Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

Markets are lower this morning. Nasdaq 100 futures are leading the drop, down -1.10%. Bitcoin is also losing steam, falling $15,000 from its December high, while Apple is on the verge of a historic $4 trillion market cap.

Let’s break it down.

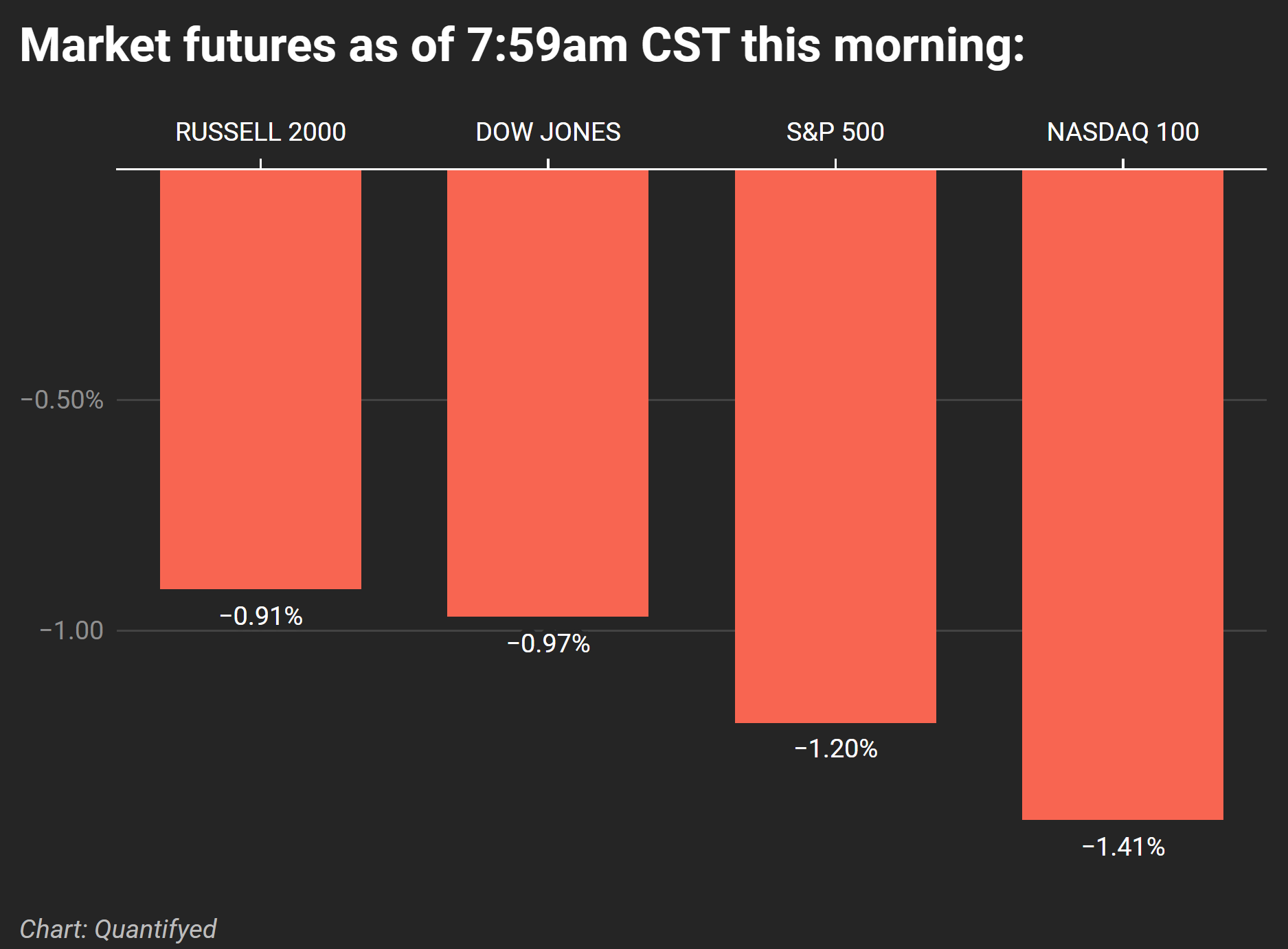

Market Futures

Markets are off to a rough start today. Here’s where the major futures stand (as of 7:59am cst):

