Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Ah, the joys of trying to buy your first home in 2024. If you’re a millennial, you’ve likely realized that getting into the housing market today feels like trying to solve a Rubik's Cube blindfolded.

Surprisingly, things weren’t always this bad. Sure, Baby Boomers had it rough too, but today’s market? It’s a whole new level of tough. Let me explain how millenials today are getting the short end of the stick.

Inventory Levels: Then vs. Now

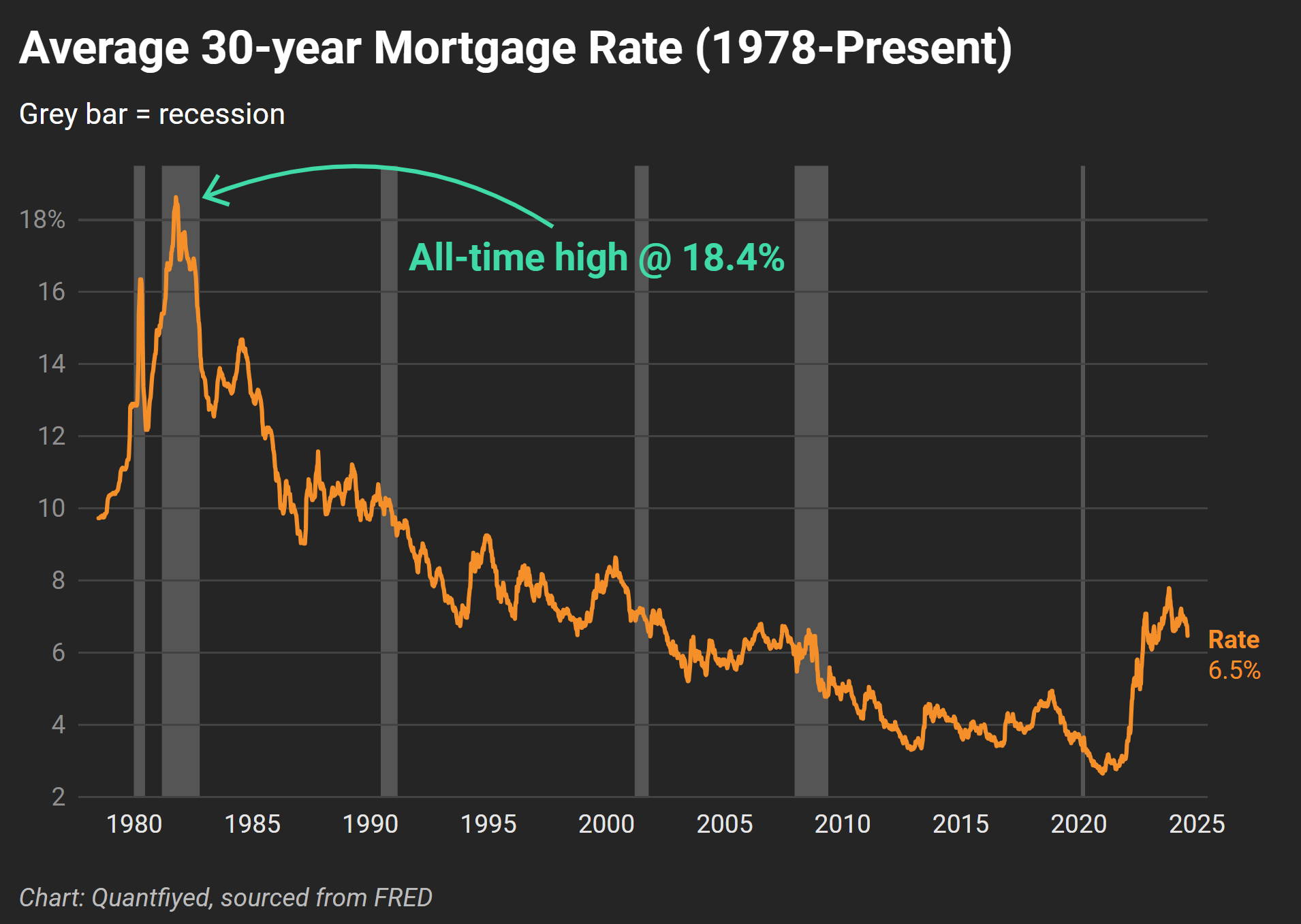

Back in the 1980s, there was actually a decent supply of homes on the market. Yeah, mortgage rates were sky-high (we're talking above 10% most of the decade), but with enough houses to go around, affordability eventually improved as rates dropped. Fast forward to today, and the script has flipped.

We’re dealing with a severe inventory shortage, which means even though mortgage rates are much lower than in the ’80s, home prices have shot up more than 50% since 2019.

Mortgage Rates and Affordability

Let’s talk numbers. In 1982, mortgage rates soared above 18%. Yet, despite these insane rates, homes were more affordable because prices weren’t as inflated as they are today.

