Featured Posts

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Office buildings are emptier than ever, reaching the highest vacancy rates in a decade.

Looks like our offices are now just fancy storage units.. Anyways, I'll dive into the reasons behind the rising office vacancies, the impact of hybrid work, and cities leading in both high and low vacancy rates.

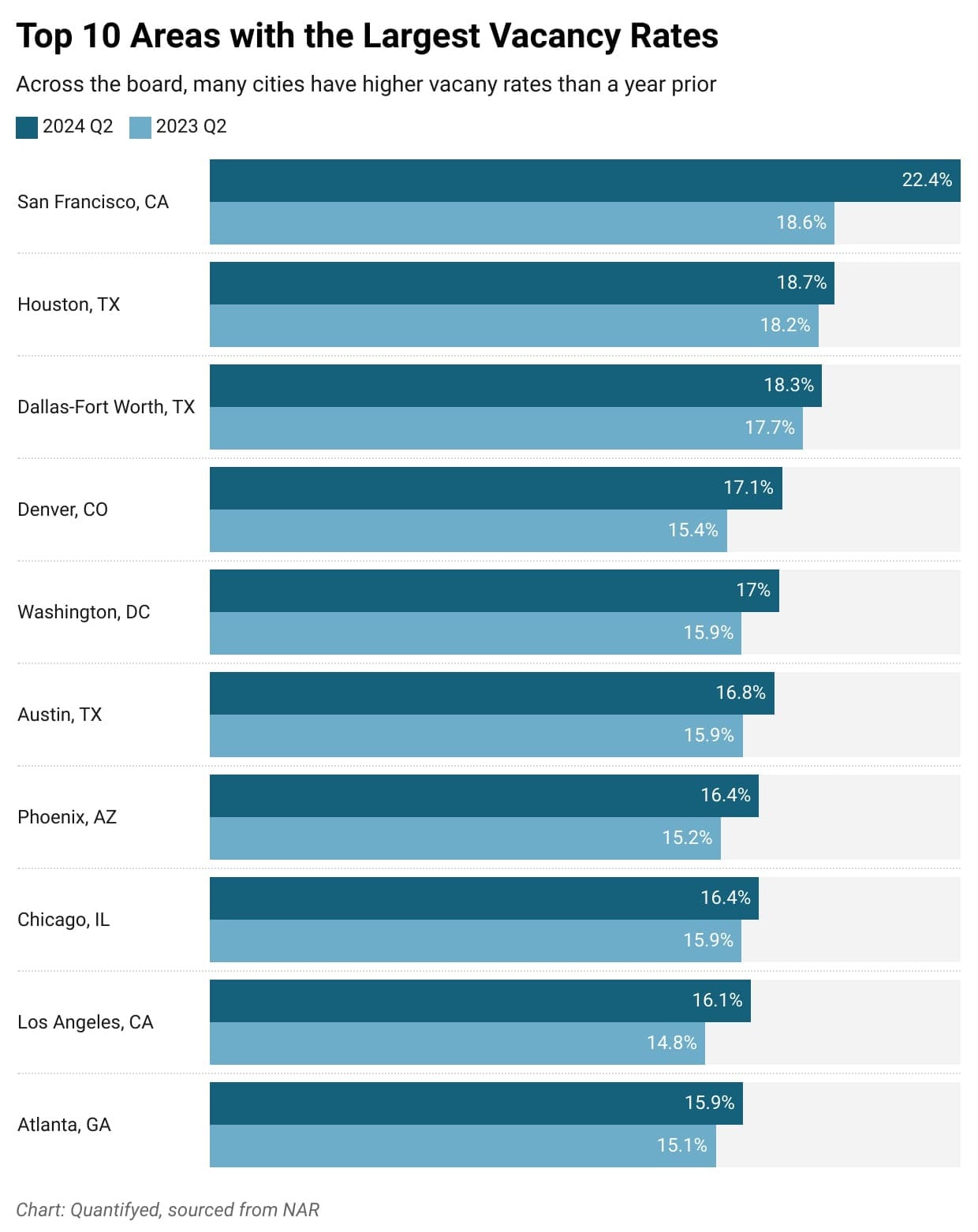

Rising Vacancy Rates: The office vacancy rate has reached a decade-high of 13.8%, up 0.8% from last year. Cities like San Francisco (22.4%) and Houston (18.7%) are leading the charge with the highest vacancy rates.

