Join 1000+ other investing insiders

Quantifyed is a weekly newsletter breaking down markets with simple, easy-to-read charts.

Snapshots

What's a Snapshot? It's our quick, 30-second breakdown of a market trend.

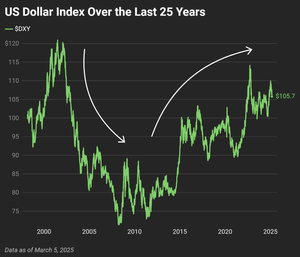

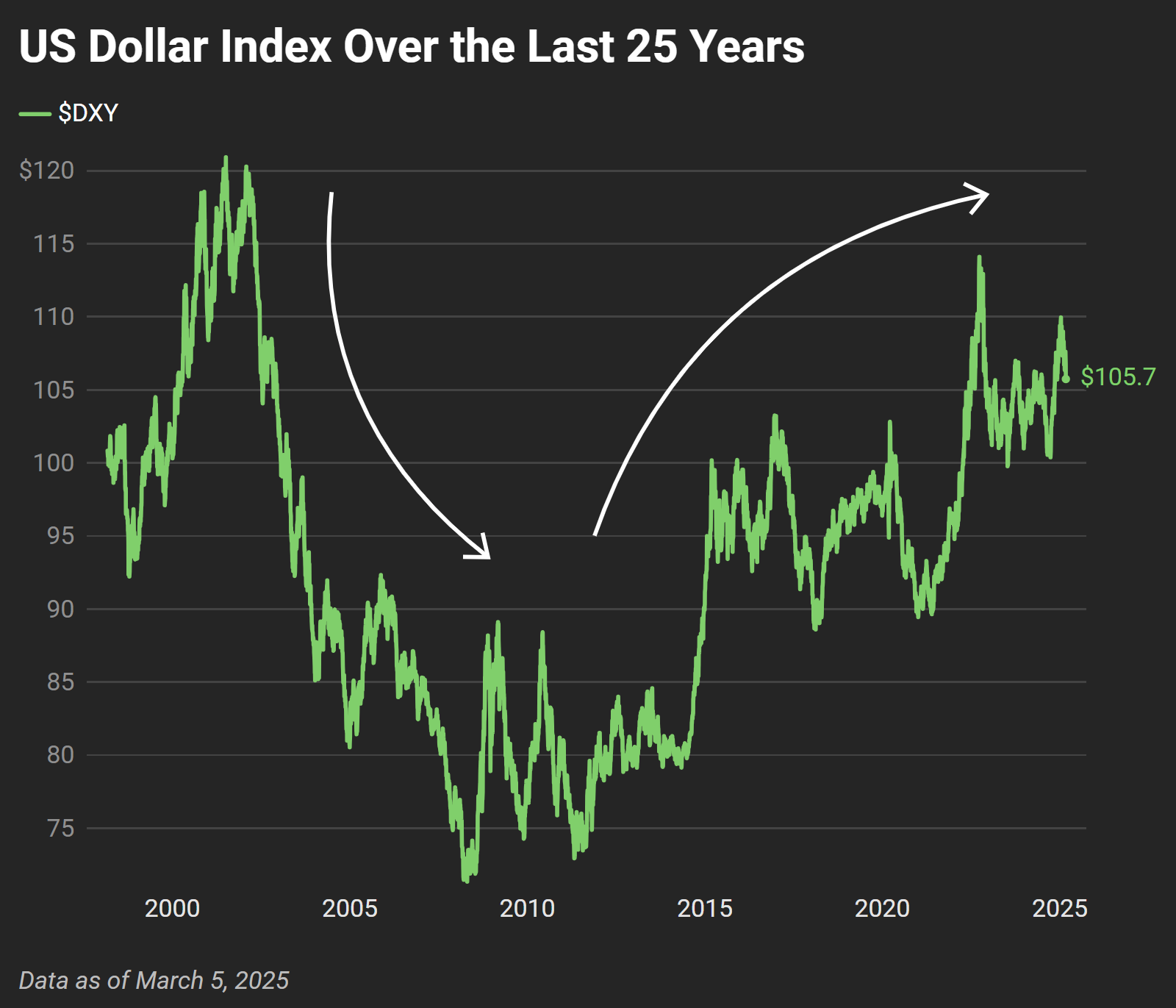

The US dollar is coming off one of its strongest periods in history. Years of low interest rates and global reliance on the U.S. financial system have made it the dominant asset in global trade.

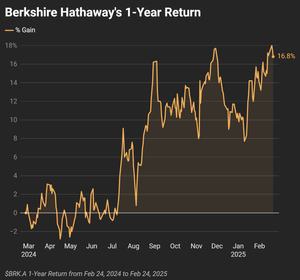

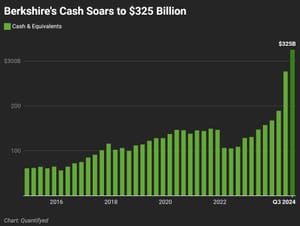

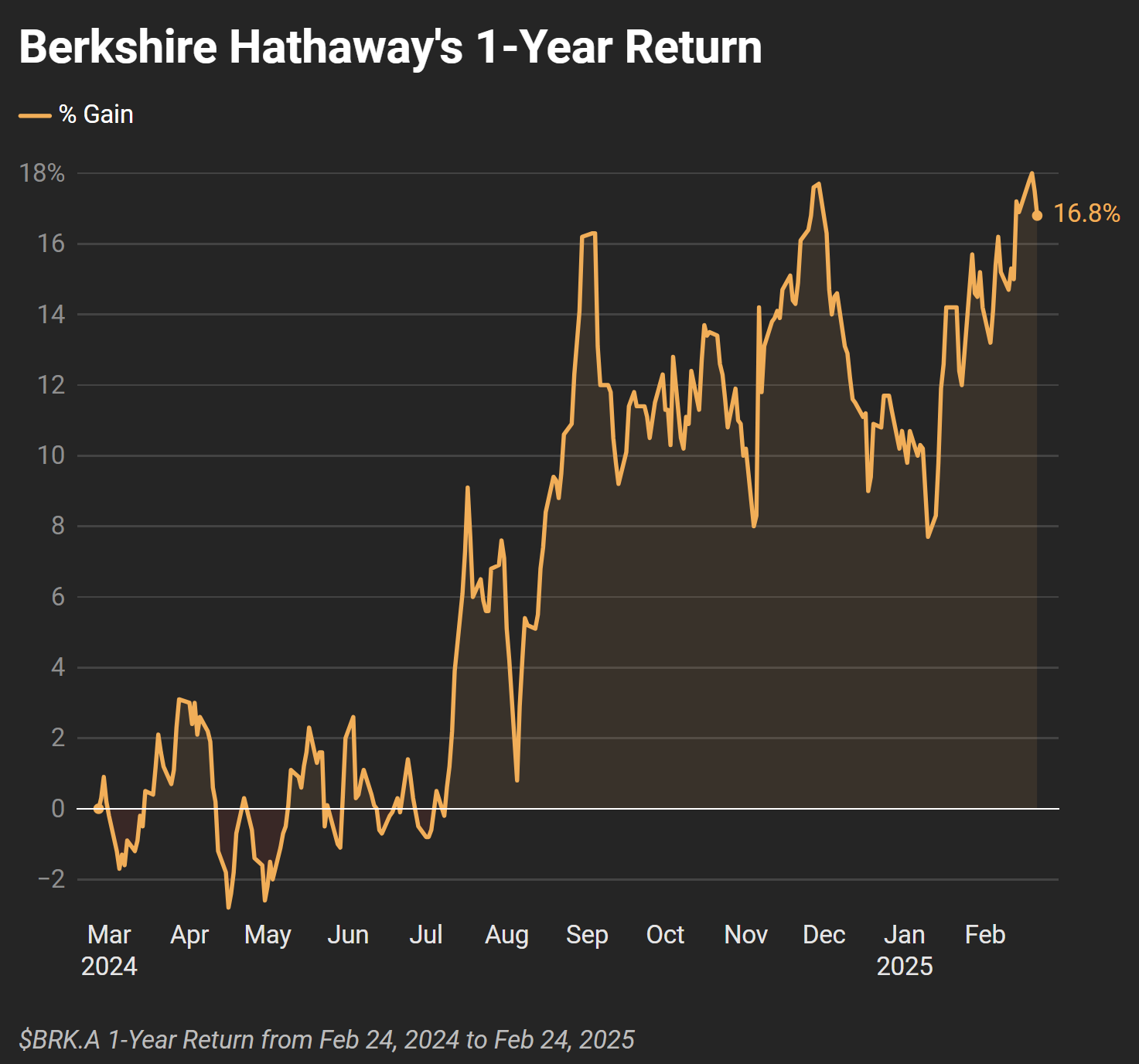

Berkshire Hathaway has been quietly crushing it this year. Warren Buffet's company posted record insurance profits after their earnings report last week.

