Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Hey! Did you see the latest Job Openings and Labor Turnover Survey (JOLTS) report? Yeah, it's as exciting as it sounds. It's like the job market just hit the pause button.

In June, the number of open positions dropped, layoffs stayed pretty much the same, and the number of people quitting hit a three-year low. It's like everyone's just staying put, like we're all stuck in a chess stalemate.

This slowdown is definitely making our once super-hot labor market cool off, maybe even heading towards a downturn.

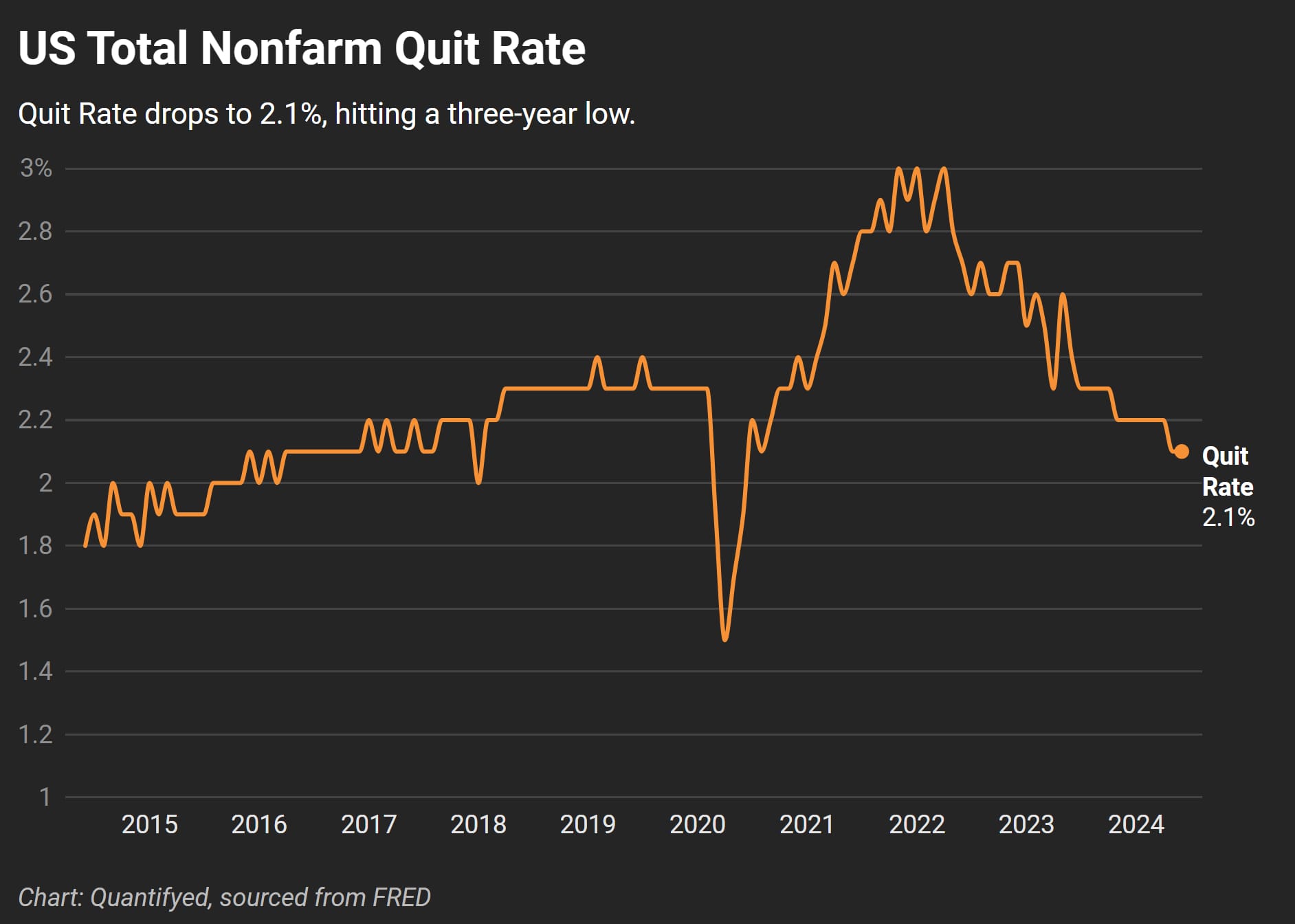

And speaking of people not moving, if you look at the US job quit rate, it's telling a story. Back in 2021, quit rates were over 3%, but now they're down to about 2.1% in May.

Right before the 2008 recession, job quit rates also hit rock bottom, around 1% in 2009. When markets are fearful, people tend to play it safe and avoid making bold career moves.

