Featured Posts

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Every time the market rallies to new highs, people start asking the same question: Are we in a bubble? And every time, the answer is basically the same: maybe, but we won’t know until it pops. That’s how bubbles work. They never feel obvious in real-time. The 1999

Markets are trying to recover after last week’s selloff, but the gains are small. As of this morning, the S&P 500 and Russell 2000 are both up just 0.03%, the Dow is up 0.11%, and crude oil is climbing 0.2%. Meanwhile, the Nasdaq 100

The market’s winning streak just hit a roadblock. Trump’s latest tariff threats, floating a 25% tax on auto, semiconductor, and pharmaceutical imports are shaking stocks today. With growing inflation concerns, market's are guessing whether this could push back Fed rate cuts in 2025. Here’s what’

Nvidia just lost $600 billion in market value in a matter of days. That kind of drop would normally scare off investors. But for retail traders, they bought in BIG time.

In just two days, retail poured $900 million into the stock, per FT.

Monday alone saw $562 million in net retail inflows, the biggest single-day buy on record.

Meanwhile, hedge funds, the so-called smart money, were dumping shares.

So who is making the right call? Retail or Institutions?

Why Retail Investors Jumped In

For retail traders, this was not panic. It was opportunity. The AI boom is not slowing down, and many believe Nvidia is still at the center of it all.

To them, a massive drop in share price just meant one thing: a discount.

Trading platforms saw the frenzy in real time. Robinhood logged one of its highest overnight trading volumes ever.

Even high-profile people got in on the action. Garry Tan, CEO of Y Combinator, openly admitted to buying the dip:

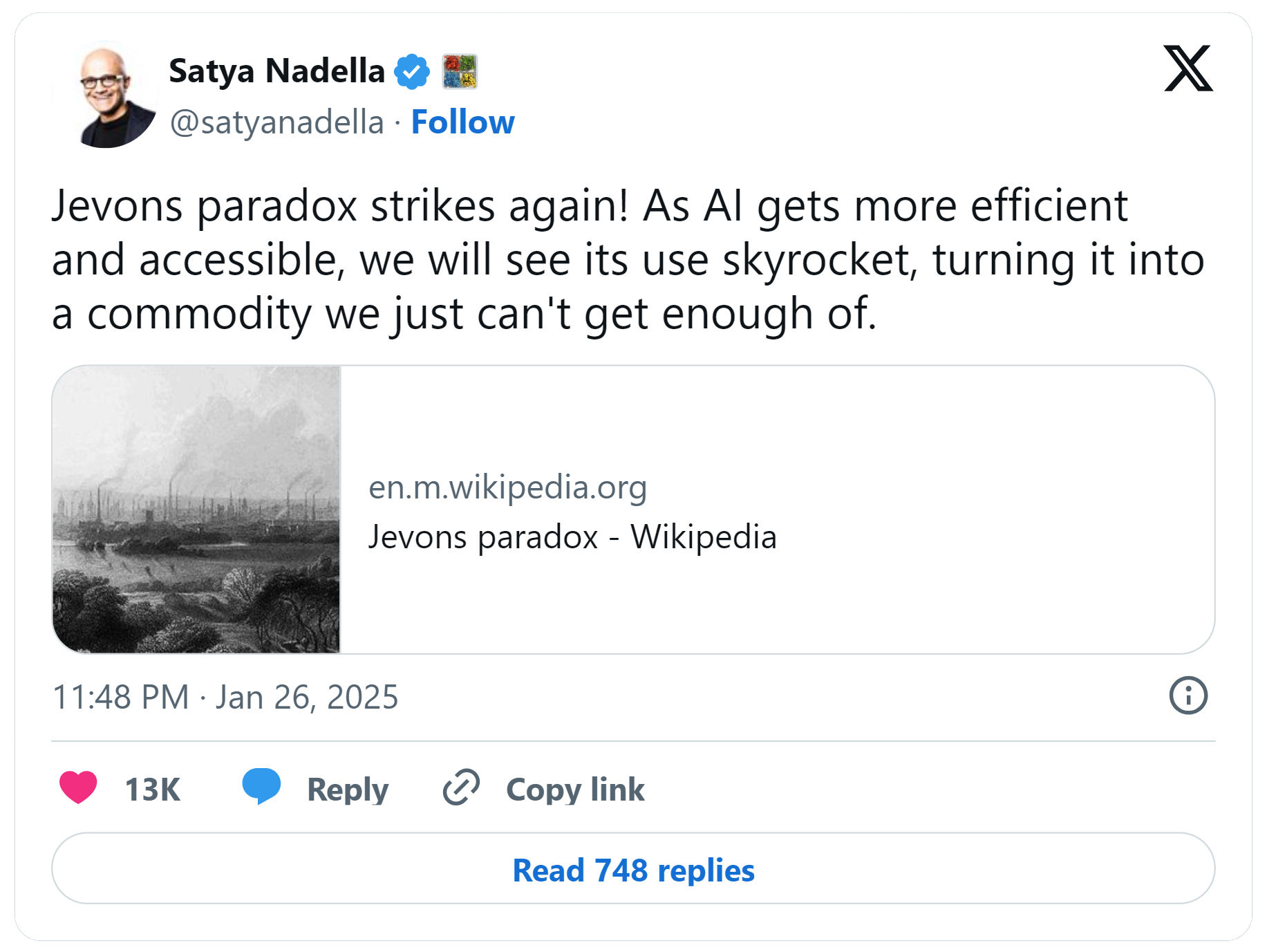

On Reddit, traders were calling this a "Jevons Paradox". The idea is that as AI gets cheaper and more efficient, demand will only keep growing. Funny enough, Satya Nadella (CEO of Microsoft) also posted about this:

The Risks of Buying This Dip

But let’s take a step back. Nvidia did not drop for no reason. The sell-off was triggered by news that China’s DeepSeek AI may have developed an advanced AI model that competes with US tech leaders like OpenAI at a much lower cost.

If that claim holds up, it could cut into Nvidia’s dominance and hit demand for its high-end chips.

Then there is the bigger issue. Retail traders love to buy the dip, but not every dip is a buying opportunity, at least in the near term.

Hedge funds were not buying. They were selling. The biggest institutional investors offloaded massive amounts of Nvidia shares during the crash. In fact, Nvidia alone made up 10% of all US stock market trading volume on Monday.

What Happens Next

One thing is certain: Nvidia has been swinging up and down since the crash.. Volatility through the roof.

If AI demand keeps growing and Nvidia maintains its lead, long-term investors could win big. But if DeepSeek or other competitors start chipping away at its market share, this dip might not be the bargain some people think it is.