Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

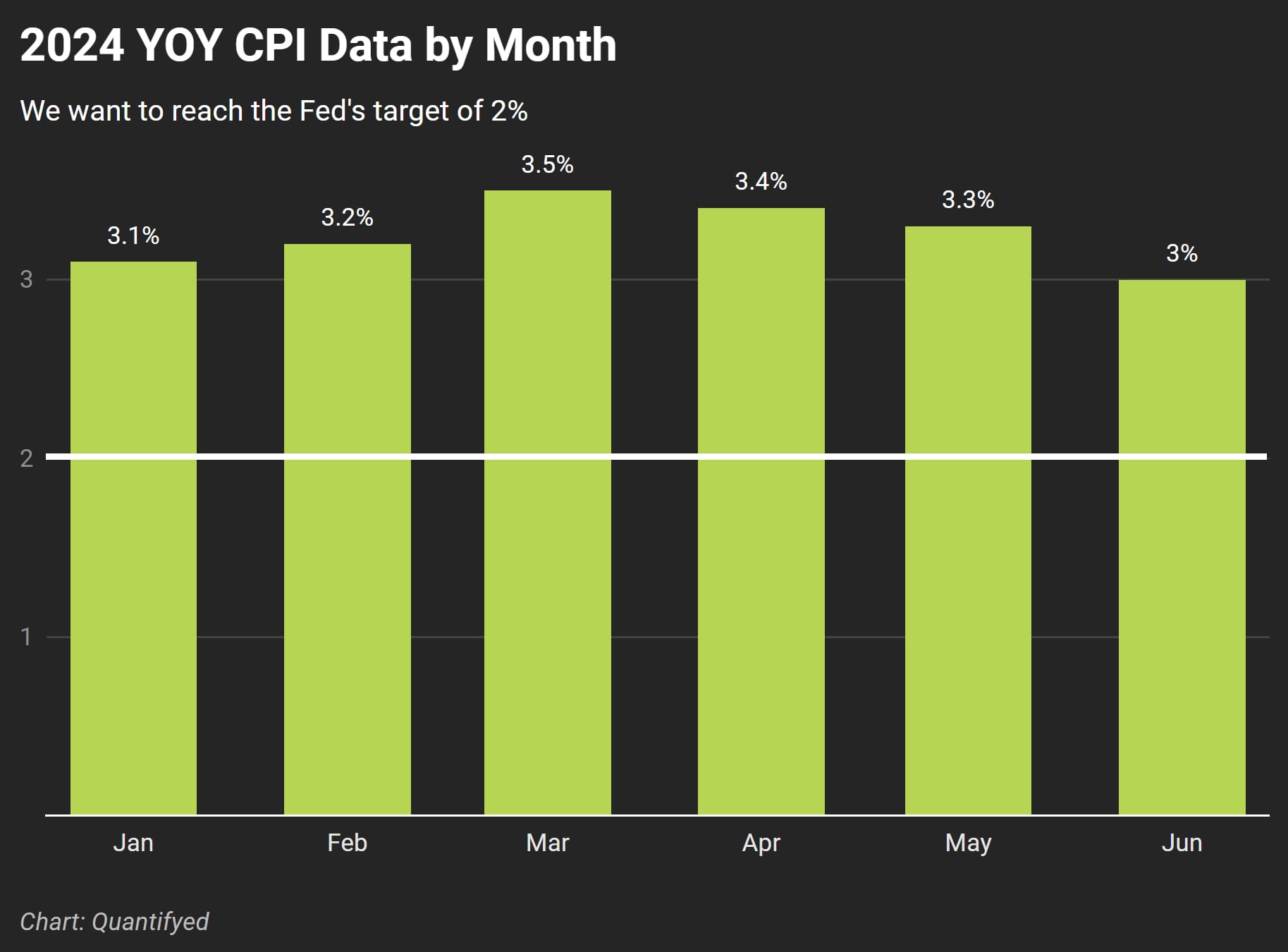

June's CPI inflation report shifted markets last week as tech giants take the back seat and small caps start to steal the spotlight

June's CPI inflation report shifted markets by a LOT. What's different?

Small caps, previously lagging, have seen huge gains. The Russell 2000 index, which just days ago was flat for 2024, soared 3.6% in its best day since November. Real estate, the S&P 500’s worst-performing sector this year, jumped 2.7%, while utilities and industrials groups advanced 1.8% and 1.3%, respectively.

Cooling inflation is easing market fears, changing our investment strategies. Last weeks performance tells us we're now paying attention to sectors that could benefit from potential interest rate cuts. Data from Thursday showed price pressures easing, deepening the market’s confidence that the Federal Reserve would cut interest rates in September.

This drop in bond yields triggered a rush into beaten-down corners of the market that could benefit from falling rates (like real estate, utilities, and industrials).