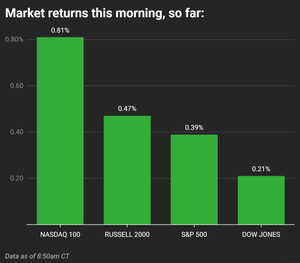

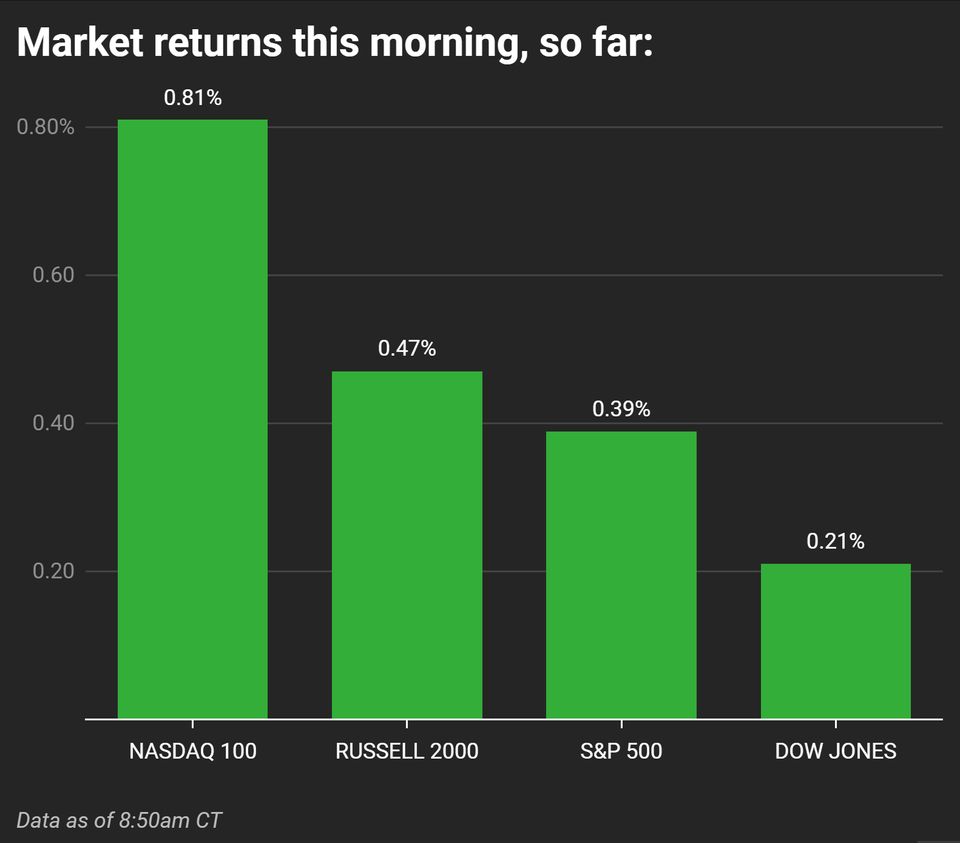

Despite Trumps' 25% tariff threats on steel and aluminum, markets don't believe it.

This morning, the S&P 500 is up 0.39%, just down 1% of it's recent all time high.

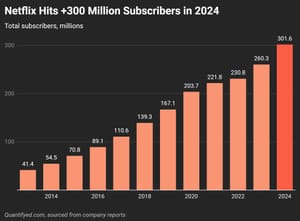

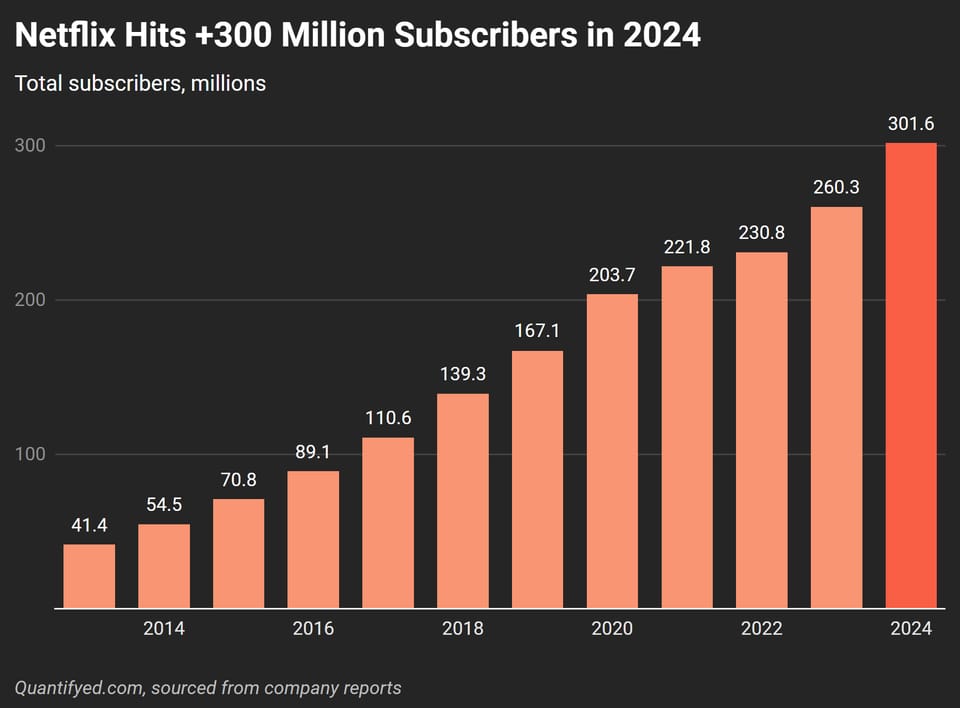

Netflix crushed Q4 earnings with $10.25B in revenue (+16% YoY) and 301.6M subscribers globally. EPS doubled, and net income nearly did too.

The Jake Paul vs. Mike Tyson fight and Squid Games 2 helped fuel the surge. Streaming wars are heating up, and Netflix is clearly leading:

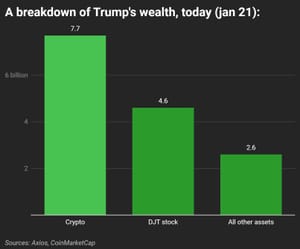

Trump’s holdings in $TRUMP Coin are worth around $7.7 billion, making it his biggest single asset.

To put that in perspective, his $DJT stock is valued at $4.6 billion, and the rest of his assets add up to $2.6 billion, per Axios.

