Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

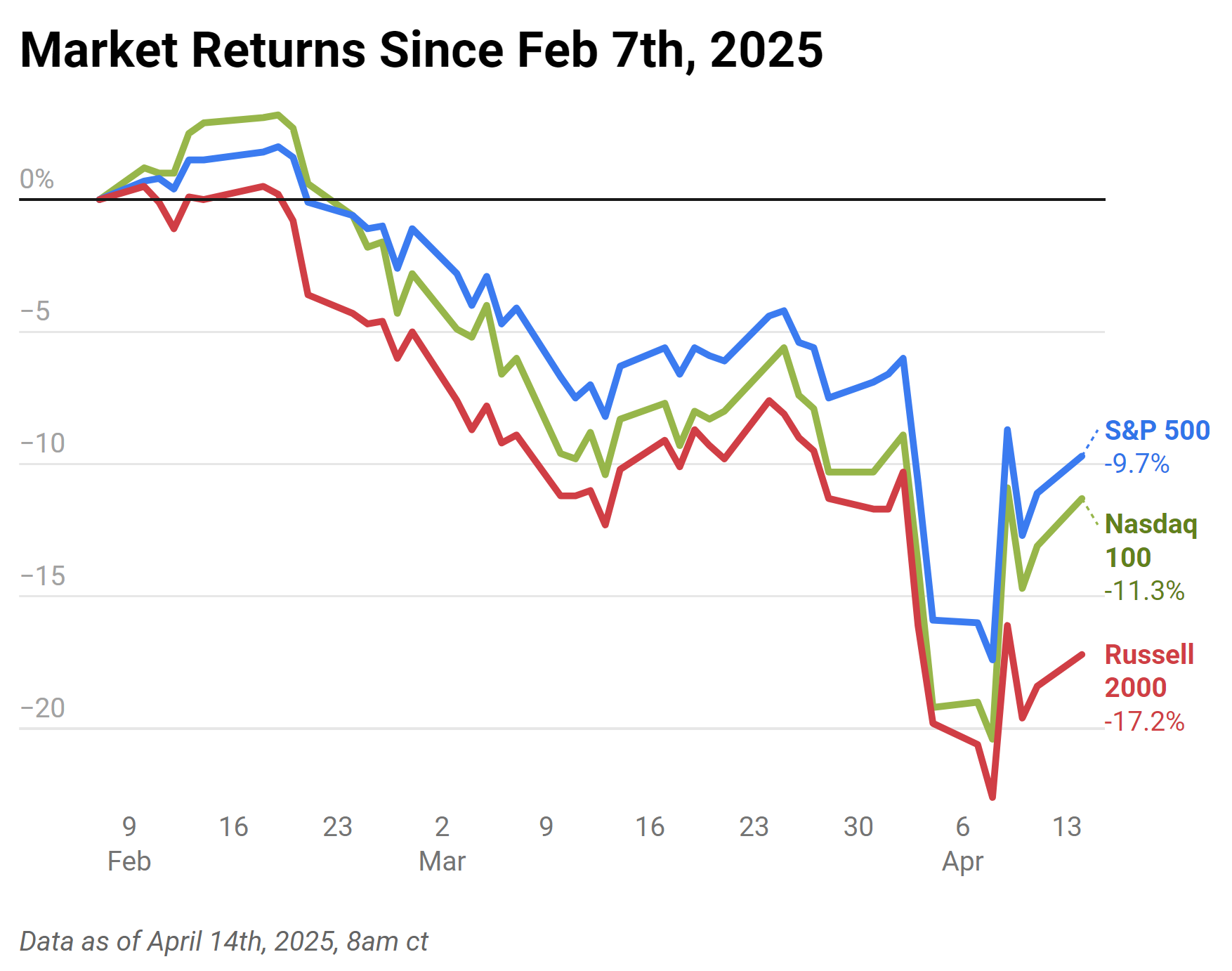

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days of overstimulation. Stocks soared, then dropped again. Bonds sold off. Gold, oil, crypto... all over the place.

It wasn’t just equities. On Monday, Treasury yields climbed. By Tuesday, nearly 23 billion shares traded hands as the market flirted with bear territory, per Bloomberg. Then Wednesday hit, and the S&P surged 9.5%, the biggest one-day move since the 2008 financial crisis.

