Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

While the stock market is on fire, smart investors are quietly hoarding gold. What do they know that the rest of the market doesn’t? In this post, I'll dig into why gold is gaining traction as a hidden asset, explore the role of central banks, and look at how the Fed’s next moves could drive gold even higher

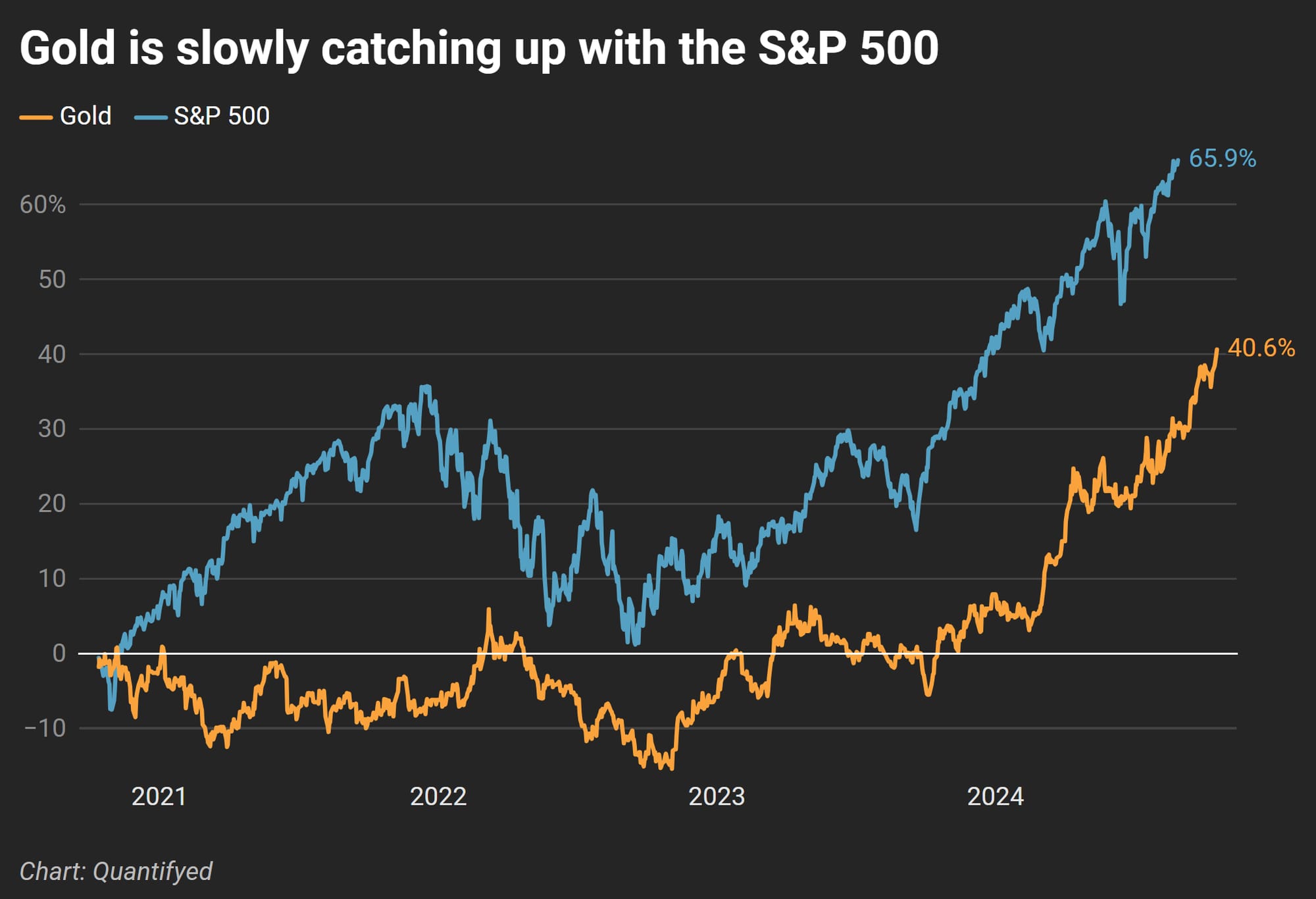

Gold’s 4-Year Performance vs the S&P 500

Over the past four years, gold has gained 40.6%, while the S&P 500 has climbed 65.9%. Although stocks are performing well, gold has gained a lot of ground recently. This gap between stocks and gold is narrowing as investors look for ways to hedge against rising uncertainty.

According to Goldman Sachs, gold’s story isn’t over yet. In fact, they forecast gold prices could hit $2,700 per ounce by early 2025. The reasons? Central bank demand, geopolitical risks, and the expectation of rate cuts from the Federal Reserve. With so much economic uncertainty on the horizon, gold is becoming the go-to asset for investors looking to manage their risk.

