Featured Posts

Last week, people saw the 7% spike in the S&P 500 and called it a relief rally. Markets breathed. Volatility cooled off for a moment. But what actually happened wasn’t just a response to Trump’s sudden 90-day tariff pause. It was a pressure release after days

Let’s talk markets. Specifically, let’s talk about what just went down (literally) in the Nasdaq this week. If you’ve been paying attention—or maybe even if you haven’t—it’s gotten pretty ugly pretty fast. I even tweeted something about it: Markets take the stairs up

The drop happened fast! If you blinked sometime in February, you might’ve missed that we were at new all-time highs. Now? We're in full correction territory. Just yesterday, the S&P 500 fell more 2%, and now close to 10% in less than a month. Not

Did you know that 56% of Wisconsin’s agricultural exports could be impacted by tariffs from Canada, Mexico, and China? Wisconsin now represents the 11th largest exporter of agricultural products in the U.S., up from 13th in 2023 (WI DATCP). In 2024, Wisconsin’s agricultural exports reached $3.97

Markets are pulling back today as traders wait for December jobs data. Futures for the S&P 500 and Nasdaq 100 are both down -0.2%.

Stocks Fall Before Jobs Data

The numbers are expected to show +165,000 new jobs added in December, with unemployment steady at 4.2%.

Why does it matter? A weaker report could fuel hopes for rate cuts, while stronger numbers might keep the Fed focused on inflation.

Here’s where things stand today:

- S&P 500: -0.28%

- Nasdaq 100: -0.2%

- Dow Jones: -0.07% (flat)

Palisades Fire Adds Pressure

Wildfire damages from the Palisades Fire in Los Angeles are weighing on the insurance sector. Stocks like Allstate and Chubb haven’t moved much, though.

This could mean investors think the losses are already priced in—or they’re not seeing the full impact yet.

Oil Prices Surge

Oil prices are spiking again. WTI crude is up 2%, hitting $74.30 a barrel (now $75 this morning), and its highest in three months. Severe winter weather has tightened U.S. crude supplies, adding pressure to markets.

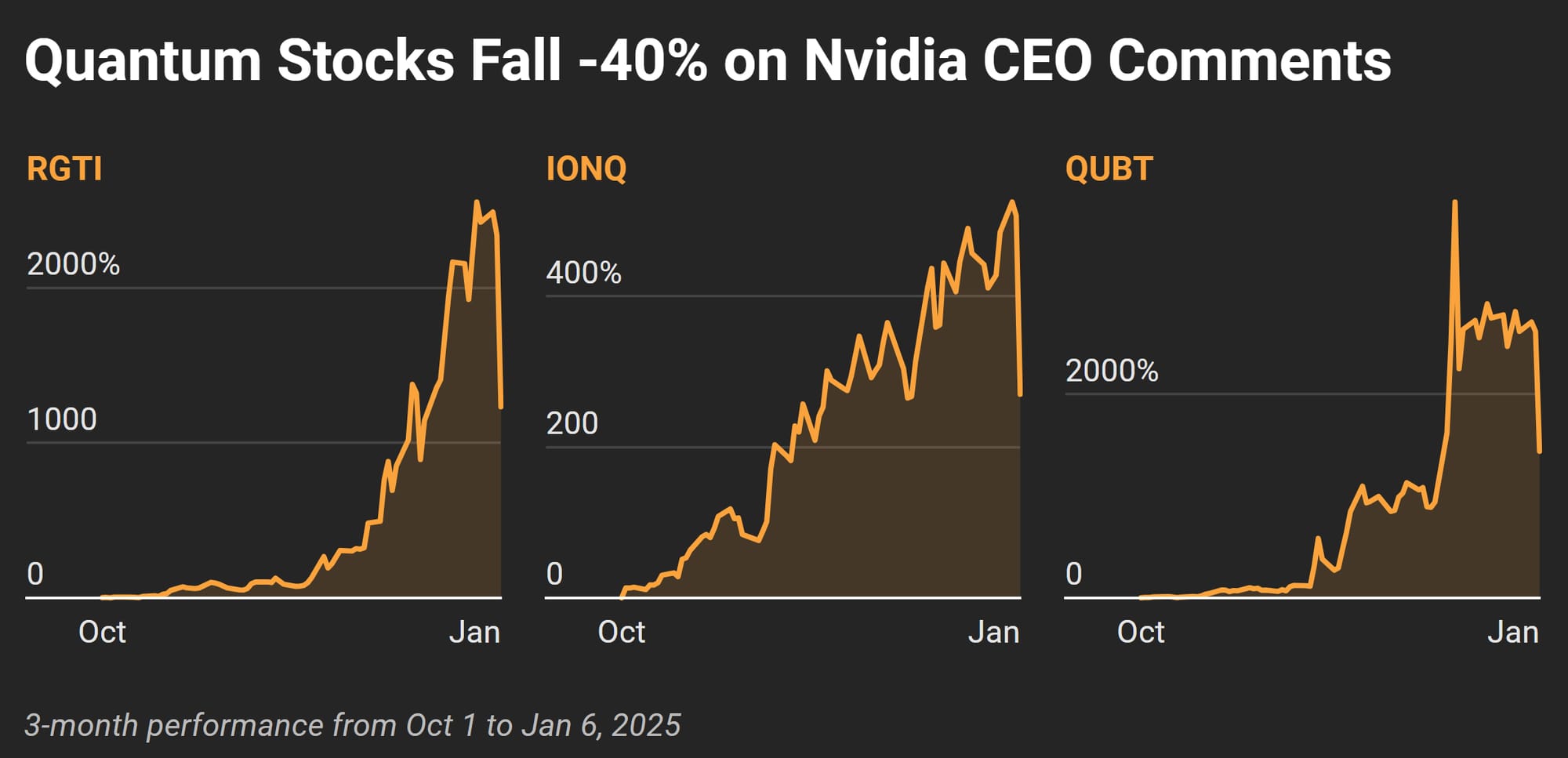

Quantum Stocks Crash

Quantum stocks are taking a beating. Nvidia’s CEO, Jensen Huang, said useful quantum computers could still be 15–30 years away. Stocks like Rigetti Computing (RGTI) and IonQ are down 40% since his remarks at CES 2025.

Here's some other trends happening today:

Crypto climbs:

- Bitcoin is up 3.1% to $94,980

- Ethereum gained 3.2% to $3,312. Speculative trades are still active.

Gold inches higher:

- Gold rose 0.6% to $2,682.06 an ounce

Stocks:

- S&P 500: -0.28%

- Nasdaq 100: -0.2%

- Dow Jones: -0.07% (flat)

Commodities:

- Oil: 2% to $74.30