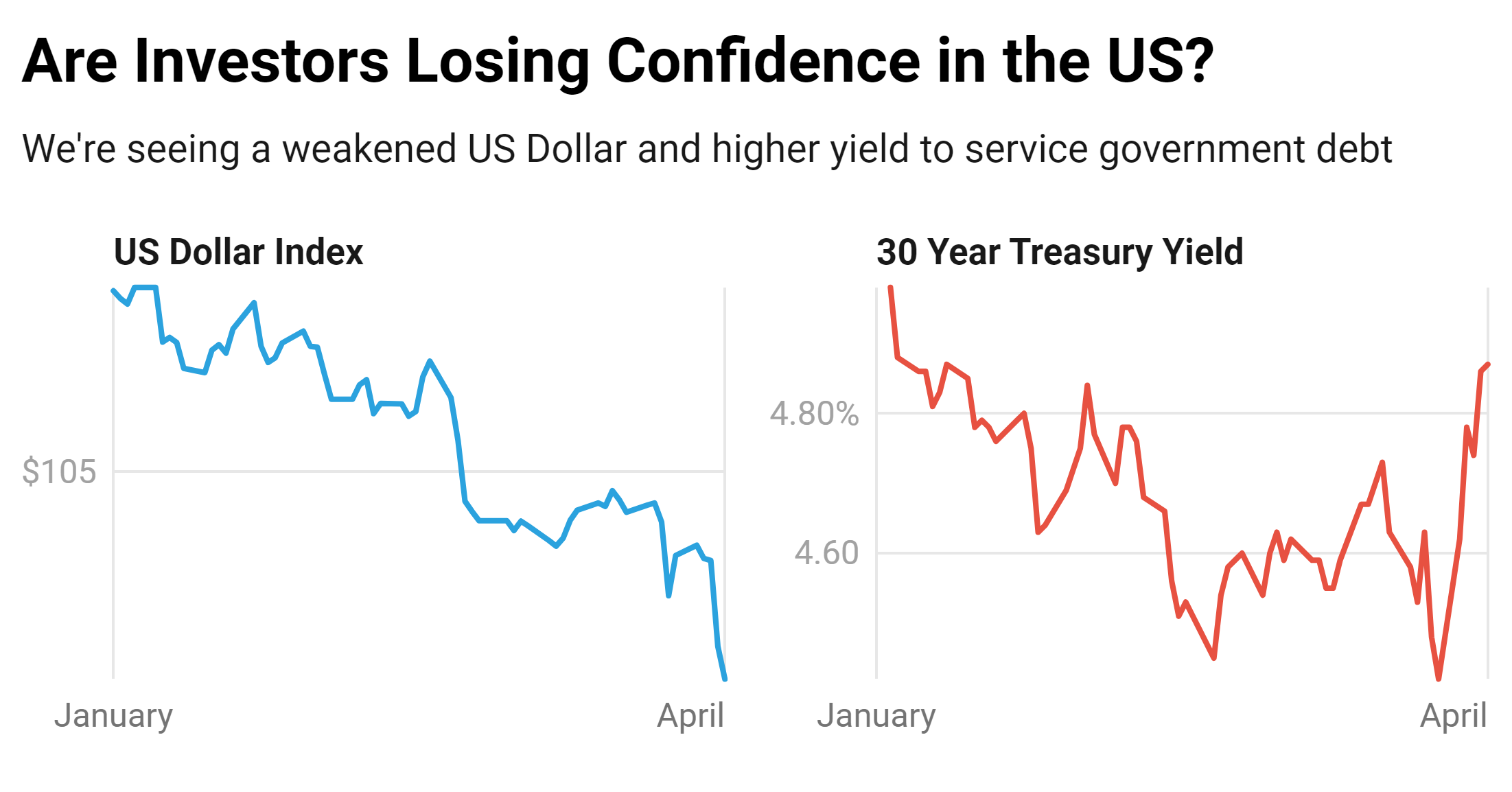

Bonds are Flashing a Warning Sign

Normally when stocks go up, bond yields tick up too. This time, yields spiked hard even during the equity rally. Long-duration bonds, especially the 30-year, saw the sharpest selloff in years. It wasn’t just investors rotating out of safety. It was selling across the board. That’s not a good sign. If bonds and the dollar are both falling, it's not just a trade unwinding, it’s confidence slipping.

