Featured Posts

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Every time the market rallies to new highs, people start asking the same question: Are we in a bubble? And every time, the answer is basically the same: maybe, but we won’t know until it pops. That’s how bubbles work. They never feel obvious in real-time. The 1999

Markets are trying to recover after last week’s selloff, but the gains are small. As of this morning, the S&P 500 and Russell 2000 are both up just 0.03%, the Dow is up 0.11%, and crude oil is climbing 0.2%. Meanwhile, the Nasdaq 100

The market’s winning streak just hit a roadblock. Trump’s latest tariff threats, floating a 25% tax on auto, semiconductor, and pharmaceutical imports are shaking stocks today. With growing inflation concerns, market's are guessing whether this could push back Fed rate cuts in 2025. Here’s what’

The Nasdaq-100 futures dropped 3% this morning, one of the steepest declines in years. Nvidia is down 10% after news broke about DeepSeek, a Chinese AI startup that developed a $6 million AI model.

Investors are questioning whether U.S. tech companies’ massive AI spending can compete with cheaper alternatives.

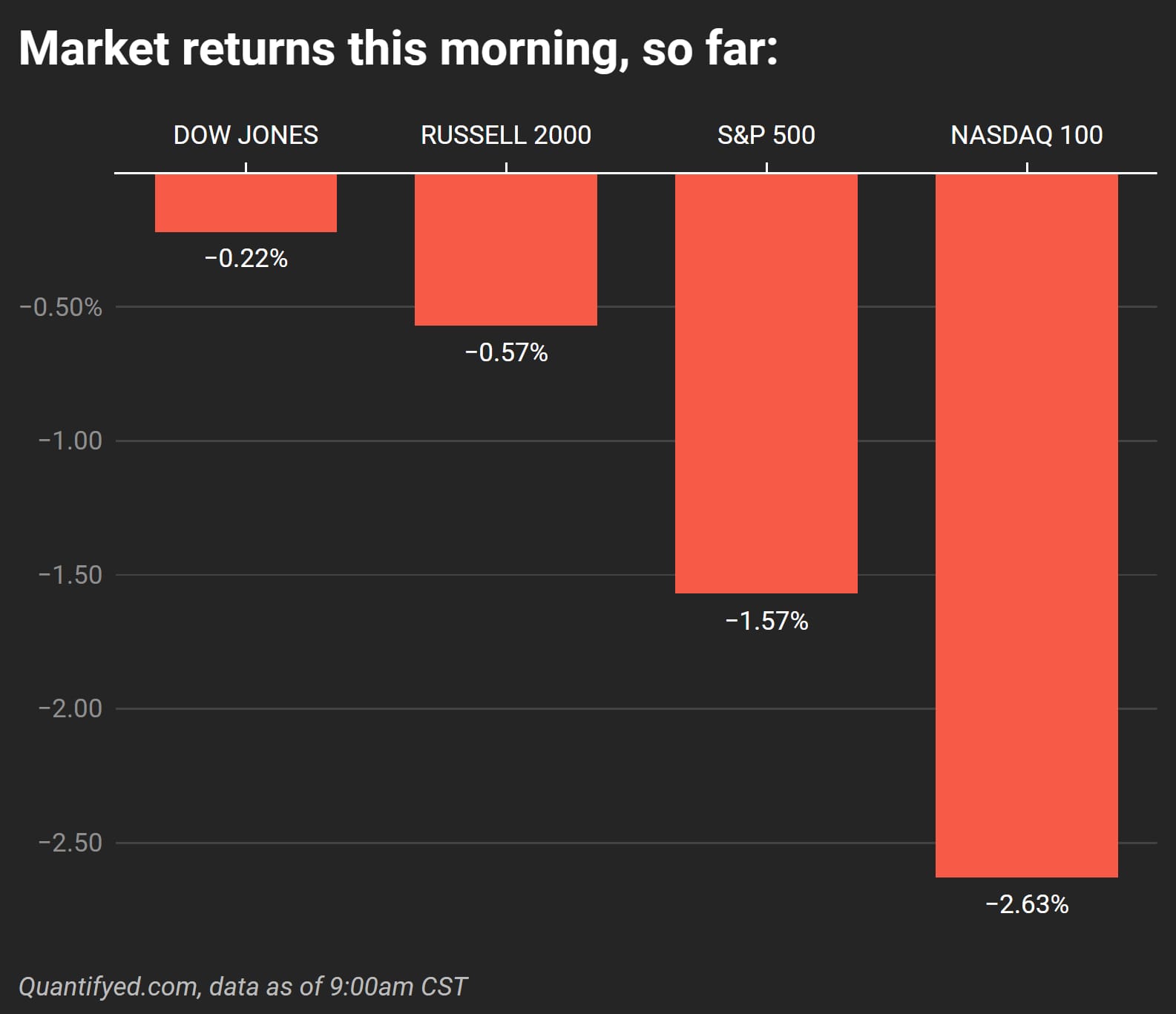

Market Returns This Morning

DeepSeek’s AI model could be the reason why markets are shaking. Here’s how major indices are performing:

- Nasdaq-100: -2.63%

- S&P 500: -1.57%

- Russell 2000: -0.57%

- Dow Jones: -0.22%

What Is DeepSeek?

DeepSeek developed a high-performing, open-source AI model for just $6 million. That’s a fraction of the billions spent by tech giants like Nvidia and Microsoft.

The model reportedly performs on par with the most advanced AI systems. This puts serious concerns about big tech’s expensive spending. If startups like DeepSeek can deliver similar results for far less, it would disrupt the entire industry.

Nvidia Leads the Sell-Off

Nvidia’s stock dropped 11% this morning.. wow. It fell from $142 to $125.70, easily wiping billions off the market.

As the leader in GPUs, critical to train large AI models, Nvidia is especially vulnerable to cheaper competition (like DeepSeek)

Is AI Expensive?

DeepSeek’s success forces us to ask: are AI stocks overvalued?

Investors will be watching earnings reports from Microsoft, Meta, and Tesla; which are all set to report on Wednesday after market close.

Key Takeaways:

- DeepSeek’s $6M AI model is challenging the heavy-spending from U.S. tech companies

- Nvidia dropped 10%, leading a 2.6% decline in the Nasdaq-100, with ripple effects across tech stocks

- Investors are rethinking whether AI valuations can hold up despite cheaper alternatives