Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Investors in 2024 aren’t holding back. Margin debt is at record highs, call options are dominating, and the S&P 500 is having its best year in over a decade. I'll break down these trends and explain what’s causing the momentum.

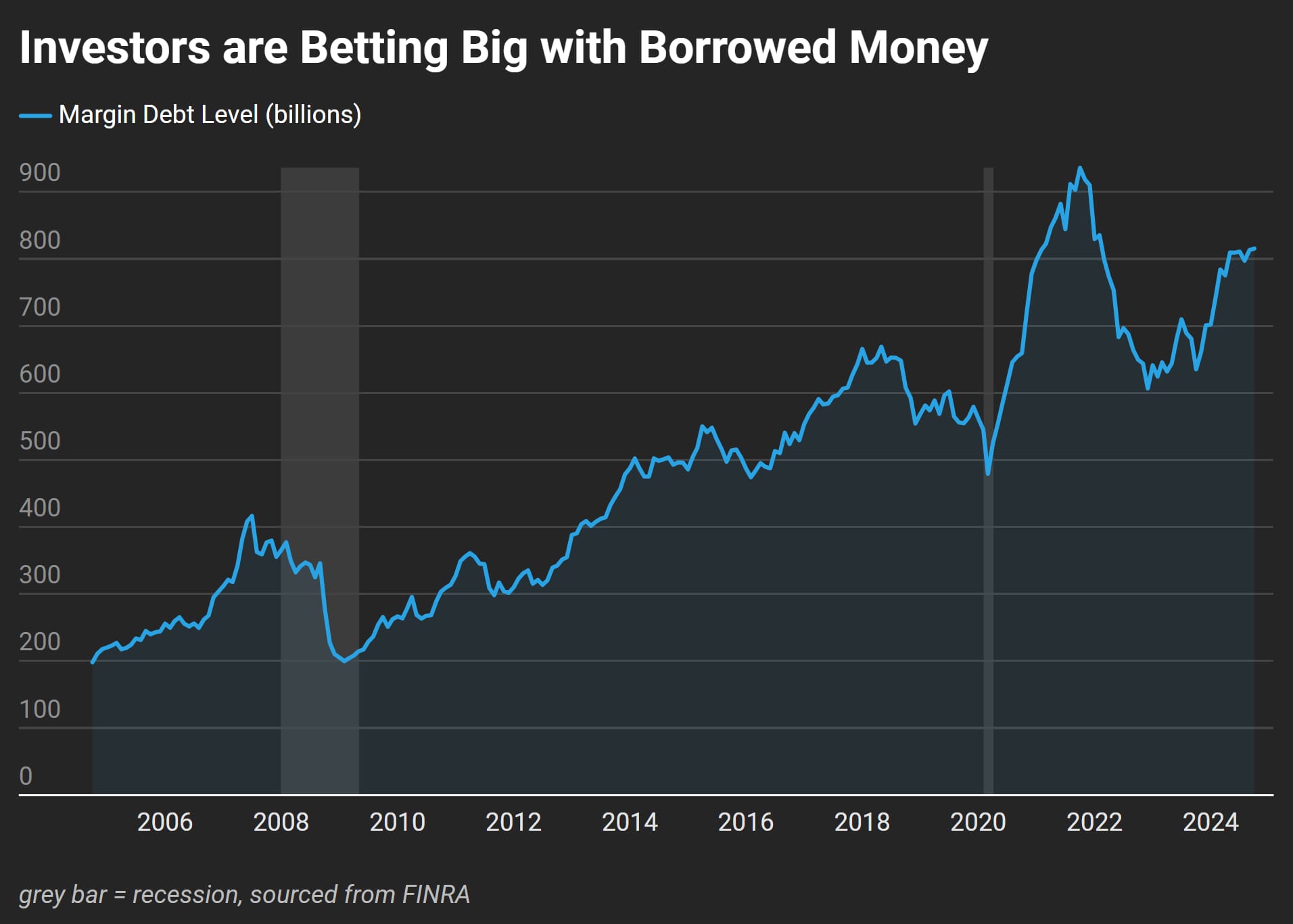

A Debt-Driven Market Rally

Investors are borrowing more than ever to fuel their market positions. Margin debt hit $815 billion last month—a 28.3% jump in borrowing since Oct last year. Just short of the all time high in 2021.

What is margin debt? It’s money investors borrow from brokers to buy stocks or other assets. Think of it like using a credit card for investing.

Why does this matter? Borrowed money can boost gains when markets go up, but it also magnifies losses.