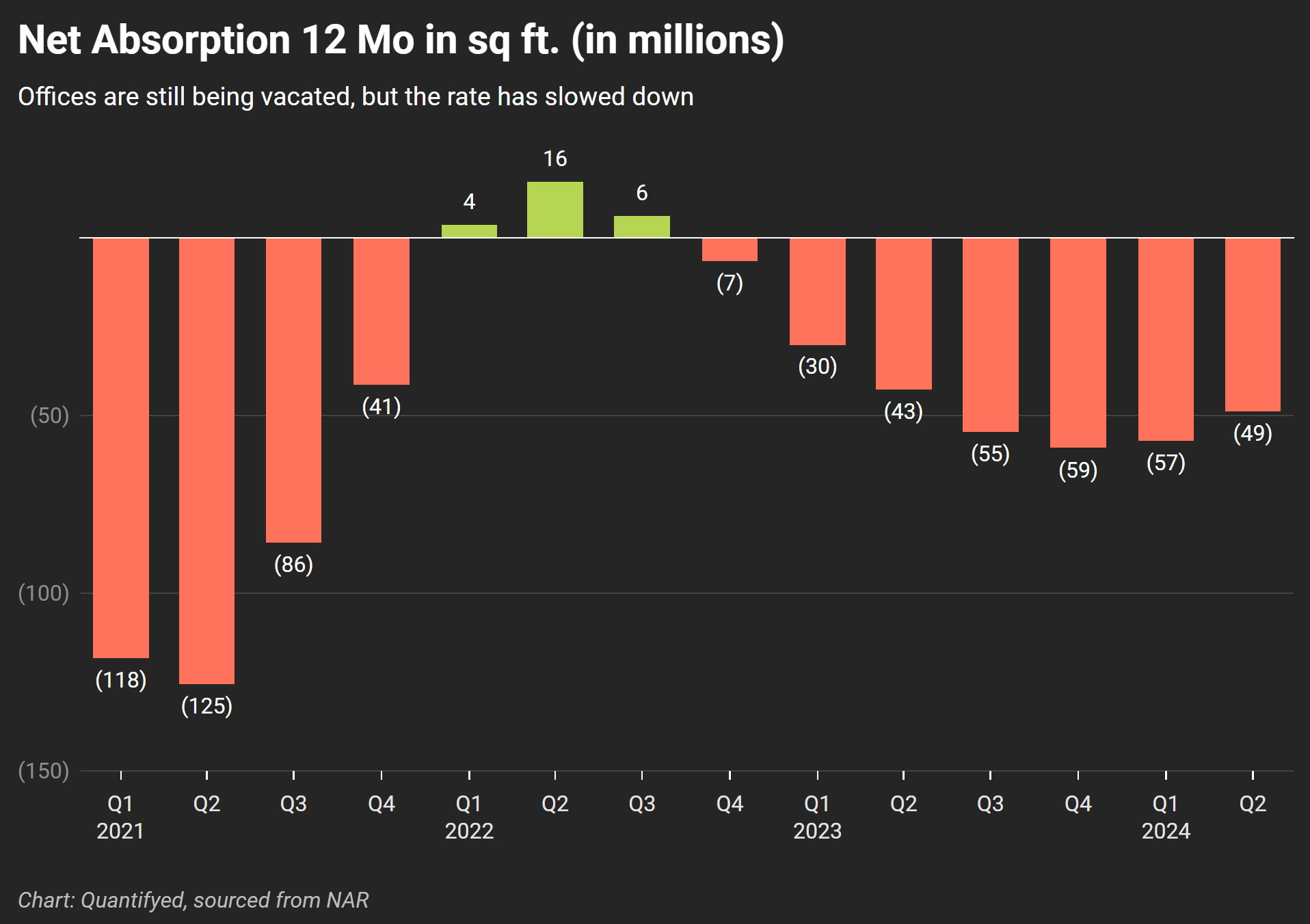

Impact of Hybrid Work: Since hybrid work has become the norm, it's reduced our need for office space. In the last quarter, if we look at the net absorption of office space, it's dropped by -48.9 million sq.ft.

Net absorption refers to the amount of office space leased versus the amount vacated, essentially showing that more office space was vacated than leased.

However, there is a silver lining. The rate of increasing losses in square footage seems to be bottoming out, as shown in the chart below 👇

Top Cities with High & Low Vacancy Rates: Looking at cities with the highest and lowest office vacancy rates reveals an interesting secret. Major tech hubs like San Francisco, Houston, and Dallas-Fort Worth have the highest vacancy rates, influenced by our shift to remote and hybrid work.