Small-Cap Stocks like Victoria’s Secret gained 6.1%, Bloomin’ Brands rose 7.1%, and Winnebago Industries added 6.7% (WSJ)

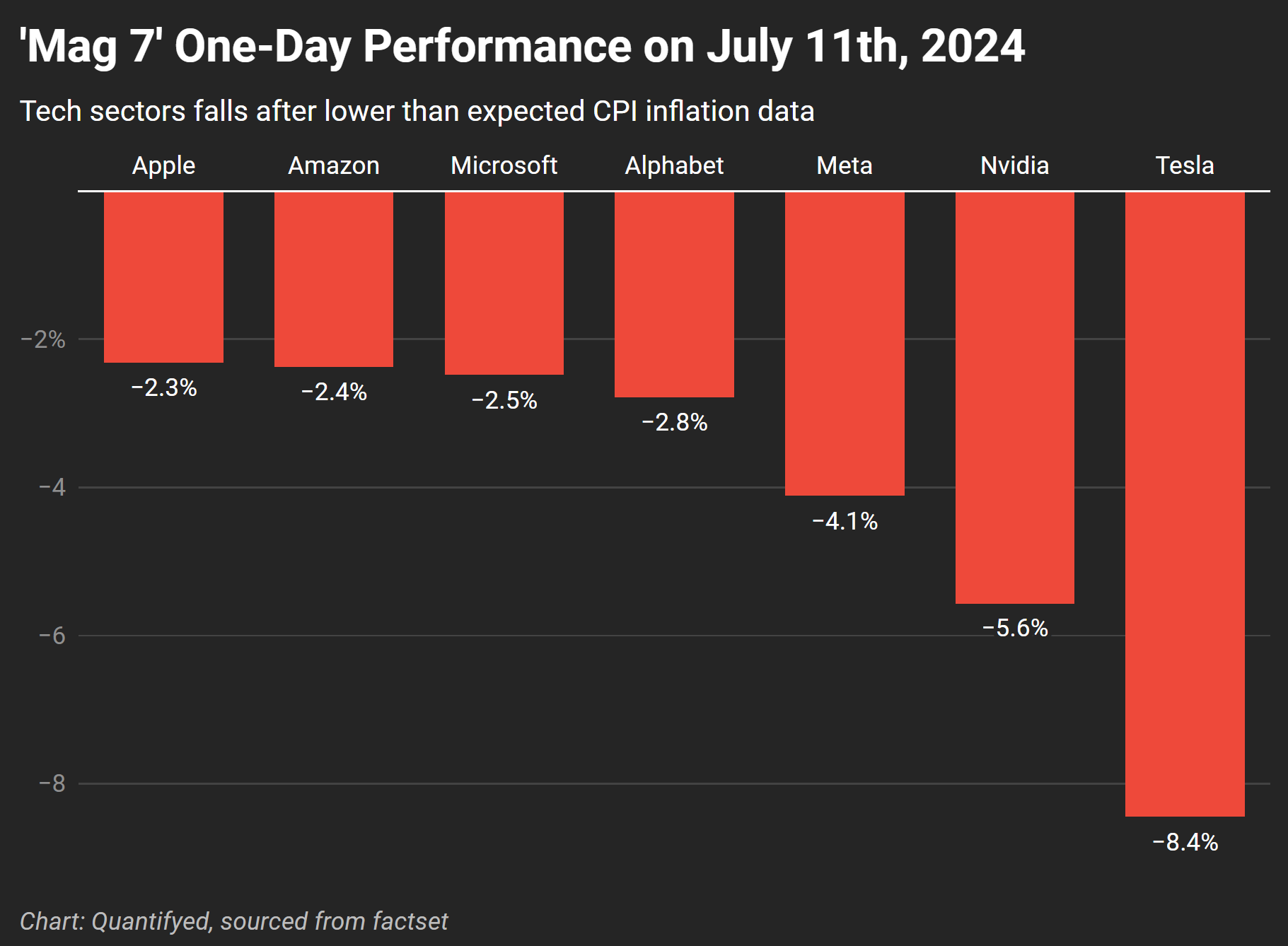

Big tech stocks, which dominated the first half of the year, faced big declines. The "Magnificent Seven" tech stocks collectively lost $597.5 billion in market value, their largest one-day loss since February 2022. Nvidia slid 5.6%, Meta Platforms declined 4.1%, and Tesla retreated 8.4%.

This rotation out of tech suggests a newfound confidence towards other investments in the stock market. Investors are finding opportunities in beaten-down sectors that could benefit from lower interest rates.

Quotes from market experts like Sinead Grant, Chief Investment Officer at BNY Wealth had this to say 👇

"There is some pent-up demand from investors to diversify more, to look for those names or those sectors that have been less well loved over the first half of the year" (WSJ)

A deeper look at the impact of cooling inflation and this abrupt transition out of big tech seems like we're taking a breather from the madness of AI recently. More people are diversifying into other industries, including small-cap stocks.

Are you going to adjust your investments in light of these changes? If you found this article insightful, share it with your network to keep them informed about this trend.