Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Thinking about jumping into the housing market? You’re not alone—especially with the recent shifts making it more enticing for buyers. But what’s really happening behind the scenes, and how should you play your cards? Let’s break it down.

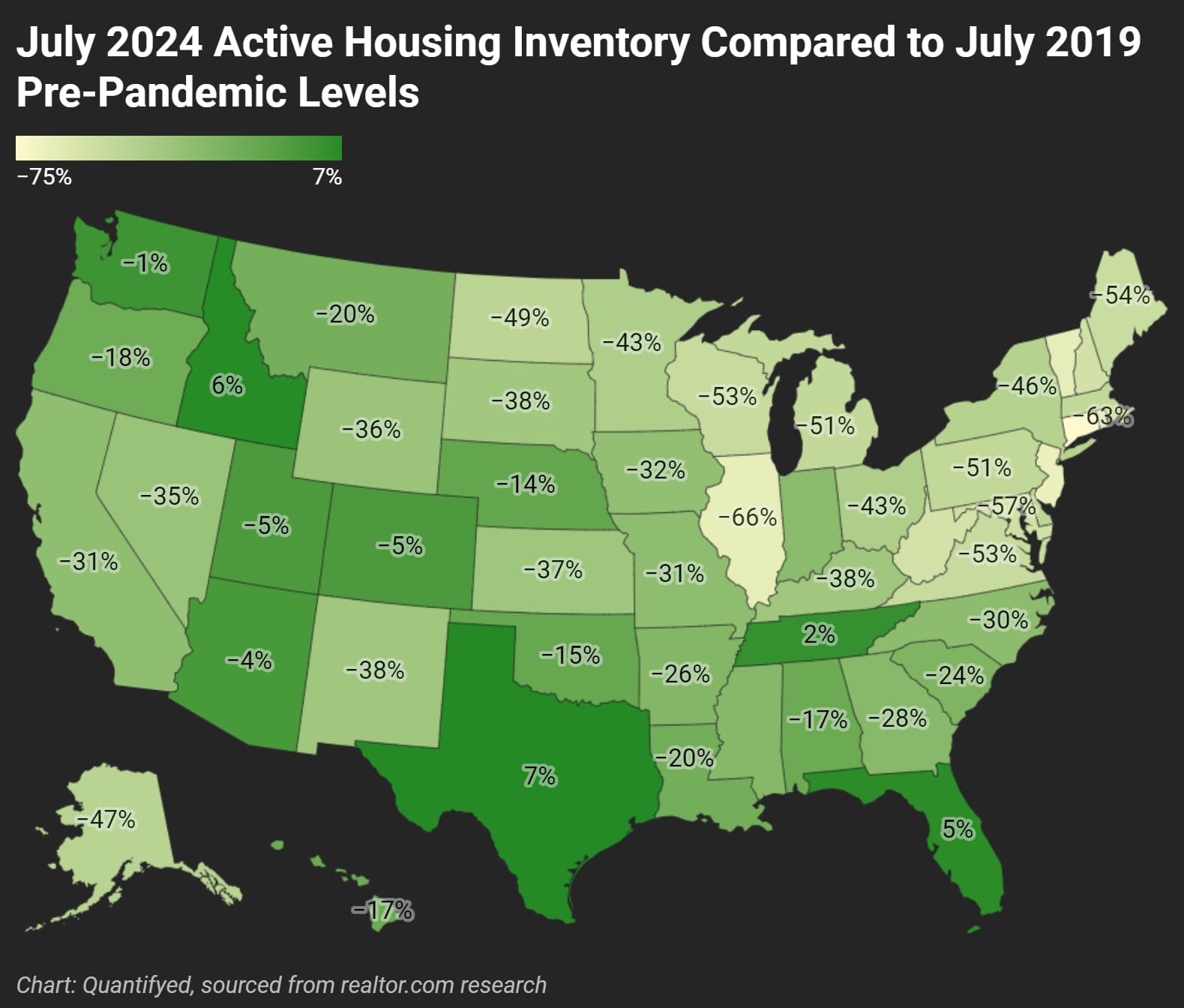

First, for-sale home inventories are finally creeping back to pre-pandemic levels in some states like Florida, Texas, and Tennessee. This is big news because, during the pandemic, the housing market was hotter than a summer sidewalk, with inventory levels plummeting and prices skyrocketing. But now, with inventory levels rising, we’re seeing a shift that could spell an opportunity for buyers.

Nationally, active listings have jumped 36.6% from July 2023 to July 2024. Even though we’re still 28.7% below July 2019 levels, this increase is starting to cool off the intense price growth we’ve seen in recent years. More homes on the market means less competition and, potentially, more negotiating power for buyers.