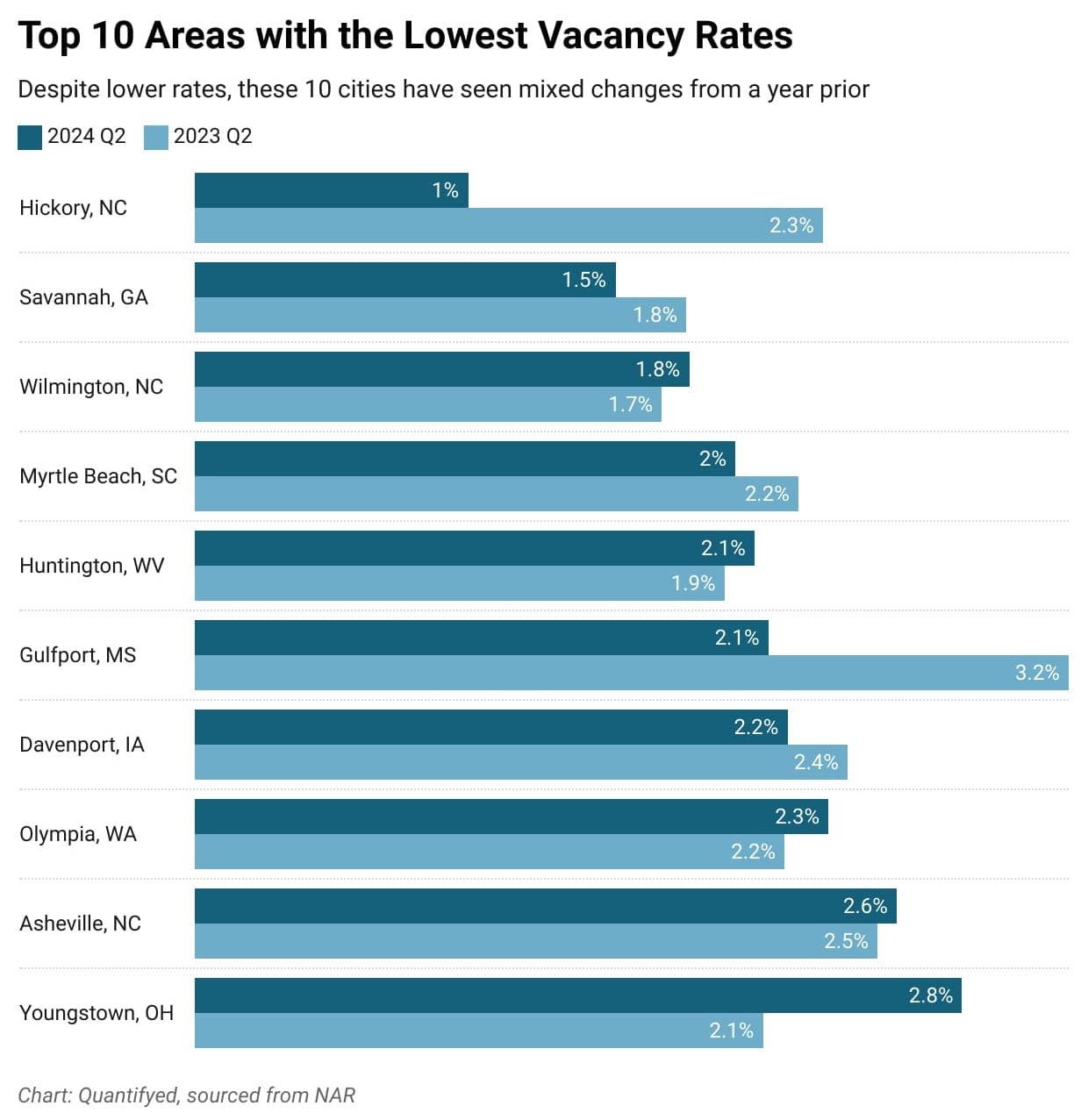

In contrast, cities like Hickory, NC (1.0%), and Savannah, GA (1.5%) have the lowest vacancy rates, likely because of smaller office markets.

San Francisco's vacancy rate skyrocketed to 22.4% in 2024 Q2 from 18.6% a year prior. Similarly, Houston's vacancy rate increased to 18.7% from 18.2%. The reasons are multifaceted but largely revolve around the tech industry's massive shift to remote work, making companies reassess the need for office space.

On the other end, Hickory, NC, saw its vacancy rate drop to an impressive 1.0%, down from 2.3% a year earlier. Savannah, GA, also saw a decline to 1.5% from 1.8%. These cities are attracting businesses looking for lower operational costs and smaller, more affordable office markets.

It's clear businesses are moving to areas with lower costs, contributing to the rise in vacancies in these major hubs.

All in all, office vacancy rates are at a decade-high, partly driven by hybrid work and shifting business locations. What do you think the future holds for office spaces in your city?