- Russell 2000: -0.91%

- Dow Jones: -0.97%

- S&P 500: -1.20%

- Nasdaq 100: -1.41%

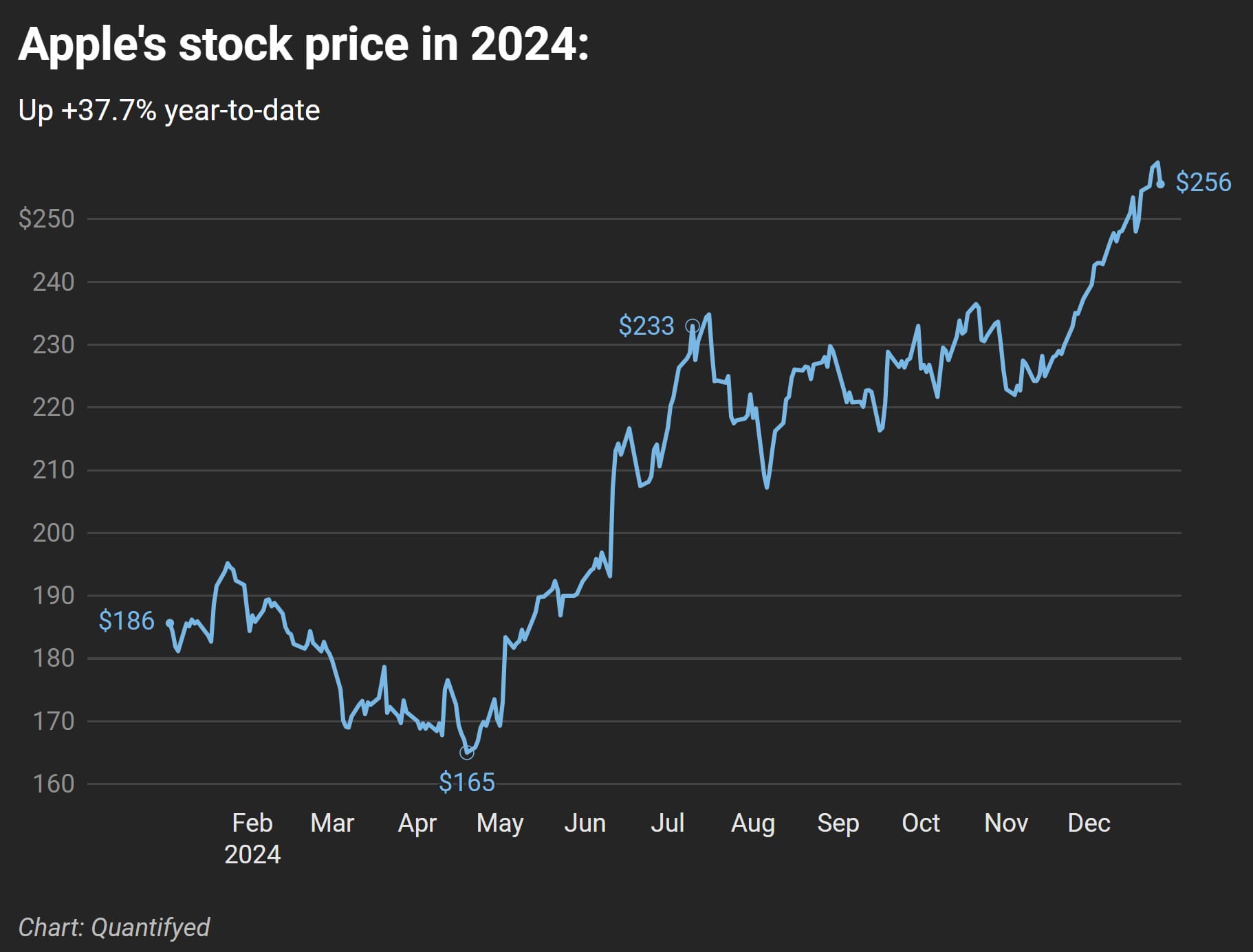

Apple nearing a $4 trillion valuation

Apple's closing in on a $4 trillion market cap! The stock is up +33% this year, trading at $256, and has added $870 billion in value in 2024 alone.

To put that in perspective, Apple would be worth more than 43% of the S&P 500 combined if it hits this milestone.

Bitcoin’s recent decline

Bitcoin is pulling back hard .. it's now trading at $93,169, about $15,000 below its mid-December high. Expectations for Fed rate cuts have cooled, taking some momentum out of the rally. Other tokens like Ethereum (+0.34% this morning) and Dogecoin (+0.04%) are also struggling.

Bitcoin is still up +110% this year, making it the best-performing investment of 2024. Traders are watching MicroStrategy, which has been aggressively buying Bitcoin, to see if it will continue its spree despite the pullback.

Key data this week

Here’s what’s coming up:

- New Year’s Day holiday, this Wednesday

- U.S. construction spending, jobless claims, manufacturing PMI, this Thursday

Current market data

- Futures Performance:

- Nasdaq 100: -1.10%

- S&P 500: -0.99%

- Dow Jones: -0.80%

- Russell 2000: -0.63%

- Cryptocurrency Performance:

- Bitcoin: -0.43% to $93,169

- Ethereum: +0.34% to $3,464