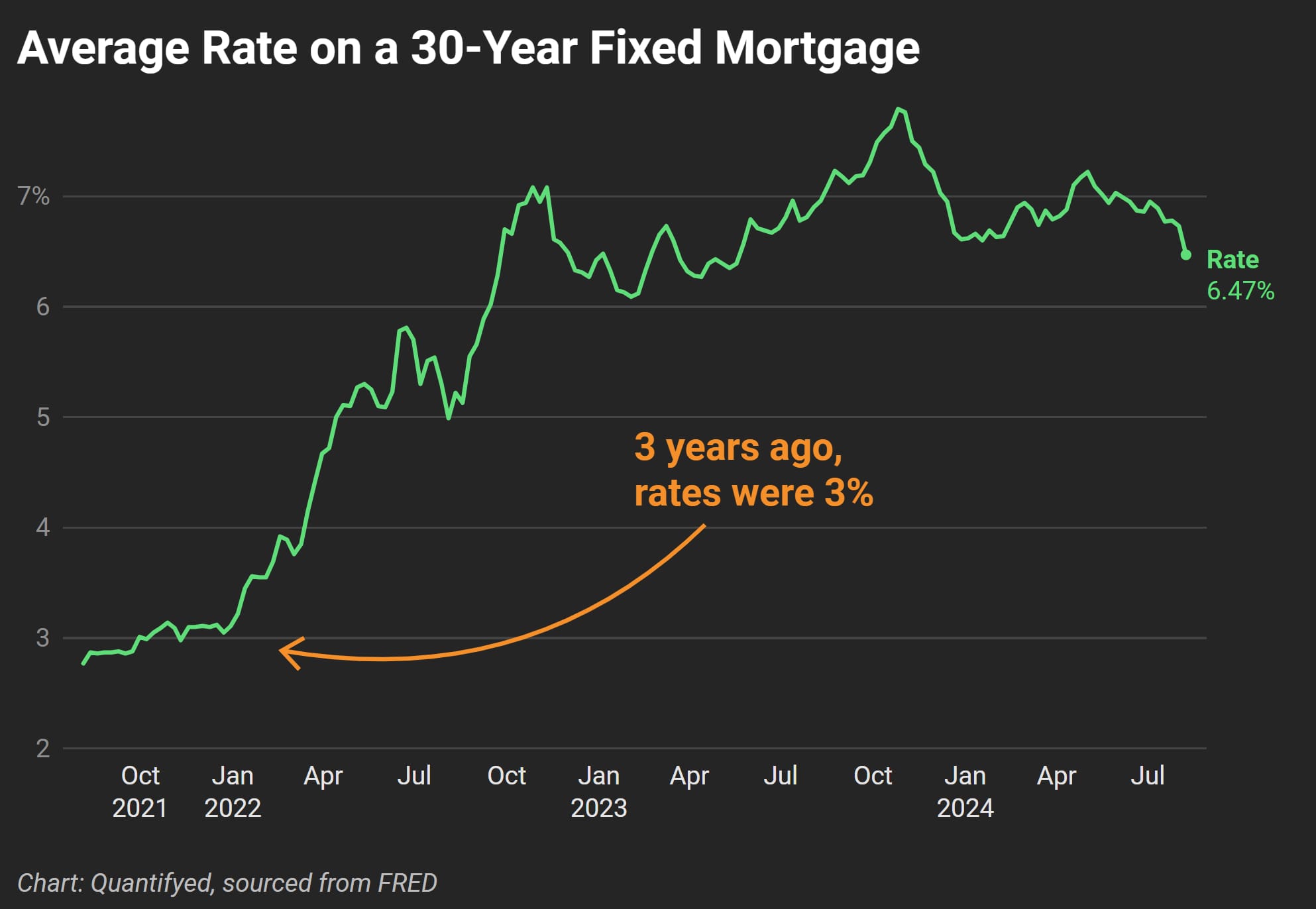

And then there’s the mortgage rates. The average 30-year fixed mortgage rate recently dropped to 6.4%, its lowest level since April 2023.

This drop actually sparked a 16% surge in refinancing applications last week, making refinancing applications 59% higher than this time last year.

But, let’s not get ahead of ourselves—many homeowners are still sitting on mortgage rates far below 6.4%, thanks to the ultra-low rates during the pandemic.

As for homebuyers, the cautious approach seems to be the name of the game. Even with more homes on the market and lower rates, so many are still holding out, hoping for even better conditions.

The big question is: are we on the cusp of a buyer’s market, or will rates and inventory levels continue to fluctuate? If rates drop even further, we could see a rush of buyers jumping into the market, possibly boosting prices.

Where does that leave us? Inventories are stabilizing, and rates are falling— good signs for buyers and sellers hoping to enter the market.