Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

Never did I think in a million years Nvidia would make their competitors support their own business. Let's dive into how Nvidia is compelling their customers to help build its cloud business.

Nvidia, traditionally a hardware giant known for its powerful AI chips, is making a bold move to transition into software. This shift is crucial for Nvidia since it needs to sustain demand and avoid the pitfalls that other hardware companies have faced in the past.

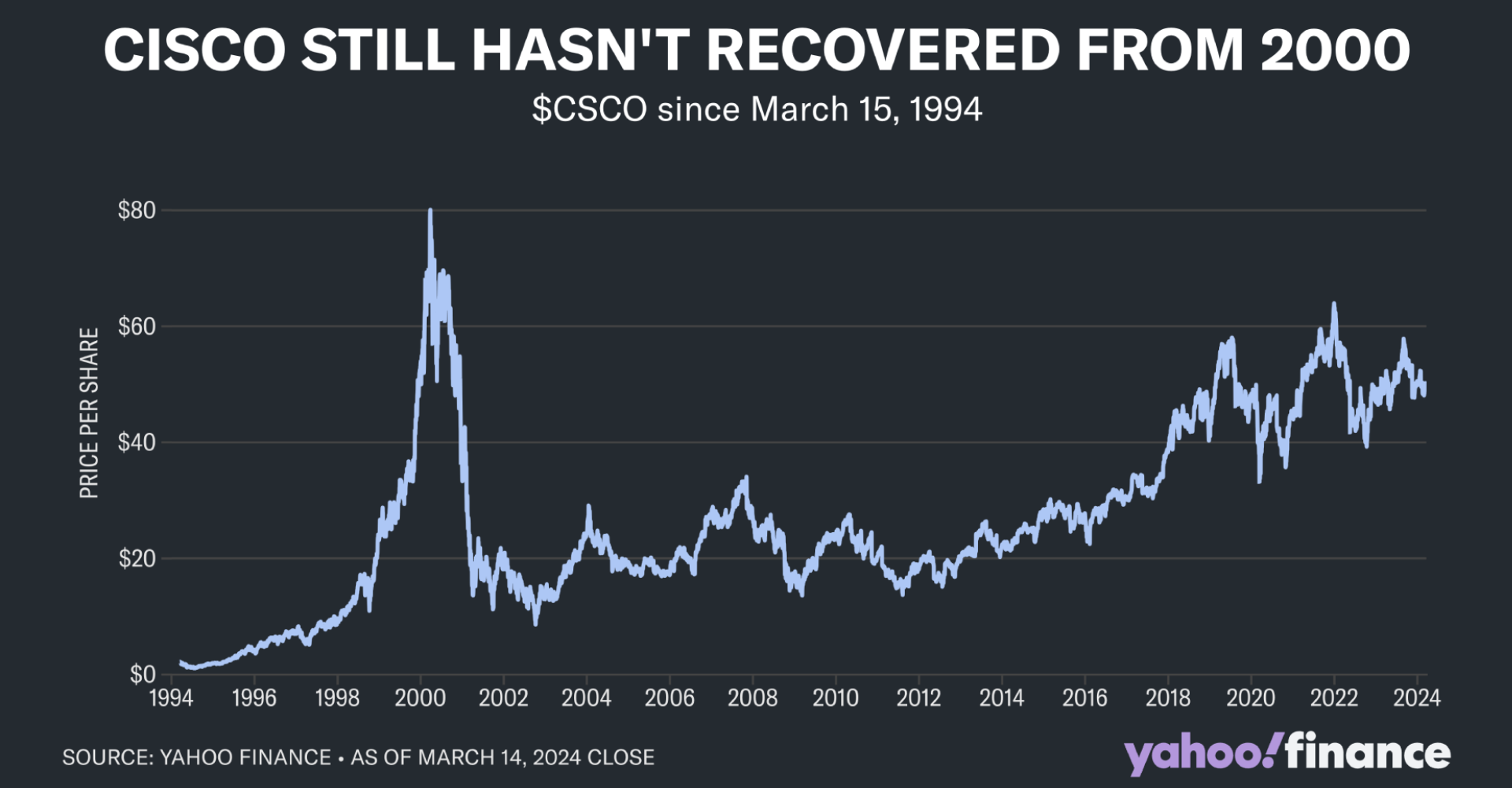

Quick History Lesson about Cisco and Apple

- Cisco: During the dot-com bubble, Cisco's market cap exceeded $500 billion, but after the bubble burst, its stock plummeted by over 80%. Despite revenue growth, Cisco never transitioned from hardware to software, leading to a huge decline in value.

- Apple: Unlike Cisco, Apple was able to migrate from hardware to software and services, such as iCloud and Apple TV, boosting it's long-term revenue growth.

"DGX Cloud has entered the chat"

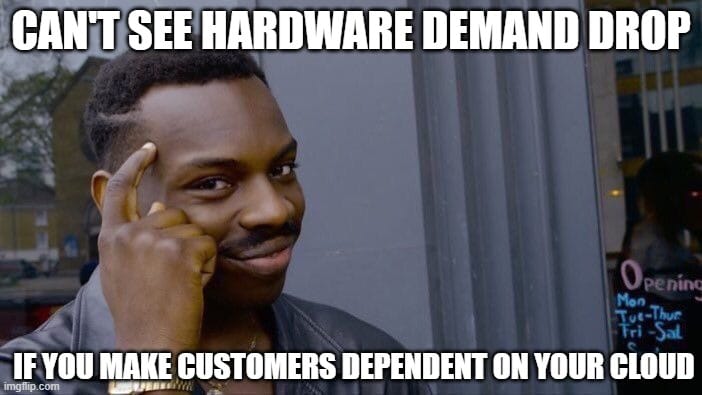

Nvidia knows their hardware will lose demand soon, and to sustain their demand, they created their own cloud business, DGX Cloud. By leveraging its monopoly in AI hardware, Nvidia pressured Amazon and several other companies into building DGX Cloud.

By pushing DGX Cloud onto other companies infrastructure, Nvidia essentially told customers, "Play by our rules, or we'll take our chips to someone who will."

This is especially conflicting for Microsoft and Amazon that also own cloud businesses.

This could have caught the attention of the Department of Justice (DOJ), which recently opened an antitrust investigation into Nvidia's practices.

Nvidia's aggressive tactics extend beyond companies like Microsoft and Amazon. They're now requiring customers to build out more space to house the GPUs they purchase, even dictating how to position the racks holding these GPUs.

This increases the cost and difficulty of switching services, effectively locking customers into Nvidia's ecosystem.

The question for investors in Nvidia is if they can successfully make the leap from hardware to software; a leap that doesn't break rules.

Do you think Nvidia can replicate success of companies like Apple, that transitioned from hardware to → software?