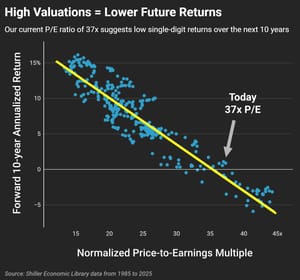

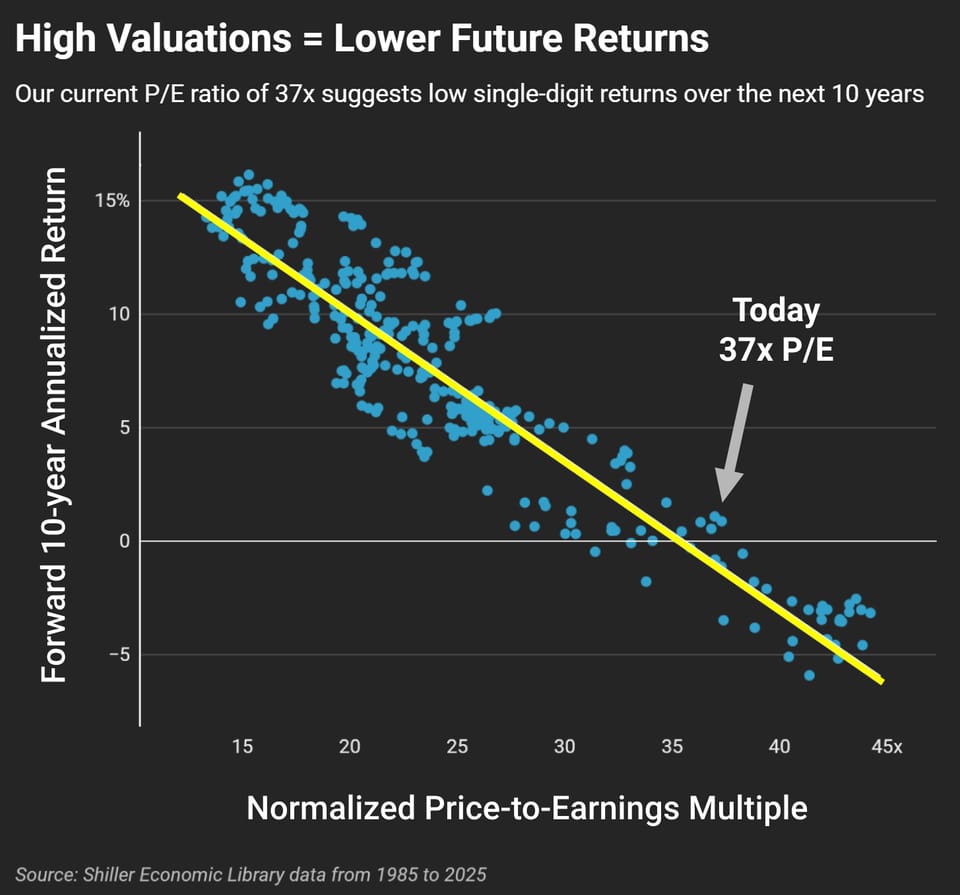

The S&P 500 is now trading at 37x earnings—one of the most expensive markets ever.

Why does that matter? When valuations get this high, future returns tend to drop.

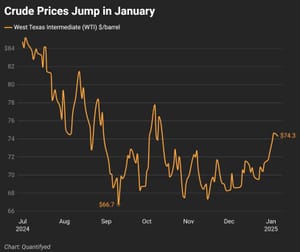

Oil prices are spiking again. WTI crude is up 2%, hitting $74.30 a barrel (now $75 this morning), and its highest in three months.

Severe winter weather has tightened U.S. crude supplies, adding pressure to markets.

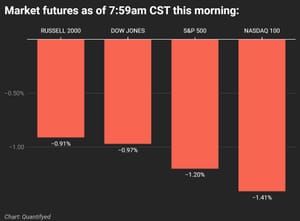

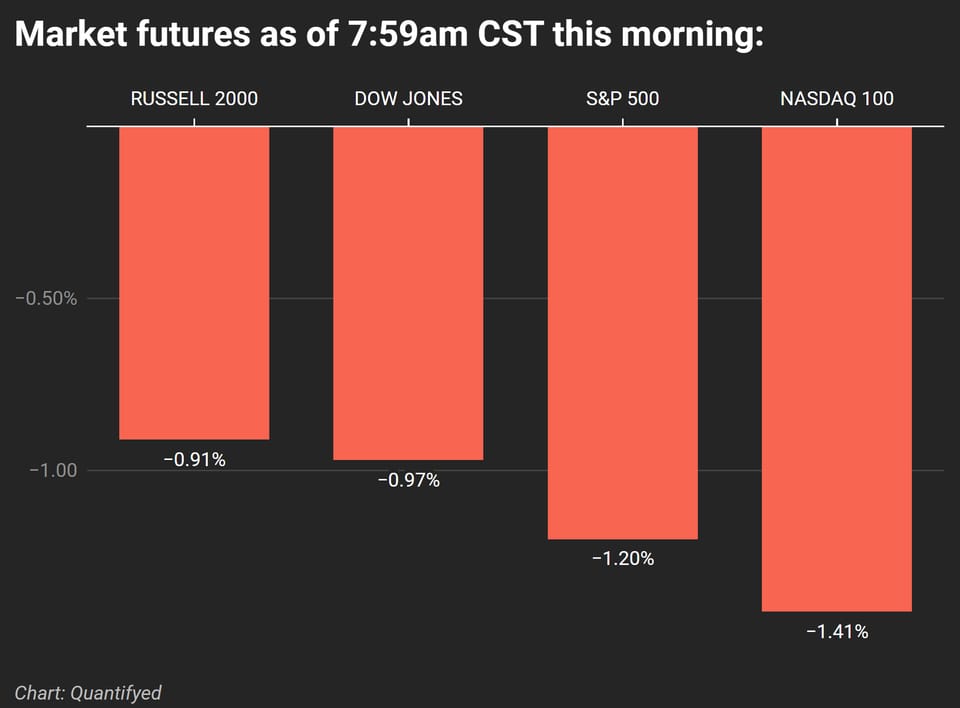

Markets are off to a rough start on the last trading day of 2024. Here’s where the major futures stand:

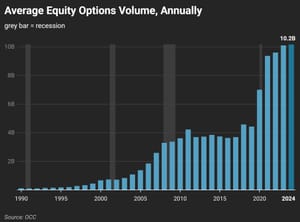

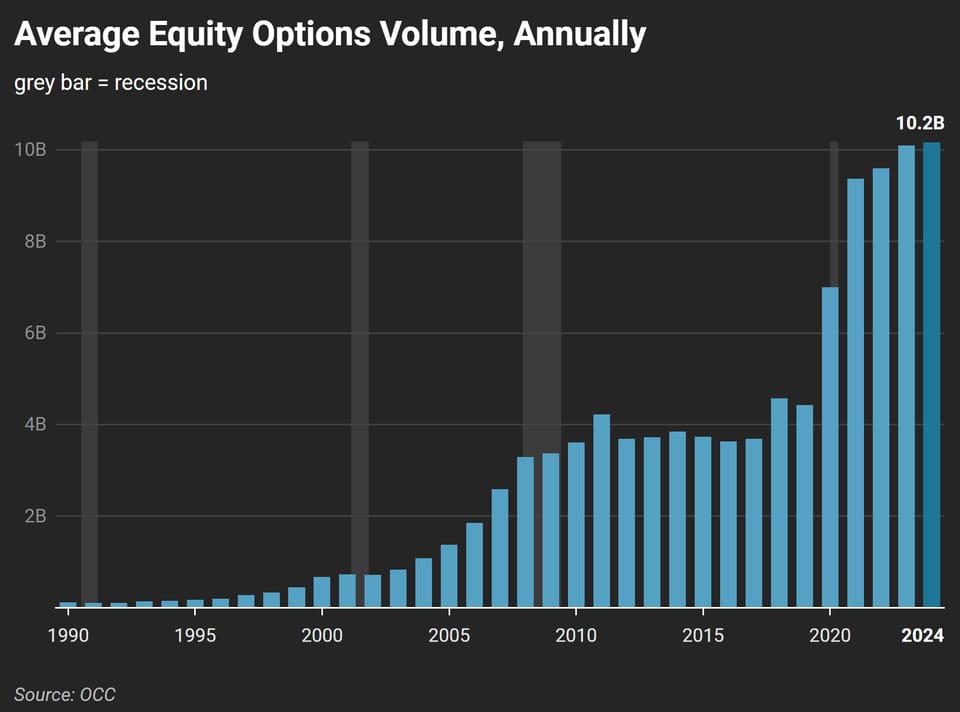

Options are taking over fast:

10.2 billion contracts were traded in 2024 .. a new record

Retail traders make up 29% of all options activity, way more than just a few years ago

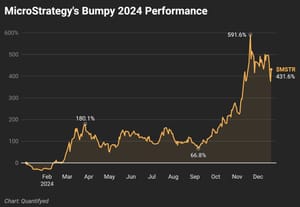

Starting today, MicroStrategy joins the Nasdaq-100—and its 2024 performance has been wild: +431.6% year-to-date

CEO Michael Saylor has been on a Bitcoin buying spree since Aug 2020, turning MSTR into less of a tech stock and more of a crypto proxy.