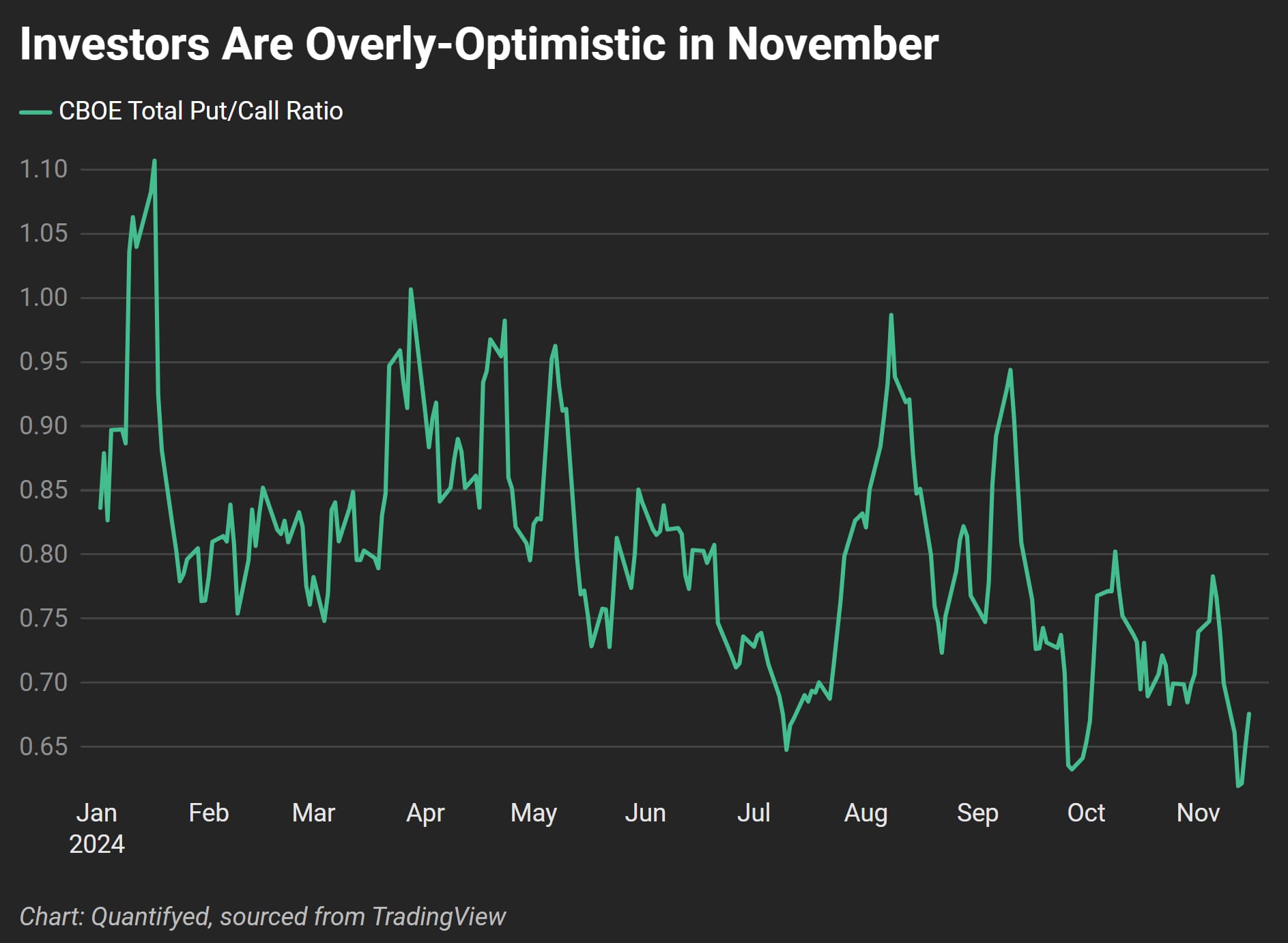

Sentiment Is Off the Charts

The CBOE Put/Call ratio is another sign of just how confident investors are right now. This number shows how many investors are betting on stocks to rise (calls) versus fall (puts). Right now, it’s sitting at 0.68—so there's more calls than puts in equities.

Investors are still betting on the market to keep climbing. Historically, periods of extreme bullish sentiment can lead to market corrections, but this is not definitive. It's more of a gauge than a predictor of market movements.

