a 4.1-month supply.

Despite the increase in supply, the median price of an existing home sold in June jumped to $426,900, an all-time high and a 4.1% increase from the previous year 👀

We're seeing (in real-time) a shift towards a buyer’s market. Homes are now sitting on the market for an average of 22 days, up from 18 days a year ago. Sellers are getting fewer offers, and more buyers are sitting out for rates to decrease.

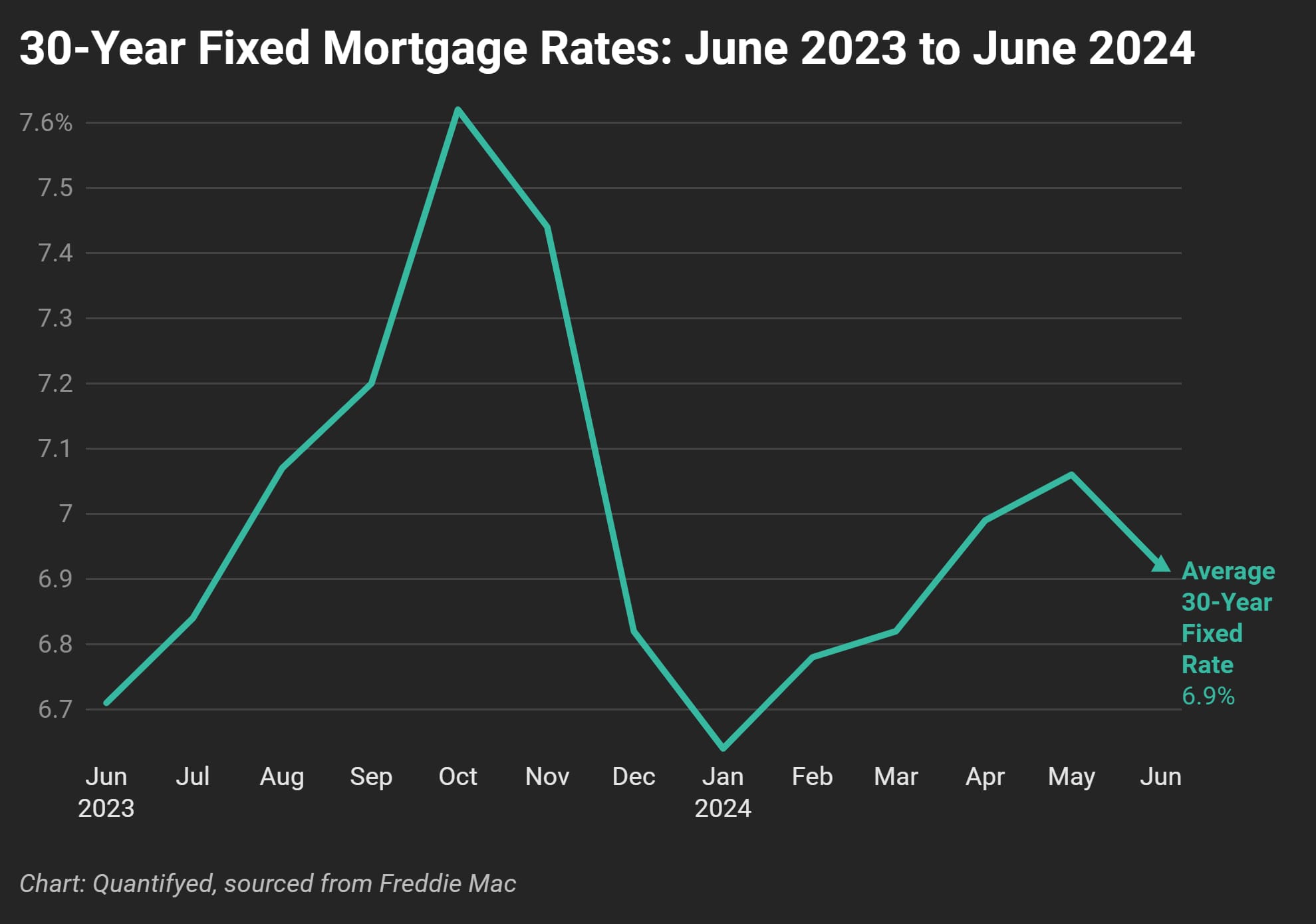

Also, recent changes in our 30-year fixed mortgage rates have had a huge affect on home sales. Mortgage rates had substantial fluctuations over the past year, peaking in October 2023 before declining to 7.1%. Despite our short recovery, rates are staying high, impacting home affordability and deterring potential buyers.

While the overall market is cooling, the median home price continues to rise, driven by stronger sales in the higher-end market. Sales of homes priced over $1 million saw gains, whereas the $250,000 and lower range experienced the most significant drop in sales. Interestingly, there has been a 50% surge in listings for homes priced between $200,000 to $350,000, reflecting a growing inventory in the lower-priced segment.

The mix of rising inventory and falling sales is reshaping the housing market. How do you think these trends could affect homebuyers and sellers?