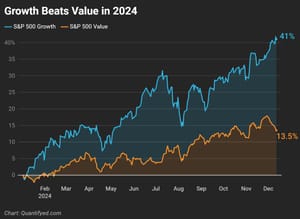

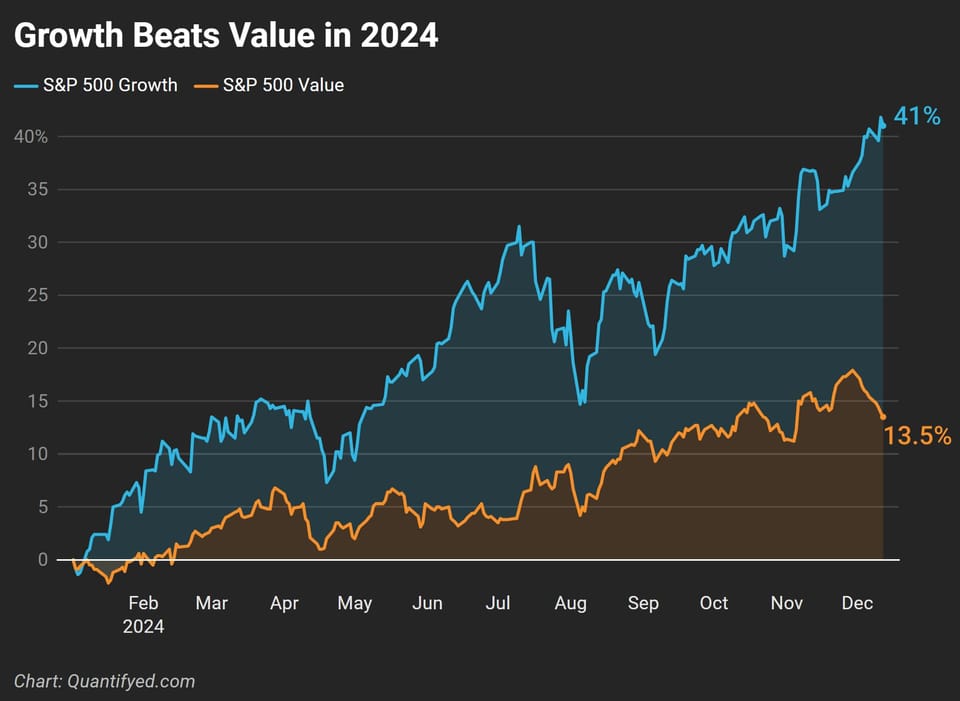

Value stocks are struggling to keep up. While the S&P 500 Growth Index has gained 41% YTD, the Value Index is up just 13.5%.

Healthcare and financial stocks have been major drags on performance, too.

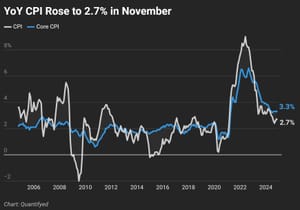

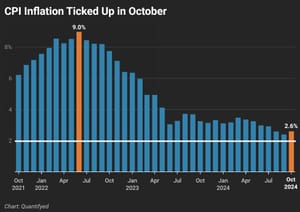

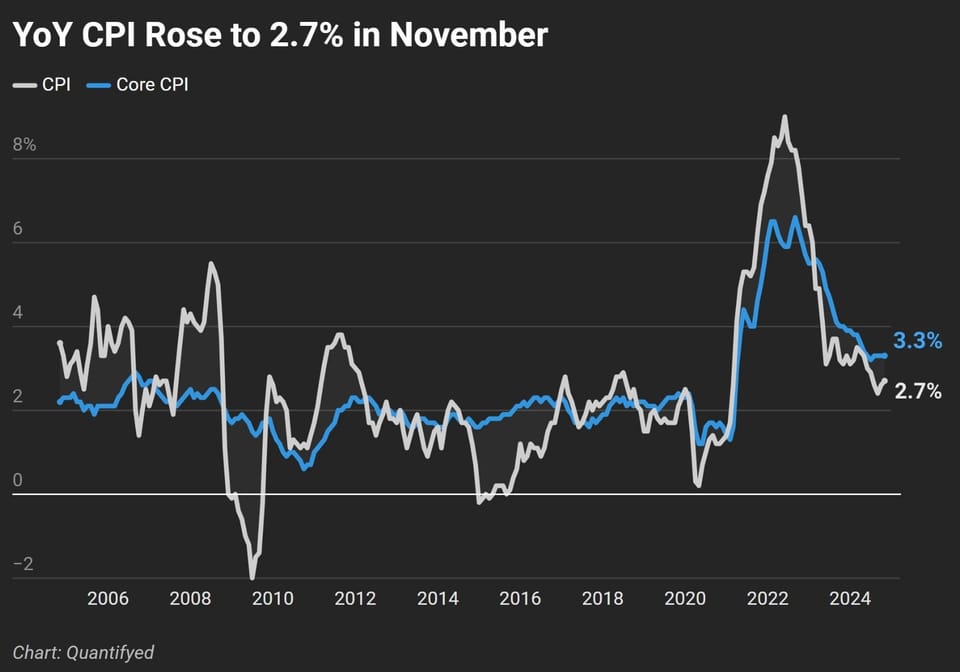

Headline CPI ticked up to 2.7% YoY in November, up from 2.6% in October. Core CPI held steady at 3.3%.

While inflation is well below its highs from last year, it’s still above the Fed’s 2% target—and now at its highest level since July 2024..

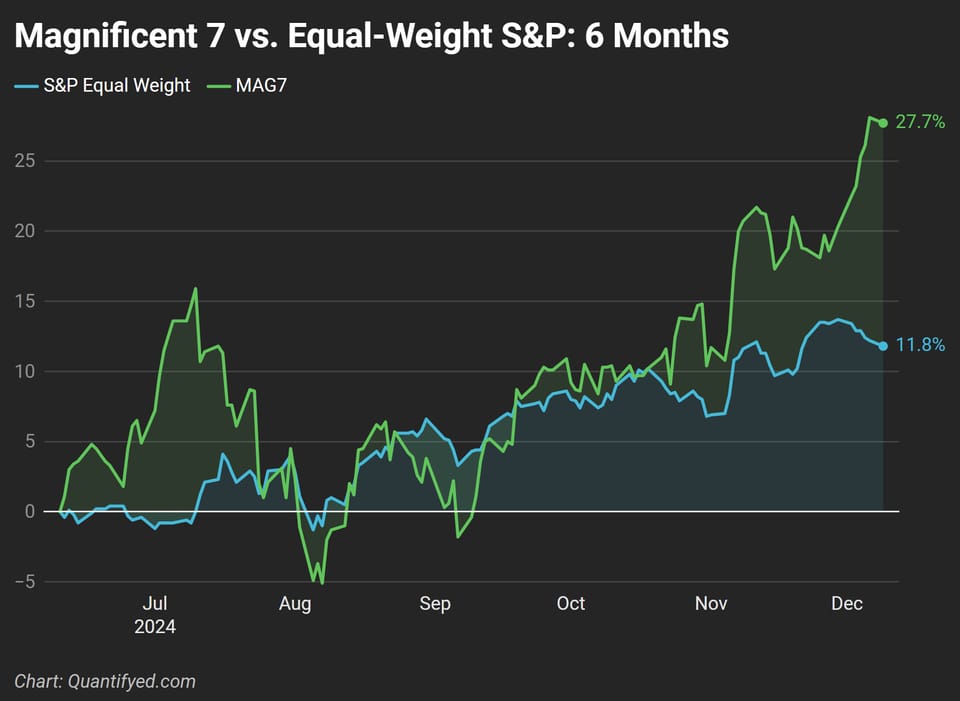

The Magnificent 7 are crushing it.

In the past 6 months, the Equal Weight MAG7 index is up +27.7%, while the Equal Weight S&P 500 is up +11.8%...

In the last 10 years, an equal weight port of TSLA, AMZN, GOOGL, AAPL, META, MSFT, and NVDA would’ve returned 39.8% annually

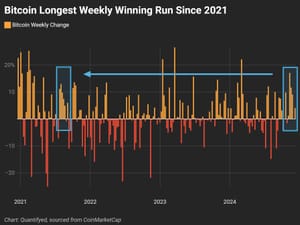

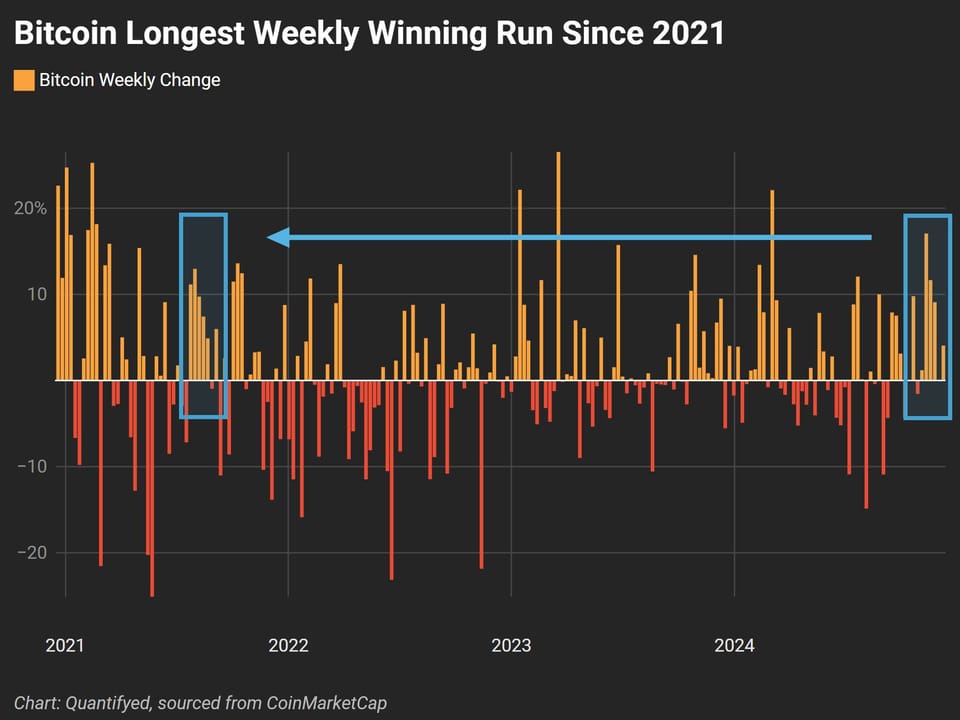

Bitcoin’s longest winning streak since 2021.. Six weeks of gains.

