Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

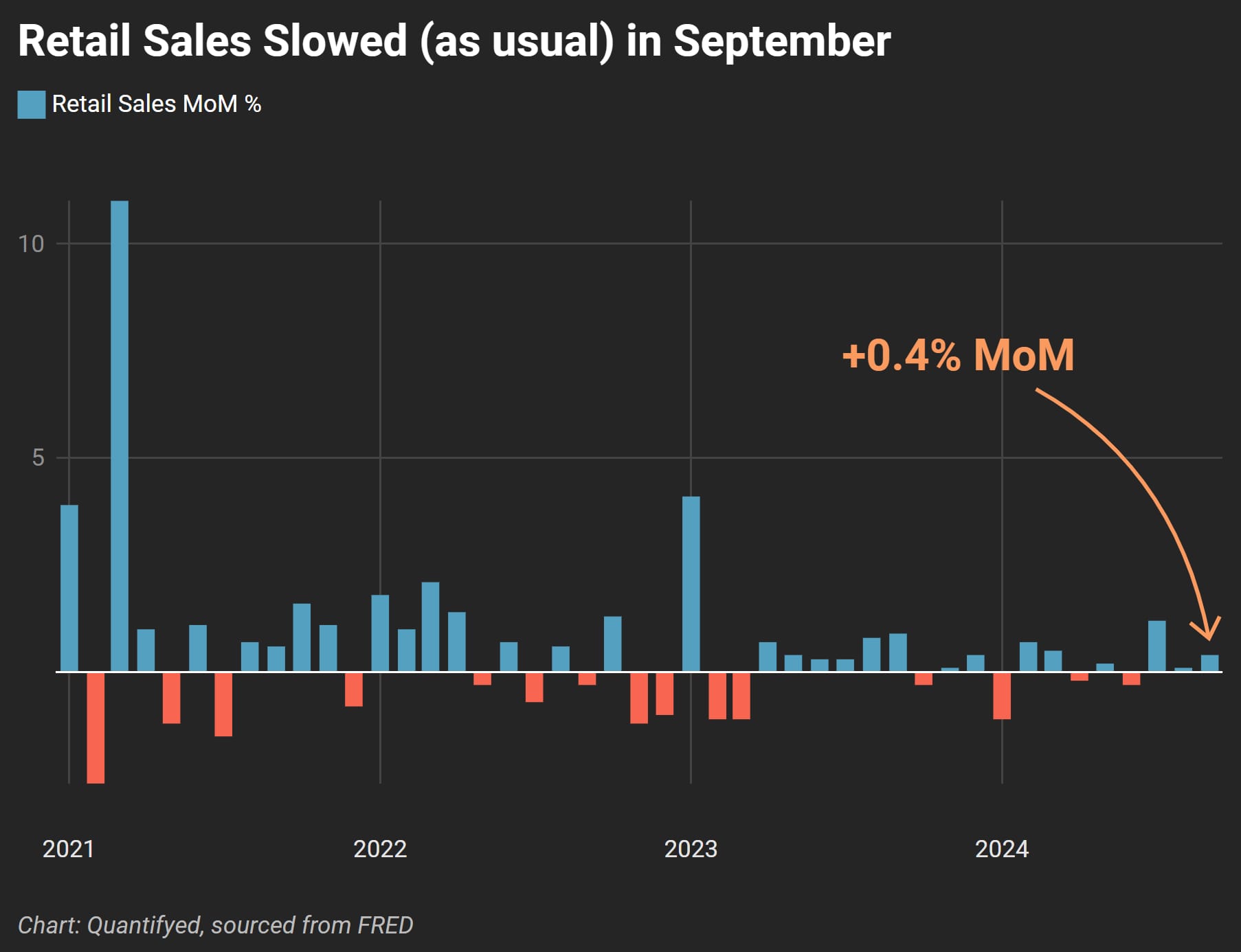

September’s retail sales rose 0.4%, beating expectations and improving on August’s unimpressive 0.1% gain. While consumer confidence continues to face headwinds like inflation, the numbers show people are still willing to spend.

