Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Momentum trading is simple: Buy winners, sell losers. Does it work though?

Momentum trading is all about buying stocks that are going up and selling those that are going down. It’s a simple strategy, but it can be a wild ride. When things are good, they’re great. But when the market changes direction, it can turn bad fast.

What is Momentum Trading? Think of momentum trading like following a trend. If a stock is on a winning streak, momentum traders jump in, hoping the streak continues. If a stock starts dropping, they sell it off quickly. There’s no digging into financial reports or worrying about long-term value—just following the trend.

How Does Momentum Trading Work? Well, there's two main ways to do momentum trading:

- Time Series Momentum: This is where you buy stocks that have been going up and sell those that have been going down.

- Cross-Sectional Momentum: Here, you compare stocks within the same group. You buy the ones doing the best and sell the ones doing the worst.

You can use momentum trading with more than just stocks—it works with bonds, commodities, and currencies too. Big hedge funds use fancy software to track these trends, but you can also do it through special ETFs.

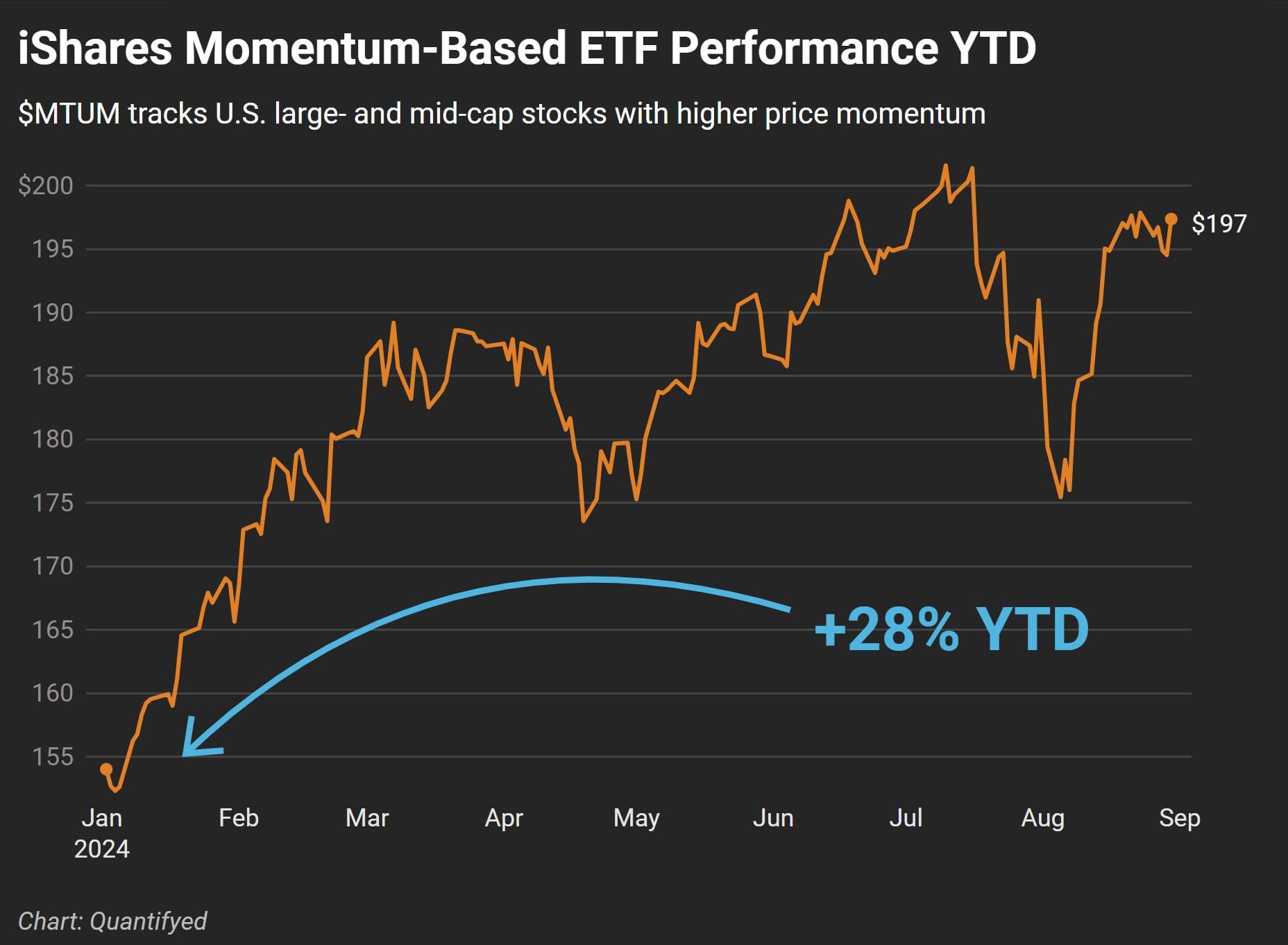

The Ups and Downs of Momentum Trading: Momentum trading can be risky and exciting when the market is moving in your favor. This year, the iShares US Momentum ETF ($MTUM) is up 28% year-to-date, much higher than the S&P 500s 19%.

What Happened in July and August?

In July and August, momentum trading hit a rough patch. As market uncertainty grew, many trades that were doing well suddenly went the other way. Those betting on big tech stocks, falling bonds, and a weak yen got hit hard when the trends reversed. The $MTUM ETF, which was heavy on tech stocks like Nvidia, saw a big drop.

So, is momentum trading still a smart move, or are we getting a warning sign for something bigger?