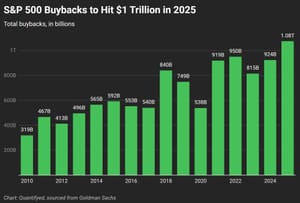

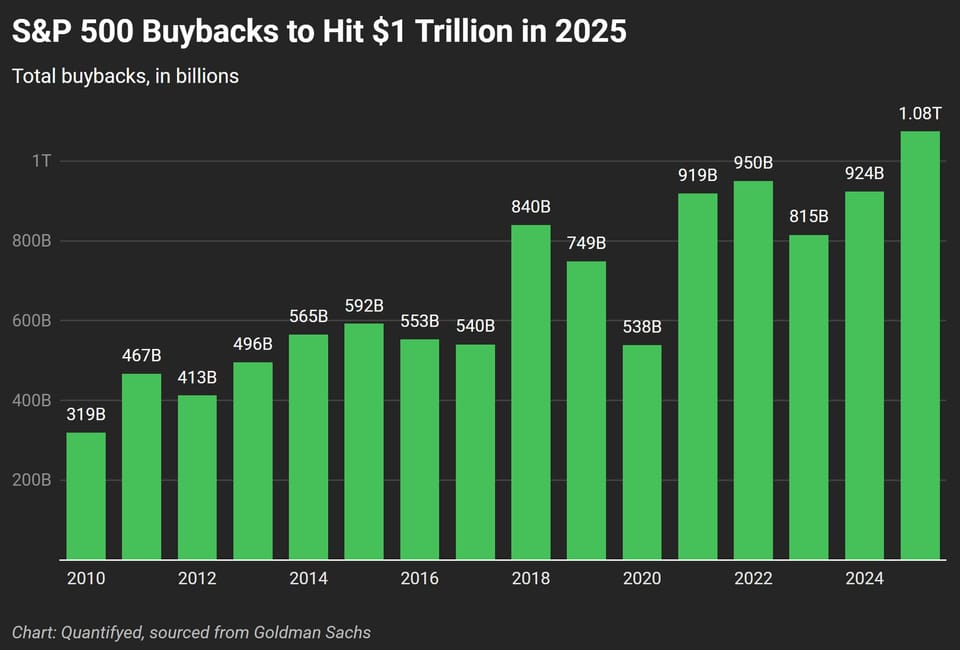

Corporate America spent $924 billion on buybacks in 2024, just shy of the $950 billion record set in 2022.

Projections for 2025 suggest buybacks will surpass $1.08 trillion, the highest ever, according to Goldman Sachs.

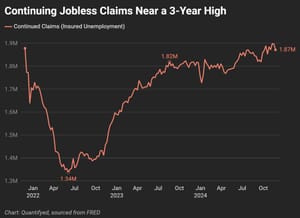

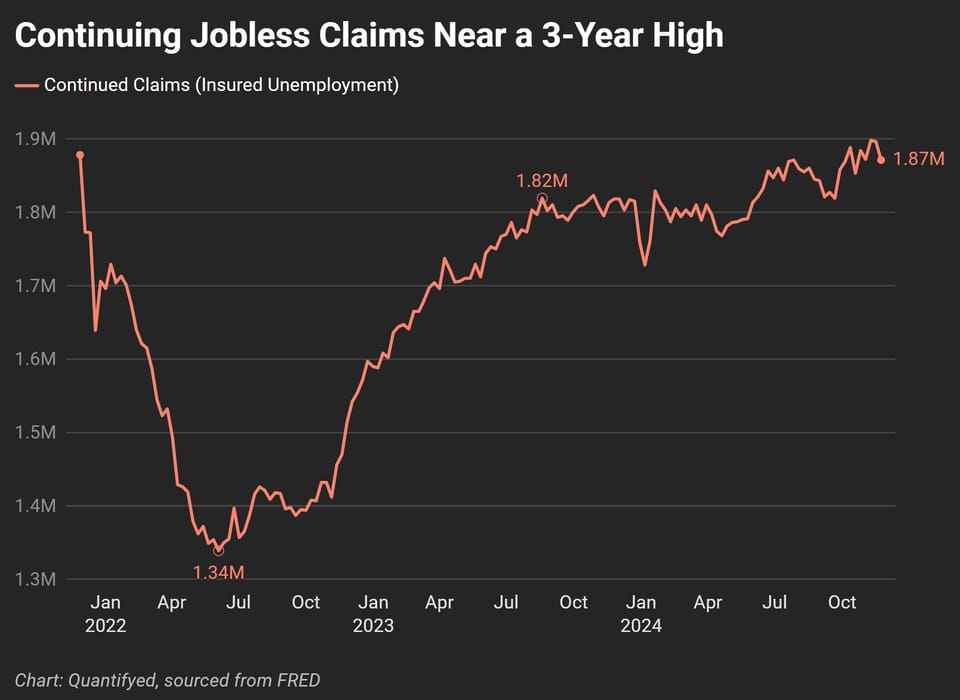

Continuing jobless claims fell to 1.871M vs 1.904M est, but still near a 3-year high. Initial jobless claims also rose to 224k, higher than 215k expected.

The largest increases were in Wisconsin (+1.9k), Pennsylvania (+647), and Kentucky (+483). The biggest decreases were in California (-9.8k)

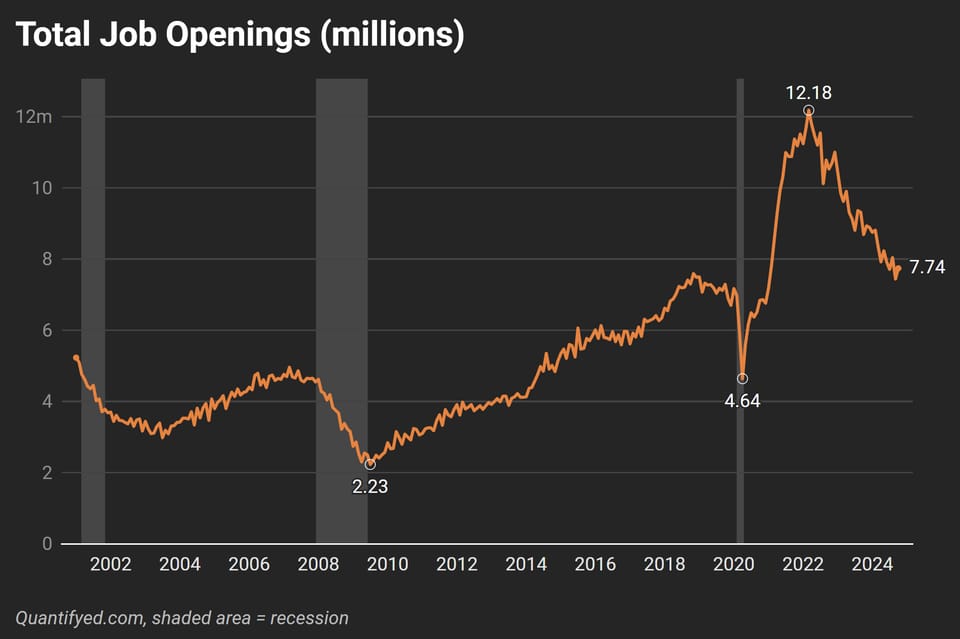

Job opening numbers came out: 7.74M vs 7.51M expected, pretty solid. Also, our 3-month moving average is still above pre-pandemic levels.

