Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Today’s a big day for two tech giants—Nvidia and Salesforce—they’re set to release earnings. While most attention is on Nvidia, Salesforce has an important update that could impact the market.

Today’s a big day for two tech giants—Nvidia and Salesforce—they’re set to release earnings.

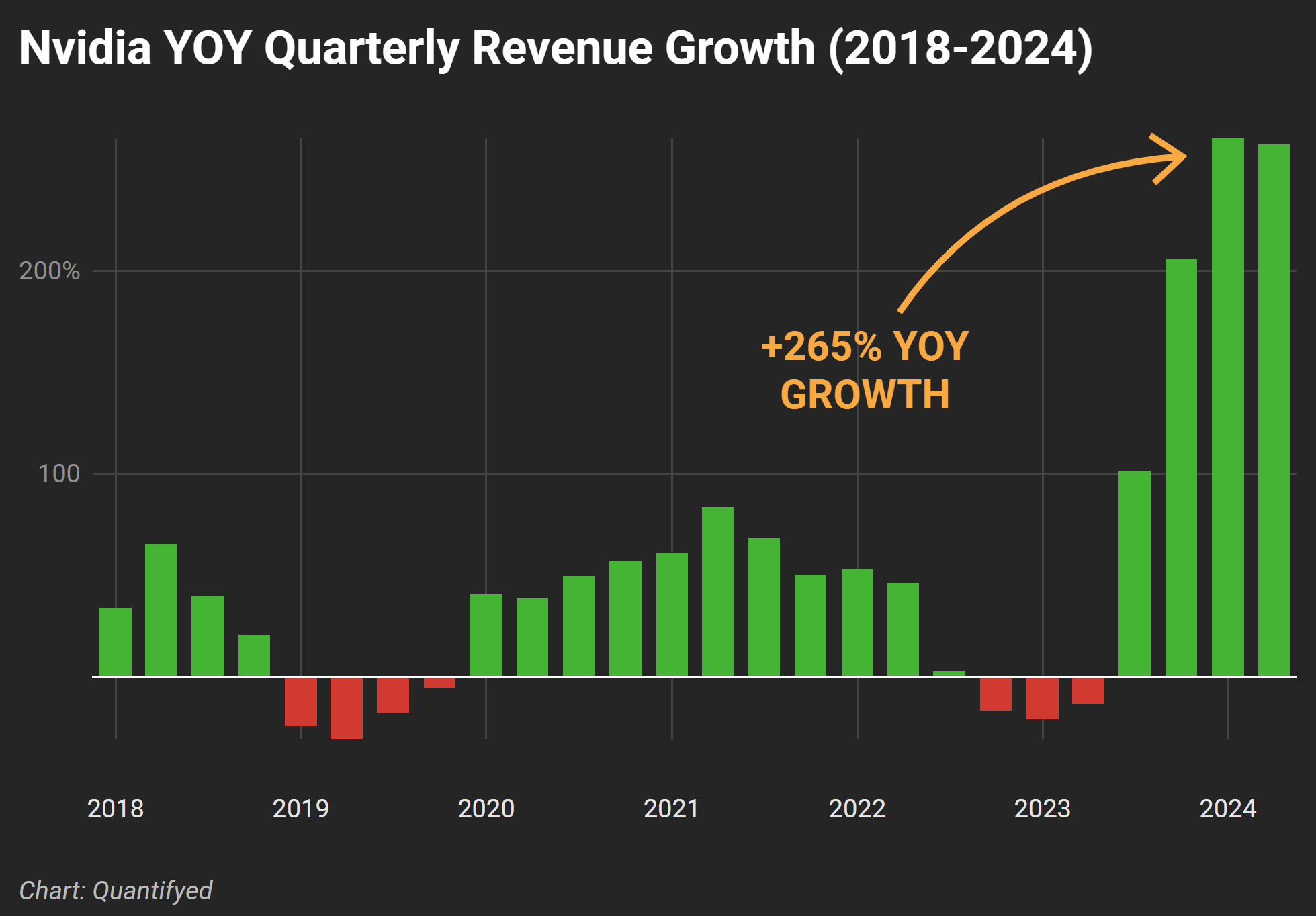

Nvidia has had a wild ride recently. Its market cap has skyrocketed, growing by nine times since 2023 thanks to its role in the AI boom. But after hitting a record high in June, the stock dropped 30%, wiping out $800 billion in market value. Now, Nvidia’s stock is back up, sitting just 6% below its peak.

The company has posted triple-digit revenue growth for the past three quarters, and today, they’re expected to report another 112% increase year-over-year, bringing in $28.7 billion. However, things might slow down next quarter, with expected growth dropping to 75%.

The big question is whether Nvidia can keep up this momentum. A lot of its revenue comes from cloud providers, who account for 40% of Nvidia’s sales. Former Google CEO Eric Schmidt mentioned that top tech companies are spending $20 billion, $50 billion, even $100 billion on Nvidia processors.

