Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Happy halloween! 🎃

It’s been a bumpy ride in the markets, with job numbers slipping while oil prices are acting like they’re on an upward escalator. Fitting, I guess, since Halloween just passed—nothing scarier than high prices and a weak job market.

Here’s the lowdown: U.S. job growth hit a new low, just as tensions in the Middle East are giving oil prices a serious boost. Let’s break down what’s happening, why it matters, and what it could mean for the markets.

Spooky Nonfarm Payrolls Data

October’s nonfarm payroll report wasn’t exactly a treat investors were hoping for—more of a trick, really. The U.S. economy added only 12,000 jobs, a steep drop from September’s 223,000. Turns out, the job market is looking a bit ghostly this fall, with hurricanes Helene and Milton, plus strikes in aerospace and hospitality, haunting those numbers.

Notice the steep drop? October’s job increase is at a low we haven’t seen in three years! The job market’s health is looking more zombie than human right now..

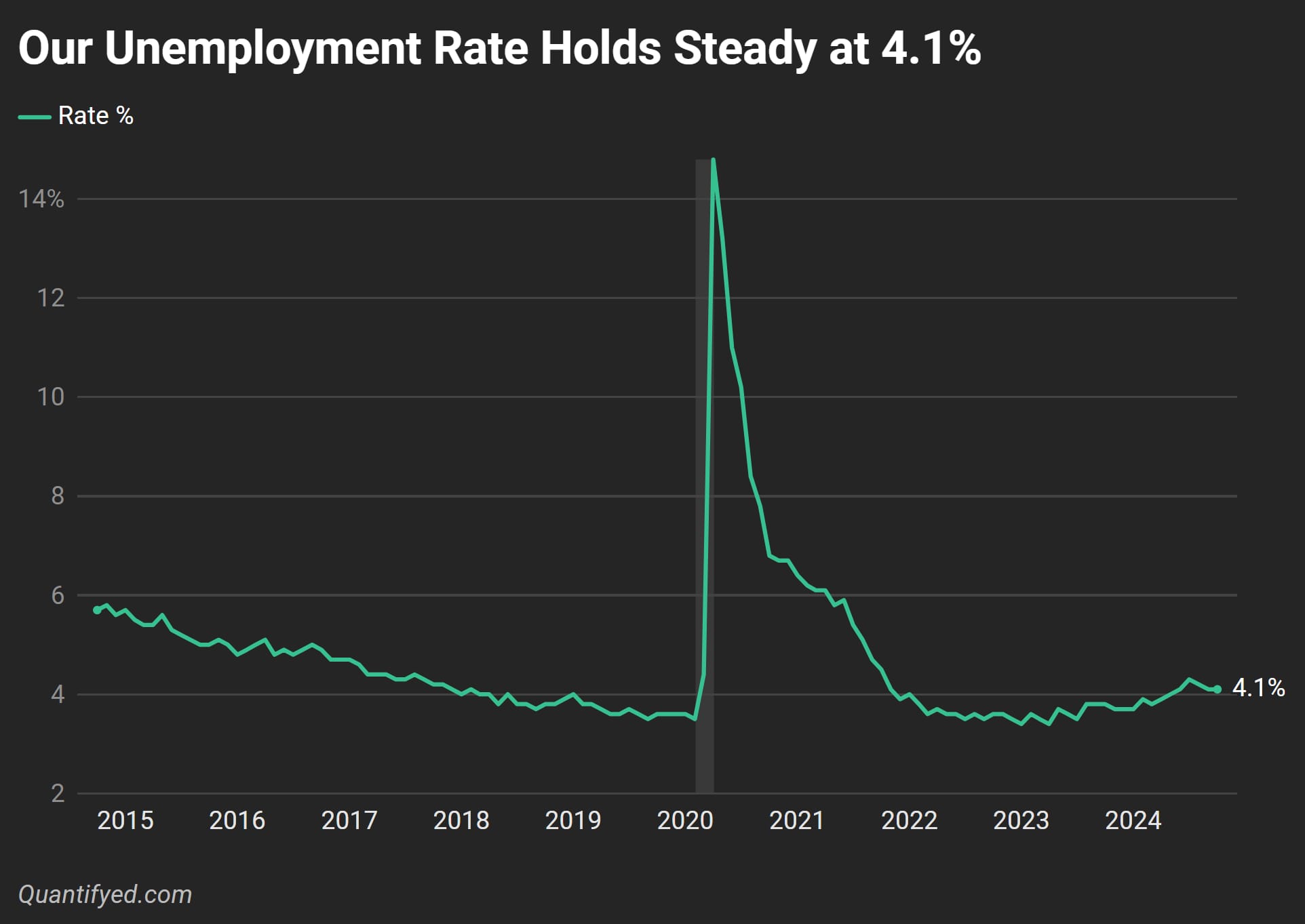

And yet, the unemployment rate held steady at 4.1%. Stable on paper, sure, but when you look closer, there’s a definite strain lurking in the labor market.

