Featured Posts

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

So, here’s something no one seems to be making a big deal about: tariffs are rising fast, and they’re dragging the US economy down. You won’t hear much about it in the headlines, but the effects could start to pile up. Higher prices, weaker growth, and more

If my paycheck had a voice, it would probably be crying right now. Grab a drink because we’re diving into the financial mess hitting our snack aisles.

On Thursday, PepsiCo and Conagra Brands reported weak quarterly results, telling us that U.S. consumers are feeling the squeeze.

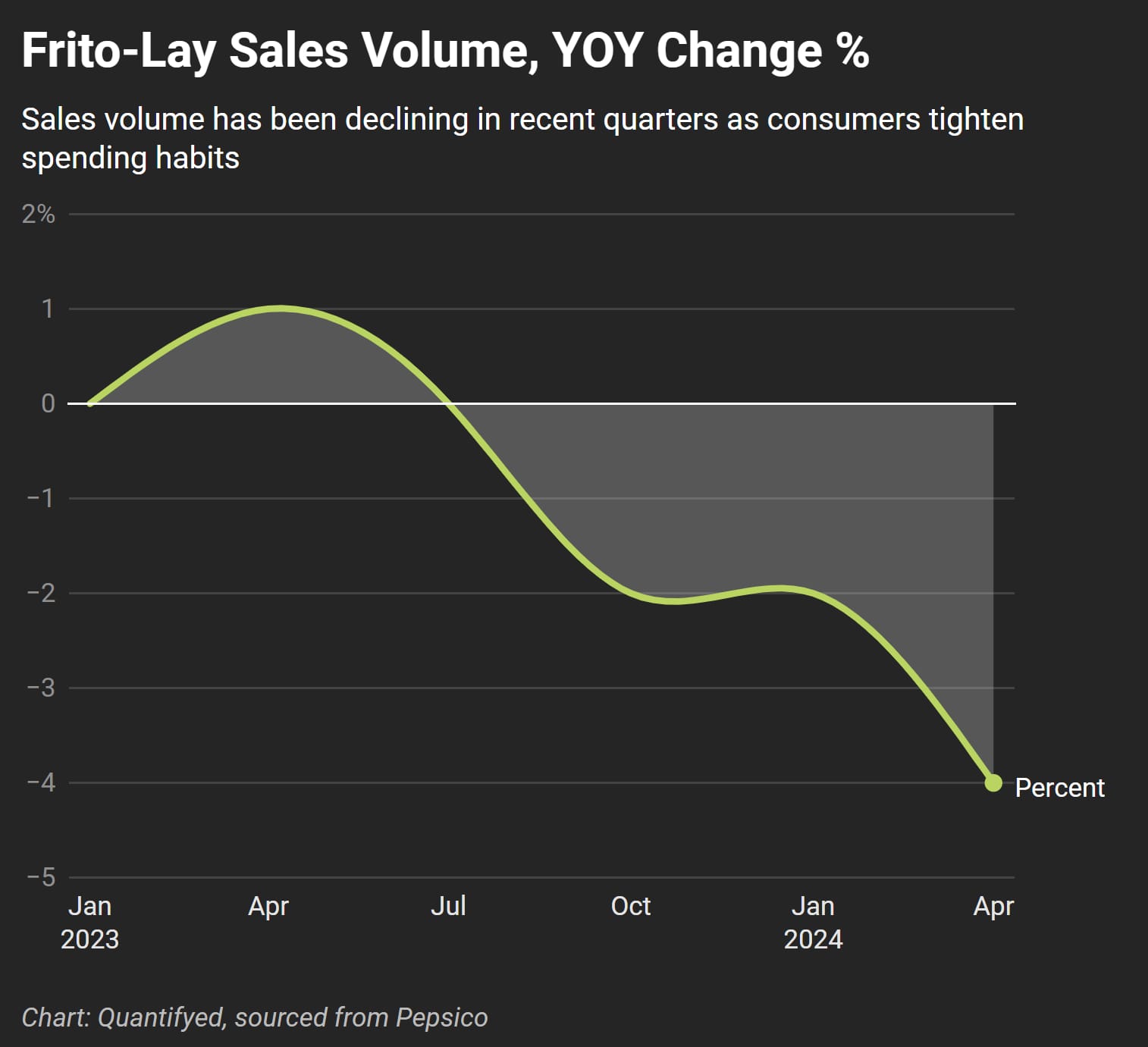

PepsiCo saw a 4% drop in its’ Frito-Lay sales volumes and a 3% decline in beverages. Despite higher prices, revenue for Frito-Lay North America was still down 0.5%, while North America beverages saw a 1% increase. The company also cut its outlook for total organic sales growth from “at least” 4% to “approximately” 4%.

“The impacts of persistent inflationary pressures and higher borrowing costs over the last few years have resulted in tighter household financial conditions,” Pepsi’s managers said.

