Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

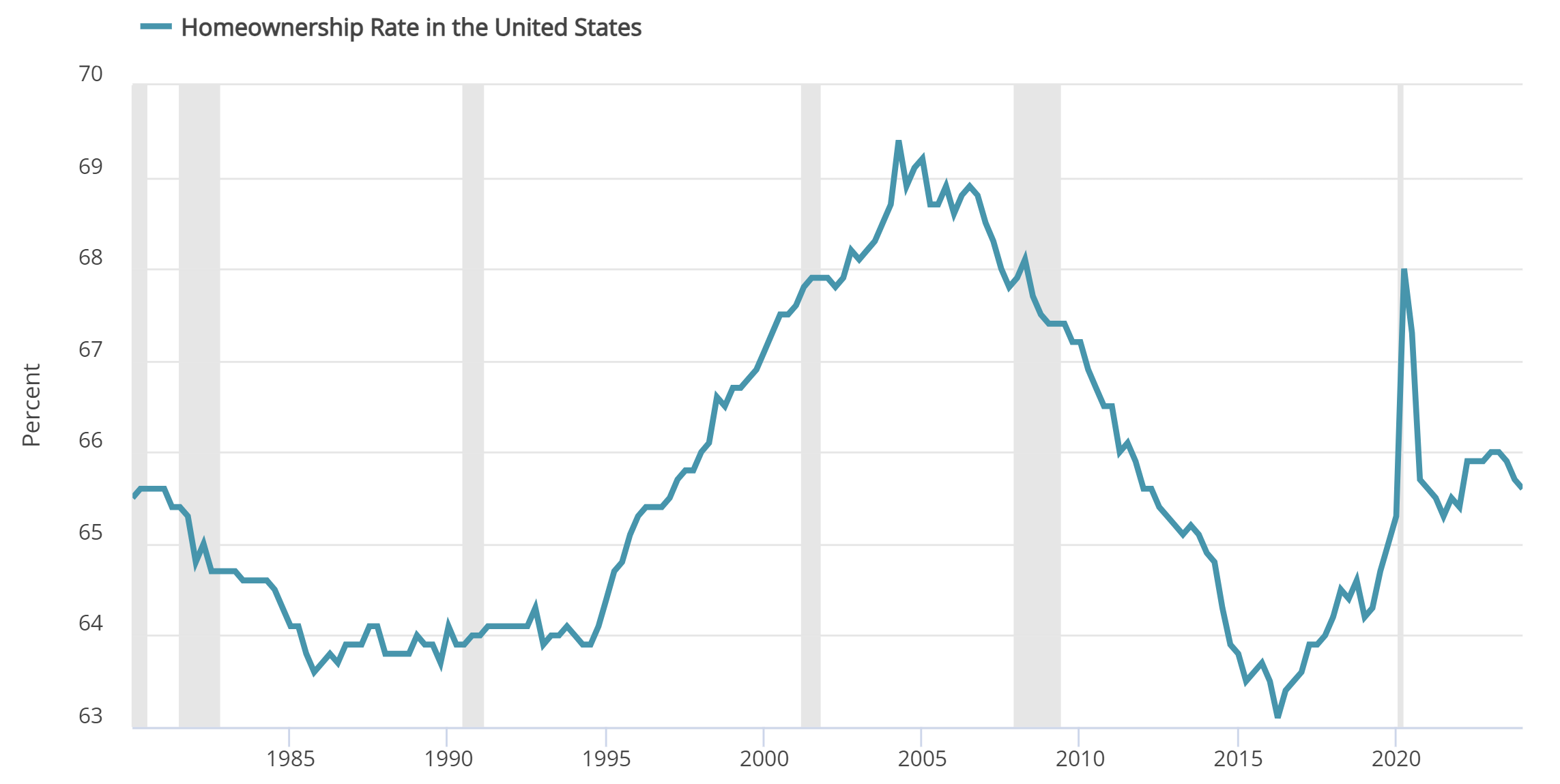

Why are homes so expensive nowadays? It ties back to the 2008 recession, and we're dealing with a lasting impact on homebuilding, material costs, and labor shortages.

Remember 2008? Can't say I remember—I was just 4 years old at the time, and my biggest concern was snack time. Anyhow, here's a quick debrief on it:

