Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

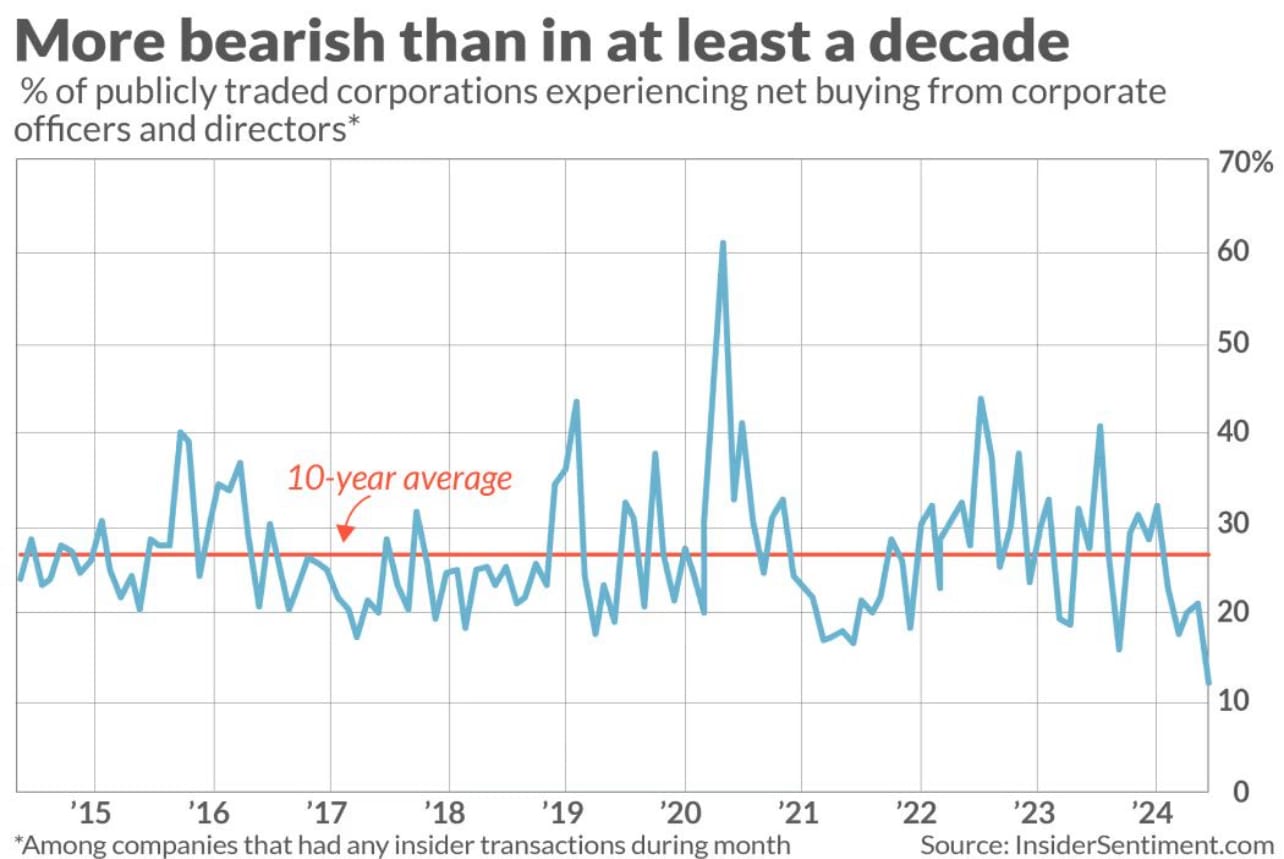

The percentage of publicly traded companies that have had net buying from corporate officers and directors has been at it’s lowest level in over a decade.

Corporate insiders are selling far more of their shares than buying. As a percentage of companies that have had any net buying from insider transactions, April was only 12.4%, well below our 10 year average of 26.5% and the lowest since 2014!

The data was crunched from insidersentiment.com, a website designed by Nejat Seyhun, a finance professor at the University of Michigan reputable for his skills in option pricing, IPOs, and insider transaction impacts on intra-day trading.

Why are insiders selling now?

It’s not unusual for insiders to take advantage of higher prices to sell some stock they previously earned. April’s low percentage is more difficult for bulls to counter, since the stock market was unusually turbulent in the first week of April, suffering several large down days from the S&P 500.