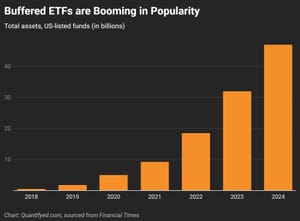

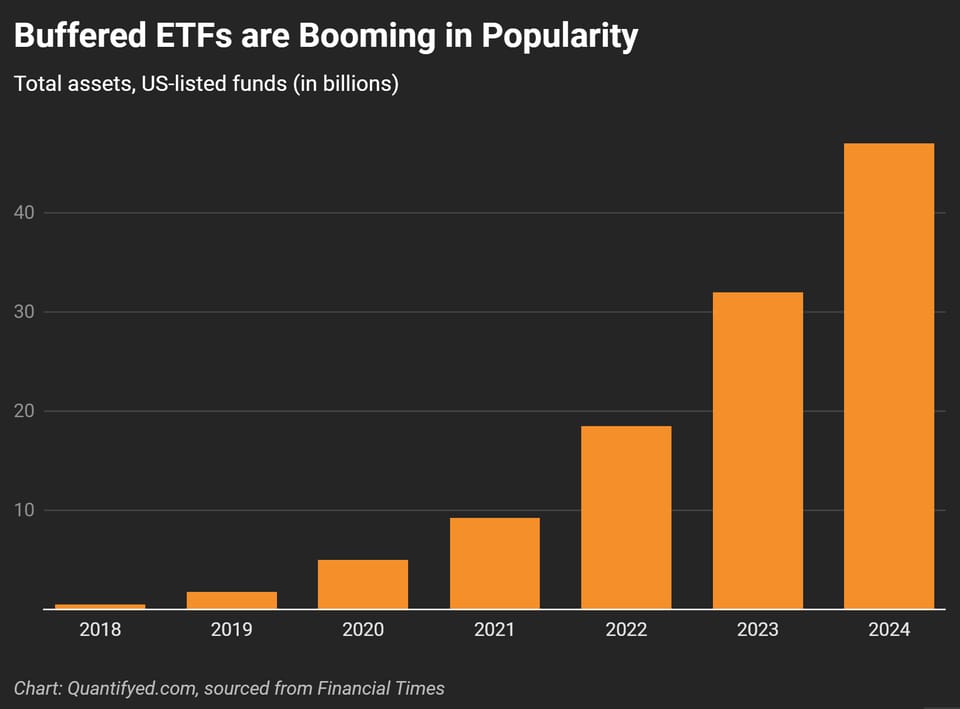

The demand for risk-managed ETFs is skyrocketing. In traditional markets, assets in buffer ETFs grew from $0 in 2018 to $47 billion in 2024.

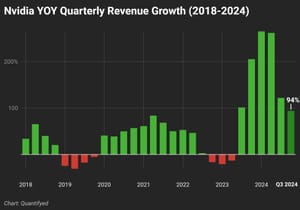

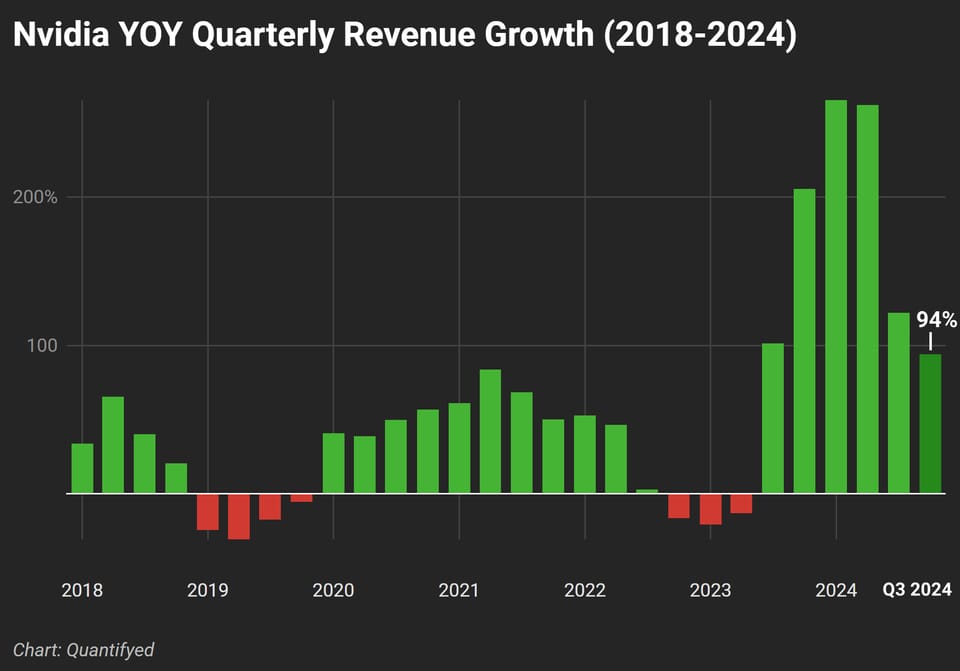

Nvidia just posted another big earnings report, beating estimates for both revenue and profit. Q3 revenue hit $35.08 billion, up 94% from last year.

Despite this, Nvidia's revenue growth this quarter is lower than the triple-digit increases of the past three quarters (122%, 262%, and 265%)

Returns the last 2 years:

Russell 2000 +25.4% vs S&P MidCap 400 +28.3%

Small caps, suprisingly, aren't doing all that bad against their peers. Friendlier tax and regulation policies will boost this category

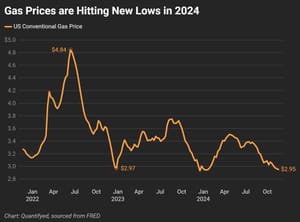

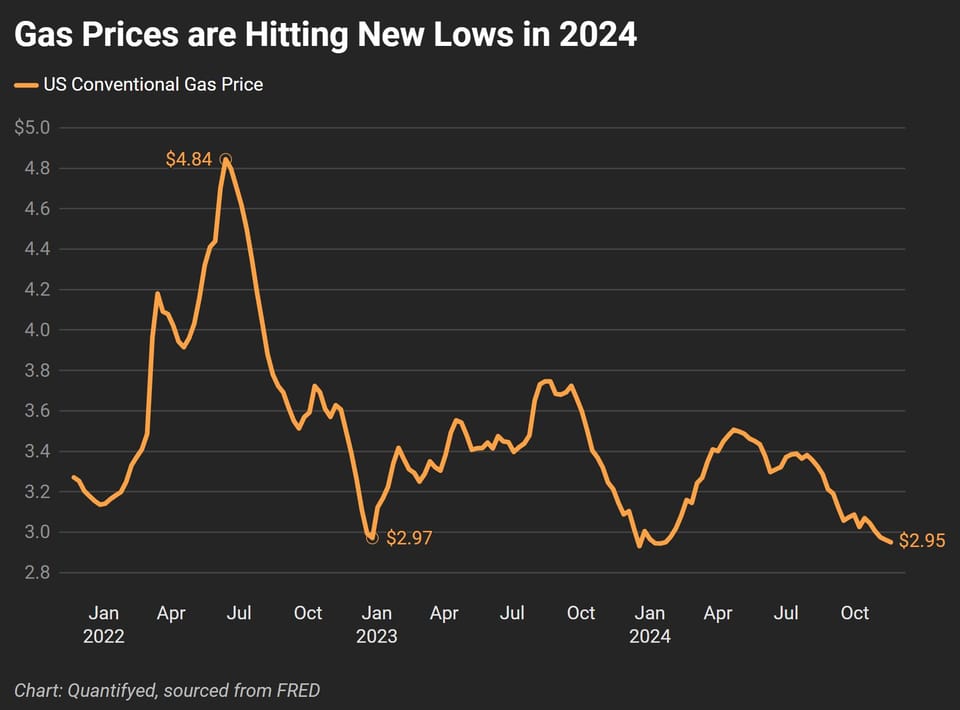

Daily national average gasoline price has fallen to the lowest since Jan 2023. Prices lower than $2.95 were last reported in late 2021.