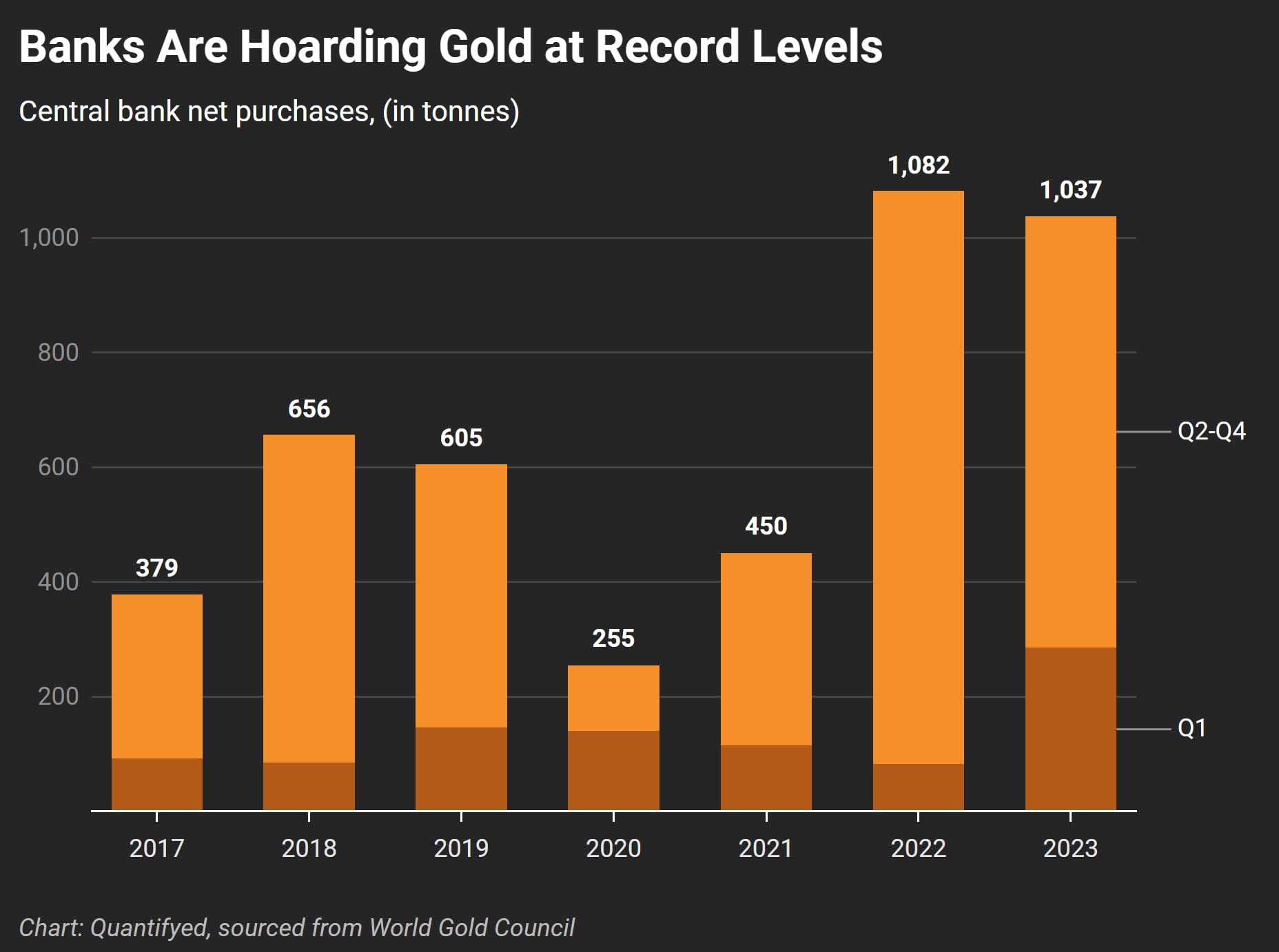

Central Banks Are Buying Gold Like Never Before

Another key driver behind gold’s rise? Central banks. In response to geopolitical instability and economic risks, central banks—especially in emerging markets—have been aggressively increasing their gold reserves.

Since 2017, banks have nearly tripled their gold purchases, buying up more than 1,000 tonnes in 2023 alone. Why? They’re hedging against potential financial sanctions, debt crises, and other global uncertainties. This massive demand is pushing gold prices higher.

Why Investors Are Paying Attention

The aggressive buying from central banks and the looming prospect of Fed rate cuts are two powerful forces behind gold’s current momentum. As interest rates decline, the opportunity cost of holding gold decreases, making it more attractive to investors.

Combine that with the global geopolitical mess we’re in, and gold is shaping up to be a reliable hedge for the future

A Few Key Takeaways:

- Gold’s Recent Growth: Over the past four years, gold has gained 40.6%, while the S&P 500 has risen 65.9%

- 2025 Forecast: Goldman Sachs predicts gold could hit $2,700 per ounce by early 2025

- Central Bank Purchases: Central banks, particularly in emerging markets, bought over 1,000 tonnes of gold in 2023

- Gold’s Growing Role: Geopolitical tensions and global uncertainty makes gold attractive to investors