Fast forward to 2024, and while mortgage rates sit at just below 6.5%—you’d need an income of $110,544 to afford a median-priced single-family home. That’s more than double what you would have needed in 2021, according to the NAR.

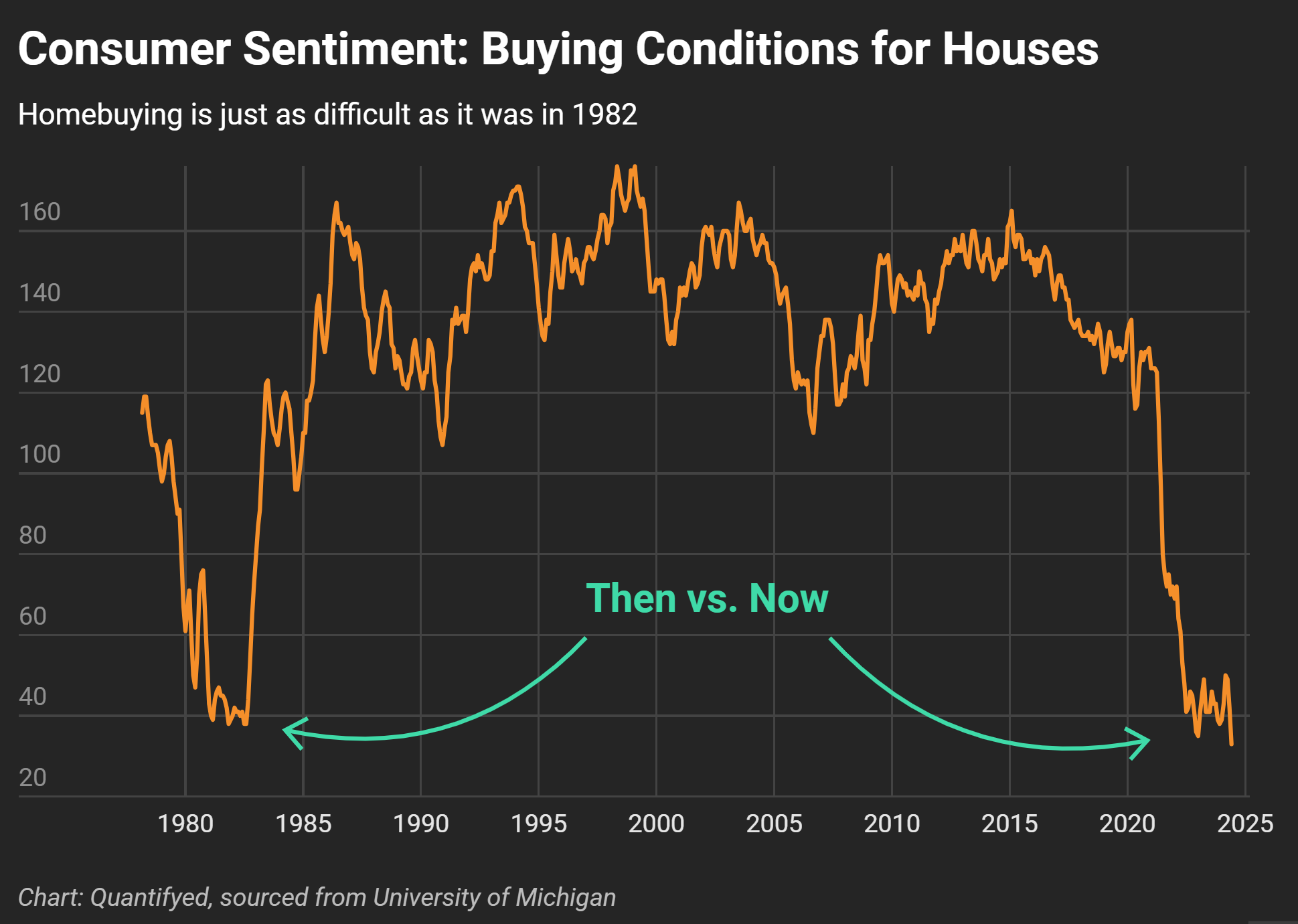

Consumer Sentiment

Back in the day, optimism was surprisingly high despite those brutal interest rates. In September 1985, 72% of consumers thought it was a good time to buy a home, according to the University of Michigan’s consumer sentiment survey.

Today? Not so much. In June 2024, that number plummeted to just 12%. The contrast is wild—it's not surprising so many millennials feel priced out of the market.

So, what does this all mean for you, the aspiring homeowner? Well, today’s market is tough. Even if mortgage rates ease by the end of the year, the persistent lack of supply is likely to keep home prices high.

The 1980s might have had their challenges, but at least there was a light at the end of the tunnel. For home-buyers today, the tunnel seems to be getting longer.