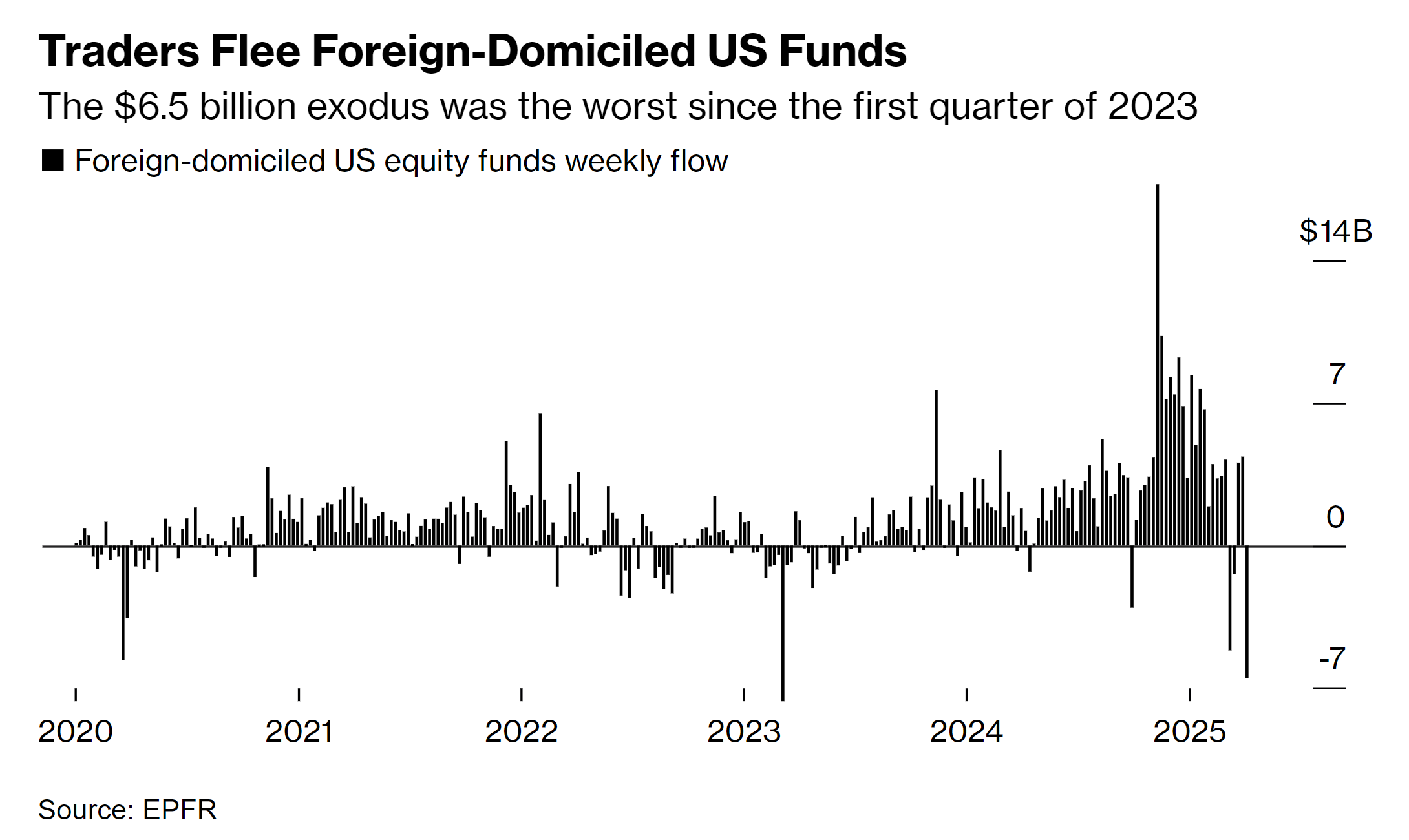

Foreign Investors Are Leaving

The data shows a big divide. Domestic funds that focus on Treasuries saw record inflows this week. But funds based overseas pulled back from U.S. equities at one of the fastest rates in years. That kind of split suggests something simple. U.S. buyers might still believe in the rebound. Foreign buyers aren’t so sure:

Currency weakness. Bond instability. Outflows. That’s usually the profile of a country–and economy–in distress. It’s not supposed to happen to the U.S. But the market action this week came unbearably close. And when global investors start treating American assets like they’d treat assets in Turkey or Brazil, it’s no longer just about tariffs. It becomes a credibility issue.

This Isn’t About Recession Fears

If you're only looking at the weekly closing prices, everything might look fine. Stocks ended higher. Yields bounced around. Bitcoin had a good week. But under the surface, this wasn’t a show of strength. It was a signal that global investors are rethinking where to allocate capital. Maybe this week was a one-off. BUT.. if it becomes a pattern, the U.S. risks losing one of its biggest advantages—being the place where money goes when everything else feels risky.