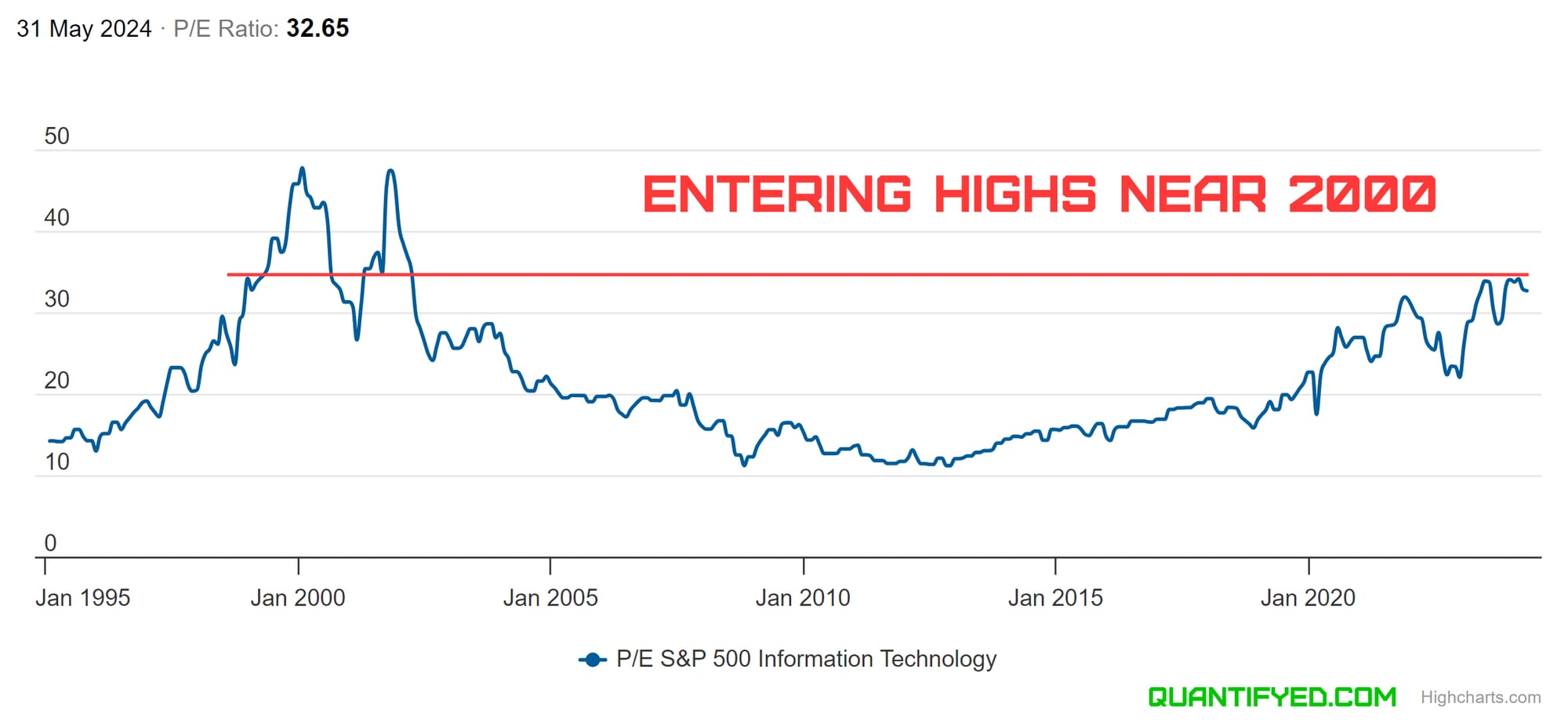

The technology sector in particular has been on a massive bull run in recent years, and valuations could be getting stretched. See this next chart,

Price-to-earnings ratios have been hitting ginormous valuations recently, comparable to years before the 2000 bubble. It's not surprising to see some investors parking their investments in growth stocks. In 2023, the S&P 500 index outperformed it's historical average return of 10%– reaching 21.9%

The bottom line?

It's not all doom and gloom! I’d recommend you keep a close eye on insider transactions. Continued high levels of insider selling, especially in companies you own, could increase the odds of a negative market reaction in the near future.