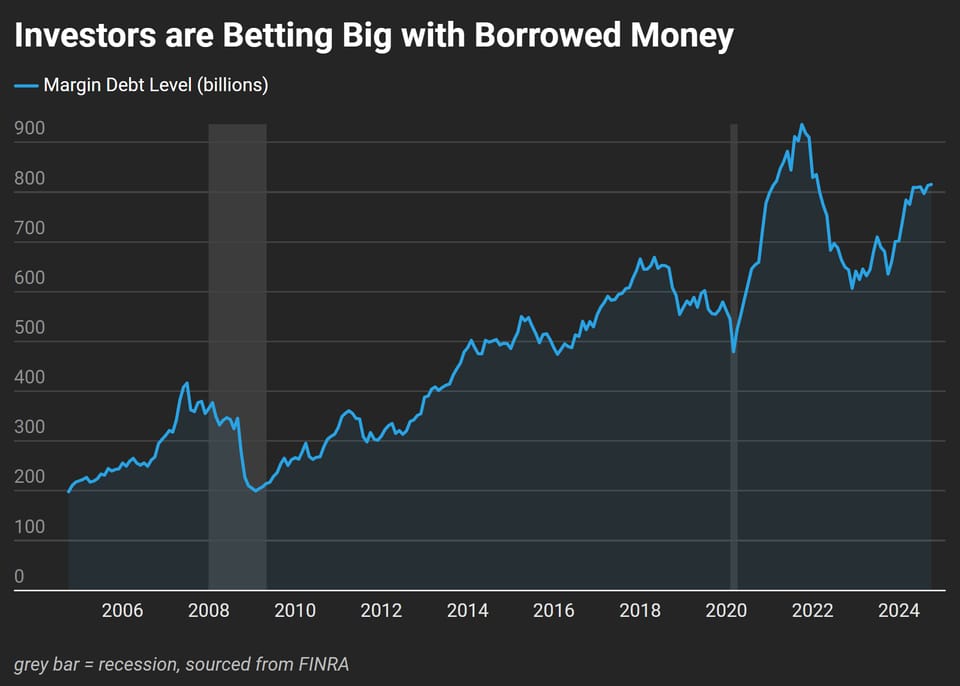

Investors are borrowing more than ever to fuel their market positions. Margin debt hit $815 billion last month—a 28.3% jump in borrowing since Oct last year.

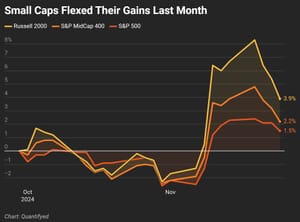

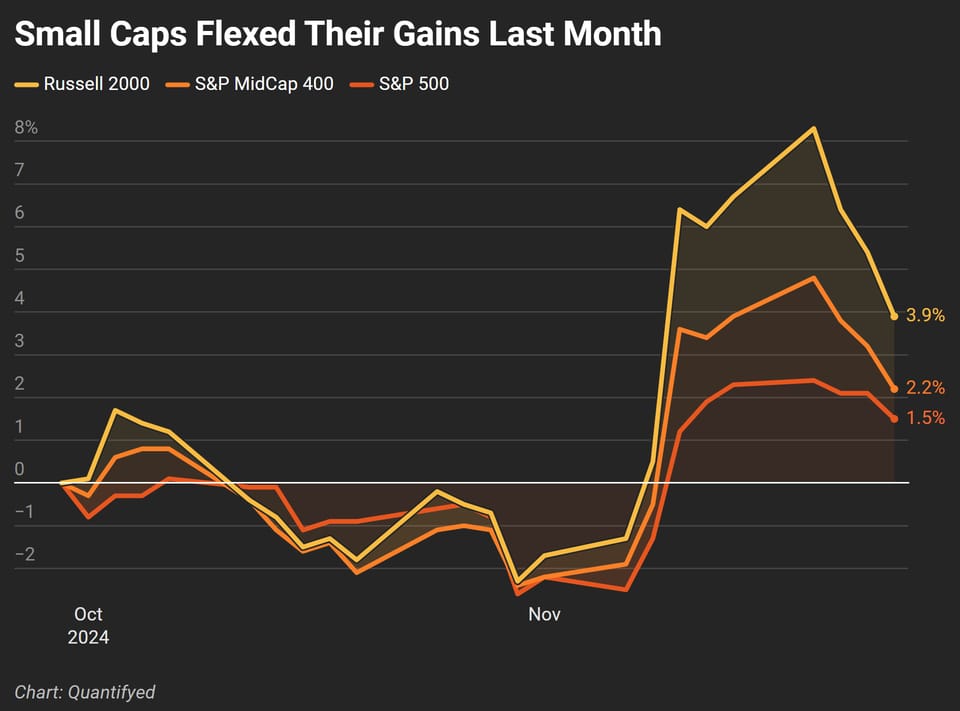

Small cap stocks have outperformed mid and large caps, posting a 3.9% gain compared to 2.2% for the S&P MidCap 400 and 1.5% for the S&P 500.

Friendlier tax and regulation policies from the Trump administration give a bost to small caps, which are more domestically focused.

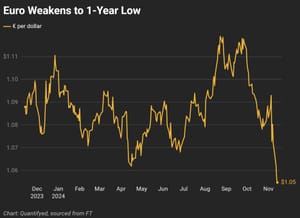

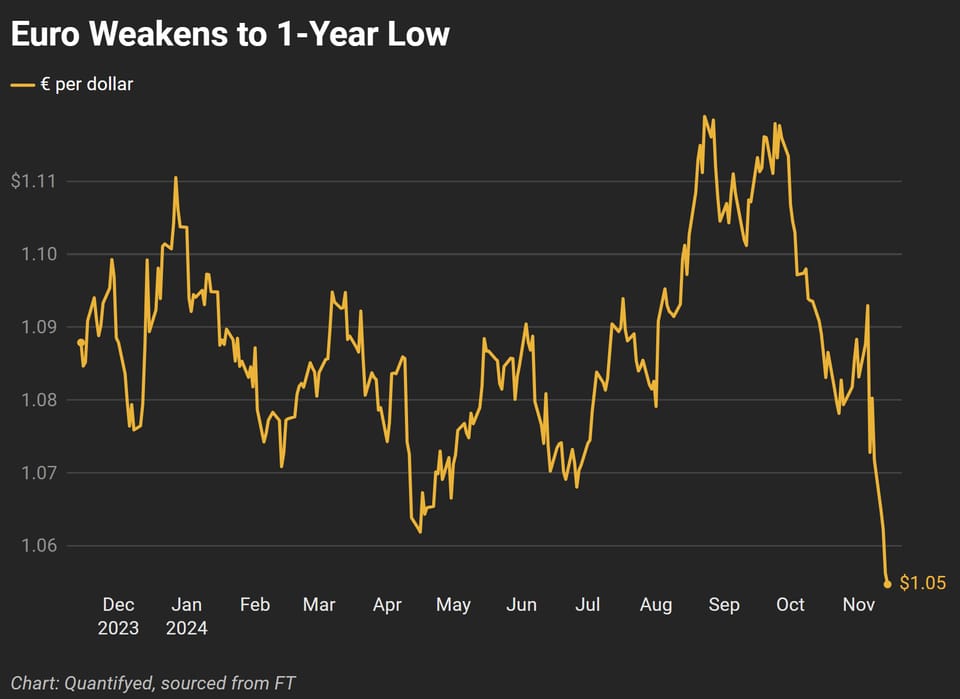

The euro just dropped to $1.05—that's great news for European exporters. Cheaper prices abroad mean companies like BMW, LVMH, and others could see a bump in global sales.

But.. if Trump imposes tariffs on EU imports, these gains could reverse fast. For now, export-heavy stocks are enjoying the weaker euro

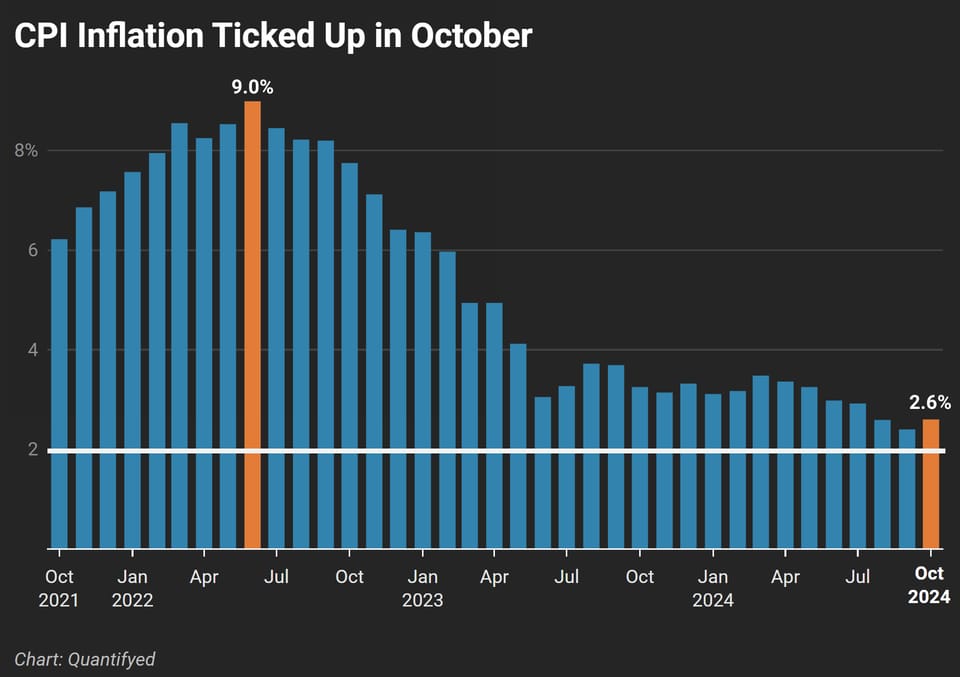

Inflation came ROSE last month to 2.6%. Core CPI also was in line with estimates at 3.3%

Both headline and core CPI inflation are higher than they were 2 months ago.

