Featured Posts

In the past year, gold has been steadily climbing, central banks have been buying at record levels, and the macro setup could be pointing to its biggest move in decades. But, it doesn't seem like investors aren’t paying attention. Stocks dominate the headlines, and gold still carries

Every time the market rallies to new highs, people start asking the same question: Are we in a bubble? And every time, the answer is basically the same: maybe, but we won’t know until it pops. That’s how bubbles work. They never feel obvious in real-time. The 1999

The market’s winning streak just hit a roadblock. Trump’s latest tariff threats, floating a 25% tax on auto, semiconductor, and pharmaceutical imports are shaking stocks today. With growing inflation concerns, market's are guessing whether this could push back Fed rate cuts in 2025. Here’s what’

I used to think I could outsmart the market by buying at rock-bottom and selling at the peak. I’d try to pinpoint those perfect days when stocks were at their lowest, and then cash out before the next downturn. But over time I learned that chasing those 'magic&

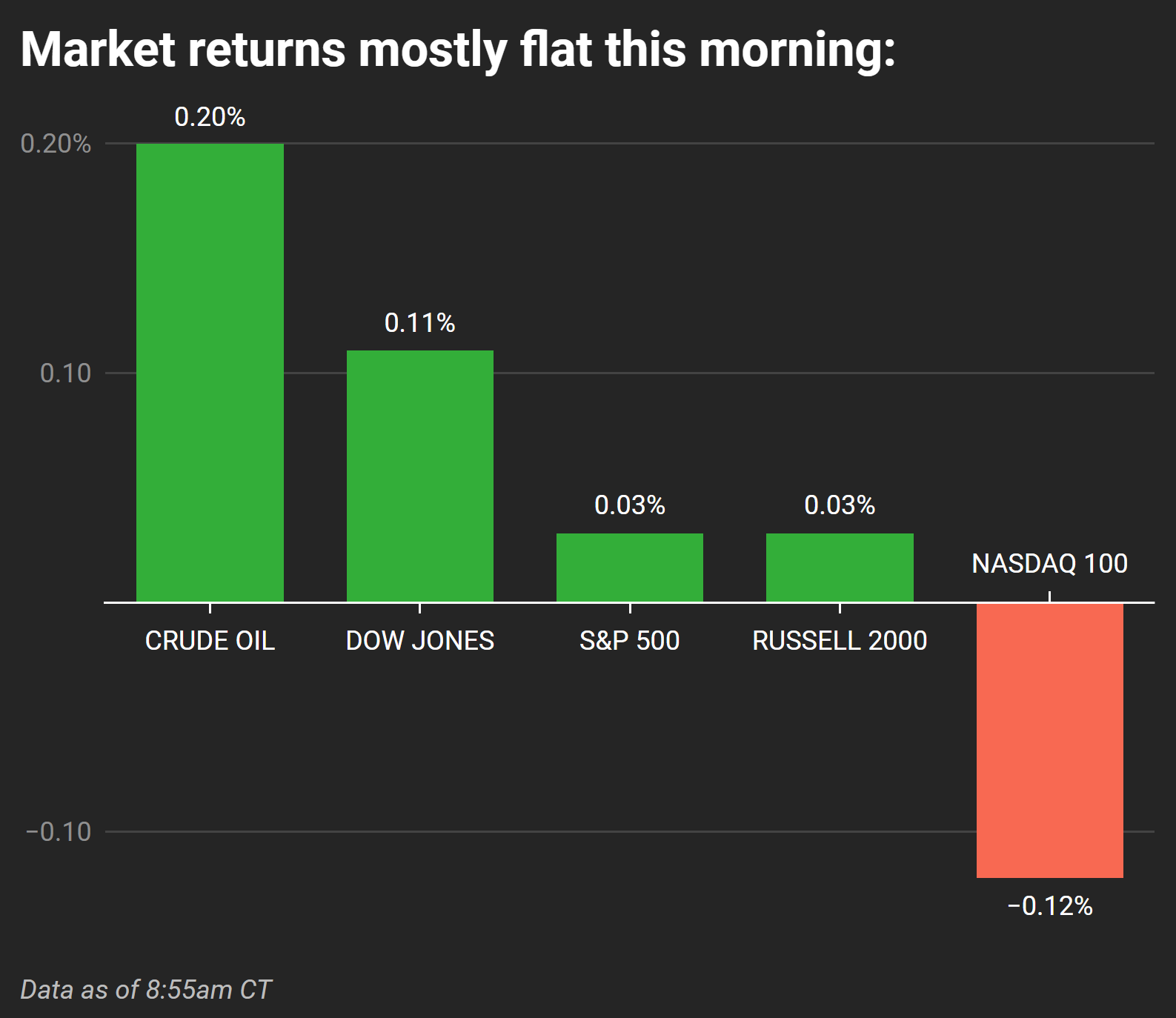

Markets are trying to recover after last week’s selloff, but the gains are small.

As of this morning, the S&P 500 and Russell 2000 are both up just 0.03%, the Dow is up 0.11%, and crude oil is climbing 0.2%. Meanwhile, the Nasdaq 100 is slightly down (-0.12%), signaling that tech stocks are still under pressure.

The big event everyone is watching? Nvidia’s earnings on Wednesday. AI stocks have led the market higher for over a year, and Nvidia has been at the center of it all.

