Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

Well, if anyone was hoping for an inflation miracle in May, keep dreaming. The Fed’s favorite inflation gauge hit 2.6% in May, right on target. It’s a step down from April’s 2.8%, hinting at possible rate cuts sooner, but let’s not get too excited just yet.

Fed Chair Jerome Powell isn’t throwing in the towel on inflation just yet. He’s clear that core inflation might not hit that sweet 2% spot until 2025. That means more rate hikes could be on the menu. Historically, the Fed juggles rate changes and forward guidance to keep things in check.

Treasury Yields Dropped. Treasury yields took a hit after the inflation data dropped, reacting to the Fed’s potential moves. The market’s already factoring in prolonged high rates, which could mean some volatility ahead.

But there’s also a glimmer of hope. If the Fed pauses rate hikes, we might see a rally in equities, similar to earlier this year. So, keep an eye on those interest rate decisions—they’re crucial.

Impacts from Inflation. Inflation hits sectors differently. In the US, housing has been a big one. Rent costs have been a headache for the Fed, but there’s a silver lining.

Consumer Spending Shifts. High inflation also affects consumer spending. People tighten their belts and focus on essentials instead of luxuries. This hits different sectors in several ways: luxury goods and non-essential services usually take the biggest hit. Specifically, the consumer-discretionary industry feels the burn; which includes retailers, airlines, and entertainment.

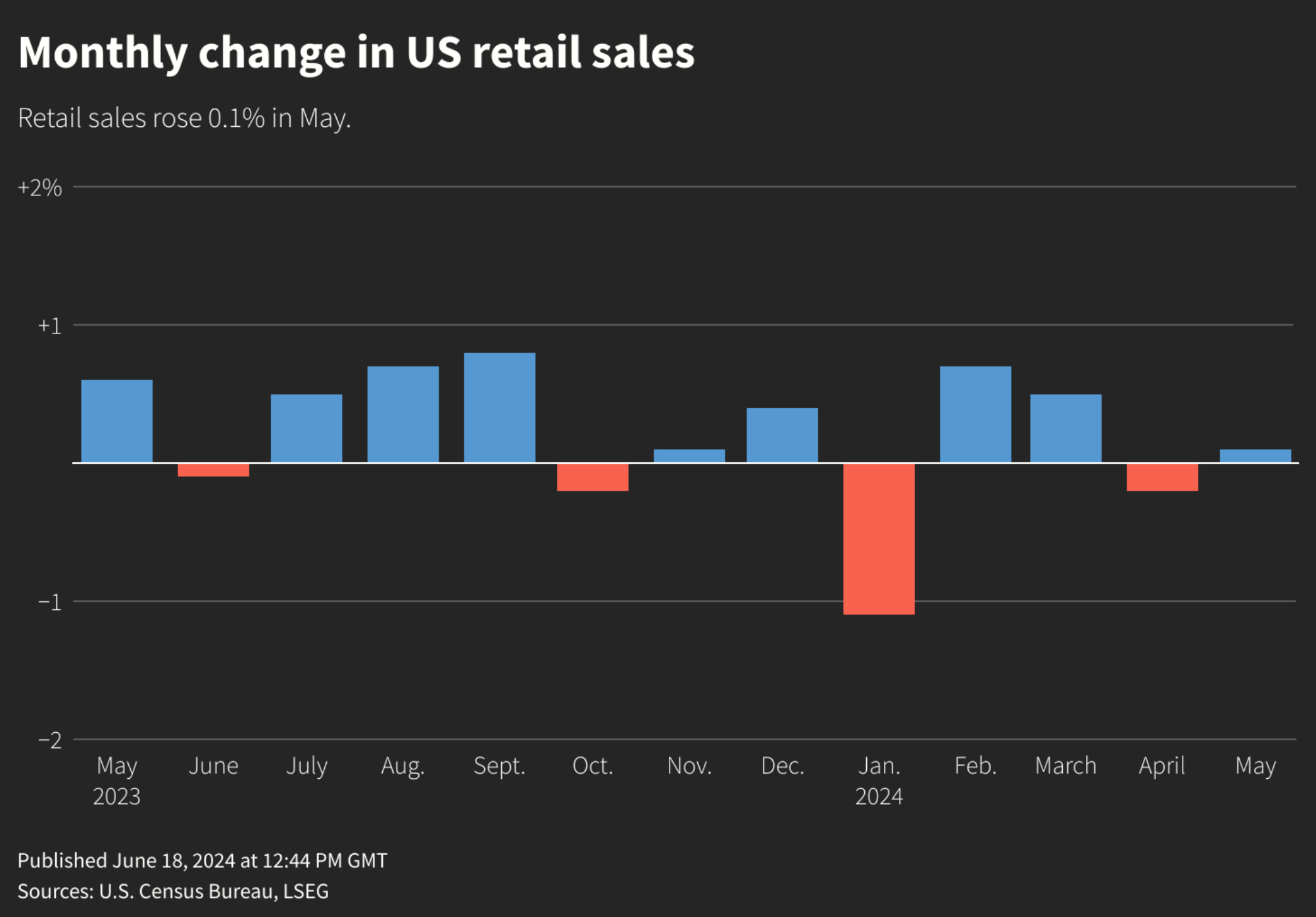

Retail sales data also tells us an interesting story. In May 2024, U.S. retail and food services sales were up slightly by 0.1% from the previous month, totaling $703.1 billion. However, sales in discretionary categories have seen slower growth.

It isn't a temporary trend; it's a larger shift as consumers adapt to higher prices and uncertainty.