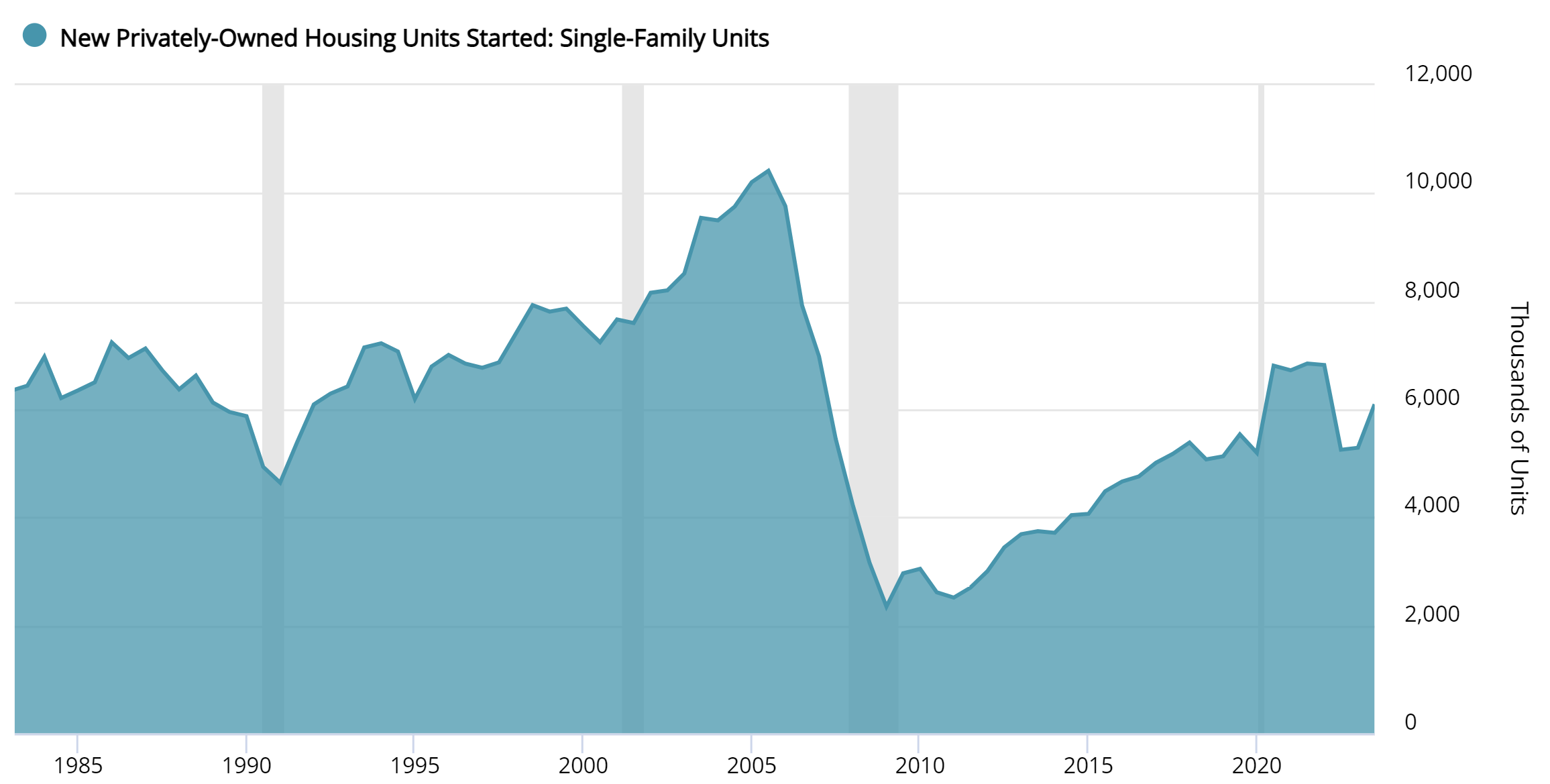

- Market Crash: The market tanked, leading to a massive drop in home starts. Single-family housing starts between 2010 and 2019? Just 7.8 million compared to 12.3 million in the 2000s. That’s like sharing half of your pizza with the Dominos delivery driver – just not enough to go around.

- Labor Shortages: Construction lost 1.5 million jobs between 2005 and 2010. This year, we're still short 500k workers. No wonder builds are taking forever.

Not only that, more hits kept coming long after the initial crash:

- Increased Material Costs: Lumber prices have been on a rollercoaster. At their peak in 2018, prices shot up 63%, adding thousands to home prices. Recently, they've been falling, due to existing affordability issues with interest rates and construction worker wages

- Regulatory Burdens: Builders got slammed with more regulations. Nearly a quarter of a new home’s cost is due to these rules. That’s like adding extra fees for breathing

- Limited Access to Land: Good luck finding land to build on. Almost 60% of builders said land supplies were low or very low in 2019. Today, the Wells Fargo Builder Confidence Index is at lows similar to March 2020.

All these problems mean one thing: homes are expensive. Affordability has tanked. In 2012, about 79% of homes were affordable for the typical family. In 2023, that dropped to 16%.

So, what can we do about it? Here‘s a couple of ideas:

- Policy Improvements: We need to cut the red tape and lower costs for builders. Helping builders will get more homes on the market.

- Innovations in Construction Methods: Think modular or pre-fabricated homes. It sounds gross, but it could work for the time being. Canada has been doing a similar strategy.

More factors affecting affordability include tight lending conditions and low resale inventory.