If their results show slowing growth or weaker AI demand, it could shake up the entire market.

AI Spending is the Biggest Question

Microsoft and Nvidia are climbing after last week’s dip. But beneath the surface, there are signs that AI spending might be cooling down.

One red flag: Microsoft is canceling multiple data center leases. That could mean demand for cloud infrastructure—which has been fueling AI growth—isn’t as strong as expected.

If Nvidia reports any weakness in AI-related sales, investors could start questioning just how sustainable the AI-driven market rally really is.

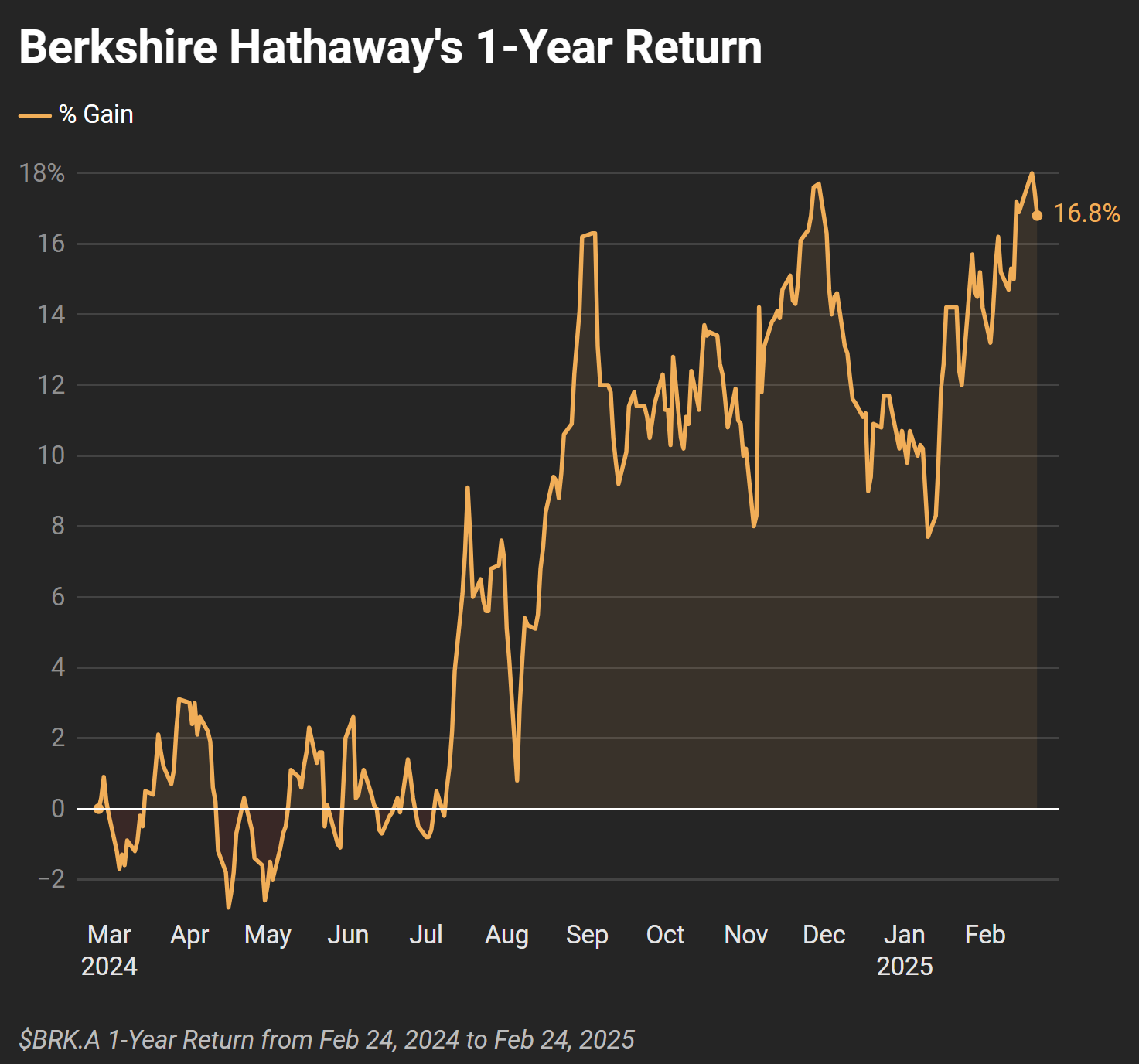

Meanwhile, Berkshire Hathaway has been quietly outperforming. Warren Buffet's company posted record insurance profits. In the past year, their stock is up 16.8%, just below the S&P 500's 18%

What’s Coming Next?

This week has a few key events that could drive markets in either direction. Nvidia reports earnings on Wednesday, and expectations are sky-high. Given how much AI stocks have led the market, a miss here could have ripple effects across tech.

On Friday, the Fed’s preferred inflation gauge (PCE data) comes out. If inflation stays higher than expected, it could push back any hopes of rate cuts, putting pressure on stocks.

Before that, on Tuesday, consumer confidence data will give a read on spending and sentiment. If consumers start pulling back, it could mean slower growth ahead.

Markets are in wait-and-see mode, and Nvidia’s earnings could be the deciding factor.