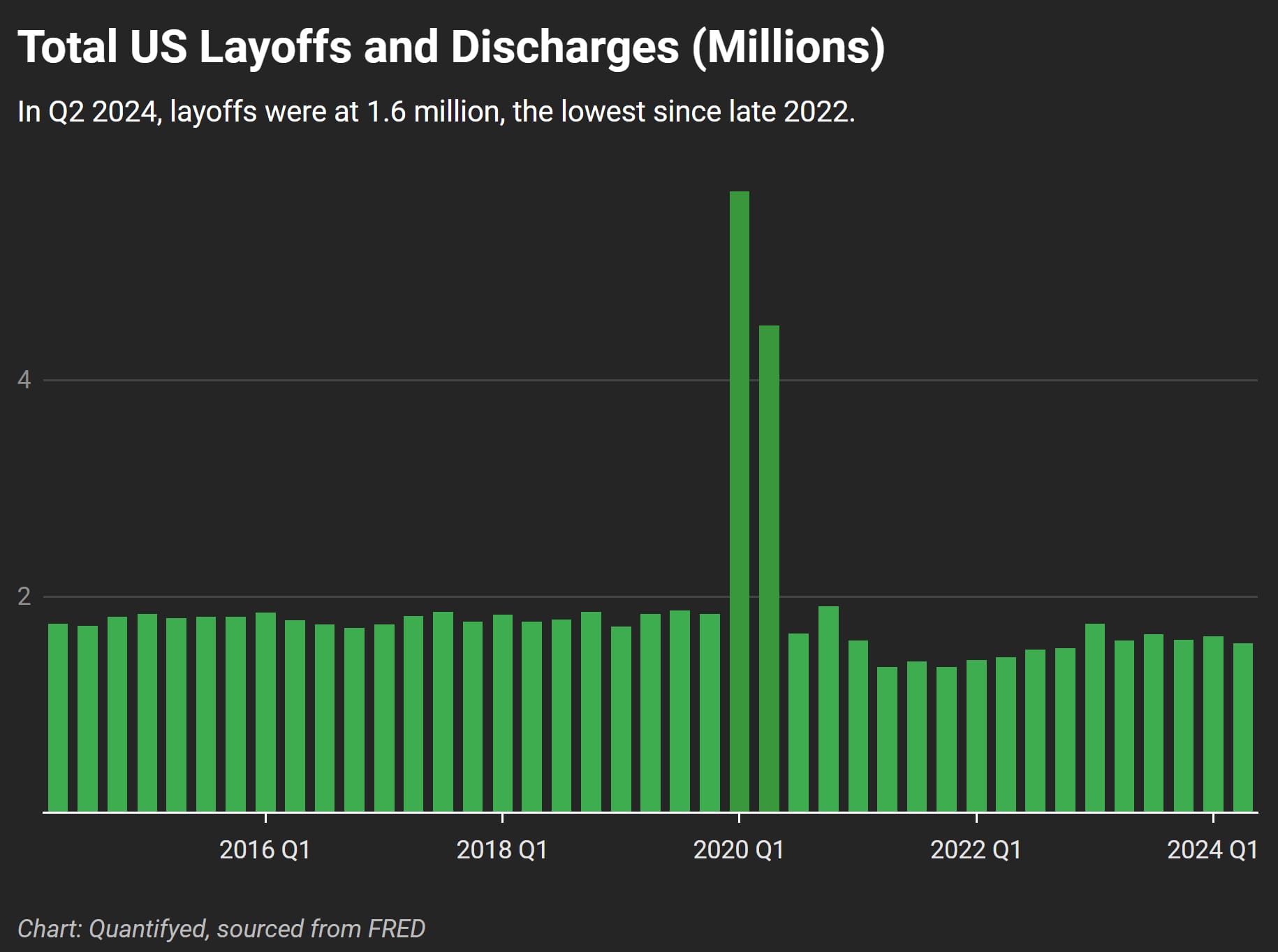

Here’s the weird part—layoffs have actually improved! In Q2, layoffs were at 1.5 million, the lowest since November 2022. Even though weekly claims for unemployment insurance have been creeping up, layoff activity is still well below pre-pandemic levels.

Our market as a whole isn’t throwing up huge red flags, but it’s definitely telling us to be cautious. Current conditions, like the high interest rates set by the Fed, are making it tougher for businesses to afford things.

One thing about the Fed though, that I've noticed, is how they're pretty in tune with market expectations. If the market is expecting a rate cut in September, the Fed often follows.

Funny enough, the Federal Reserve is expected to announce their rate decision today (tue, jul 1st). After that's announced, we'll have a better idea of what's to come in September if we do decide to cut rates then.

It's also worth thinking about job postings in general since many of the jobs that are disappearing recently could be fake anyway. People apply for certain positions and never get a response because the job might have been filled already, yet the opening is still posted as active.

Basically, it's recruiters collecting resumes just in case, but there’s no actual job available. I'm not a recruiter expert, but a quick speculation on my end.

But here's the big question: when the Fed does cut rates, how long does it take for these cuts to impact the job market? And how high could unemployment go before it stabilizes?