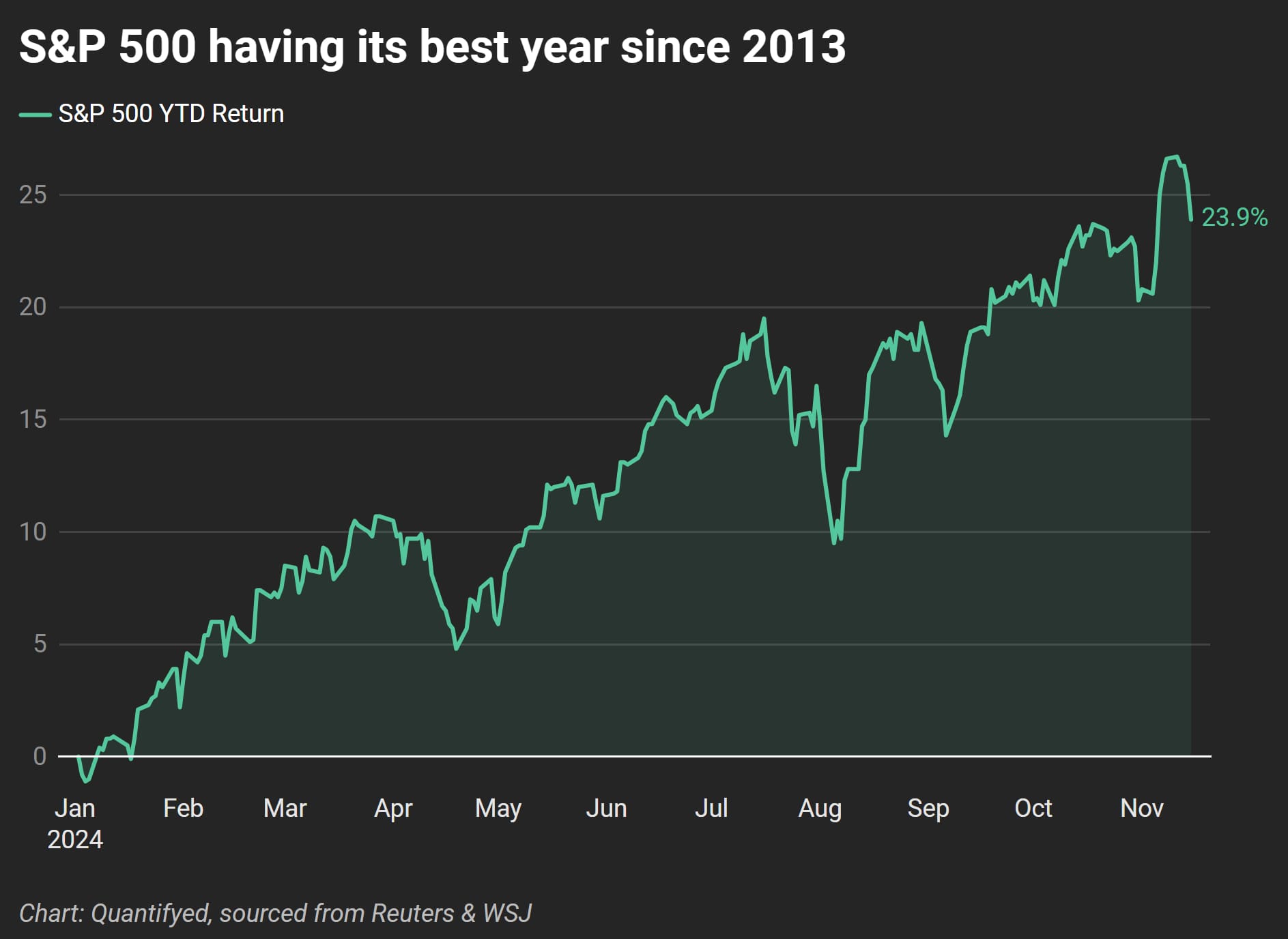

S&P 500’s Stellar Year

The S&P 500 is up 23.9% year-to-date, making it the best year since 2013. Tech stocks—especially those tied to AI—have been driving the bulk of the gains. Nvidia alone accounted for over a third of the S&P 500's returns.

It’s easy to see why optimism is high. But markets that climb this quickly can end up being vulnerable if the momentum fades.

What Does It All Mean? High leverage, extreme optimism, and a hot market make an interesting mix. Investors are clearly confident. The real question is whether that confidence is justified.

Key Takeaways:

- Investors borrowed $815 billion in margin debt this year.

- The Put/Call ratio hit 0.65, a sign of increased optimism.

- The S&P 500 is up 23.9%, its best year (so far) since 2013.

Curious how the election shook up the markets? Check out this post for a closer look at the key moves and what’s driving them.