A better translation for that quote would be, "We’re all getting stingy because everything costs an arm and a leg."

Conagra Brands, known for Slim Jim and Marie Callender’s, reported a 2.4% decline in organic sales for the fiscal fourth quarter. Slight improvements in snack sales volume were noted due to price promotions, but they expect organic sales to range from down 1.5% to flat this fiscal year.

CEO Sean Connolly pointed out that returning to overall volume growth will be gradual 👇

“It’s not one of these events where we sprinkle a little money on the consumer and they forget they ever experienced runaway inflation,”

No kidding, Sean. We remember, and so do our wallets.

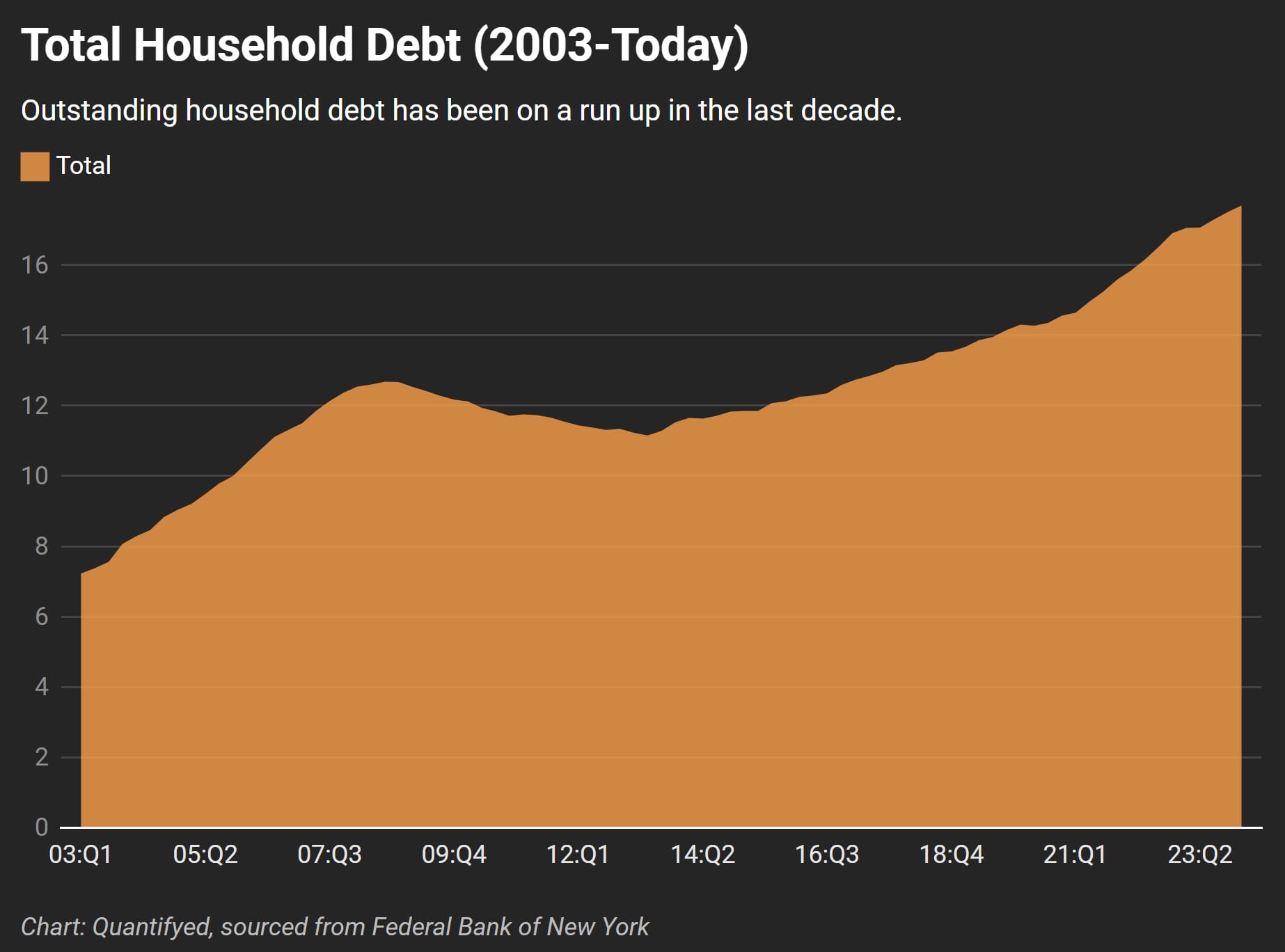

It could also be said that the rise in household debt highlights the financial strain on consumers → leading to cautious spending.

This supports why companies like PepsiCo and Conagra are seeing declining sales volumes despite efforts to adjust prices and products.

If U.S. consumer sentiment keeps weakening, maintaining such market performance could be a tough nut to crack.