And for good reason—Nvidia’s CFO said that for every $1 spent on their chips, these companies could make $5 in revenue over four years.

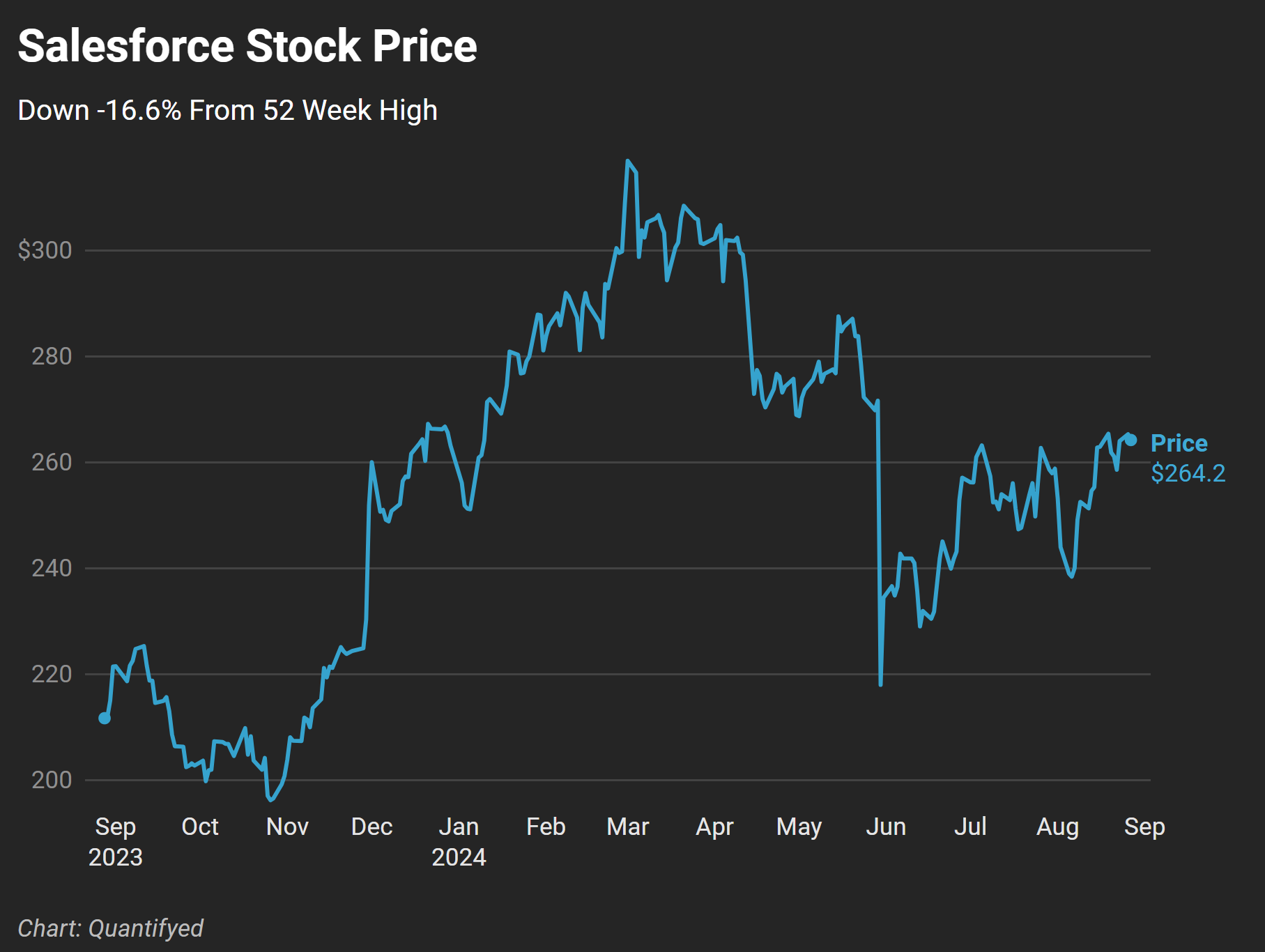

While Nvidia gets most of the attention, Salesforce is also reporting its earnings today. The company had a rough start to the year, with its stock dropping 20% on May 30th after a disappointing first-quarter report.

Still, analysts are expecting Salesforce to post second-quarter earnings of $2.35 per share on revenue of $9.22 billion, up from $2.12 per share on $8.6 billion a year ago.

Salesforce’s stock is up just 0.8% year-to-date, compared to the S&P 500’s 18% gain. Also, the real focus for Salesforce could be its AI initiatives, especially Einstein GPT, which it launched in March 2023.

As these earnings reports come out, there are a few things to keep an eye on. For Nvidia, it’s all about whether they can keep the AI momentum going and whether their revenue forecast for the next quarter meets expectations. For Salesforce, the focus could be on how well they’re doing with their AI strategy.