Featured Posts

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Every time the market rallies to new highs, people start asking the same question: Are we in a bubble? And every time, the answer is basically the same: maybe, but we won’t know until it pops. That’s how bubbles work. They never feel obvious in real-time. The 1999

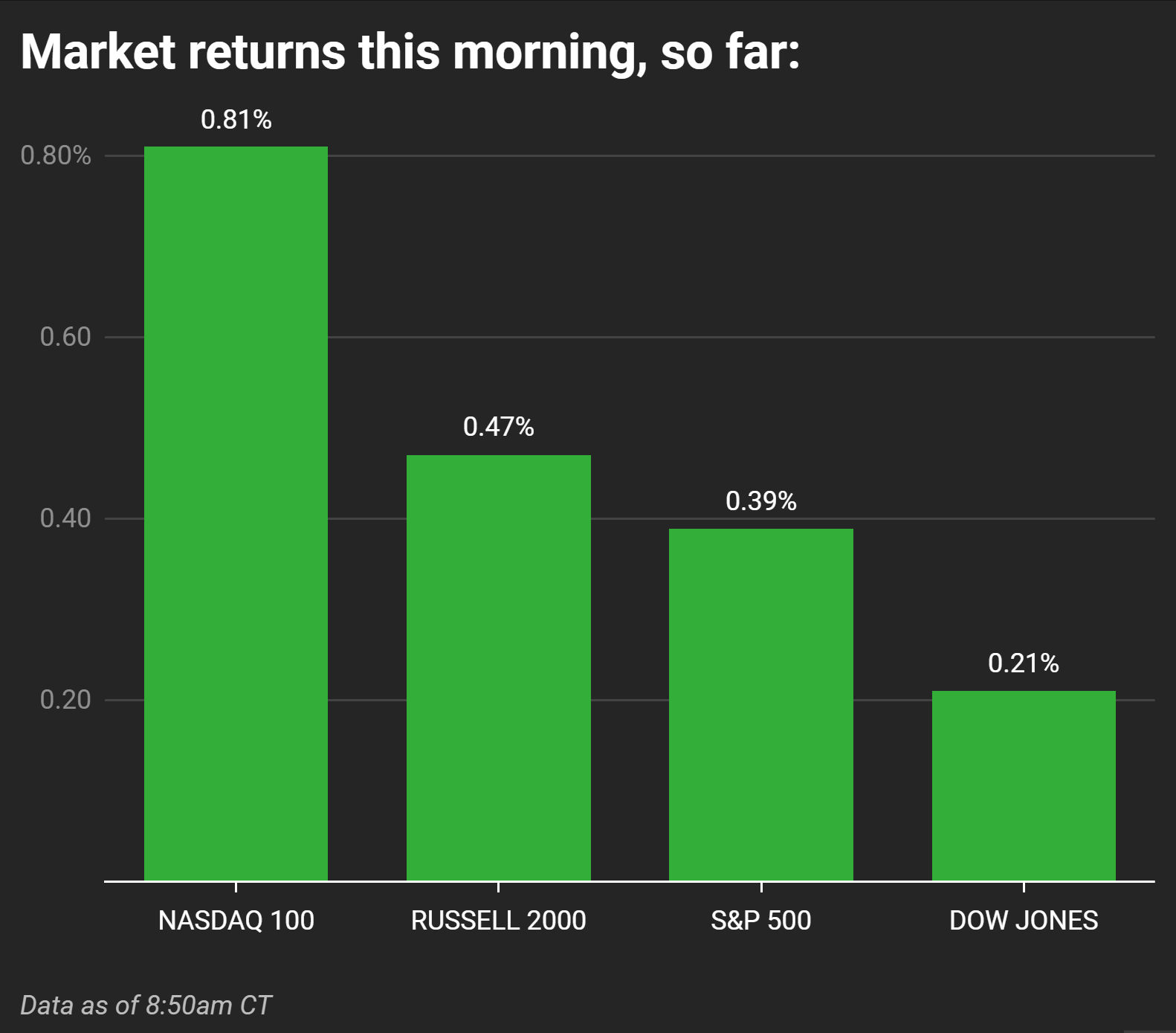

Markets are trying to recover after last week’s selloff, but the gains are small. As of this morning, the S&P 500 and Russell 2000 are both up just 0.03%, the Dow is up 0.11%, and crude oil is climbing 0.2%. Meanwhile, the Nasdaq 100

The market’s winning streak just hit a roadblock. Trump’s latest tariff threats, floating a 25% tax on auto, semiconductor, and pharmaceutical imports are shaking stocks today. With growing inflation concerns, market's are guessing whether this could push back Fed rate cuts in 2025. Here’s what’

Another round of tariff threats just hit, this time with a 25% levy on steel and aluminum imports. Normally, this kind of news would shake up markets, but so far that’s not happening.

Stock futures are up. The Dow, S&P 500, and Nasdaq are all slightly higher to start the week. Gold prices, however, are hitting record highs, and Treasury yields are moving up as well.

So, why is the market brushing this off? And will that last?

Tariff Threats, No Big Reaction

Despite Trump's tariff threat, markets are rising. Dow futures are up 0.2%, S&P 500 futures are up 0.3%, and the Nasdaq is up 0.5%.

Steel stocks are jumping. Nucor, U.S. Steel, and Steel Dynamics are all up, as tariffs could give them an advantage. Other sectors are mostly steady. The bigger focus for investors right now is the upcoming inflation report, which will shape expectations for Federal Reserve policy.

Meanwhile, Treasury yields are also still elevated. The 10-year yield is at 4.5%, still at a historic high.

Gold and Oil Climb

Gold is climbing fast. Prices are up 1.5% to $2,931 per ounce, marking a new record. That suggests at least some investors are hedging against uncertainty.

Oil is also edging up. Brent crude is at $75.18 per barrel, while WTI sits at $71.50, both up 0.7%. The market is waiting to see whether tariffs will impact trade flows, but for now, the reaction has been mostly muted.

Why Markets Aren’t Reacting

There are a few reasons investors aren’t rushing to sell. First, they’ve seen this before. Trump has frequently used tariffs as a negotiation tactic. Markets have learned not to overreact to the first announcement.

Second, the bigger focus is on inflation. The Bureau of Labor Statistics (BLS) is releasing the January consumer price index (CPI) report on Wednesday, which'll tell us whether the Federal Reserve is likely to keep interest rates higher for longer. For most people, we'd call that a bigger concern than tariffs.

For now, markets are treating this as just another policy announcement that may or may not turn into something bigger. But that could change quickly. If the tariffs actually take effect, or if other countries respond with their own trade measures, the market reaction might be different.