Oil Prices Rise from the Grave

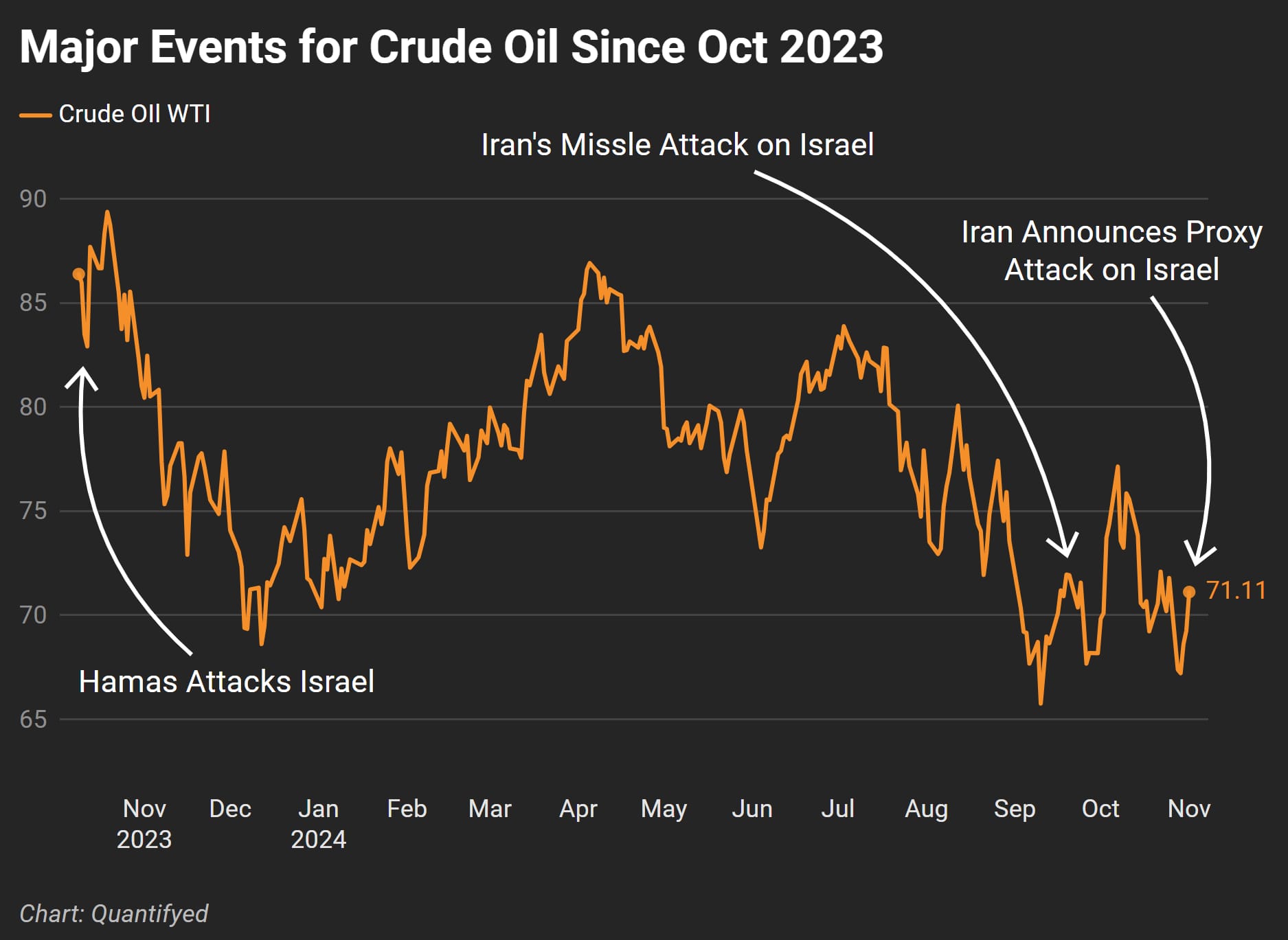

Meanwhile, oil prices are on the rise. Think of it as the market’s version of a haunted house—every time you turn a corner, something jumps out. With Iran hinting at a proxy attack on Israel, the Middle East is starting to heat up. These types of tensions have a way of pushing oil prices higher—and this time’s no different.

Brent crude is up by 2.2%, hitting $74.45 a barrel, while WTI (West Texas Intermediate) rose 2.7% to $71.14. When the geopolitical stakes rise, oil markets tend to get jittery.

Take a look at the recent timeline—Hamas’s initial attacks, Iran’s missile threat, and now the proxy attack plans. Each of these events has been nudging oil prices up, adding to the overall tension.

Markets are in the Twilight Zone

With job numbers low and oil prices rising, the markets are looking more volatile than ever. Investors are caught between inflation fears and worries about slower economic growth. The Federal Reserve are also considering an interest rate cut to keep things steady.

While job growth isn’t looking great, the unemployment rate itself has held at 4.1%. This brings a bit of perspective: the Fed doesn’t get a free pass to cut rates just because job growth slowed. Steady unemployment means inflation concerns are still very much in play.

Key Takeaways

- Jobs Growth Slowed Significantly: October added only 12,000 jobs—the lowest since July 2021—thanks to hurricanes and industry strikes.

- Oil Prices Spike Due to Geopolitical Tensions: Brent crude rose 2.2% to $74.45; tensions with Iran raised supply concerns, impacting global prices.

- Market Volatility Heightened: Rising oil prices and a stagnant labor market mean more caution for investors