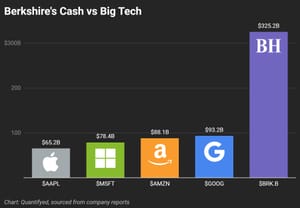

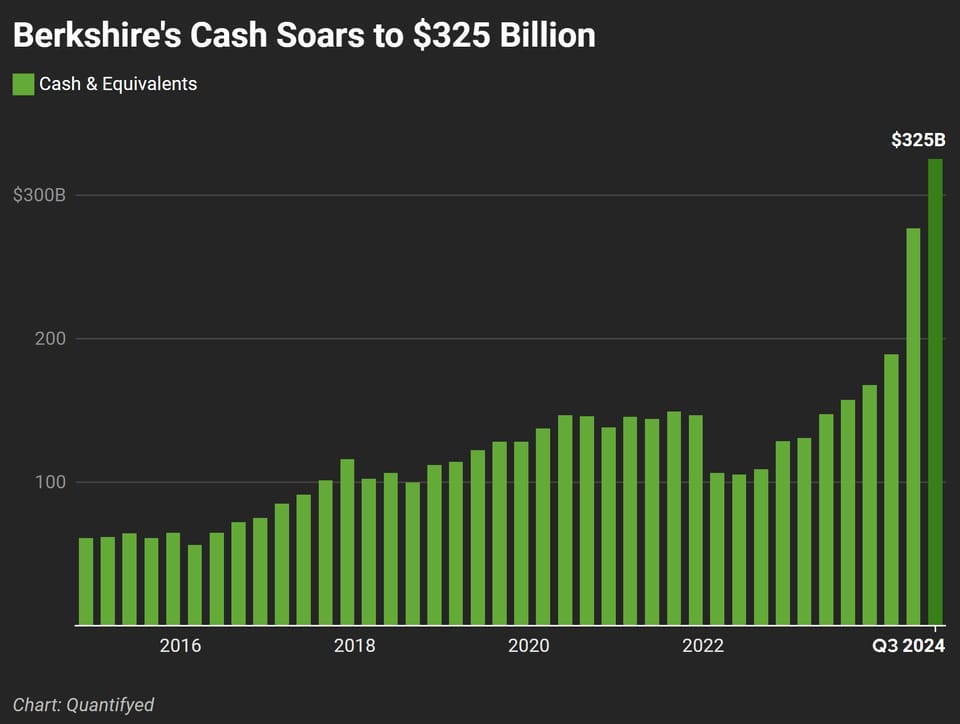

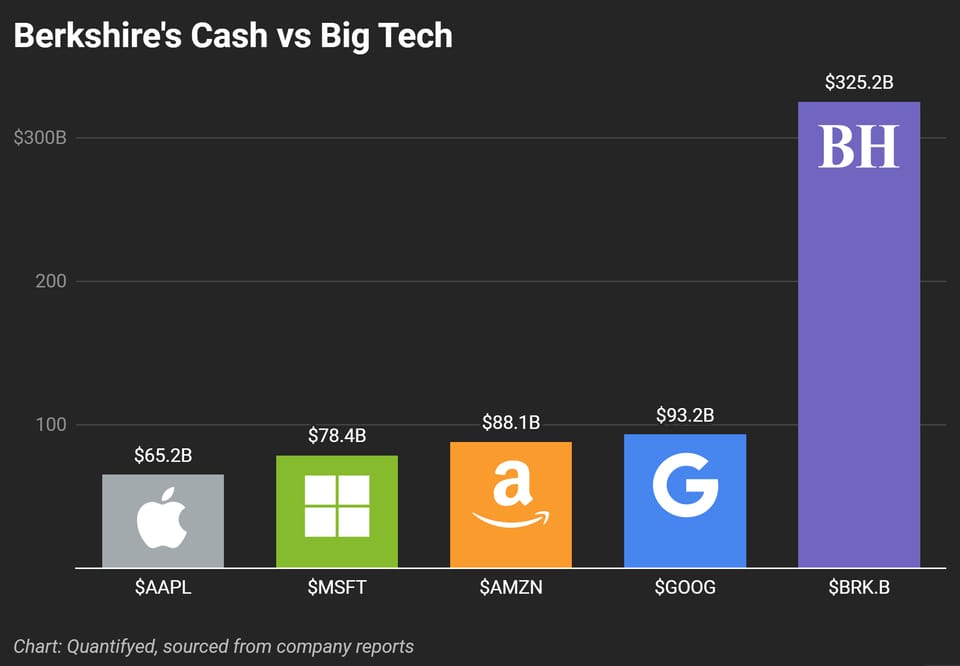

Berkshire Hathaway's recent Apple stock sale rocketed their cash to record highs.

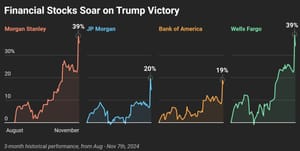

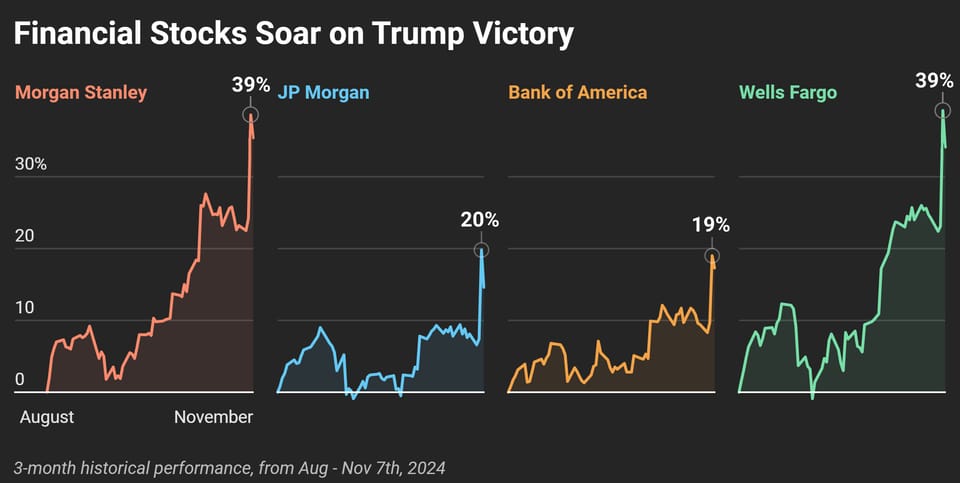

We're calling this bounce in financial stocks the Trump Jump. After Wednesday's US election, stocks like Morgan Stanley and Wells Fargo skyrocketed.

Investors are likely confident that Trump’s return means lighter regulations and friendlier conditions for banks.

Fun fact: If you spent $1M a day, it’d still take you 891 years to burn through all the cash on Berkshire’s balance sheet.

Read Our Latest Posts

Latest Posts

Every time the market rallies to new highs, people start asking the same question: Are we in a bubble? And every time, the answer is basically the same: maybe, but we won’t know until it pops. That’s how bubbles work. They never feel obvious in real-time. The 1999

Markets are trying to recover after last week’s selloff, but the gains are small. As of this morning, the S&P 500 and Russell 2000 are both up just 0.03%, the Dow is up 0.11%, and crude oil is climbing 0.2%. Meanwhile, the Nasdaq 100

The market’s winning streak just hit a roadblock. Trump’s latest tariff threats, floating a 25% tax on auto, semiconductor, and pharmaceutical imports are shaking stocks today. With growing inflation concerns, market's are guessing whether this could push back Fed rate cuts in 2025. Here’s what’