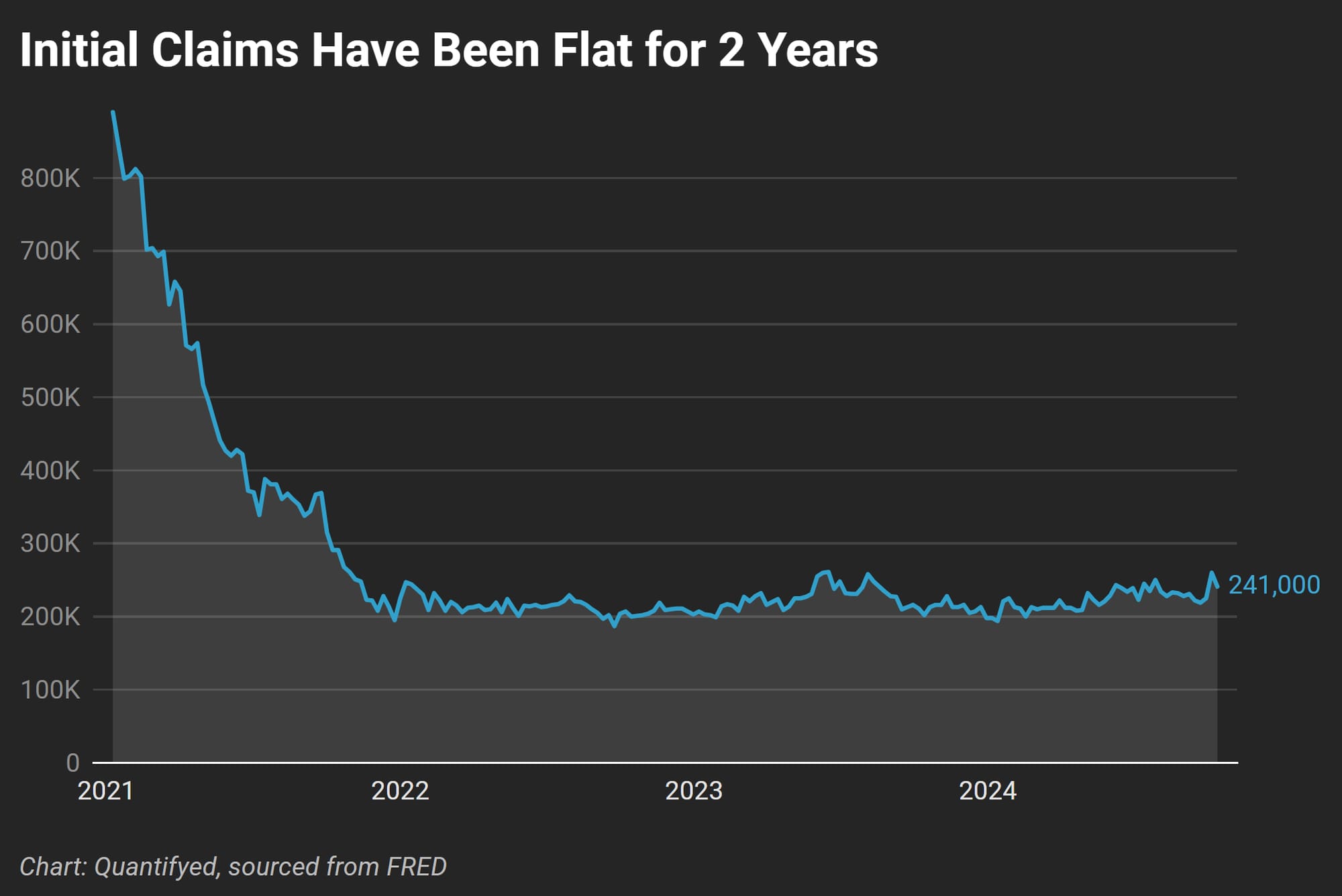

On the labor side, initial jobless claims dropped by 19,000 to 241,000, showing that the labor market, much like those jobless claims charts, is staying flat... as usual. Despite recent hurricanes disrupting regional economies, the overall trend in claims hasn't budged much in two years.

Both data points tell the same story: steady consumer spending and an unmoved labor market. Not exactly fireworks, but stability beats volatility any day.

A Few Key Takeaways:

- Retail sales increased by 0.4% in September, up from the sluggish 0.1% in August

- Jobless claims dropped by 19,000 to 241,000

- Claims have remained flat for two years, signaling a steady labor market

- Growth sectors included clothing and restaurants, while electronics sales slumped

No big surprises here, but if you were expecting a meltdown, you’ll have to wait. Businesses should take this as a signal that, for now, the consumer engine is still running.