Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

I got a jolt reading our newest jobs report. May job openings hit 8.1 million, hinting at short-term stability but long-term uncertainty. I'll break down what this means and how you should react.

The Job Openings and Labor Turnover Survey (JOLTS) gives us a monthly recap of the U.S. labor market, showing changes job openings, hiring, quitting, and layoffs.

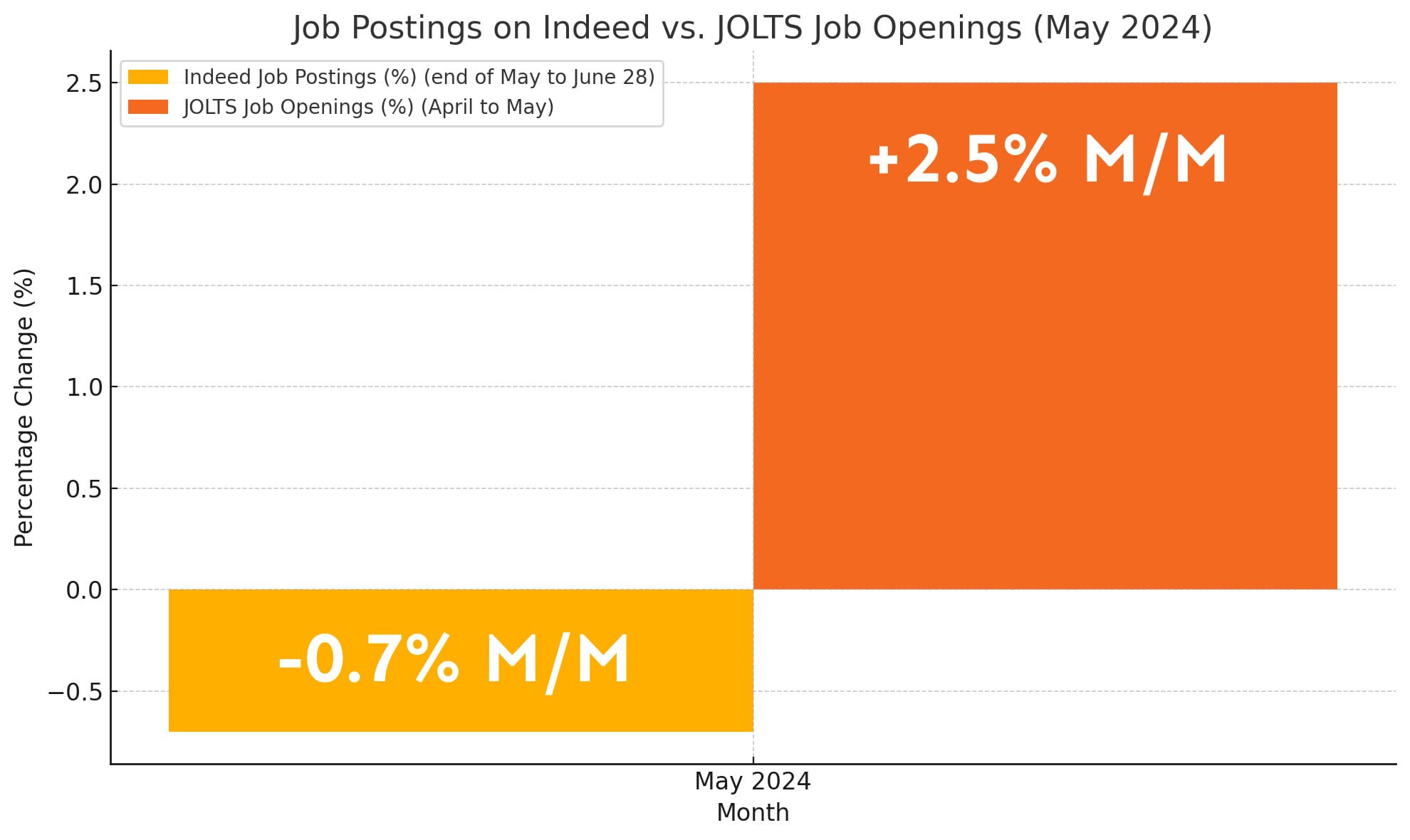

The May JOLTS report saw an increase in job openings, rising to 8.1 million from a revised 7.9 million in April. This 2.5% month-over-month increase suggests some short-term stability, but don’t mistake this one-month change for a broader upward trend.

The labor market remains balanced, with stable hiring and quitting rates and low layoffs. However, any further decline in job openings could quickly become concerning → affecting unemployment.

Job Openings Trends: Job openings data can be volatile, and the May increase doesn't mean we're out of the woods yet. Total job openings are still down 15% year-over-year, telling us we're in a longer-trend of cooling labor demand.

The labor market isn't heating up, but after several years of declines, at some point our job openings need to stop falling to make sure we keep a healthy labor market.

For instance, job postings on Indeed declined by just 0.7% from the end of May through June 28, suggesting that the next JOLTS report should show job openings around 8 million.

If total job openings fall below this level, it could push the unemployment rate higher, which stood at 3.7% in May 2024, up from 3.4% in April.

Funny enough, the words “little changed” were repeated over half a dozen times in the May JOLTS report, telling us there's still no change in hiring, quitting, and layoff rates.

This stability is a positive sign, but there are risks if job openings continue to decline. The current level of job openings is consistent with a healthy and balanced market, but further declines could signal trouble ahead.

How We Should React: The labor market's at a crossroads. Cutting interest rates this year might help keep worker demand up, but it could also overheat an already balanced market. The Fed's been cautious, and any moves need to be well-thought-out to keep things stable.

The May 2024 JOLTS report shows short-term stability but long-term uncertainty. With job openings around 8 million, the market's balanced, but further declines could be risky. I'll keep a close eye on this situation and let you know if anything new happens.